Can I Claim Vat Back In Europe You must claim your VAT refund online via the authorities in the country where your business is based If you are eligible for a refund the authorities will pass on

Claiming a refund on or after 1 January 2021 If you re charged VAT in an EU member state you ll normally be able to reclaim this from the tax authority in that country You ll Yes if you are a visitor from outside the EU you can claim a VAT refund on goods purchased in the UK that you re exporting Before leaving the UK ensure that you

Can I Claim Vat Back In Europe

Can I Claim Vat Back In Europe

https://i.pinimg.com/originals/cd/cb/3e/cdcb3e969a7204deb4cf7a6386aff6d2.png

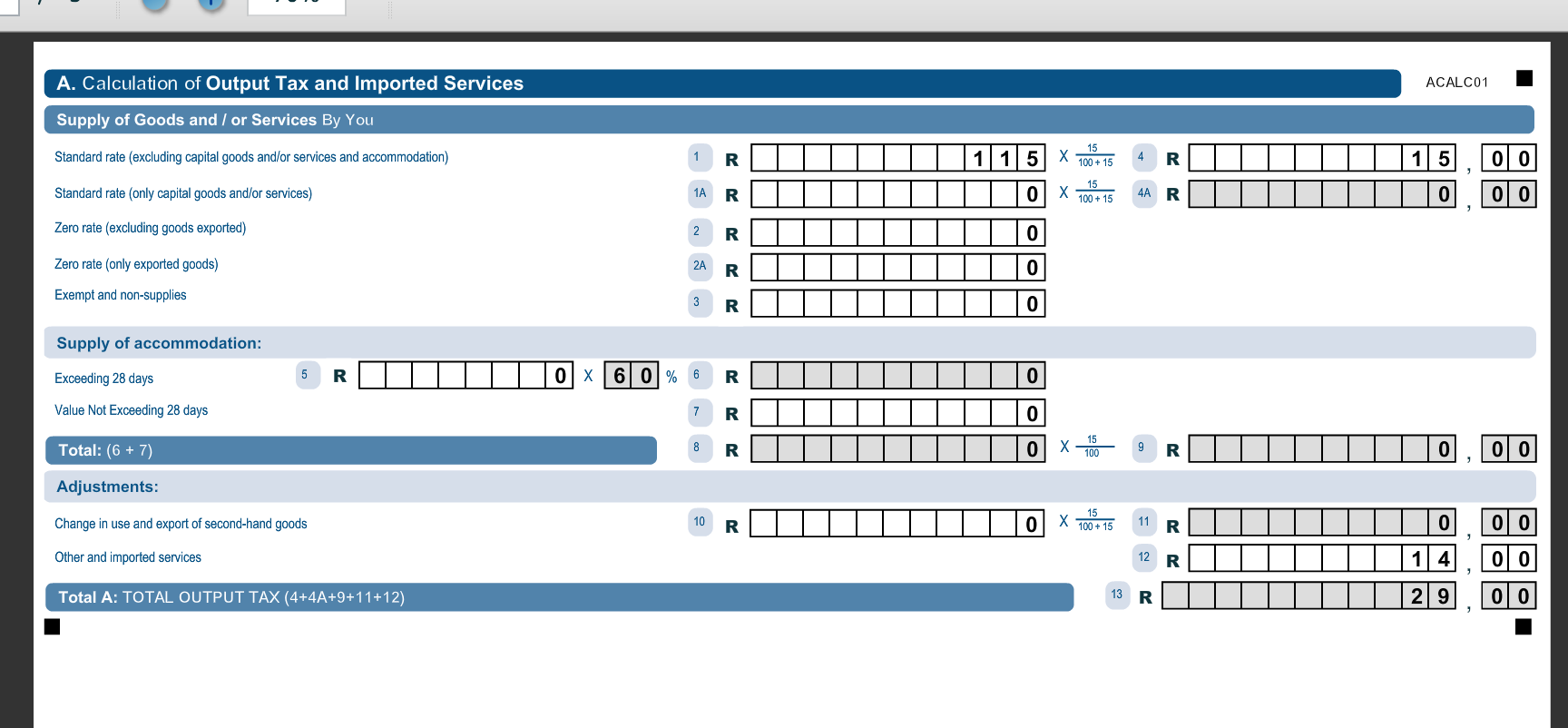

How Far Back Can You Claim Vat In South Africa Greater Good SA

https://gg.myggsa.co.za/how-far-back-can-you-claim-vat-in-south-africa-.jpg

Who Can Claim Vat In South Africa Greater Good SA

https://gg.myggsa.co.za/who-can-claim-vat-in-south-africa-.jpg

Only VAT value added tax can be refunded Only available for visitors check out the definition below Only participating shops will You may have to pay VAT on goods and services bought for your business in an EU country You ll still be able to claim refunds of this VAT if your business is

The deadline for claiming VAT incurred on expenses in the EU on or before 31 December 2020 was 31 March 2021 How to claim a refund on or after 1 January 2021 Any VAT A business registered for VAT in one EU member state can reclaim VAT incurred in another member state However where the business is registered or otherwise liable or eligible

Download Can I Claim Vat Back In Europe

More picture related to Can I Claim Vat Back In Europe

Can I Claim VAT Back At Heathrow UK Airport News info

https://image.uk-airport-news.info/1662830942388.jpg

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

https://img.hechtgroup.com/can_i_claim_vat_back_on_a_commercial_property.png

Can You Claim Back VAT Without Receipt Accountant s Answer

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/10/Can-you-claim-back-VAT-without-a-receipt.jpg

Visitors to the EU who are either returning home or going on to another non EU country may claim VAT refunds within three months of purchase Simply put as long as you reside outside of the EU you re Call 44 0 330 024 3200 and discover how we can help you The UK s exit from the EU has seen an increase in VAT amounts being charged by overseas suppliers

Assuming you left the store with your purchase receipt and VAT paperwork but no refund you ll need to get the refund processed before going home If you ve bought merchandise In Belgium the minimum is 50 euros about 54 in Spain there is no minimum purchase amount to claim a VAT refund One important thing to note is that

How To Claim Back VAT VAT Guide Xero UK

https://www.xero.com/content/dam/xero/pilot-images/guides/guide-to-gst-bas-vat/354050_Hero_Guide to VAT_claimingx2.1646877578209.png

Can You Claim Vat Back On Fuel Without A Receipt RECHARGUE YOUR LIFE

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/can-you-claim-vat-back-on-fuel-without-a-receipt_447356-1.jpg

https://europa.eu/youreurope/business/taxation/vat/vat-refunds

You must claim your VAT refund online via the authorities in the country where your business is based If you are eligible for a refund the authorities will pass on

https://www.gov.uk/government/publications/...

Claiming a refund on or after 1 January 2021 If you re charged VAT in an EU member state you ll normally be able to reclaim this from the tax authority in that country You ll

Sars Vat 201 Form Download Greekcaqwe

How To Claim Back VAT VAT Guide Xero UK

Can I Claim Back European VAT YouTube

Can You Still Collect Vat When Yo Leave South Africa Greater Good SA

How To Claim A VAT Refund Everything You Need To Know

How To Claim VAT Back On Expenses Goselfemployed co

How To Claim VAT Back On Expenses Goselfemployed co

What Can Farmers Claim VAT Back In Ireland VAT Calculator Ireland

All You Need To Know About VAT In South Africa Contador Accountants

Can I Claim Vat Back As A Sole Trader Pearson Mckinsey

Can I Claim Vat Back In Europe - From new European Health Insurance cards when going to the EU and changing rights around living and working in various EU countries through to value