Can I Claim Self Education Expenses Topic no 513 Work related education expenses You may be able to deduct the cost of work related education expenses paid during the year if you re A

If you re claiming a deduction for self education expenses incurred before 1 July 2022 you may have to reduce your allowable self education expenses by 250 You may be able to claim a deduction for self education expenses if your self education relates to your current work activities As your current work activities relate to accounting

Can I Claim Self Education Expenses

Can I Claim Self Education Expenses

https://www.shartruwealth.com.au/wp-content/uploads/2022/05/How-to-claim-self-education-expenses-on-your-tax.jpg

Can I Claim My Education Expenses UBOMI Beyond Money

https://ubomi.com.au/wp-content/uploads/2022/04/Can-I-Claim-My-Education-Expenses-1.jpg

When can I Claim Self education Expenses Richards Financial Services

https://www.richards.net.au/wp-content/uploads/2019/11/Untitled-design4.png

Individuals may be able to claim self education expense deductions for tuitionfees incurred when undertaking courses of study that are not subsidised by the Hi I saw in another post that someone asked if they can claim their further education expenses on tax Background abt myself I work as a PCA but I have an

Maximize tax savings by claiming self education expenses Learn how to deduct costs for courses books and to reduce your taxable income Taxpayers can claim self education expenses which includes undertaking university courses where they are able to show the study is connected with their income

Download Can I Claim Self Education Expenses

More picture related to Can I Claim Self Education Expenses

Handling Deductions For Self education Expense Articles

https://blog.ohm.com.au/site/wp-content/uploads/handling-deductions-for-self-education-expense-768x363.jpg

Five Things Students Need To Know For Tax Time The Canberra Times

https://www.canberratimes.com.au/images/transform/v1/crop/frm/EPJMFvETpvLvtfsQ9ZEeUX/6f6f5c7e-2946-4ecc-b2a0-dd0781d4e527.jpg/r0_0_7820_5213_w1200_h678_fmax.jpg

Self education What Can You Claim GENFOCUS

https://www.genfocus.com.au/wp-content/uploads/Self-education-What-can-you-claim-1024x576.jpg

Because you received the additional compensation as wages you re treated as paying the tuition yourself out of pocket To determine if you can claim the Who can claim self education expenses Accountant and Principal at RBizz Accountants Raj Kumar says there s a golden rule for anyone unsure if they can

Need to know how to deduct job related education expenses from your taxes Learn about allowable education expenses and get tax answers at H R Block An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to

How To Claim Self Education Expenses Tax Deduction Bmgsec

https://bmgsec.com.au/wp-content/uploads/2023/01/image.png

Self education What Can You Claim RA Advisory Business Accountants

https://raadvisory-1a683.kxcdn.com/wp-content/uploads/2023/10/Self-education-What-can-you-claim.jpg

https://www.irs.gov/taxtopics/tc513

Topic no 513 Work related education expenses You may be able to deduct the cost of work related education expenses paid during the year if you re A

https://www.ato.gov.au/individuals-and-families/...

If you re claiming a deduction for self education expenses incurred before 1 July 2022 you may have to reduce your allowable self education expenses by 250

Self Education Expense One Click Life

How To Claim Self Education Expenses Tax Deduction Bmgsec

Claiming Self Education Expenses Venture Private Advisory

Self education What Can You Claim Epoch Intelligent Accounting

Self Employed Allowable Expenses Accounting Basics Best Accounting

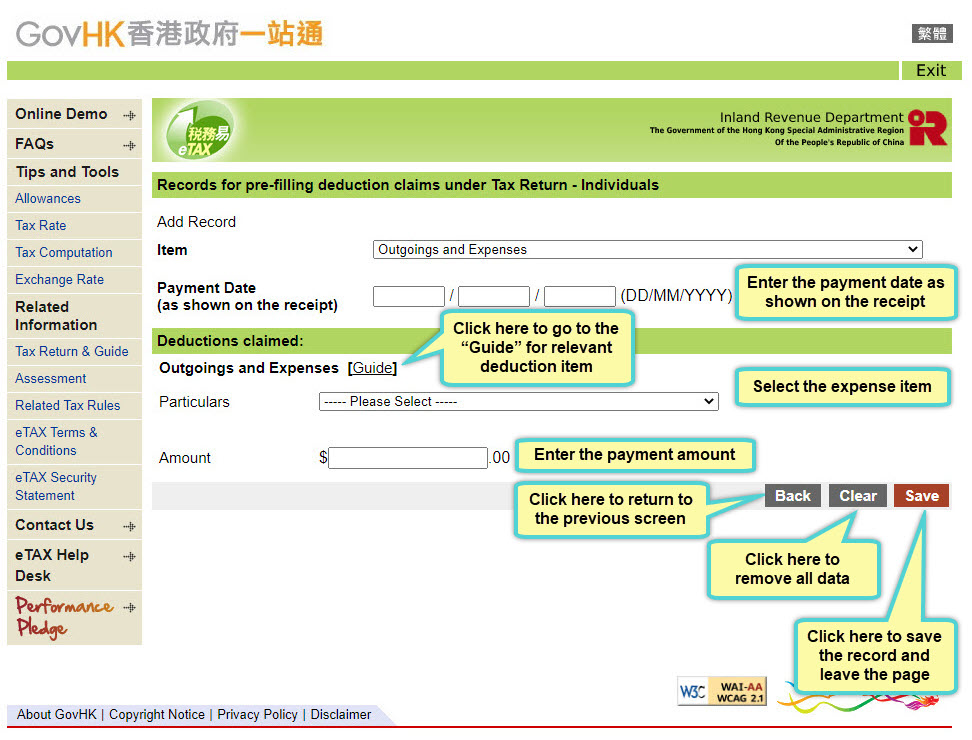

Add Record

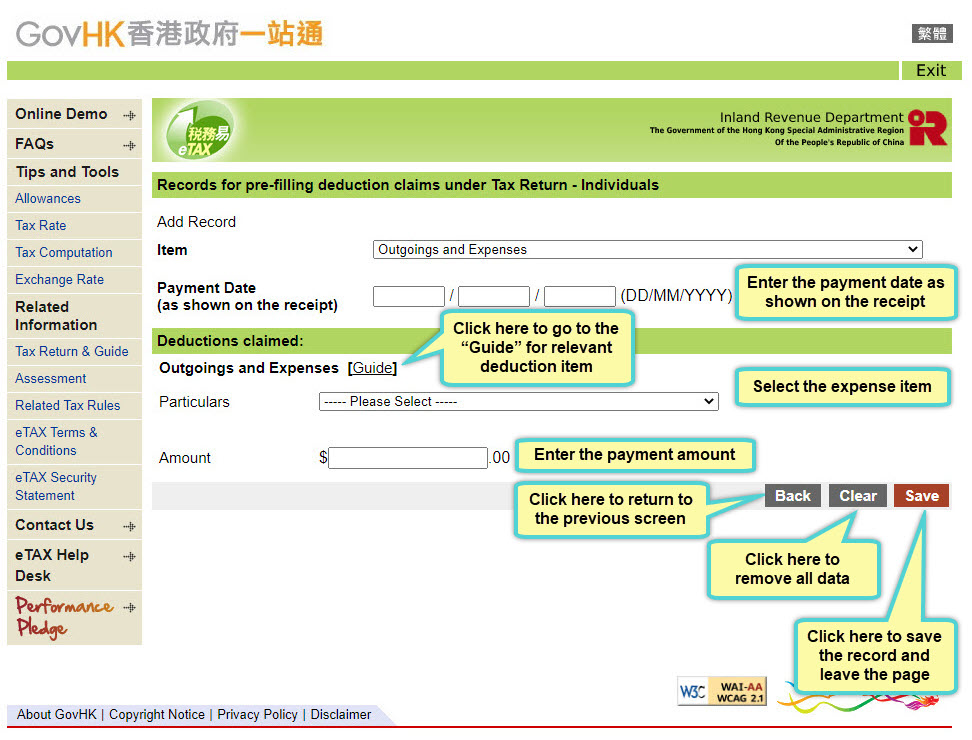

Add Record

2017 No 1

Expired Tax Breaks Deductible Unreimbursed Employee Expenses

Claiming Self Education Expenses New Guidelines For FY 2023 24

Can I Claim Self Education Expenses - Self education expenses are deductible when the course you undertake leads to a formal qualification and meets certain conditions Find out more about these deductions