Can I Deduct Charitable Contributions If I Take The Standard Deduction In California Taxpayers can choose to itemize their deductions which is required when taking a charitable contribution deduction or they take the standard deduction when filing their tax returns

Yes Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions To see if the Generally you can only deduct charitable contributions if you itemize deductions on Schedule A Form 1040 Itemized Deductions Gifts to individuals are not

Can I Deduct Charitable Contributions If I Take The Standard Deduction In California

Can I Deduct Charitable Contributions If I Take The Standard Deduction In California

https://i.pinimg.com/originals/af/59/e6/af59e64fc3a91862e2d872a12bb4cdc4.png

Should You Take The Standard Deduction On Your 2021 2022 Taxes

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-.jpg

2022 Standard Deduction Amounts Are Now Available Bankruptcy L Lawyers

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions Generally you may deduct up to Ordinarily people who choose to take the standard deduction cannot claim a deduction for their charitable contributions Due to this special provision many

By law recordkeeping rules apply to any taxpayer claiming a charitable contribution deduction Usually this includes getting a receipt or acknowledgement Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must

Download Can I Deduct Charitable Contributions If I Take The Standard Deduction In California

More picture related to Can I Deduct Charitable Contributions If I Take The Standard Deduction In California

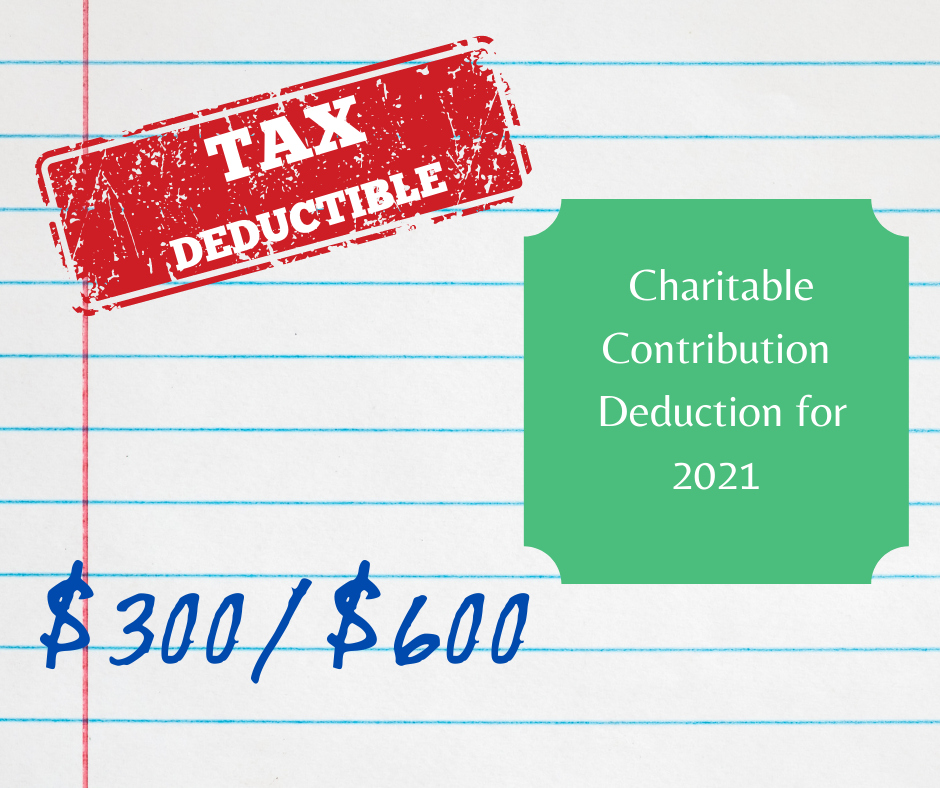

Charitable Contribution Deduction For 2021 PPL CPA

https://www.pplcpa.com/wp-content/uploads/2022/02/TAX-DEDUCTIBLE.png

You Can Deduct Up To 300 In Charitable Donations This Year even If You

https://image.cnbcfm.com/api/v1/image/106081541-1565893199626gettyimages-875247398.jpeg?v=1638285913

The Complete Charitable Deductions Tax Guide 2023 2024

https://daffy.ghost.io/content/images/2022/05/Daffy-Donor-advised-funds-Tax-Deductions-2022.png

The standard deduction for the 2023 tax year is 13 850 for single filers 20 800 for heads of household and 27 700 for married couples filing jointly However if your Home Will charitable contributions carryover when using the standard deduction in a 1040 return Charitable contributions current carryovers are calculated for the

Can you take charitable tax deductions without itemizing No unlike the 2021 tax year to take a tax deduction for your charitable contributions in 2023 and No if you take the standard deduction you do not need to itemize your donation deduction However if you want your deductible charitable contributions you must

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

Tax Deductions For Charitable Donations

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA17y0HM.img?w=3000&h=2000&m=4&q=100

https://www.investopedia.com/articles/…

Taxpayers can choose to itemize their deductions which is required when taking a charitable contribution deduction or they take the standard deduction when filing their tax returns

https://tax.thomsonreuters.com/blog/charitable...

Yes Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions To see if the

How Much Do You Need To Donate For Tax Deduction

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

The Standard Deduction And Itemized Deductions After Tax Reform

Can I Deduct Charitable Contributions In 2020 If I Don t Itemize YouTube

Standard Deduction Vs Itemized Deduction Which Should I Ch Ramsey

2021 Taxes For Retirees Explained Cardinal Guide

2021 Taxes For Retirees Explained Cardinal Guide

2022 Federal Tax Brackets And Standard Deduction Printable Form

List Of Tax Deductions Here s What You Can Deduct

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

Can I Deduct Charitable Contributions If I Take The Standard Deduction In California - The deductible portion for charitable contributions is typically capped at a maximum of 60 of your AGI However depending on the nature of the property