Can I Claim Daycare Expenses On My Taxes If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work you may be able to take the credit for child and dependent care expenses Your federal income tax may be reduced by claiming the Credit for Child and Dependent Care expenses on your tax return

If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit on your 2023 or 2024 taxes of up to 35 of Up to 3 000 of qualifying expenses for a maximum credit of 1 050 for one child or dependent or The child and dependent care credit can be claimed on tax returns filed in mid April You ll need to attach two forms to the standard Form 1040 Form 2441 and Schedule 3

Can I Claim Daycare Expenses On My Taxes

Can I Claim Daycare Expenses On My Taxes

https://i.ytimg.com/vi/n1cFkBpDpnQ/maxresdefault.jpg

Can I Claim Daycare Expenses On My Tax Return Preggy Finance

https://preggyfinance.com/wp-content/uploads/2023/01/christopher-ryan-JoS5xzulJx4-unsplash-scaled.jpg

Home Preggy Finance

https://preggyfinance.com/wp-content/uploads/2023/08/marek-studzinski-B9E3-UtEgXg-unsplash-scaled.jpg

3 000 for one qualifying person 6 000 for two or more qualifying persons How much you can claim phases out depending on your income Requirements for the Child Care Tax Credit To claim this valuable tax credit the following should all be true You and your spouse usually file as married filing jointly See Filing exceptions below While claiming daycare expenses toward a tax credit won t defray all the costs associated with child care it can help reduce them significantly This article will break down what the daycare tax credit is how to qualify and how it can lower your final tax bill

You must file IRS Form 2441 Child and Dependent Care Expenses with your tax return For instructions on how to complete the necessary tax forms visit the IRS s website at www irs gov and get IRS Publication 503 Child and Dependent Care Expenses Can You Claim the Child and Dependent Care Tax Credit You may be eligible for a tax credit of up to 35 By William Perez Updated on December 30 2022 Reviewed by Ebony J Howard Fact checked by Hans Jasperson In This Article Photo The Balance Joshua Seong

Download Can I Claim Daycare Expenses On My Taxes

More picture related to Can I Claim Daycare Expenses On My Taxes

Daycare Expenses Tax Deduction 2023 Can You Claim Daycare On Your 2023

https://phantom-marca.unidadeditorial.es/a9f55cdd3d7a748fca77e32a32e48c4f/resize/1320/f/jpg/assets/multimedia/imagenes/2023/03/10/16784381602456.png

L Thuy t M H nh Kinh T M H nh Kinh T L G Cho V D C c

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/2f005117bd9326f76d152f1e9e0bb161/thumb_1200_1698.png

Can You Write Off Daycare Expenses On Taxes Parents Plus Kids

https://i.pinimg.com/736x/10/c1/61/10c161c465afc1f6f92f8c4ccdf33c79.jpg

For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more Depending on their income taxpayers could write off up to 50 of these expenses For the purposes of this credit the IRS defines a qualifying person as A taxpayer s dependent who is under age 13 when the care is To claim the credit you can file Form 1040 1040 SR or 1040 NR You must complete Form 2441 and attach it to your Form 1040 1040 SR or 1040 NR Enter the credit on your Schedule 3 Form 1040 line 2 The amount of credit you can claim is limited to your tax You can t get a refund for any part of the credit that is more than this limit

If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 you can claim a tax credit of 50 of all qualifying expenses up to a maximum credit of 3 000 for one child or dependent The credit also covers up to 6 000 for two or more children In most years you can claim the credit regardless of your income The Child and Dependent Care Credit does get smaller at higher incomes but it doesn t disappear except for 2021 In 2021 the credit is unavailable for any taxpayer with adjusted gross income over 438 000 Care you can claim

Pin On Finance Tips For Virtual Assistants

https://i.pinimg.com/736x/93/b8/f7/93b8f7d2c0623c4de076f0f8bf3f9582.jpg

Is Preschool Tax Deductible In Canada Ictsd

https://cdnictsd.ictsd.org/is-preschool-tax-deductible-in-canada-.jpg

https://www.irs.gov/credits-deductions/individuals/...

If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work you may be able to take the credit for child and dependent care expenses Your federal income tax may be reduced by claiming the Credit for Child and Dependent Care expenses on your tax return

https://turbotax.intuit.com/tax-tips/family/...

If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit on your 2023 or 2024 taxes of up to 35 of Up to 3 000 of qualifying expenses for a maximum credit of 1 050 for one child or dependent or

Retirement Expense Worksheet Emmamcintyrephotography

Pin On Finance Tips For Virtual Assistants

Still Not Too Late To File Parents Can Claim Daycare Expenses paren

Can I Claim Medical Expenses On My Taxes TMD Accounting

Can I Claim Medical Expenses On My Taxes TurboTax Tax Tips Videos

Pin On SAHM

Pin On SAHM

How Does Daycare Affect Taxes Big Fun Playcare

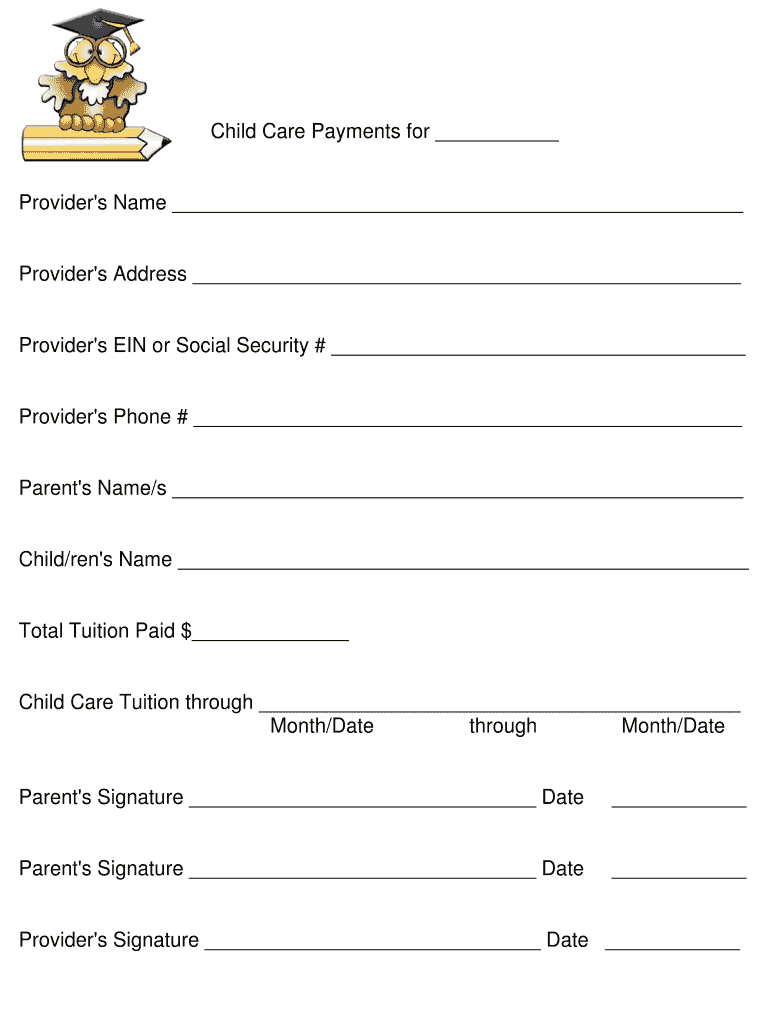

Printable Day Care Forms For Parents Printable Forms Free Online

Daycare Budget Template Excel Printable Word Searches

Can I Claim Daycare Expenses On My Taxes - You must file IRS Form 2441 Child and Dependent Care Expenses with your tax return For instructions on how to complete the necessary tax forms visit the IRS s website at www irs gov and get IRS Publication 503 Child and Dependent Care Expenses