California Tax Rebates For Electric Cars Web The Clean Vehicle Rebate Project CVRP promotes clean vehicle adoption in California by offering rebates for the purchase or lease of new eligible zero emission vehicles

Web CVRP Clean Vehicle Rebate Program CVRP Get up to 7 500 to purchase or lease a new plug in hybrid electric vehicle PHEV battery electric vehicle BEV or a fuel cell Web 28 ao 251 t 2023 nbsp 0183 32 California offers its own 7 500 tax rebate with fewer limitations You can see if your vehicle is eligible on the Clean Vehicle Rebate Project s website You might

California Tax Rebates For Electric Cars

California Tax Rebates For Electric Cars

https://i0.wp.com/www.electricrebate.net/wp-content/uploads/2022/08/california-electric-car-rebates-mapped-interactive-cleantechnica.png

The California Electric Car Rebate A State Incentive Program OsVehicle

https://i0.wp.com/www.californiarebates.net/wp-content/uploads/2023/04/the-california-electric-car-rebate-a-state-incentive-program-osvehicle-3.jpg?w=1030&ssl=1

California Electric Car Rebate EV Tax Credit Incentives Eligibility

https://8billiontrees.com/wp-content/uploads/2022/12/California-Electric-Car-Rebate-Featured-Image.png

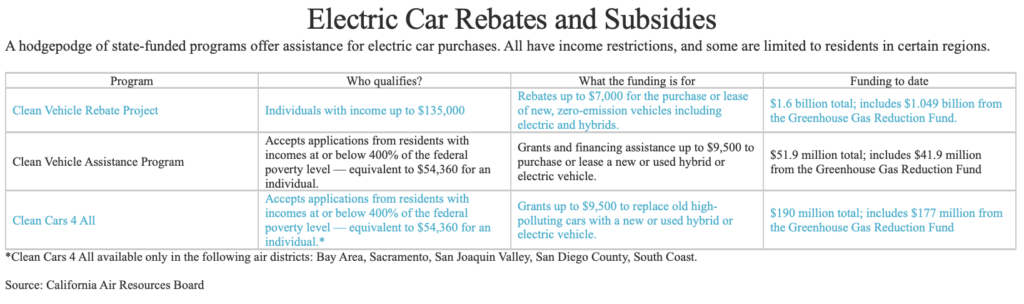

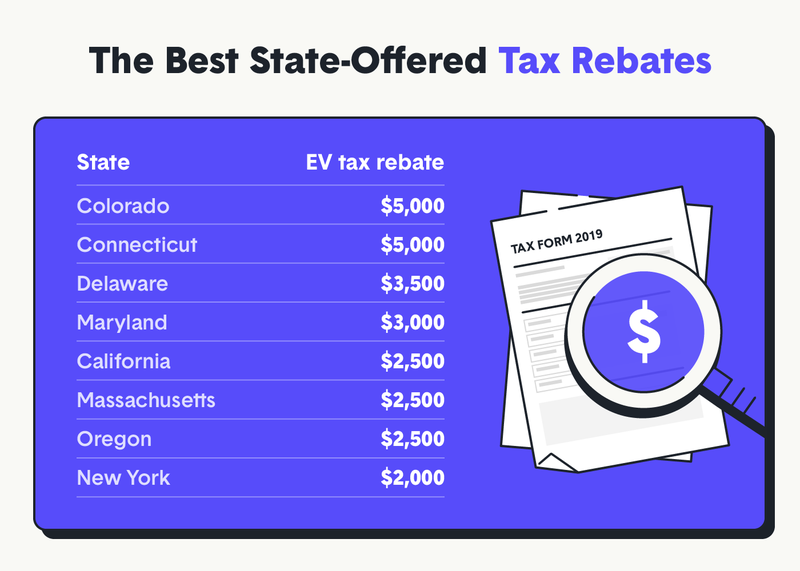

Web 11 avr 2023 nbsp 0183 32 Eligible taxpayers can get a rebate of up to 4 500 for FCEVs 2 000 for EVs 1 000 for PHEVs and 750 for emissions free motorcycles Buyers with low or Web 2 ao 251 t 2022 nbsp 0183 32 All of the programs which award up to 7 000 or 9 500 toward the purchase of an electric car have income limits The rebate project is for residents with incomes

Web 6 f 233 vr 2023 nbsp 0183 32 In November 2022 the Board approved adjustments to this plan that include larger Increased Rebate amounts for lower income car buyers the inclusion of prepaid Web 7 sept 2023 nbsp 0183 32 Car buyers also may qualify for a federal tax credit of up to 7 500 for some vehicles with income restrictions of 150 000 for individuals and 300 000 for married

Download California Tax Rebates For Electric Cars

More picture related to California Tax Rebates For Electric Cars

Ev Car Tax Rebate Calculator 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/california-s-ev-rebate-changes-a-good-model-for-the-federal-ev-tax-23.png?fit=570%2C278&ssl=1

California Electric Car Rebate 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/01/California-Electric-Car-Rebate-Form-2022-768x812.png

California Tax Rebate On Electric Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2023/05/southern-california-edison-rebates-for-electric-cars-2022-carrebate.jpg

Web 28 d 233 c 2022 nbsp 0183 32 Rebates for drivers who qualify boosted to 7 500 for electric vehicles and 6 500 for plug in hybrids California bumps up EV incentives for low to moderate Web Southern California Edison SCE customers who purchase or lease an electric vehicle can apply for a rebate of up to 1000 through the Clean Fuel Reward Program Make sure you have the

Web 74 400 84 800 Up to 15 savings Edmunds Rating Max EPA Range 285 mi View Incentives 5 View Inventory 2024 Audi e tron GT 9 500 Available Rebates MSRP Web 20 janv 2023 nbsp 0183 32 Shop California Electric Car Rebate EV Tax Credit Incentives Eligibility Hybrids Tesla amp More Written by Georgette Kilgore Cars January 20 2023 With more

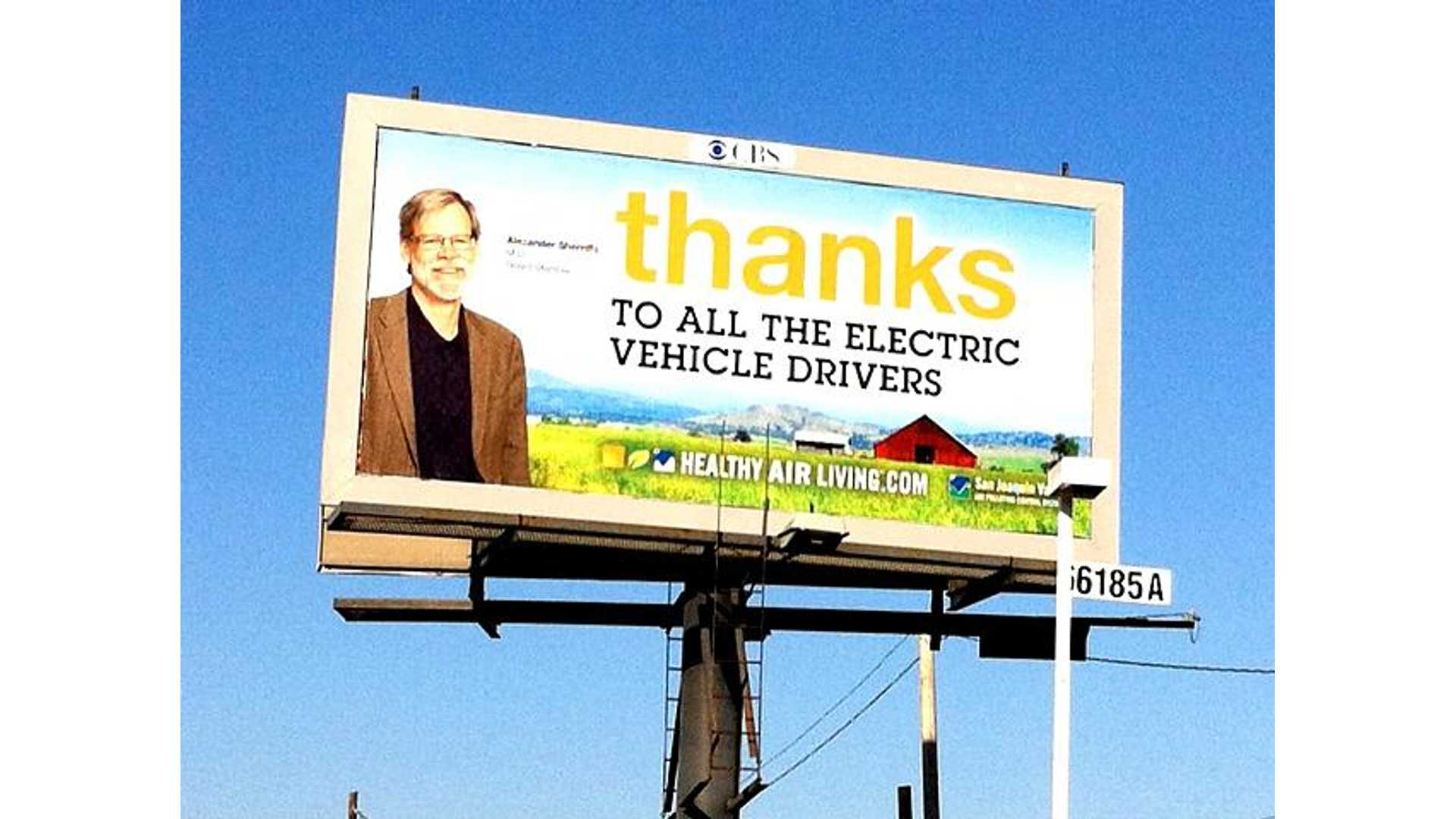

San Joaquin Electric Car Rebate 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/local-central-california-government-offers-3-000-ev-rebate-video.jpg

Can Californians Afford Electric Cars Wait Lists For Rebates Are Long

https://www.ca-sba.org/wp-content/uploads/2022/08/electric-car-rebates-subsidies-1024x304.png

https://driveclean.ca.gov/node/919735

Web The Clean Vehicle Rebate Project CVRP promotes clean vehicle adoption in California by offering rebates for the purchase or lease of new eligible zero emission vehicles

https://ww2.arb.ca.gov/sites/default/files/movingca/cvrp.htm

Web CVRP Clean Vehicle Rebate Program CVRP Get up to 7 500 to purchase or lease a new plug in hybrid electric vehicle PHEV battery electric vehicle BEV or a fuel cell

Tax Rebates For Electric Car 2023 Carrebate

San Joaquin Electric Car Rebate 2023 Carrebate

California Electric Car Rebates Norm Reeves Superstore

2022 Tax Rebate For Electric Cars 2023 Carrebate

California Rebates Electric Car 2023 Carrebate

Does California Offer Electric Car Rebates

Does California Offer Electric Car Rebates

California Rebates For Hybrid Electric Cars Restricted After Plan

Tax Rebate Lease Electric Car 2022 2023 Carrebate

Southern California Edison Rebates For Electric Cars 2023 Carrebate

California Tax Rebates For Electric Cars - Web 2 000 Additional Details x Alameda Municipal Power AMP Used All Electric Vehicle Rebate Local Vehicle Incentive Maximum Incentive 4 000 Additional Details x Antelope