Can I Claim Work Expenses On My Taxes If you re eligible you ll usually be able to claim tax relief on your job expenses online If you cannot claim online there are other ways you can claim

If you re going to claim and itemize your work expenses you ll need to complete Schedule A of Form 1040 You need to have sufficient proof for each itemized expense which The expense reimbursement process allows employers to pay back employees who have spent their own money for business related expenses When employees receive an

Can I Claim Work Expenses On My Taxes

Can I Claim Work Expenses On My Taxes

https://cobbamos.com/wp-content/uploads/2021/05/Expenses-1-scaled.jpg

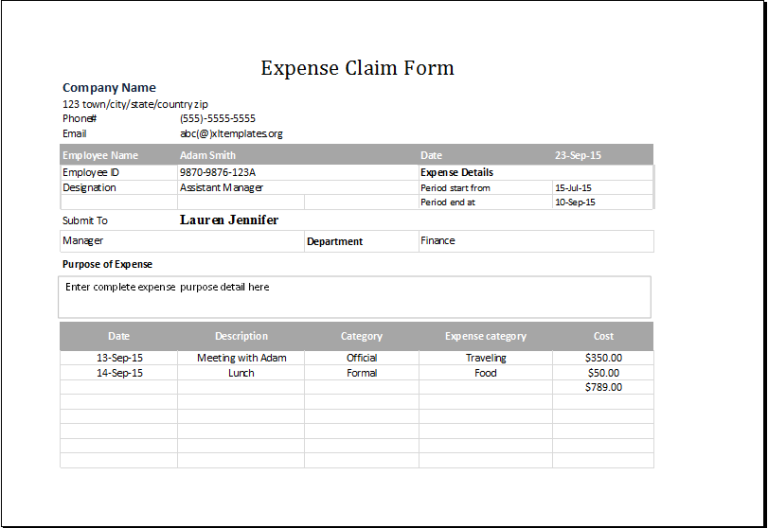

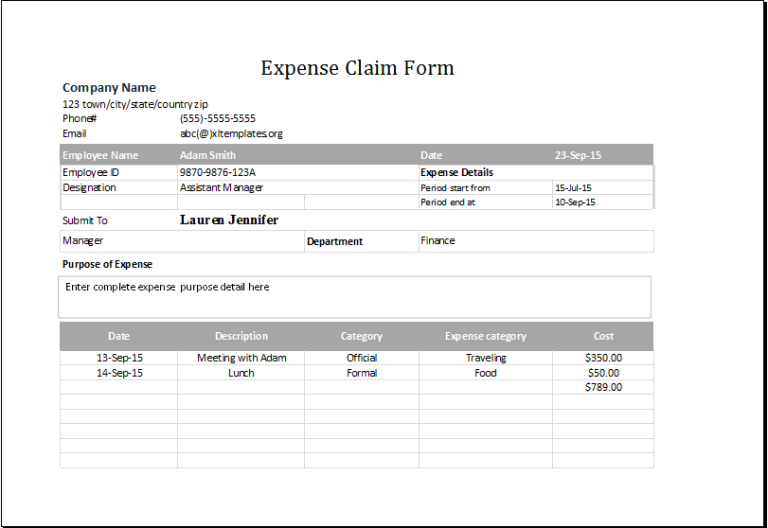

Expense Claim Form Template Excel

https://www.xltemplates.org/wp-content/uploads/2016/02/expense-claim-form-1-768x528.png

Can I Claim Work Pants On Tax A Guide To Deducting Work Clothing

https://shunvogue.com/images/resources/can-i-claim-work-pants-on-tax_20230913002109.webp

Job related expenses for employees are no longer deductible on most people s federal return in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act TCJA that You don t have to keep receipts for work related expenses that are 10 or less as long as the total claim doesn t exceed 200 But the ATO does want you to keep a record of all

Until 2026 most unreimbursed employee expenses cannot be deducted from your taxes However there are some exceptions You may be able to deduct employee business You can deduct eligible employee expenses if you re employed by a state or local government and are compensated in whole or in part on a fee basis Disabled

Download Can I Claim Work Expenses On My Taxes

More picture related to Can I Claim Work Expenses On My Taxes

Can I Claim Medical Expenses On My Taxes TMD Accounting

http://tmdaccounting.com/wp-content/uploads/2017/08/Can-I-Claim-Medical-Expenses-on-My-Taxes-.png

What Expenses Can I Claim When Working From Home

https://images.prismic.io/ember-bank/77595ebf-efdd-46b9-9dfa-17ff6e6d8cdc_How-do-i-claim-for-my-expenses.jpg?auto=compress,format&width=1100

Operating Expenses OpEx Formula And Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/11/30185632/Operating-Expenses-Model.jpg

You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you have qualified May I claim my job related education expenses as an itemized deduction or an education credit on my tax return Answer Generally you cannot deduct job related education

Prior to the passage of the Tax Cuts and Jobs Act employees were able to deduct unreimbursed job expenses as a personal itemized deduction This wasn t the most A local law enforcement commissioner revealed during a House Homeland Security hearing on Tuesday stunning new details about the security failures that led to the near

Expense Claim Form Template Excel Printable Word Searches

https://i2.wp.com/wordtemplate.net/wp-content/uploads/2017/10/Expense-Claim-Form.jpg

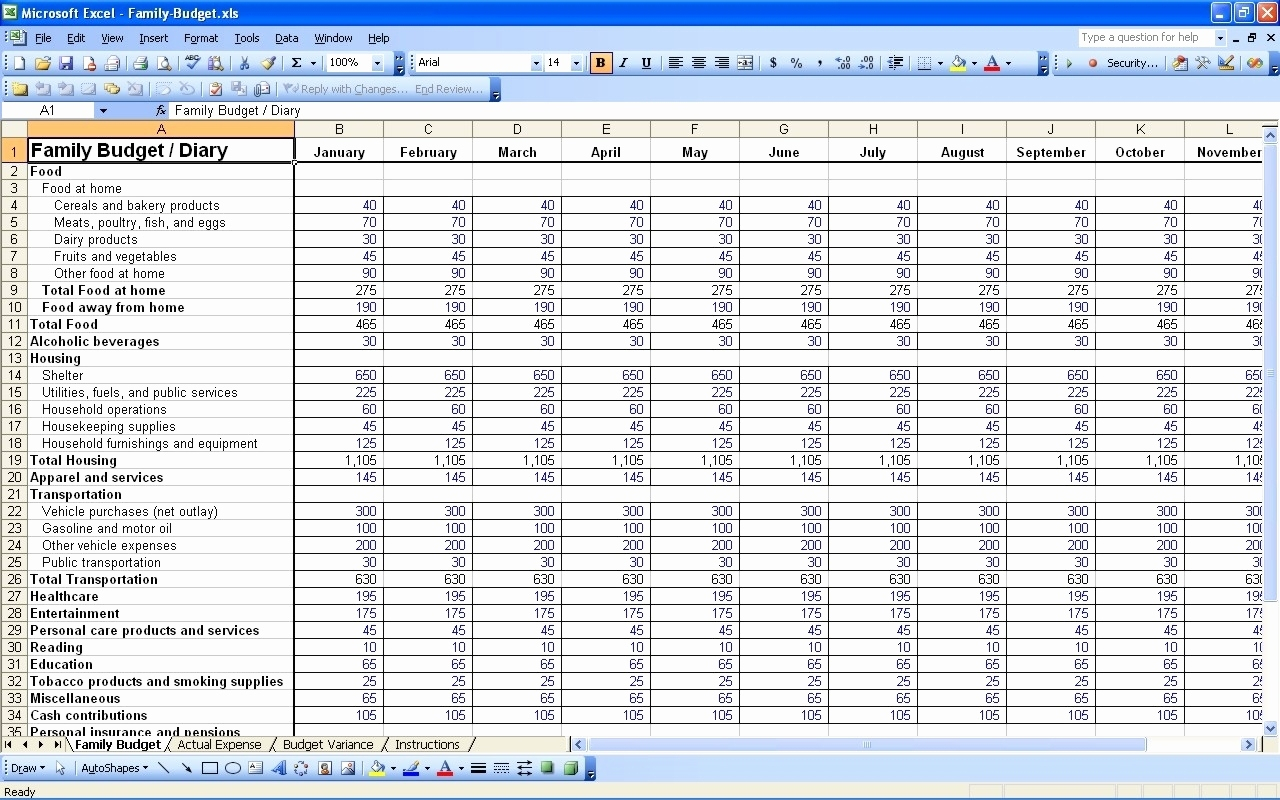

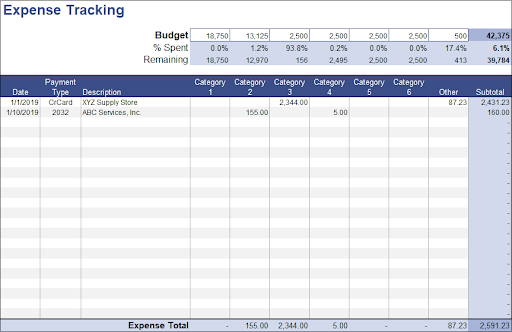

Tax Expenses Spreadsheet Template

https://db-excel.com/wp-content/uploads/2019/01/tax-expenses-spreadsheet-with-small-business-expense-spreadsheet-daily-tax-template-invoice-sample.jpg

https://www.gov.uk/tax-relief-for-employees

If you re eligible you ll usually be able to claim tax relief on your job expenses online If you cannot claim online there are other ways you can claim

https://www.cnet.com/personal-finance/taxes/how-to...

If you re going to claim and itemize your work expenses you ll need to complete Schedule A of Form 1040 You need to have sufficient proof for each itemized expense which

The Ultimate List Of Self Employed Expenses You Can Claim

Expense Claim Form Template Excel Printable Word Searches

Free Excel Spreadsheet For Business Expenses In 2022 BPI The

EXCEL Of Expenses Claim Sheet xlsx WPS Free Templates

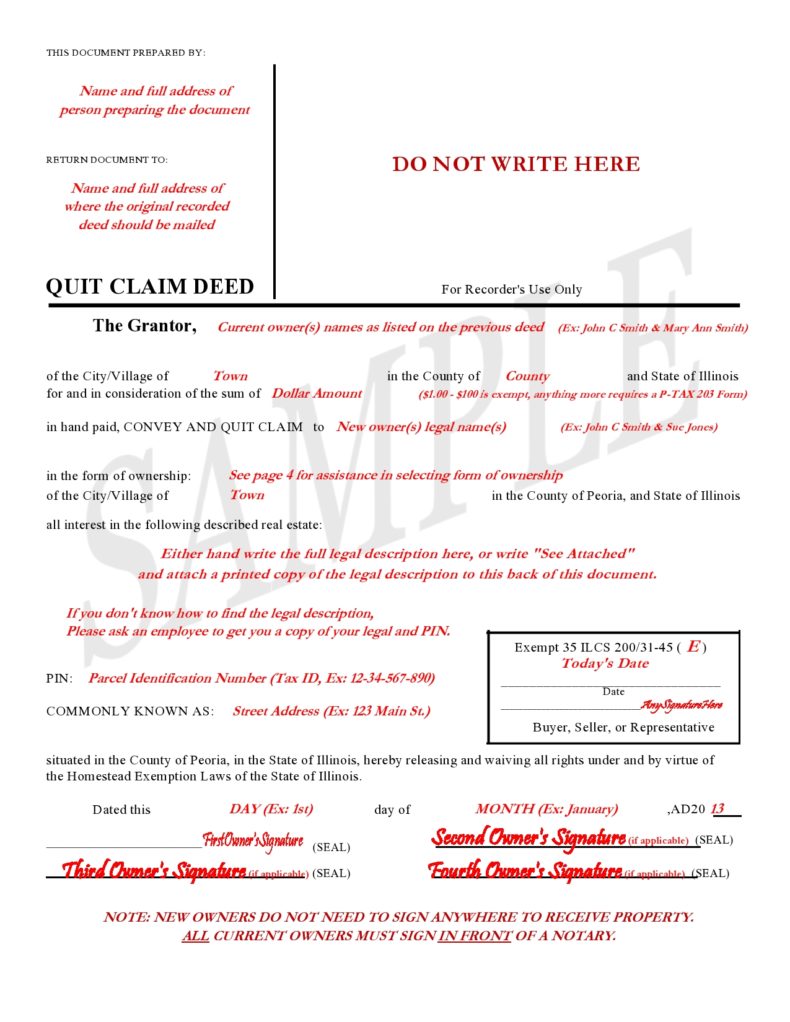

Example Of A Quit Claim Deed Completed Fill Out And Sign Printable

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

How To Calculate Cost Of Goods Sold In Accounting Haiper

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

How To Calculate Cost Of Goods Sold In Accounting Haiper

Tax Return Should I Claim 400 Or 3 000 For Home Office Expenses For

Printable Tax Deduction Cheat Sheet

Taxes You Can Write Off When You Work From Home INFOGRAPHIC

Can I Claim Work Expenses On My Taxes - Whether it s work related expenses or more unique deductions like performance tools or handbags knowing eligible claims can greatly impact your refund Our Tax Experts