Can Child Claim American Opportunity Credit To claim the AOTC or LLC use Form 8863 Education Credits American Opportunity and Lifetime Learning Credits Additionally if you claim the AOTC the law

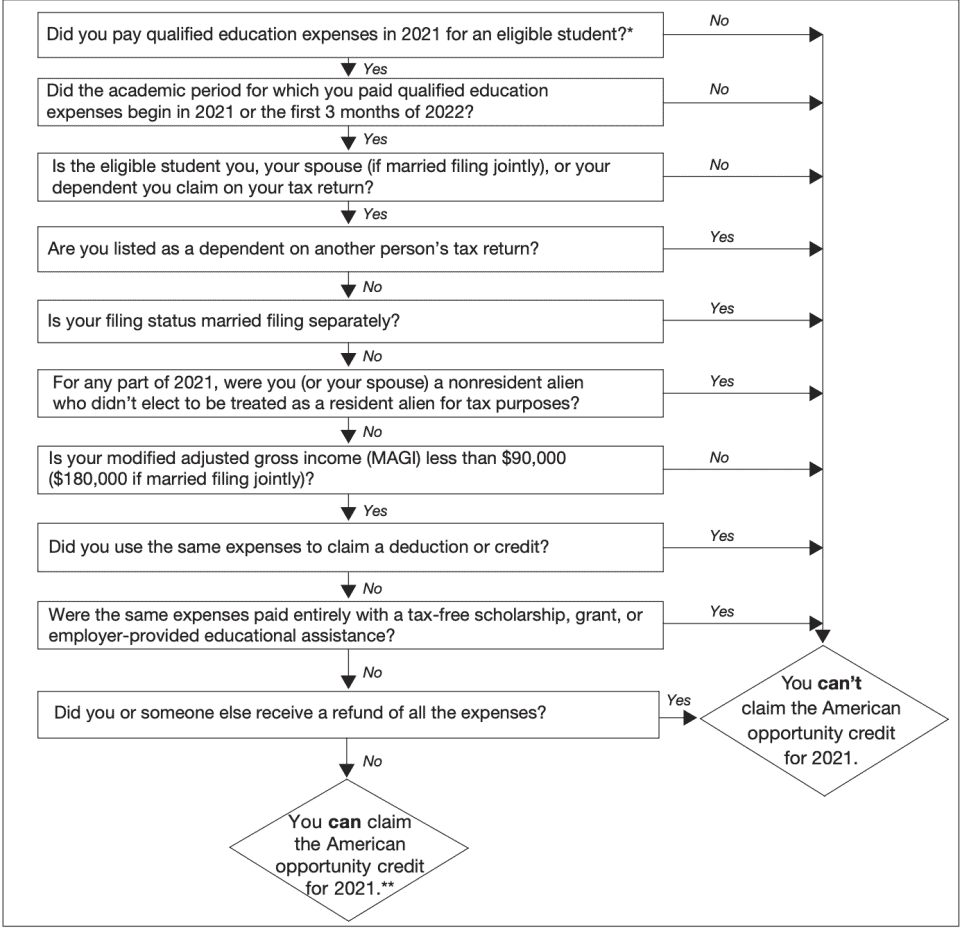

If there are qualified education expenses for your dependent during a tax year either you or your dependent but not both of you can claim an American opportunity credit for Education credits like the American Opportunity Tax Credit AOTC and the Lifetime Learning Credit LLC can help with the cost of higher education See if you qualify

Can Child Claim American Opportunity Credit

Can Child Claim American Opportunity Credit

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjxJY0iSAFwZrqUmkOlm-jT8URsttyofPCOeDZppZld2Yt9UmoOewuC5XP5-lNEYGuVKlh1_rihdYs6h1OFgsCMPpdpW8UPXYLcMBYr-mwYsGmwvnbYQDXb0F4mAzUHvfMvGivCc_icg3FOJDNNOIZUO5SXH8UayfXOz0kFiBGVSJ0P1VUr75WRt5Qc/s906/AO.jpg

What Happens If You Accidentally Claim The American Opportunity Credit

https://image.isu.pub/230412123948-63d39351ec81367ceb54e31df0d7c3fd/jpg/page_1.jpg

American Opportunity Tax Credit Eligibility Refundable Calculator

https://www.urbanaffairskerala.org/wp-content/uploads/2023/02/photo_2023-02-13_05-52-21-1024x577.webp

If you claim her as a dependent then only you can claim her education credits even if you are disqualified by your income If you can claim her but do not actually claim her as a If your son checked on his tax return that he is not being claimed as a dependent then he is allowed to claim the American Opportunity credit because he is also a student over

The American Opportunity Tax Credit is a valuable tax benefit that provides financial relief to eligible students and families particularly in 2025 By following the steps to You can claim the American Opportunity credit for qualified education expenses you pay for a dependent child as well as for expenses you pay for yourself or your spouse If you have several students in your family

Download Can Child Claim American Opportunity Credit

More picture related to Can Child Claim American Opportunity Credit

Can You Claim American Opportunity Credit Income Tax 2023 YouTube

https://i.ytimg.com/vi/tQklBjt7or0/maxresdefault.jpg

Who Can And Should Take The American Opportunity Credit Symphona

https://www.symphona.us/wp-content/uploads/2017/03/fb-2-1.jpg

American Opportunity Tax Credit Calculator Internal Revenue Code

https://www.irstaxapp.com/wp-content/uploads/2023/02/american-opportunity-tax-credit-1024x576.png

Claiming the AOTC previously You can only claim the American Opportunity Tax Credit four times per student The Hope Credit a predecessor of the American Opportunity Credit available through 2009 will also count in the four If you paid for your child s college expenses from a 529 plan you might still be able to claim the IRS American Opportunity Credit There are a few different ways your 529 and the American Opportunity Credit can be used together

Can a student under 24 claim the AOTC You cannot claim any portion of the American Opportunity Credit as a refundable credit on your tax return if you were under the age of 24 at the end of 2020 By claiming your dependent you may be eligible for the American Opportunity Tax Credit up to 2 500 per student or the Lifetime Learning Credit up to 2 000 per return

Can I Claim The American Opportunity Credit For Past Years Leia Aqui

https://www.taxaudit.com/TaxAudit.com_Site/media/BlogSite/76754258.jpg?ext=.jpg

Here s Who Can Claim The American Opportunity Credit GOBankingRates

https://cdn.gobankingrates.com/wp-content/uploads/2021/01/money-education-iStock-621861380.jpg

https://www.irs.gov › credits-deductions › individuals › ...

To claim the AOTC or LLC use Form 8863 Education Credits American Opportunity and Lifetime Learning Credits Additionally if you claim the AOTC the law

https://ttlc.intuit.com › community › college...

If there are qualified education expenses for your dependent during a tax year either you or your dependent but not both of you can claim an American opportunity credit for

2022 Education Tax Credits Are You Eligible

Can I Claim The American Opportunity Credit For Past Years Leia Aqui

American Opportunity Tax Credit Veteran

What Would Disqualify A Taxpayer From Claiming The American Opportunity

What Happens If You Accidentally Claim The American Opportunity Credit

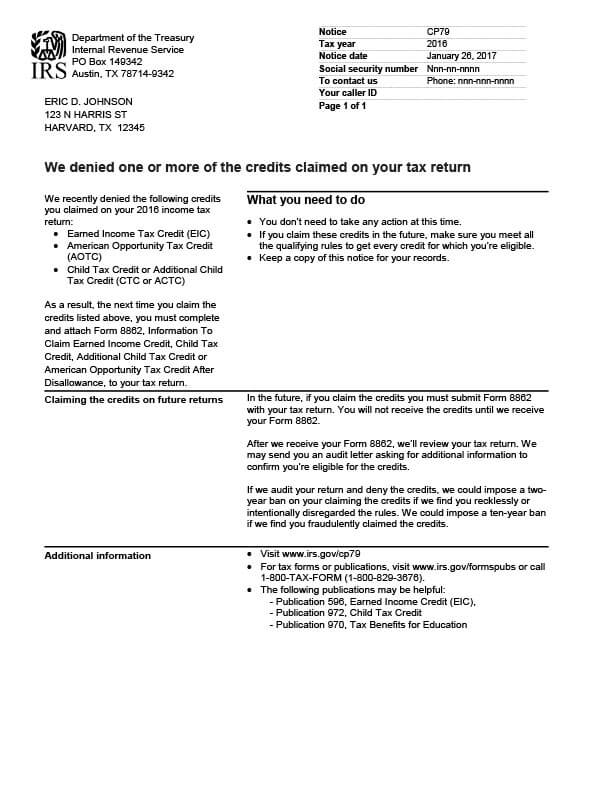

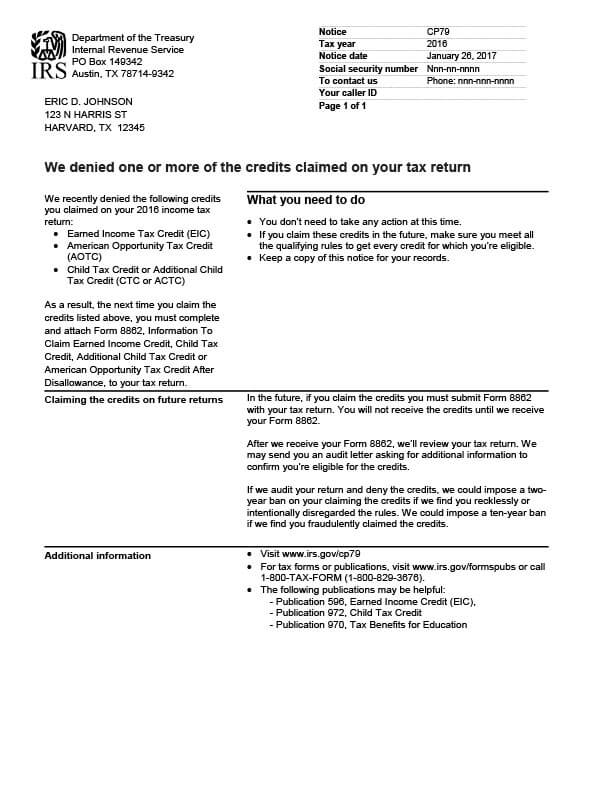

IRS Notice CP79 Tax Defense Network

IRS Notice CP79 Tax Defense Network

What Happens If You Accidentally Claim The American Opportunity Credit

University Store

IRS Form 8863 Instructions

Can Child Claim American Opportunity Credit - The American Opportunity Tax Credit is a valuable tax benefit that provides financial relief to eligible students and families particularly in 2025 By following the steps to