Can I Claim Home Loan Interest Before Possession Web 16 Mai 2013 nbsp 0183 32 However the total amount of interest paid on home loan prior to possession of house property as can be claimed as pre construction interest in 5 equal

Web Yes it is possible to claim a tax rebate on Home Loan before possession Know how tax exemptions on the interest component of a Home Loan work in the case of under Web 22 Juni 2023 nbsp 0183 32 I took a home loan in 2021 I will get possession of my flat in 2024 tentatively I am paying regular EMI since 2021 inclusive of Principal amp Interest both

Can I Claim Home Loan Interest Before Possession

Can I Claim Home Loan Interest Before Possession

https://www.paisabazaar.com/wp-content/uploads/2019/05/HRA-Home-Loan.jpg

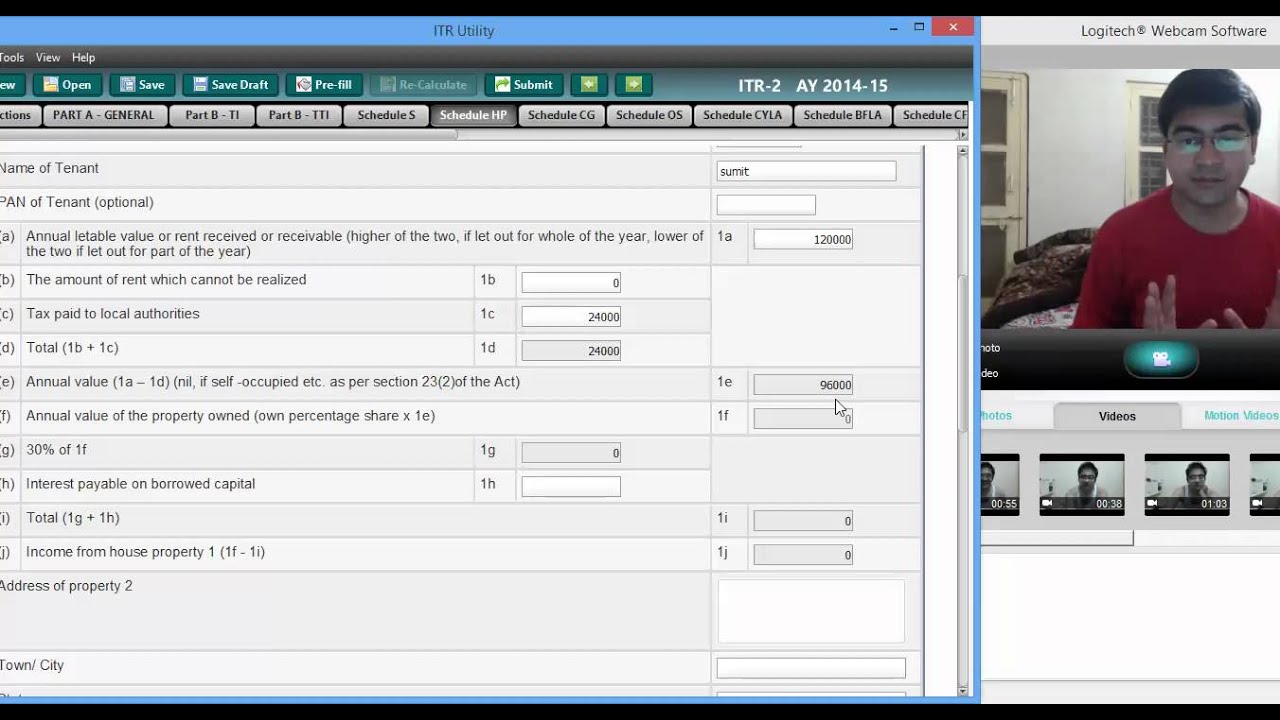

How To Claim Interest On Home Loan Deduction While Efiling ITR

https://mytaxcafe.com/how-to-e-file/images/HLI/house4c.jpg

How To Claim Interest On Home Loan Deduction While Efiling ITR

https://mytaxcafe.com/how-to-e-file/images/ITR/8.jpg

Web 28 Jan 2014 nbsp 0183 32 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that financial year can be claimed Web Before the 2016 Budget Section 24 b of the Income Tax Act allowed homeowners of any self occupied property to get home loan interest deduction worth Rs 2 lakh for the

Web Homeowners can claim the deduction on interest for the home loan only from the year in which the construction of the property is completed In this case Prakash can claim it Web 18 Dez 2023 nbsp 0183 32 You cannot claim tax deductions till the construction of the house is completed Once it is completed you can claim an aggregate of interest paid for the

Download Can I Claim Home Loan Interest Before Possession

More picture related to Can I Claim Home Loan Interest Before Possession

Claim Home Loan Interest YouTube

https://i.ytimg.com/vi/lLsiLdhH5m4/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYKCBYKHIwDw==&rs=AOn4CLAKaqb0GzFCEPBBv2QE5FYVcwdfuw

Understanding Home Loan Refinance Interest Rates In 2023 Money

https://i.pinimg.com/originals/1b/66/fd/1b66fda37115a14cabf98db5215efe2d.jpg

How To Claim Home Loan Deduction In ITR Or How To Claim Home Loan

https://i.ytimg.com/vi/cLR0lUWLdWA/maxresdefault.jpg

Web 24 Dez 2021 nbsp 0183 32 Since the house is is being sold within five years from the end of the financial year in which possession of the house was obtained any pre EMI rebate Web Yes you can claim deductions on the interest paid on the house loan before possession albeit after the construction is complete and the property is ready for occupancy If the

Web 4 Okt 2021 nbsp 0183 32 In our considered view for claiming deduction of interest under Sec 24 b of the Act there is neither any such precondition nor an eligibility criteria prescribed that Web 5 Feb 2023 nbsp 0183 32 Principal repayment The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under

Home Loan Interest Rates Top 15 Banks That Offer The Lowest Mint

https://images.livemint.com/img/2019/10/20/original/Homeloan_1571577540061.png

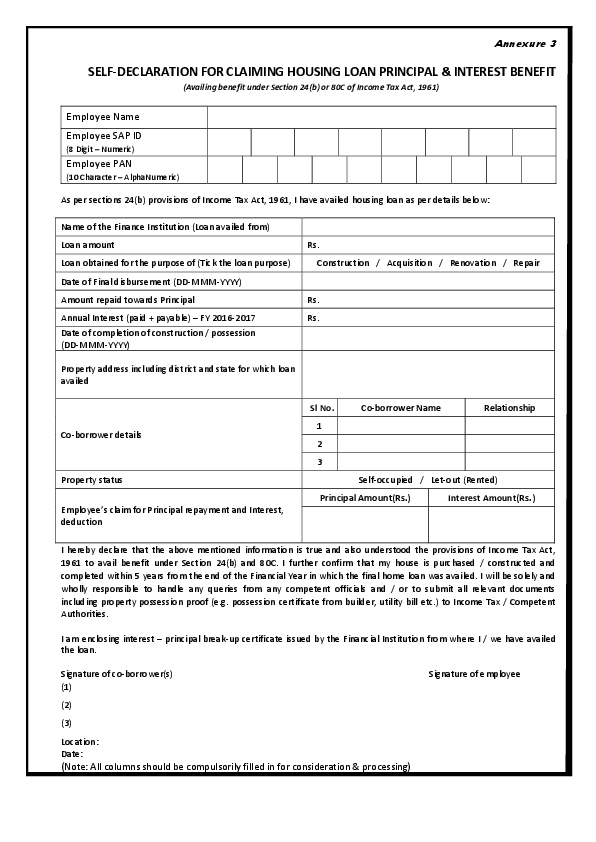

PDF SELF DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL INTEREST

https://0.academia-photos.com/attachment_thumbnails/51719845/mini_magick20180818-9322-1ak7apf.png?1534603265

https://taxmantra.com/tax-benefit-on-home-loan-in-case-of-pre-and-post...

Web 16 Mai 2013 nbsp 0183 32 However the total amount of interest paid on home loan prior to possession of house property as can be claimed as pre construction interest in 5 equal

https://www.bajajhousingfinance.in/claim-tax-benefit-on-home-loan...

Web Yes it is possible to claim a tax rebate on Home Loan before possession Know how tax exemptions on the interest component of a Home Loan work in the case of under

How To Claim Home Loan Interest For Under Construction Property

Home Loan Interest Rates Top 15 Banks That Offer The Lowest Mint

Home Loan Interest Deduction Procedure To Claim HomeCapital

How To Fill Housing Loan Interest In ITR 1 YouTube

Do You Need To Give Up HRA Exemption To Claim Home Loan Interest

Home Loan Programs Explained UW Funding

Home Loan Programs Explained UW Funding

Best Home Loan Interest Rate Comparison

Can I Claim Home Office Expenses YouTube

Can I Claim Home Loan Interest For An Under Construction Property

Can I Claim Home Loan Interest Before Possession - Web 6 Feb 2022 nbsp 0183 32 The interest that is paid before the possession of the property is tax deductible in five installments The installment period starts from the year in which the