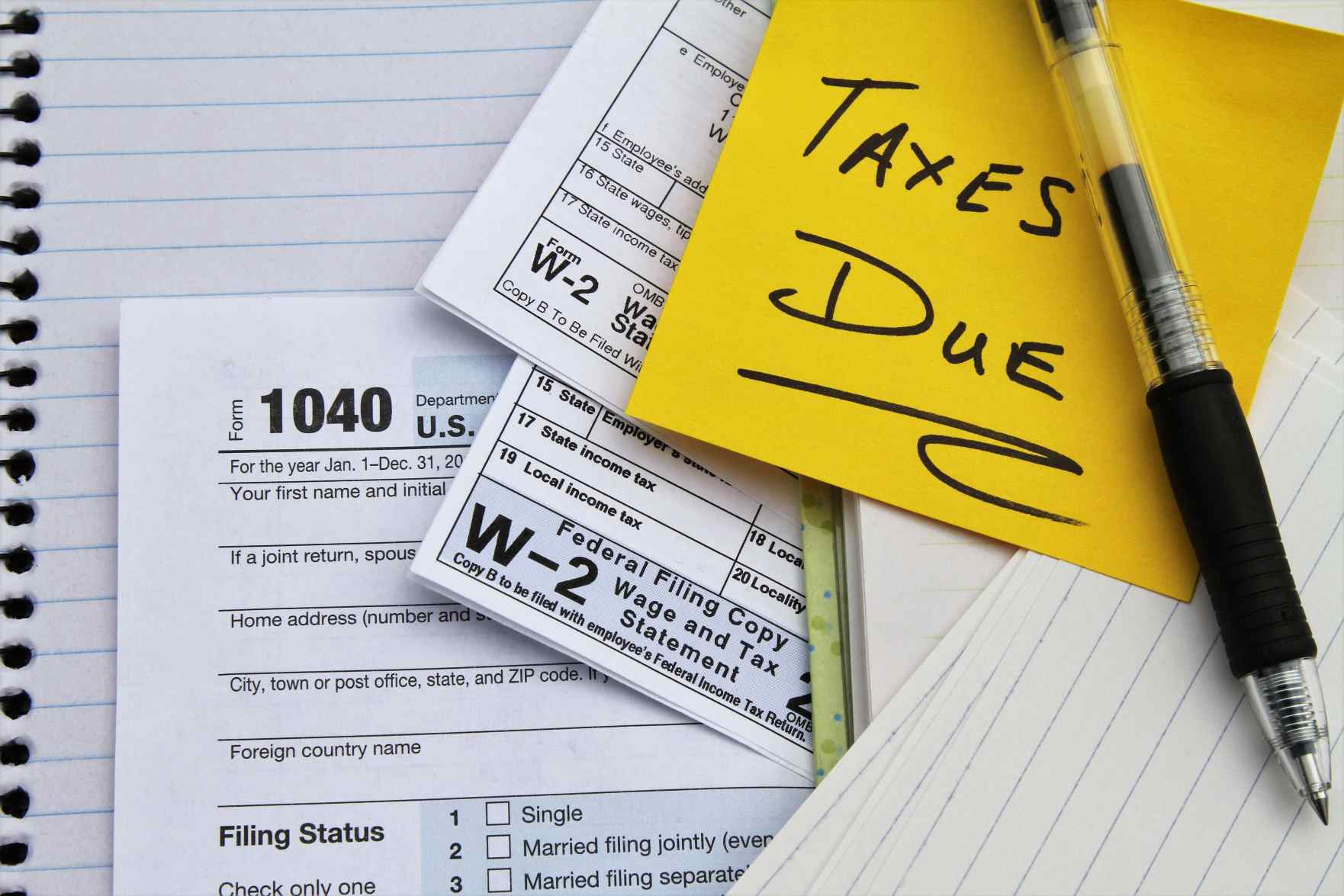

Can I Claim Internet On My Taxes For School Tax season often prompts individuals to explore deductions and credits to reduce their financial burden One area of interest is whether the cost of a computer purchased for

If you are an educator using your computer for school purposes you can use the educator expense deduction to deduct up to 300 of the cost for 2024 With TurboTax Live Full Service a local expert matched to your unique Yes you can deduct internet fees and Word 2013 if you are claiming the American Opportunity Credit You will have to figure out the portion you use for college versus the

Can I Claim Internet On My Taxes For School

Can I Claim Internet On My Taxes For School

https://www.gannett-cdn.com/-mm-/d8340c24781da72edad3ed5c705ee2a1eba422cf/c=0-22-2114-1217/local/-/media/2017/01/29/USATODAY/USATODAY/636213215291027598-GettyImages-518322266.jpg?width=3200&height=1680&fit=crop

Which States Pay The Most Federal Taxes A Look At The Numbers

https://dyernews.com/wp-content/uploads/taxmap-1.png

Can I Claim The Child Support I Pay On My Taxes ChooseGoldmanlaw

https://i.ytimg.com/vi/9nWgIHEB9rQ/maxresdefault.jpg

If you re self employed and WFH your Wi Fi bill can help you save on taxes Learn tips from a CPA on writing off internet expenses Education expenses can be complex but we ll simplify them for you Here are examples of what you can and can t deduct You can deduct Tuition Enrollment fees

However you may be able to claim an American opportunity tax credit for the amount paid to buy a computer if you need a computer to attend your university For more American Opportunity Tax Credit gives you a credit for up to 2 500 of both tuition and other educational expenses With this one you can include the expenses you listed However it can

Download Can I Claim Internet On My Taxes For School

More picture related to Can I Claim Internet On My Taxes For School

What Expenses Can I Claim As A Sole Trader The Financial Resilience Hub

https://financialresiliencehub.co.uk/wp-content/uploads/2022/02/businessman-and-businesswoman-sitting-on-floor-organizing-blank-sheets-of-paper.jpg

Karvy Private Wealth Plan Your Taxes The Smart Way

http://1.bp.blogspot.com/-WmHjzoGbgKc/T3G_NRcrlWI/AAAAAAAABuw/OsvcVGMarrc/s1600/tax.jpg

Can I Claim It What Counts As A Work Expense When You re Doing Your

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1dkqlk.img

These deductions can be claimed on your tax return Tax credits There are tax credits available for internet related expenses such as the American Recovery and According to the IRS you can often deduct qualified educational expenses including internet if you are enrolled in an eligible institution of higher education The one caveat is that you must pay the internet bill directly to the

The IRS generally considers the internet a personal living or family expense meaning internet costs are unfortunately not a qualified education expense at this time The only exception to Claiming Internet as a deduction can be a useful strategy for small businesses and individuals with significant Internet usage However it s essential to understand the rules and

School Should Be Teaching Us Taxes Mf s When School Actually Teaches

https://cdn.verbub.com/images/school-should-be-teaching-us-taxes-mf-s-when-school-actually-teaches-361639.jpg

How Many Kids Can You Claim On Taxes Hanfincal

https://hanfincal.com/wp-content/uploads/2022/01/how-many-kids-can-you-claim-on-taxes-hanfincal.jpg

https://accountinginsights.org › can-you-write-off-a...

Tax season often prompts individuals to explore deductions and credits to reduce their financial burden One area of interest is whether the cost of a computer purchased for

https://turbotax.intuit.com › tax-tips › colle…

If you are an educator using your computer for school purposes you can use the educator expense deduction to deduct up to 300 of the cost for 2024 With TurboTax Live Full Service a local expert matched to your unique

Earned Income Tax Credit EITC Tax Refund Schedule For Tax Years 2022

School Should Be Teaching Us Taxes Mf s When School Actually Teaches

My Expenses On Tax Amazon Appstore For Android

More Taxes Imgflip

Tax Liabilities Difference Between A Tax Lien Levy Garnishment

Filing Taxes Online The Leading 6 Perks Of Taxes Filing Online Twit

Filing Taxes Online The Leading 6 Perks Of Taxes Filing Online Twit

Your Terms Are Acceptable r PoliticalCompassMemes Political

What Can I Claim On My Taxes 2024 Updated RECHARGUE YOUR LIFE

Can I Claim Internet On My Taxes For School Leia Aqui How Much Of My

Can I Claim Internet On My Taxes For School - Generally if your computer is a necessary requirement for enrollment or attendance at an educational institution the IRS deems it a qualifying expense If you are