Can I Claim Vat Back On Fuel Similar to the way you claim tax relief on expenses a business can only claim back the VAT it pays on fuel for journeys which are wholly and exclusively related to business The easiest scenario is

You must claim your VAT refund online via the authorities in the country where your business is based If you are eligible for a refund the authorities will pass on Can you reclaim VAT on fuel Yes you can reclaim VAT on fuel when it comes to road fuel used for business miles or on a company car This is the simplest option when it comes

Can I Claim Vat Back On Fuel

Can I Claim Vat Back On Fuel

https://i.ytimg.com/vi/7WPNzt9Niu4/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGHIgQChAMA8=&rs=AOn4CLBwoqKVdPn8kl-fdQCtUBKae4Lkvg

Can You Claim Back VAT Without Receipt Accountant s Answer

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/10/Can-you-claim-back-VAT-without-a-receipt.jpg

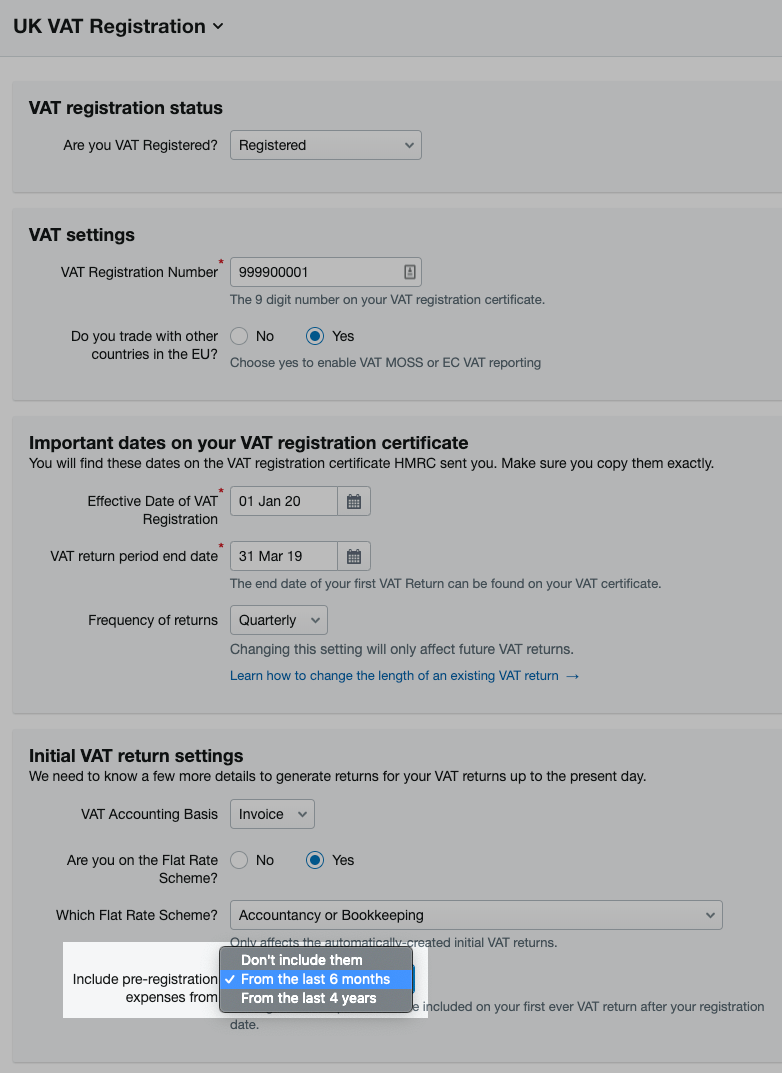

How To Claim VAT Back On Purchases Made Before You Were VAT registered

https://support.freeagent.com/hc/article_attachments/360006829680/KB-V-SUV-PRC-01-Final.png

Claiming back VAT on your car rentals fuel may seem complicated due to the differing compliancy and deductibility rules in different EU countries but it really doesn t have to be How to Claim Back VAT on Fuel There are four options available when it comes to getting back the VAT on fuel which includes petrol and diesel Reclaim 100 of the VAT on fuel that is used purely

The short answer is yes but there are limitations to consider You can only reclaim VAT on fuel if you use it for business purposes only This is known as exclusive use and means Can I reclaim the VAT I have paid on the fuel I use in my car and if so can I claim it all If the car is only used for business purposes then all the input VAT can be

Download Can I Claim Vat Back On Fuel

More picture related to Can I Claim Vat Back On Fuel

Can You Claim Vat Back On Fuel Without A Receipt 2023 Updated

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/can-you-claim-vat-back-on-fuel-without-a-receipt_447356-1-768x432.jpg

How Do I Claim VAT Back On My New Build Welsh Oak Frame

https://www.welshoakframe.com/wp-content/uploads/2018/03/shutterstock_525276400-1024x682-1.jpg

)

Reclaiming VAT On EVs Can A Business Claim VAT Back On An Electric Car

https://a.storyblok.com/f/121741/2000x1246/69922056d8/white-paper-download.png/m/1000x0/filters:quality(50)

Employers who are registered for VAT can claim back input tax on the fuel element of any mileage payments they make for business mileage Calculating the input tax The input If you drive your own car for business purposes other than a generic commute you can make a claim against the approved mileage allowance payment rate AMAP to get

VAT on fuel opt not to reclaim If your business mileage is so low that the fuel scale charge would be higher than the VAT you reclaim you can choose not to reclaim any There are different ways of reclaiming VAT on fuel if you do not pay a fixed rate under the Flat Rate Scheme You can reclaim all the VAT on fuel if your vehicle is used only for

Can A Builder Claim VAT Back On Materials And Other Expenses Countingup

https://countingup.com/wp-content/uploads/2021/05/what-items-are-exempt-from-vat.png

How To Claim VAT Refund An EU Guide

https://www.freshbooks.com/wp-content/uploads/2021/12/Vat-refund.jpg

https://www.theaccountancy.co.uk/vat/c…

Similar to the way you claim tax relief on expenses a business can only claim back the VAT it pays on fuel for journeys which are wholly and exclusively related to business The easiest scenario is

https://europa.eu/youreurope/business/taxation/vat/vat-refunds

You must claim your VAT refund online via the authorities in the country where your business is based If you are eligible for a refund the authorities will pass on

How Far Back Can You Claim VAT On Expenses Goselfemployed co

Can A Builder Claim VAT Back On Materials And Other Expenses Countingup

As A Registered Trader What Can I Claim VAT Back On Accountancy

Can Small Businesses Claim Back VAT Tamar Telecom

How Long Can I Claim Vat Back Adonicdesign

What Expenses Can I Claim VAT On Jon Davies Accountants

What Expenses Can I Claim VAT On Jon Davies Accountants

Can You Claim Vat On Motor Vehicle License Webmotor

Registering For VAT Amazon VAT Services Amazon co uk

Can You Claim Vat Back On Home Improvements Homely Abode

Can I Claim Vat Back On Fuel - Like any other registered person a partly exempt business can treat the VAT on road fuel used for private motoring that has been provided free or below cost as