Can I Claim Vat Back On Rental Property If the rented property is residential then the Flat Rate Scheme will necessitate him accounting for VAT on an exempt income stream You should review

Provided the rental properties incur less than 45 000 worth of gross costs with VAT of 7 500 or under and the VAT is less than half of the total VAT incurred it You can reclaim 50 of the VAT on the purchase price and the service plan You work from home and your office takes up 20 of the floor space in your house You can reclaim

Can I Claim Vat Back On Rental Property

Can I Claim Vat Back On Rental Property

https://gg.myggsa.co.za/how-far-back-can-you-claim-vat-in-south-africa-.jpg

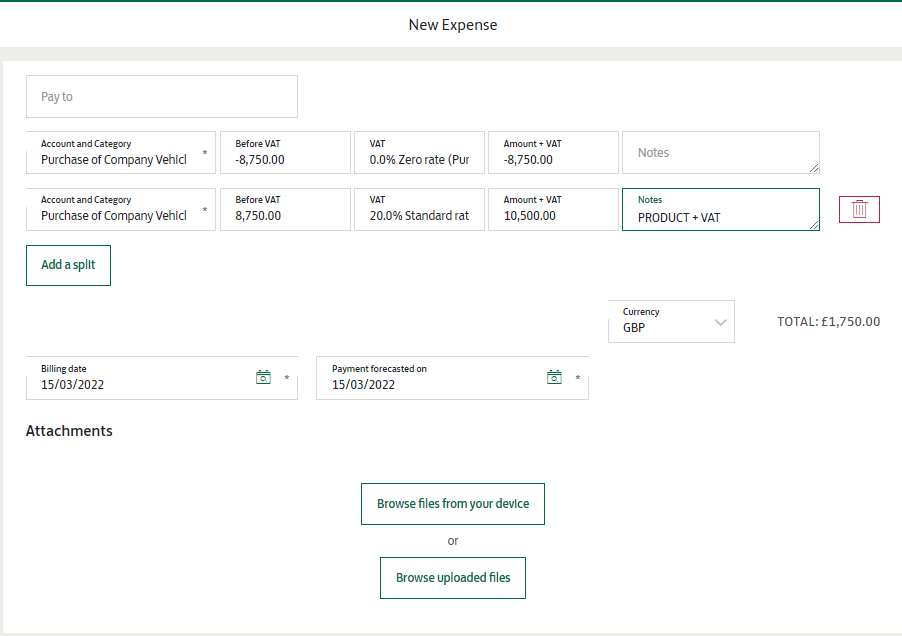

How To Claim Back VAT VAT Guide Xero UK

https://www.xero.com/content/dam/xero/pilot-images/guides/guide-to-gst-bas-vat/354050_Hero_Guide to VAT_claimingx2.1646877578209.png

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

https://img.hechtgroup.com/can_i_claim_vat_back_on_a_commercial_property.png

As a general rule landlords can claim the expenses of running and maintaining their property which reduces their tax bill If the rent you charge covers services like water or council tax you ll need to 20 Jul 2021 Back to Articles The VAT system allows registered persons to reclaim VAT on costs incurred that relate to their business activities Rural businesses and estates can

Could you please assist on the following If a landlord of a commercial property opts to tax that property and charges VAT on rent does the tenant have to opt Where VAT is incurred on development of residential property this can only be recovered via the zero rating regime Under this regime if a developer constructs a residential

Download Can I Claim Vat Back On Rental Property

More picture related to Can I Claim Vat Back On Rental Property

Can You Claim Back VAT Without Receipt Accountant s Answer

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/10/Can-you-claim-back-VAT-without-a-receipt.jpg

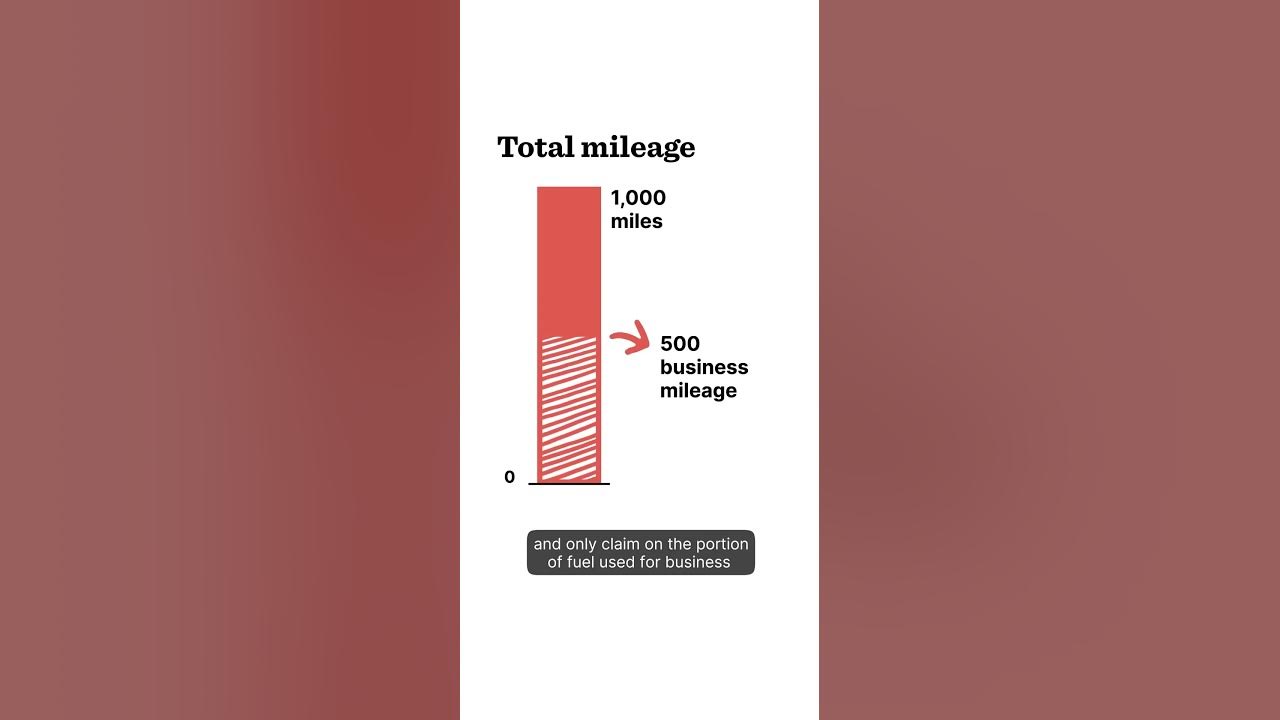

Can You Claim VAT Back On Fuel YouTube

https://i.ytimg.com/vi/749I1hBjINc/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ab4HgAKAD4oCDAgAEAEYfyA3KDUwDw==&rs=AOn4CLDi0gj9PvsXVLxYspSIj3mVyqob1g

Can You Claim Vat Back On Fuel Without A Receipt 2024 Updated

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/can-you-claim-vat-back-on-fuel-without-a-receipt_447356-1.jpg

In most cases VAT incurred on the refurbishment of residential property is not recoverable However there are some instances where it may be possible to reclaim some of the VAT In this article we It recovers the VAT of 30 000 on the refurbishment and rents the property to NewCo for 25 000 per annum plus VAT of 5 000 which cannot be reclaimed by ABC Ltd As

For details of their tax saving products please visit www indicator flm co uk or call 01233 653500 If your business rents its premises you ll usually need express The main principle is that if your supplies of income from the property sale lease licence etc will be zero rated then you can claim VAT on costs subject to the

How To Claim A VAT Refund Everything You Need To Know

https://www.claimcompass.eu/blog/content/images/2020/05/How-to-Claim-a-VAT-Refund.png

How To Claim VAT Back On Expenses Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2019/07/claiming-back-vat.png

https://www.accountingweb.co.uk/any-answers/...

If the rented property is residential then the Flat Rate Scheme will necessitate him accounting for VAT on an exempt income stream You should review

https://www.cowgills.co.uk/news/vat-tips-for...

Provided the rental properties incur less than 45 000 worth of gross costs with VAT of 7 500 or under and the VAT is less than half of the total VAT incurred it

How To Claim VAT Back On Expenses Finance Blog Bookkeeping Software

How To Claim A VAT Refund Everything You Need To Know

How Can I Claim VAT Back From A Vehicle Purchase Business Finance

Who Can I Claim As A Dependent

Can I Claim Back VAT Small Business UK

Can I Claim VAT Back On My Work Tools Tax Rebates

Can I Claim VAT Back On My Work Tools Tax Rebates

Figuring Out Depreciation On Rental Property EamonMunira

The Right To Claim Back VAT

Why Businesses Are Allowed To Claim VAT Back Online Accounting Guide

Can I Claim Vat Back On Rental Property - As a general rule landlords can claim the expenses of running and maintaining their property which reduces their tax bill If the rent you charge covers services like water or council tax you ll need to