Can I Claim Uniform Expenses On My Taxes Verkko For example a uniform with a company logo isn t suitable for everyday wear so it would qualify as a deduction Work clothes are tax deductible if your employer requires you

Verkko 84 rivi 228 nbsp 0183 32 1 tammik 2015 nbsp 0183 32 Income Tax Guidance Check how much tax relief you can Verkko You can claim tax relief for a uniform A uniform is a set of clothing that identifies you as having a certain occupation for example nurse or police officer You may also be

Can I Claim Uniform Expenses On My Taxes

Can I Claim Uniform Expenses On My Taxes

https://www.taxback.co.uk/wp-content/uploads/2017/01/Part-Time-Jobs-PAYE-Tax-Refunds-1242x800.jpg

Work Uniform Expenses Claim Work Uniform Tax Deductions

https://www.etax.com.au/wp-content/uploads/2014/03/Work-uniform-expenses.jpg

Work Uniform Expenses Claim Your Work Uniform As A Tax Deduction If

https://i.pinimg.com/originals/9b/85/f5/9b85f5a2483ec7f56cea1df3f46ac7b6.png

Verkko 18 elok 2023 nbsp 0183 32 Eligible pieces of clothing can be claimed alongside your other deductible expenses on Schedule C of your tax return You Verkko Occupation Specific work clothing e g a chef s hat Deducting expenses for work clothing is a great way to reduce your tax By accurately submitting deductible

Verkko If you have to buy a uniform that identifies clearly what you do you can put that into your accounts and claim tax relief on it An example would be a uniform for a self Verkko 29 jouluk 2023 nbsp 0183 32 The cost of maintaining their uniforms should be dealt with via their tax code with their tax free personal allowance raised to compensate And if you re self employed instead of claiming via the

Download Can I Claim Uniform Expenses On My Taxes

More picture related to Can I Claim Uniform Expenses On My Taxes

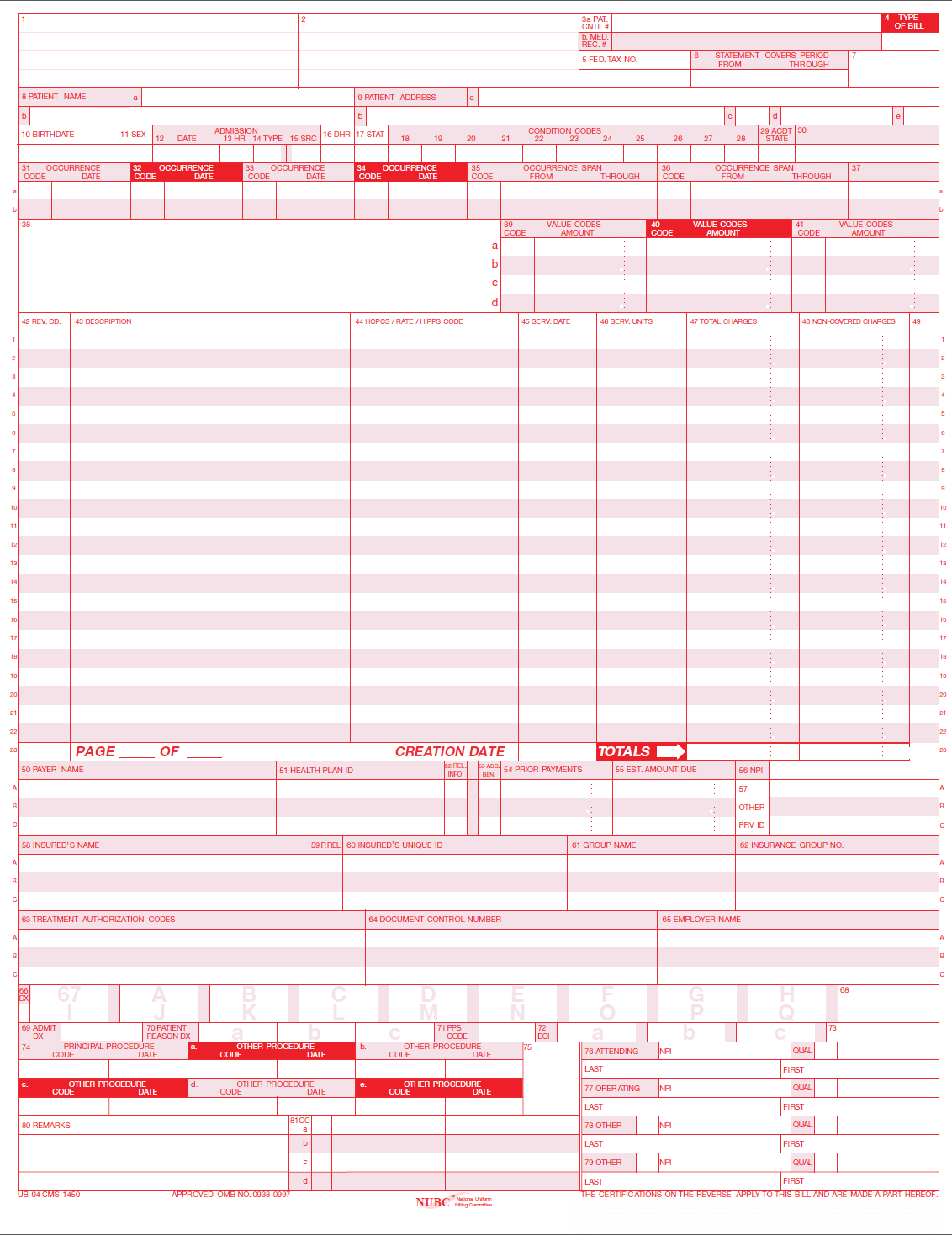

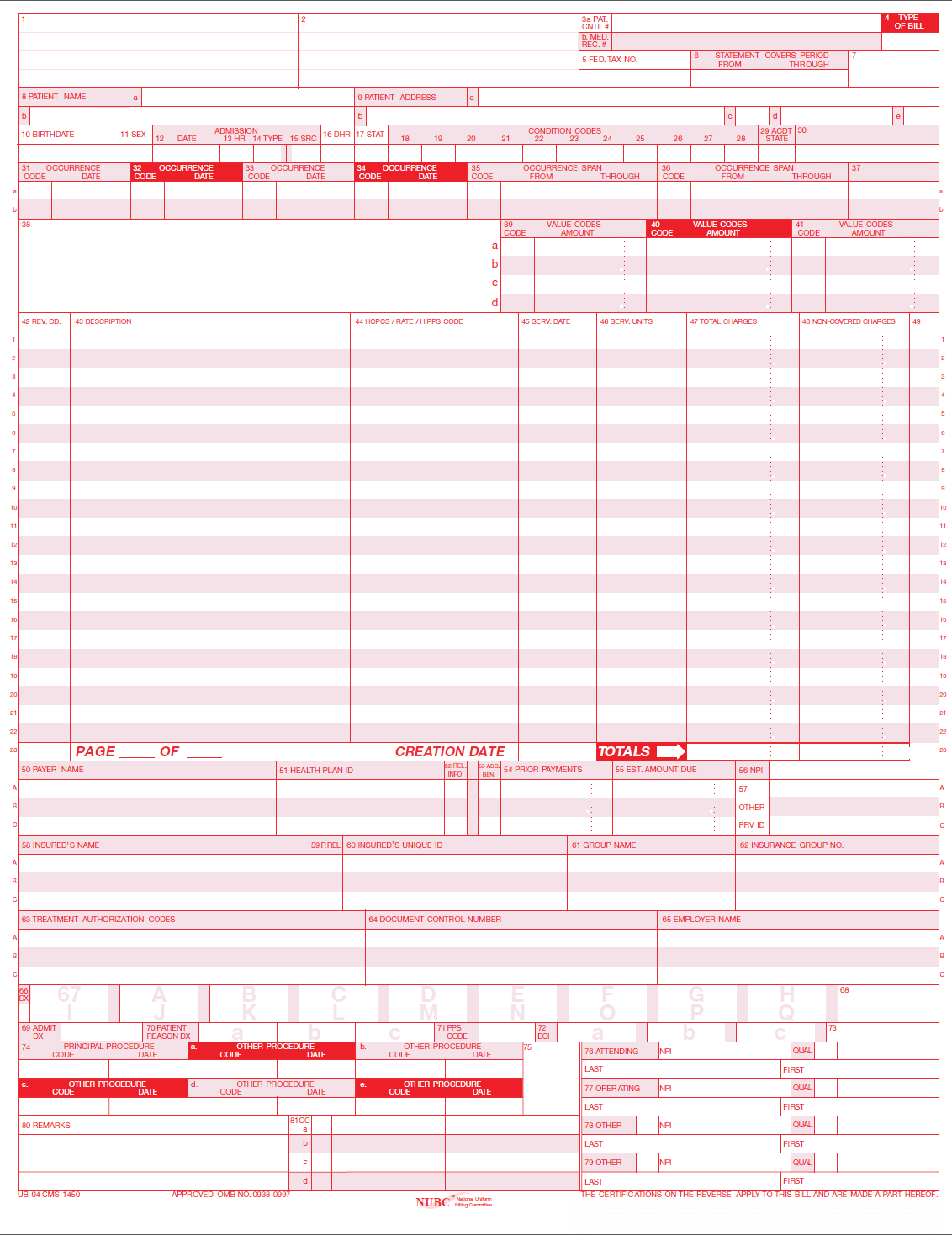

UB 04 Uniform Bill Claims Fiachra Forms Charting Solutions

https://fiachraforms.com/wp-content/uploads/paper-claim-forms-ub-04.png

Tax Tips Uniform Expenses And Tax Deductions Online Tax Australia

https://i.ytimg.com/vi/5QTxEIQI1sI/maxresdefault.jpg

Business Expenses What You Can And Can t Claim The Independent Girls

https://i.pinimg.com/originals/42/07/ec/4207ec069b3d10ab765b00092d50d10a.png

Verkko The basics of this deduction are fairly straightforward If the uniform or clothing could be worn outside of work you shouldn t claim it as a tax deduction However the line Verkko 26 tammik 2017 nbsp 0183 32 Whether your company s uniforms will qualify for that exclusion is uncertain based on the facts you ve provided Code 167 162 generally allows a

Verkko 15 toukok 2023 nbsp 0183 32 Yes uniform tax relief can be claimed for up to the previous four years This is still the case even if you ve moved jobs in that time and no longer work for that particular employer What is the flat Verkko 11 helmik 2022 nbsp 0183 32 If you re going to claim and itemize your work expenses you ll need to complete Schedule A of Form 1040 You need to have sufficient proof for each

UB 04 Uniform Bill Claims Fiachra Forms Charting Solutions

https://fiachraforms.com/wp-content/uploads/ub-04-paper-claim-form.png

Can I Claim Medical Expenses On My Taxes TMD Accounting

https://tmdaccounting.com/wp-content/uploads/2017/08/Can-I-Claim-Medical-Expenses-on-My-Taxes-.png

https://www.hrblock.com/tax-center/filing/adjustments-and-deductions...

Verkko For example a uniform with a company logo isn t suitable for everyday wear so it would qualify as a deduction Work clothes are tax deductible if your employer requires you

https://www.gov.uk/guidance/job-expenses-for-uniforms-work-clothing...

Verkko 84 rivi 228 nbsp 0183 32 1 tammik 2015 nbsp 0183 32 Income Tax Guidance Check how much tax relief you can

Quick Guide Who Should Claim Medical Expenses On Taxes Canada

UB 04 Uniform Bill Claims Fiachra Forms Charting Solutions

How To Declare Your Income And Expenses As A Blogger Canada Save

How To Claim Mileage From The IRS Step By Step Updated For 2024

Tax Return Should I Claim 400 Or 3 000 For Home Office Expenses For

Common Deductible Business Expenses Business Expense Bookkeeping

Common Deductible Business Expenses Business Expense Bookkeeping

Frequently Asked Questions PHSP HSA Smartin Benefits

Can I Claim Lost Rent On My Taxes Leeuwdesigns

Business Expenses Dnslader

Can I Claim Uniform Expenses On My Taxes - Verkko 2 lokak 2023 nbsp 0183 32 This interview will help you determine if you can deduct certain expenses related to producing or collecting taxable income This topic addresses many of these