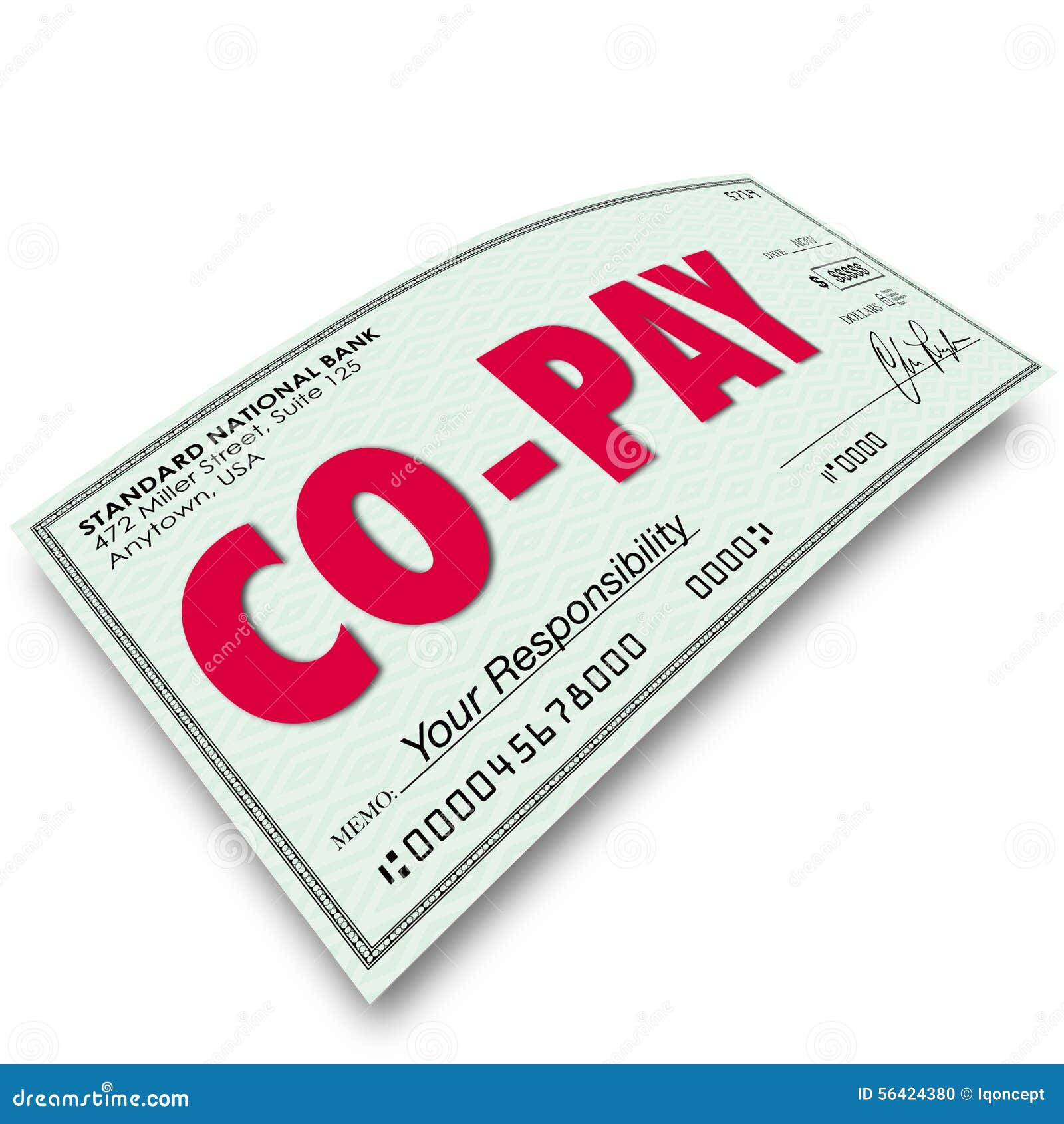

Can I Claim Medical Insurance Payments On My Taxes For the 2022 and 2023 tax years you re allowed to deduct any qualified unreimbursed healthcare expenses you paid for yourself your spouse or your dependents but only if

Yes loved it Could be better If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than You typically can t claim a medical expense deduction for health premiums if you get coverage through your employer tax deductions are available for medical expenses for

Can I Claim Medical Insurance Payments On My Taxes

Can I Claim Medical Insurance Payments On My Taxes

https://digitalasset.intuit.com/IMAGE/A8wIQsQik/medicalexpenses_INF14196.jpg

Medical Payments Per Workers Compensation Claim Grew About 3 Percent

http://ww1.prweb.com/prfiles/2017/12/06/14990702/WC_claims_form5.jpg

Fillable Health Insurance Claim Form Printable Forms Free Online

http://www.contrapositionmagazine.com/wp-content/uploads/2020/07/health-insurance-claim-form-1500-fillable-free.jpg

Because these contributions are already tax advantaged you cannot claim them as a separate deduction on your tax return But if you pay for your medical expenses Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication This is an adjustment to income rather than an itemized deduction for premiums you paid on a health insurance policy covering medical care including a qualified long term care

Download Can I Claim Medical Insurance Payments On My Taxes

More picture related to Can I Claim Medical Insurance Payments On My Taxes

Fillable Online Can I Claim Medical Expenses On My Taxes H R Block Fax

https://www.pdffiller.com/preview/564/82/564082259/large.png

Can I Claim Medical Expenses On My Taxes

https://ercare24.com/wp-content/uploads/2016/08/Can-I-Claim-Medical-Expenses-on-Taxes.jpg

Insurance Payment Options Serene Behavioral Health

https://i1.wp.com/serenehs.com/wp-content/uploads/2018/11/1140-apply-health-insurance-aarp.imgcache.revd38ac59ee010d158c0874b1125c8fe2f.jpg?fit=1140%2C655&ssl=1

Feb 7 2022 at 1 30 p m Getty Images You may be eligible for tax benefits to offset some of your health insurance premiums or medical expenses Health insurance is You can claim your health insurance premiums on your federal taxes if you buy your own health insurance itemize deductions and spent more than 7 5 of your income on

If you re able to claim your health insurance as a medical expense deduction you can only deduct medical expenses if you itemize your deductions and they exceed 7 5 of your If you pay premiums for a private health insurance plan you may be eligible for a credit against your taxes Find out how to report these amounts on your income tax return

Solved 1 What Percentage Of Medical Insurance Payments Can Chegg

https://media.cheggcdn.com/study/3f2/3f2b12fc-781f-4be6-823a-af88ff3c9ecf/image

Can I Go To Jail For Not Paying My Taxes Lawyer Blogger

https://lawyerblogger.com/wp-content/uploads/2021/03/can-I-go-to-jail-for-not-paying-taxes.jpg

https://www.investopedia.com/are-health-insurance...

For the 2022 and 2023 tax years you re allowed to deduct any qualified unreimbursed healthcare expenses you paid for yourself your spouse or your dependents but only if

https://www.hrblock.com/tax-center/filing/...

Yes loved it Could be better If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than

Browse Our Image Of Medical Insurance Receipt Template Invoice

Solved 1 What Percentage Of Medical Insurance Payments Can Chegg

The Medical Care Tax Credit What It Is And How To Claim It Nursa

Medical Payments Per Comp Claim Decrease In California Business Insurance

Can I Claim Medical Expenses On My Taxes TMD Accounting

Sample Letter To Insurance Company For Medical Claim Download Printable

Sample Letter To Insurance Company For Medical Claim Download Printable

How To Avoid TDS On Interest On Fixed Deposits Bank FD Wealth18

Medical Insurance Template Orthopedic And Traumathology Cartoon

Can You Claim Health Insurance Cost On Taxes

Can I Claim Medical Insurance Payments On My Taxes - You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication