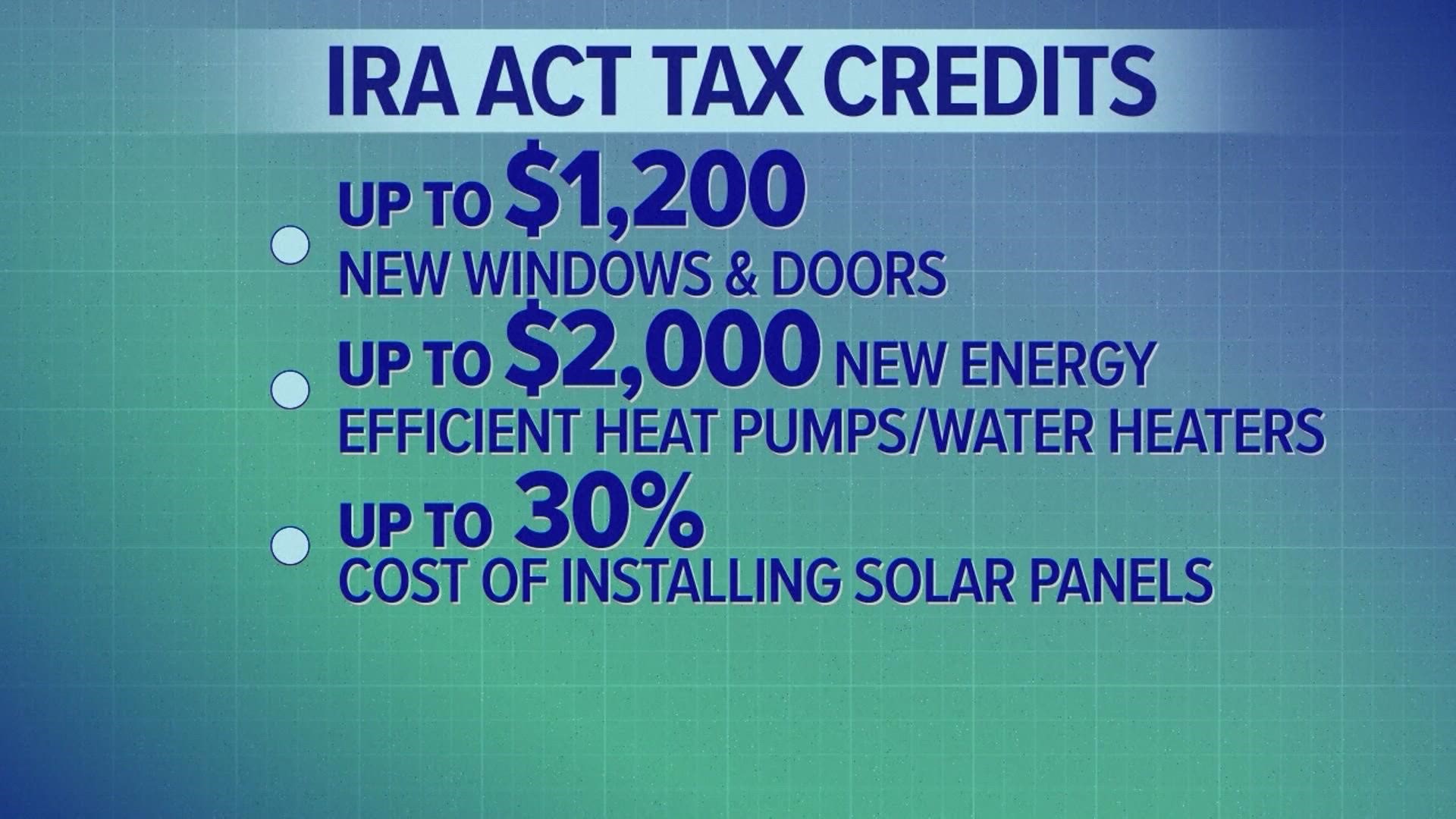

Can I Claim Energy Tax Credit If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

You may claim the residential clean energy credit for improvements to your main home whether you own or rent it Your main home is generally where you live most of the time The credit applies to new or existing homes located in the United States You can t claim the credit if you re a landlord or other property owner who doesn t live in the home A Consumers can claim the same or varying credits year after year with new products purchased but some credits have an annual limit See the table above Q How do consumers find qualified professionals to conduct home energy audits A Visit our Professional Home Energy Assessments page Q What products are eligible for tax

Can I Claim Energy Tax Credit

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg)

Can I Claim Energy Tax Credit

https://cdn.vox-cdn.com/thumbor/WuOuOQRdPx1e96FGTdEFcOHebJ8=/0x0:1000x669/1200x800/filters:focal(525x411:685x571)/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg

Energy Tax Credits Armanino

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

Inflation Reduction Act Increases Home Energy Tax Credits Wfaa

https://media.wfaa.com/assets/WFAA/images/e2c1cb63-8375-4e50-be65-6c75edcd8446/e2c1cb63-8375-4e50-be65-6c75edcd8446_1920x1080.jpg

Key Takeaways An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces the total Energy tax credits aren t refundable tax credits This means that you can reduce your total tax to zero if you have a large enough credit But you can t get any excess credit amount as a payment to you on your tax return if you have more energy credit than your total tax Any unused energy tax credit claimed on your tax return can

Claim 30 up to 1 200 for these qualifying energy property costs and certain energy efficient home improvements Windows Skylights Doors Insulation Water Heaters Natural Gas Oil Propane Furnaces Boilers Central Air Conditioners Electric Panel Upgrade Home Energy Audit Save 30 on Residential Clean Energy Equipment The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Download Can I Claim Energy Tax Credit

More picture related to Can I Claim Energy Tax Credit

California Solar Tax Credit LA Solar Group

https://la-solargroup.com/wp-content/uploads/2020/10/Calculating-Solar-Tax-Credit.jpg

Home Energy Tax Credits Will Ease The Pain Of An Ailing A C

https://www.fredsheatingandair.com/wp-content/uploads/2017/03/TaxCredits-770x494.jpg

Can I Claim GST On Car Insurance PolicyBachat

https://www.policybachat.com/FAQsImages/can-i-claim-gst-on-car-insurance-5727.jpg

The IRS today issued frequently asked questions FAQs in Fact Sheet 2024 15 to address the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements A related IRS release IR 2024 113 April 17 2024 identifies the FAQs revisions as The updated FAQs supersede earlier FAQs that Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other

Claiming energy tax credits for 2022 and 2023 4 min read Share Making energy efficient updates to your home is a great move for our environment But you might feel the pinch in your household budget The good news is that there are a couple of tax credits that can help out your pocketbook Here s the worksheet you ll need to apply the tax credits when you file your tax return IRS Form 5695 Residential Energy Credits If you have questions contact your tax preparer or the Internal Revenue Service IRS for more information The Renewable Energy tax credits have also been extended and now will be available through the end of 2023

Tax Credit ClimaCool

https://climacoolcorp.com/images/18.14995922187eadd2c85269/1683913191583/TaxGuide-MockUp_BLUE.png

Equipment Tax Credits For Primary Residences About ENERGY STAR

https://www.energystar.gov/sites/default/files/TaxCredit_Residential.png

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg?w=186)

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

You may claim the residential clean energy credit for improvements to your main home whether you own or rent it Your main home is generally where you live most of the time The credit applies to new or existing homes located in the United States You can t claim the credit if you re a landlord or other property owner who doesn t live in the home

Who Can I Claim As A Dependent

Tax Credit ClimaCool

What Is Input Credit ITC Under GST

What Happens If You Don t File A Tax Return Tax Time Tax Refund

Can I Claim R D With No Records Of My R D Activities

Make Sure You Get These Federal Energy Tax Credits Consumer Reports

Make Sure You Get These Federal Energy Tax Credits Consumer Reports

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Solar Tax Credit

.jpg?auto=compress&crop=focalpoint&fit=crop&fp-x=0.5&fp-y=0.5&ixlib=php-2.3.0)

Which Car Expenses Can I Claim Through My Limited Company

Can I Claim Energy Tax Credit - No There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made Q4