Can I Claim Meal Allowance Verkko 19 jouluk 2023 nbsp 0183 32 The self employed daily food allowance can be claimed as a business expense on your Self Assessment tax return But you can t just claim everything you

Verkko These expenses cannot be claimed if a meal or beverage is not purchased the meal does not constitute additional expenditure the Verkko Explore the topic Expenses and employee benefits Tax and reporting rules for employers providing meals for employees and directors

Can I Claim Meal Allowance

Can I Claim Meal Allowance

https://www.nswtf.org.au/wp-content/uploads/2021/11/meal_allowance.jpg

Monetary Meal Allowance What Pitfalls May Occur When It Is Used

https://www.dreport.cz/en/wp-content/uploads/sites/4/2021/05/dreamstime_m_139027058.jpg

Meal Allowance For Employees Everything You Need To Know

https://blog.empuls.io/content/images/2023/06/meal-allowance-for-employees.webp

Verkko You can claim for a meal allowance or actual meal costs whilst you are working at a remote site away from your normal place of work Or when staying away from home Verkko 97 rivi 228 nbsp 0183 32 Free food and beverages provided to the employee 1 Fully Taxable Free meals in excess of Rs 50 per meal less amount paid by the employee shall be a

Verkko 11 lokak 2023 nbsp 0183 32 2 Snapchat Snapchat gives its people 16 day for food 3 SAP Depending on the office SAP would provide in house catered meals or a food stipend 4 Webflow Webflow has not set a Verkko 14 maalisk 2023 nbsp 0183 32 Meal allowance rates overseas HMRC has also issued a fairly extensive list of countries and the rates that apply to each If you re staying more than 24 hours you can be reimbursed for the

Download Can I Claim Meal Allowance

More picture related to Can I Claim Meal Allowance

When Can I Claim The Finalisation Rewards Honkai Impact 3 Amino Amino

http://pm1.narvii.com/7213/5cf29fc8bb4725306782999cf785d43cf0fd7b03r1-2048-1152v2_uhq.jpg

How To Set Up A Meal Allowance For Your Employees

https://www.peoplekeep.com/hubfs/All Images/Featured Images/How to set up a meal allowance for your employees_featured.jpg

Can I Claim Meal Travel Expenses For 2019 Tax Year McClish Tax

https://www.mcclishtax.com/wp-content/uploads/2022/11/rsw-1280-fish-chips.webp

Verkko Meals To calculate your meal expenses you can use either the simplified or detailed method or in certain situations the batching method The most you can deduct for Verkko If you are reimbursed for the meals you can t claim them this applies to meals purchased within your allowance If you bought meals outside of your meal

Verkko the employee should have incurred a cost on a meal food and drink after starting the journey and retained appropriate evidence of their expenditure Employers can pay Verkko 11 hein 228 k 2023 nbsp 0183 32 A meal allowance rate is a type of per diem that is standardised They can also be referred to as scale rate payments or subsistences expenses These

OVERTIME MEAL ALLOWANCES WHAT YOU CAN CLAIM AS A TAX DEDUCTION

https://langleymckimmie.com.au/wp-content/uploads/2023/01/Meal-Allowance-1536x1025.jpg

SARS Ups Amount You Can Claim For Work related Food And Travel Expenses

https://www.thesouthafrican.com/wp-content/uploads/2020/03/b92d297c-food-allowance.jpg

https://taxscouts.com/.../what-is-the-self-employed-daily-food-allowance

Verkko 19 jouluk 2023 nbsp 0183 32 The self employed daily food allowance can be claimed as a business expense on your Self Assessment tax return But you can t just claim everything you

https://www.travelperk.com/.../subsistence-al…

Verkko These expenses cannot be claimed if a meal or beverage is not purchased the meal does not constitute additional expenditure the

Who Can I Claim As A Dependent

OVERTIME MEAL ALLOWANCES WHAT YOU CAN CLAIM AS A TAX DEDUCTION

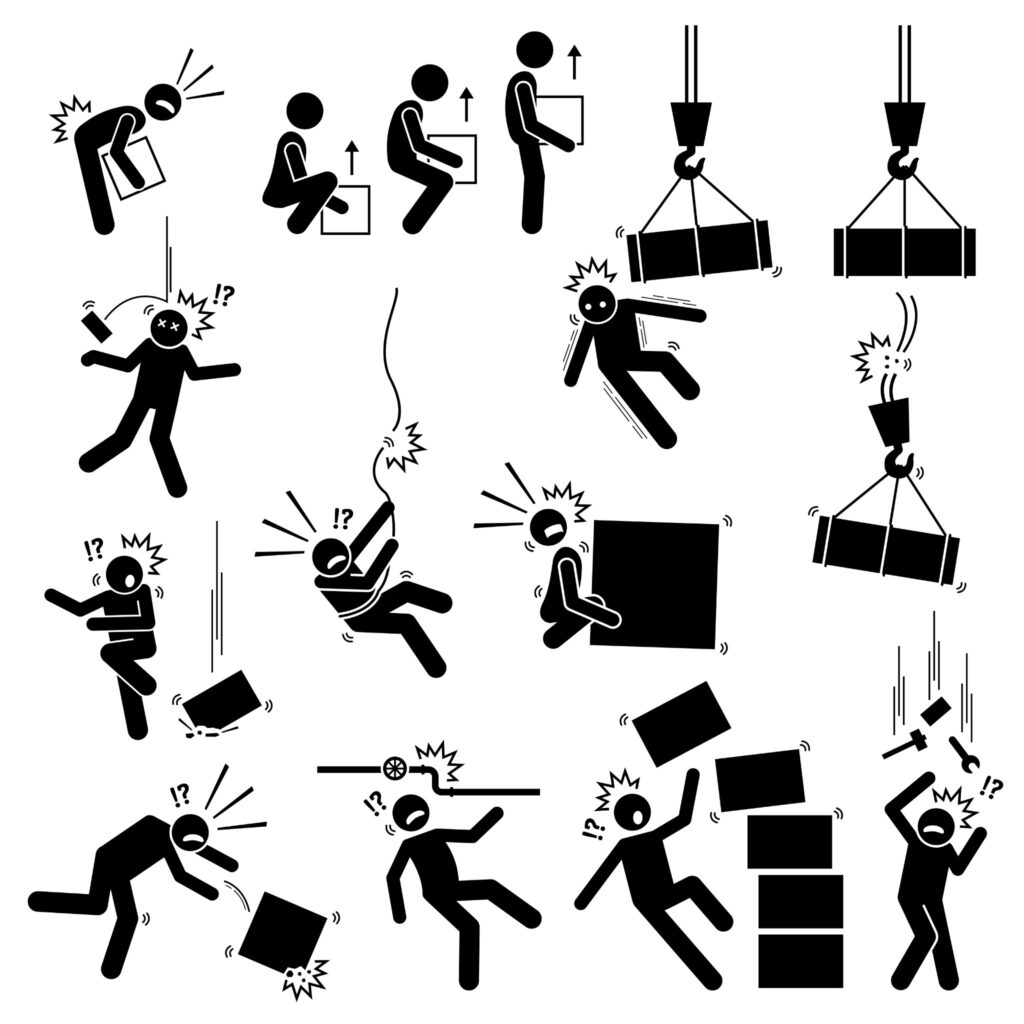

No Manual Handling Risk Assessment In The Workplace Can I Claim

Medicare Food Allowance And Grocery Benefits Medigap

Claiming Meal Allowance In Ireland Payroll Express

What Products Do VAT Exemption For Disability Apply To And Can I Claim

What Products Do VAT Exemption For Disability Apply To And Can I Claim

Meal Allowances Wall Street Oasis

Cobb Amos Estate Agents As A Landlord What Expenses Can I Claim

Meal Allowance And Taxation In Salary For Indian Employees 2022

Can I Claim Meal Allowance - Verkko 11 lokak 2023 nbsp 0183 32 2 Snapchat Snapchat gives its people 16 day for food 3 SAP Depending on the office SAP would provide in house catered meals or a food stipend 4 Webflow Webflow has not set a