Can Hsa Contributions Be Pre Tax Your contributions to your HSA are made with pre tax dollars which allows you to annually claim a tax deduction equivalent to the amount of your contribution for the year

You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for other reasons the amount you withdraw will be subject to income tax and may be subject to an additional 20 tax Health savings accounts HSAs let you save and pay for qualified medical expenses with tax free dollars 1 But there are limits to how much you can contribute each year Overcontributing can lead to unexpected tax penalties Keep these rules for HSA contributions in mind

Can Hsa Contributions Be Pre Tax

Can Hsa Contributions Be Pre Tax

https://www.zenefits.com/workest/wp-content/uploads/2022/12/HSA-e1677100040197.jpg

CCFBank Health Savings Accounts HSA See Benefits

https://ccf.us/wp-content/uploads/2022/01/hsa-card-render.png

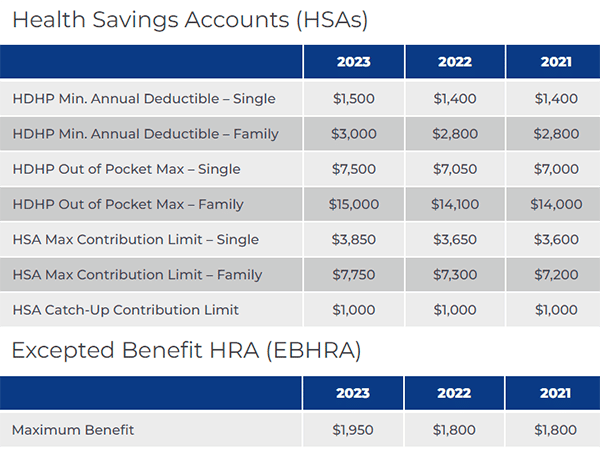

Blog 2023 Health Savings Account Limits Gold Standard Tax

http://www.goldstandardtax.com/wp-content/uploads/2022/09/2023-HSA-Limits.png

An HSA lets you set aside pre tax income to cover healthcare costs that your insurance doesn t pay You can open an HSA if you have a qualifying high deductible health plan For the 2022 tax year If you re enrolled in this type of health plan you can make pre tax contributions to an HSA allowing you to pay for qualified medical expenses tax free This can help create a cash cushion to offset the higher deductibles that HSA eligible health plans typically have

If you enroll in an HSA eligible health plan through the health insurance marketplace rather than through an employer you may not be able to make the same type of pre tax contributions as you would through an employer sponsored HSA Because HSA contributions can be made with pre tax funds you can deduct the amount you ve contributed from your taxable income in the year you

Download Can Hsa Contributions Be Pre Tax

More picture related to Can Hsa Contributions Be Pre Tax

Can I Invest The Money In My HSA FSA Insurance Neighbor

https://www.insuranceneighbor.com/wp-content/uploads/sites/2939/2020/11/HSA-Money-Medical-Health.jpg

HSA Contribution Limits Higher In 2022 Linden Wealth Management

https://static.twentyoverten.com/61915772e25fc62c82c655d3/l7zX6mfsDT/HSAPlan-min.jpeg

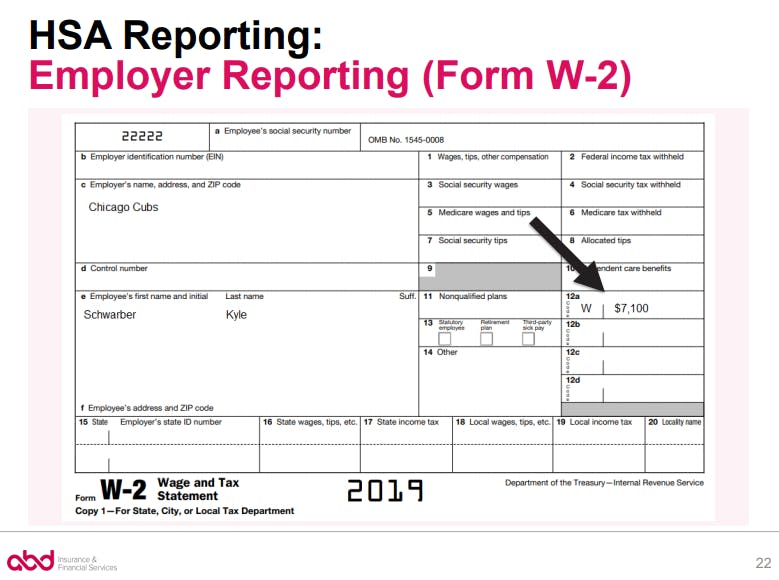

HSA Form W 2 Reporting

https://images.prismic.io/newfront/NmUwZDEzZDgtY2E4Ni00NDVlLTgwY2MtOThiNDgxZDUzZDM3_4_24_20_chart1.png?auto=compress,format&rect=0,0,779,580&w=779&h=580

Contributing to a health savings account HSA allows you to pay for qualified medical expenses with tax free dollars If you have an HSA through an employer you can make contributions on a pretax basis If you have an HSA that s not through an employer you may be able to deduct your contributions on your tax return All contributions to your HSA are tax deducible or if made through payroll deductions are pre tax which lowers your overall taxable income Your contributions may be 100 percent tax deductible meaning contributions can be deducted from your gross income

You have until the tax filing deadline to make a prior year Health Savings Account HSA contribution And the more money you put into your HSA the more you ll reduce your taxable income Learn how Tax documents What tax documents will I get from HSA Bank You may get both a 1099 SA and 5498 SA from us 1099 SA The HSA plan allows you to contribute pre tax money to the account meaning the IRS will not levy income tax on that money no matter how you earn it You use the HSA

IRS Announces 2023 HSA Contribution Limits

https://blog.threadhcm.com/hs-fs/hubfs/HSA Contribution Limits Table.png?width=1536&name=HSA Contribution Limits Table.png

Health Spending Accounts What s The Difference Between An HSA And FSA

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA-1024x316.jpg

https://www.fool.com/retirement/plans/hsa/rules

Your contributions to your HSA are made with pre tax dollars which allows you to annually claim a tax deduction equivalent to the amount of your contribution for the year

https://www.irs.gov/publications/p969

You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for other reasons the amount you withdraw will be subject to income tax and may be subject to an additional 20 tax

IRS Announced 2023 Health Savings Account HSA Contribution Limits HRPro

IRS Announces 2023 HSA Contribution Limits

Benefits Caterpillar

What Is An HSA And How Do They Work

Differences Between 401k Pre Tax Contributions After Tax

How Much Can You Contribute To An Hsa In 2022 2022 CGR

How Much Can You Contribute To An Hsa In 2022 2022 CGR

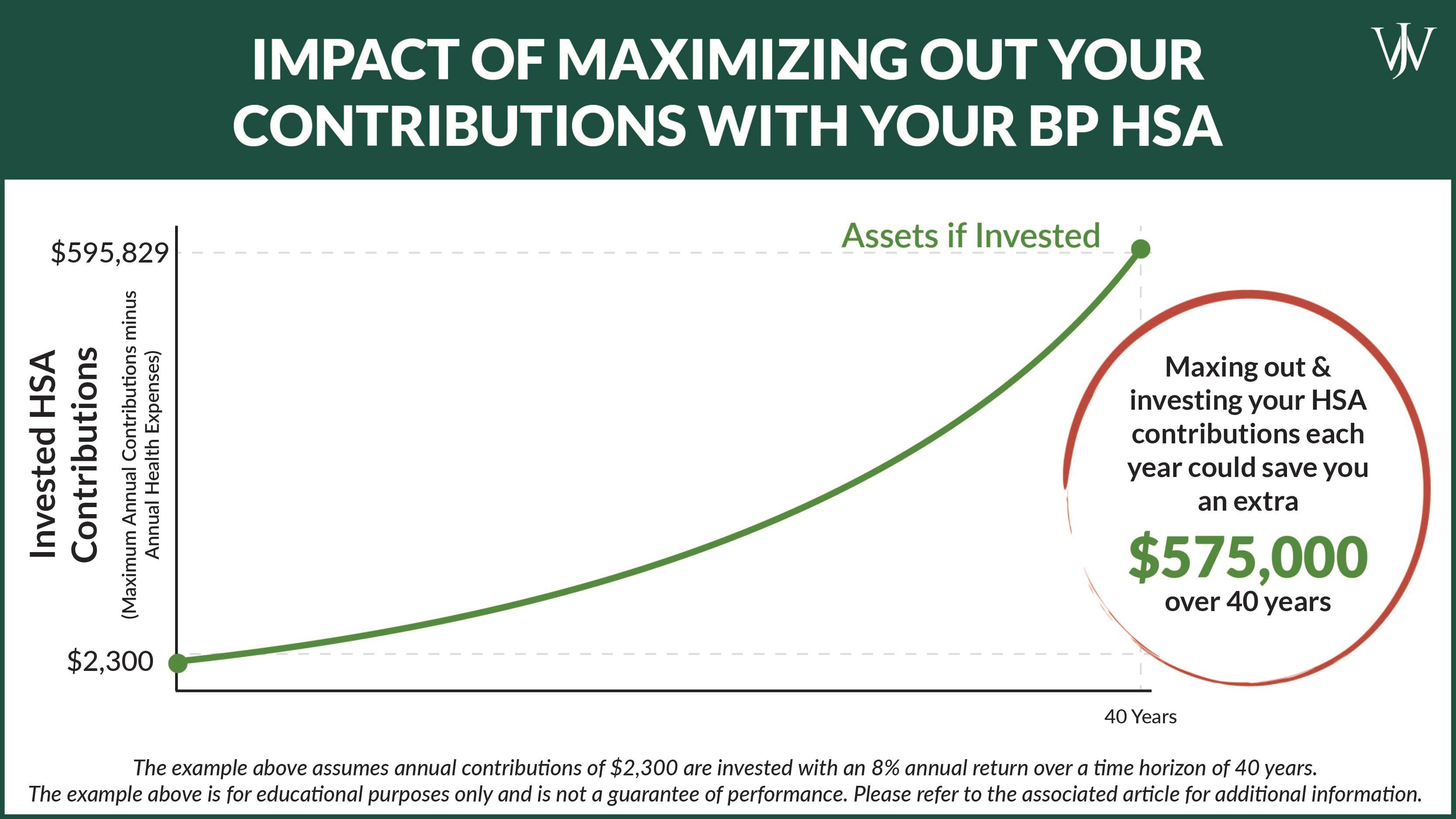

BP HSA Tax Benefits Investment Strategies To Consider In Open Enrollment

What You Need To Know About Health Savings Accounts HSAs

HSAs Beyond The Triple Tax Advantage Retirement Daily On TheStreet

Can Hsa Contributions Be Pre Tax - An employee s contributions to an HSA unless made through a cafeteria plan are includible in income as wages and are subject to federal income tax withholding and social security and Medicare taxes or railroad retirement taxes if applicable