Can I Claim Tax Relief On My Wife S Pension You can get tax relief on private pension contributions worth up to 100 of your annual earnings You ll either get the tax relief automatically or you ll have to claim it yourself

As your wife is not a taxpayer she can put 2 880 into a personal pension scheme and receive 20 per cent tax relief The government will top up her contribution by 720 making the maximum I have read that it is possible to pay into my wife s pension each tax year and that she then benefits from 20 tax relief on the amount paid in so that she effectively gets 1 20

Can I Claim Tax Relief On My Wife S Pension

Can I Claim Tax Relief On My Wife S Pension

https://25174313.fs1.hubspotusercontent-eu1.net/hubfs/25174313/assets_comparehero/maximise-income-tax-relief.jpg

Claiming For Working From Home Expenses In 2021 22

https://rfm-more.co.uk/wp-content/uploads/2021/09/Working-from-home-expenses.jpg

Hecht Group Does Pennymac Pay Property Taxes

https://img.hechtgroup.com/1663215364372.jpg

If you re a registered tax payer you won t have to pay tax on your pension contributions up to a limit This is known as tax relief The amount of tax relief you receive is dependent on the There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer chooses which

Overview You can get tax relief on most contributions you make to registered pension schemes some overseas pension schemes You can t claim relief for payments you You ll only get tax relief on personal pension contributions up to 100 of your UK earnings or 3 600 if this is greater if you re a low or non earner Let s say you earned 35 000 a year

Download Can I Claim Tax Relief On My Wife S Pension

More picture related to Can I Claim Tax Relief On My Wife S Pension

Are You Owed A Tax Refund On Your Pension

https://static.wixstatic.com/media/86bc97_3cbaa83e44154d0592e1aed784b07f19~mv2.jpg/v1/fill/w_980,h_653,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/86bc97_3cbaa83e44154d0592e1aed784b07f19~mv2.jpg

Mac Financial Making Pension Contributions Before The End Of The Tax

http://macfinancial.uk.com/wp-content/uploads/2016/02/pension1.jpg

What Is Pension Tax Relief Moneybox Save And Invest

https://www.moneyboxapp.com/wp-content/uploads/2020/01/Copy-of-How-do-_pensions-work_-02-1024x516.png

Tax relief is payable only on eligible contributions made into your Nest retirement pot The contributions that are eligible for tax relief are One off and regular contributions paid by you With relief at source your employer takes away tax from your salary and then deducts your pension contribution from your after tax pay which is sent to your pension provider Your

Your provider may also take off any tax due on your State Pension through Pay As You Earn PAYE On some occasions you might pay emergency tax when you take money from your You can t claim any tax relief yourself on the money you ve paid in as it s treated as if it had been paid by your husband If your husband is a higher rate taxpayer

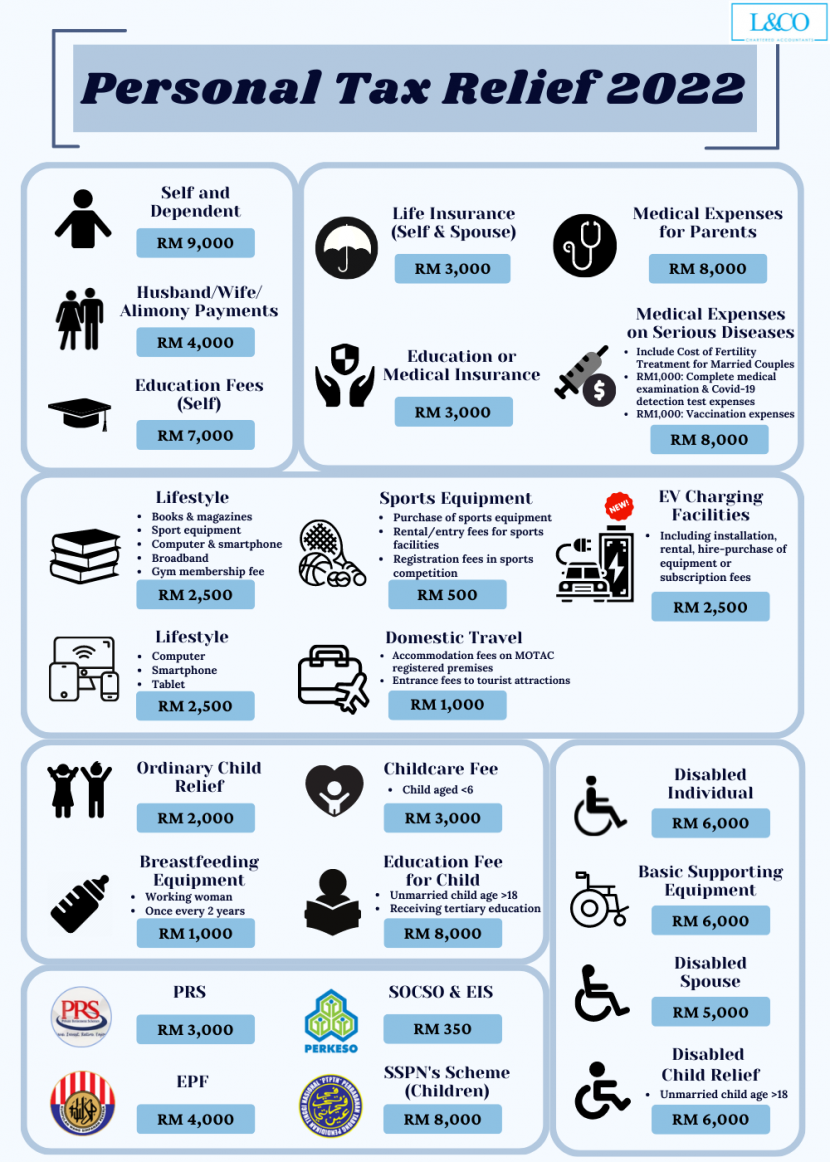

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/3-3-1024x1024.png

Can I Get Tax Relief On Pension Contributions Financial Advisers

https://www.insightifa.com/wp-content/uploads/2022/12/Tax-Relief-On-Pensions.jpg

https://www.gov.uk/tax-on-your-private-pension/pension-tax-relief

You can get tax relief on private pension contributions worth up to 100 of your annual earnings You ll either get the tax relief automatically or you ll have to claim it yourself

https://www.ft.com/content/db749266-1ea0-11e7-b7d3-163f5a7f229c

As your wife is not a taxpayer she can put 2 880 into a personal pension scheme and receive 20 per cent tax relief The government will top up her contribution by 720 making the maximum

List Of Personal Tax Relief And Incentives In Malaysia 2023

Personal Tax Relief 2022 L Co Accountants

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Tax Relief 2019 Malaysia Jan Hudson

Personal Tax Relief 2022 L Co Accountants

Can I Claim Tax Relief On Pension Contributions Chapman Robinson

Can I Claim Tax Relief On Pension Contributions Chapman Robinson

What Expenses Can I Claim If I m Self employed

Can I Claim Tax Relief On Mortgage Interest

Claiming Tax Relief On Expenses Moorgates

Can I Claim Tax Relief On My Wife S Pension - You ll only get tax relief on personal pension contributions up to 100 of your UK earnings or 3 600 if this is greater if you re a low or non earner Let s say you earned 35 000 a year