Can I Get A Tax Credit For Working From Home You can claim the deduction whether you re a homeowner or a renter and you can use the deduction for any type of home where you reside a single family home an apartment a condo or a

2023 and 2024 Work From Home Tax Deductions Here s a guide to claiming deductions and other tips on how to handle your federal taxes if you are an employee working from home There are two ways that eligible taxpayers can calculate the home office deduction In the simplified version you can take 5 per square foot of your home office up to 300 square feet

Can I Get A Tax Credit For Working From Home

Can I Get A Tax Credit For Working From Home

https://static.cargurus.com/images/article/2017/05/19/10/07/all_you_need_to_know_about_tax_credits_for_electric_and_hybrid_vehicles-pic-5583828754740272087-1600x1200.jpeg

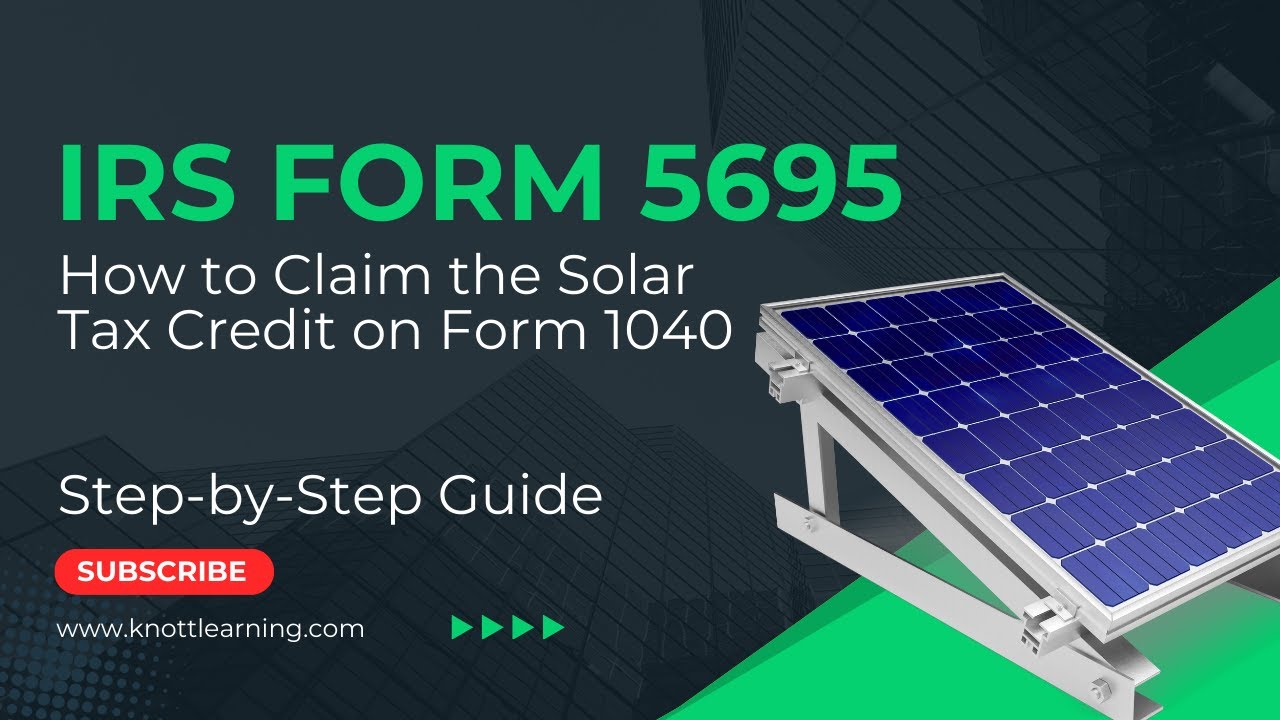

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

8 Reasons To Hire Someone To Help With Your Income Tax Planning Black

https://blackdiamondfs.com/wp-content/uploads/2021/08/taxfilingstatus.jpeg

To avoid paying taxes on the same income twice the taxpayer can credit the taxes paid in their non resident state against their home state s tax liability or So who gets to take work from home tax deductions Well the IRS reserves them for self employed independent contractors In other words if you work full time as a freelancer or have a side hustle that requires an office you qualify to deduct a portion of your home s expenses

Self employed workers can claim eligible deductions for business expenses and for working out of a home office You can choose between two methods for calculating your business use of home tax deductions the simplified and direct methods If you re a regular employee working from home you can t deduct any of your related expenses on your tax return In the past you could claim an itemized deduction for

Download Can I Get A Tax Credit For Working From Home

More picture related to Can I Get A Tax Credit For Working From Home

Income Tax Rates For The Self Employed 2020 2021 TurboTax Canada Tips

https://turbotax.intuit.ca/tips/images/self-employed-taxes-canada.jpg

How To Find Tax ID Number TIN Number

https://tinidentificationnumber.com/wp-content/uploads/2021/08/4-ways-to-find-a-federal-tax-id-number-wikihow-1-scaled.jpg

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Working from home tax relief is an individual benefit so a couple or a group of flatmates can all claim it if you are all working from home You can use our income tax calculator to work out your tax payments Home Office Deduction at a Glance If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as mortgage interest insurance utilities repairs and depreciation for that area

If I m an employee working from home do I qualify for a home office tax deduction If you re an employee working remotely rather than a business owner you unfortunately don t qualify for the home office tax deduction however some states do allow this tax deduction for employees If I m an employee and my job is fully remote and I have working from home can I deduct my work from home expenses Although there has been an increase in employees working at home since coronavirus under tax reform employees can no longer take federal tax deductions for unreimbursed employee expenses like work from

/tax-id-employer-id-397572-final-41c5a87996eb4ebd87dda185e52fea9a.png)

Differences Among A Tax ID Employer ID And ITIN

https://www.thebalancemoney.com/thmb/D5iOrYTRfjREp8u3TTLAHu5gBw4=/1500x1000/filters:fill(auto,1)/tax-id-employer-id-397572-final-41c5a87996eb4ebd87dda185e52fea9a.png

Learn The Steps To Claim Your Electric Vehicle Tax Credit

https://andersonadvisors.com/wp-content/uploads/2023/04/Electric-vechiles.jpg

https://www.nerdwallet.com/article/taxes/home-office-tax-deduction

You can claim the deduction whether you re a homeowner or a renter and you can use the deduction for any type of home where you reside a single family home an apartment a condo or a

https://smartasset.com/taxes/work-from-home-tax-deductions

2023 and 2024 Work From Home Tax Deductions Here s a guide to claiming deductions and other tips on how to handle your federal taxes if you are an employee working from home

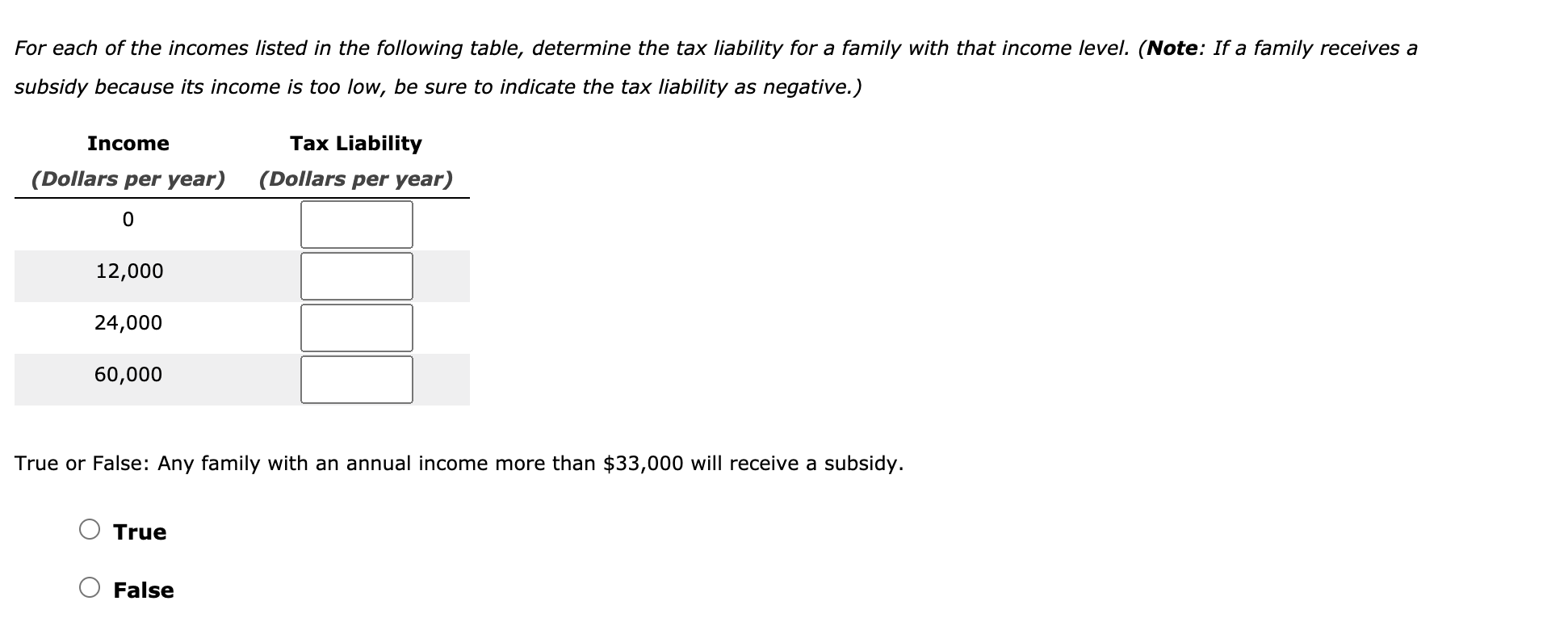

Solved 6 The Negative Income Tax Many Economists Believe Chegg

/tax-id-employer-id-397572-final-41c5a87996eb4ebd87dda185e52fea9a.png)

Differences Among A Tax ID Employer ID And ITIN

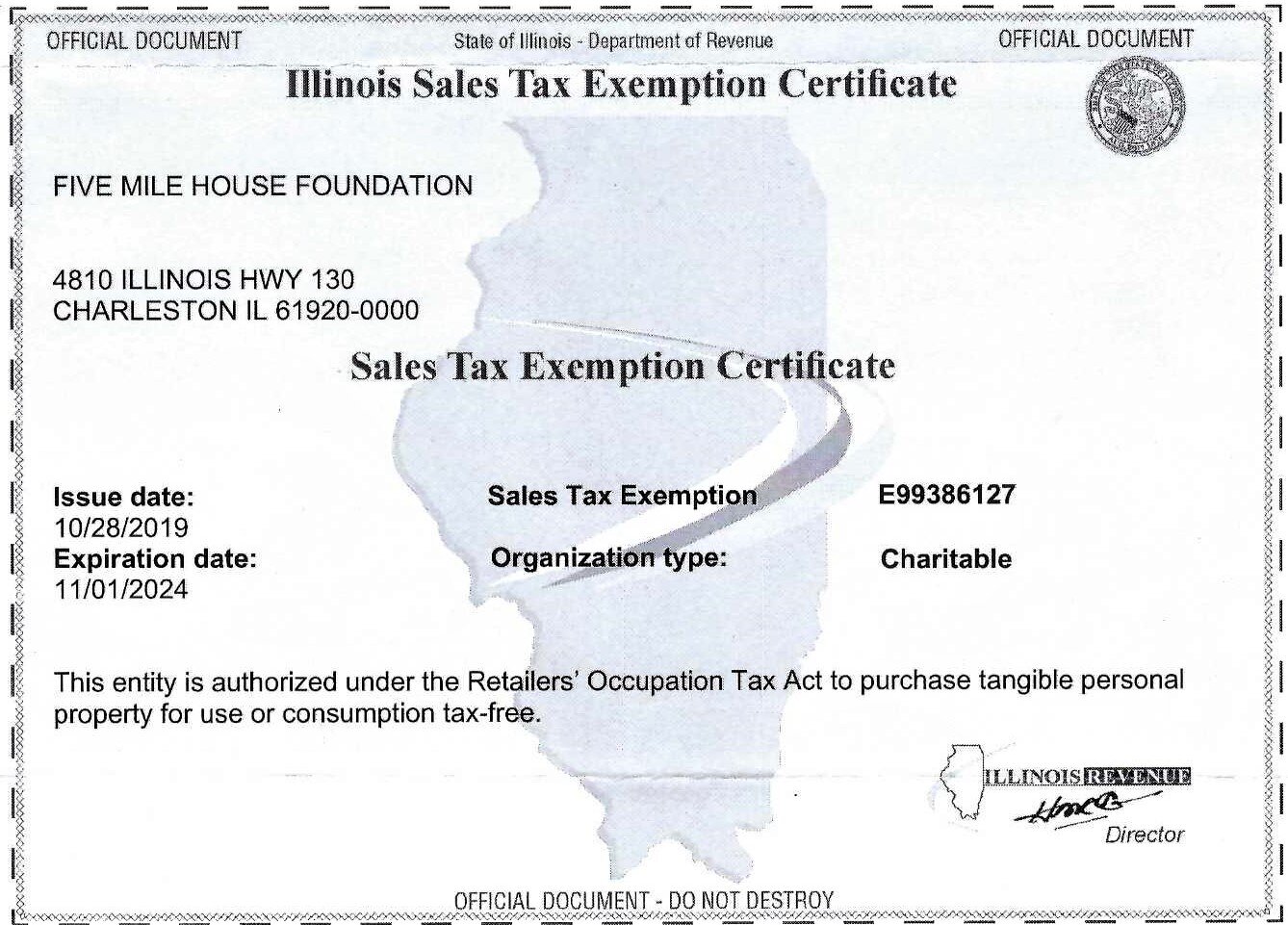

Illinois Tax Exempt Certificate Five Mile House

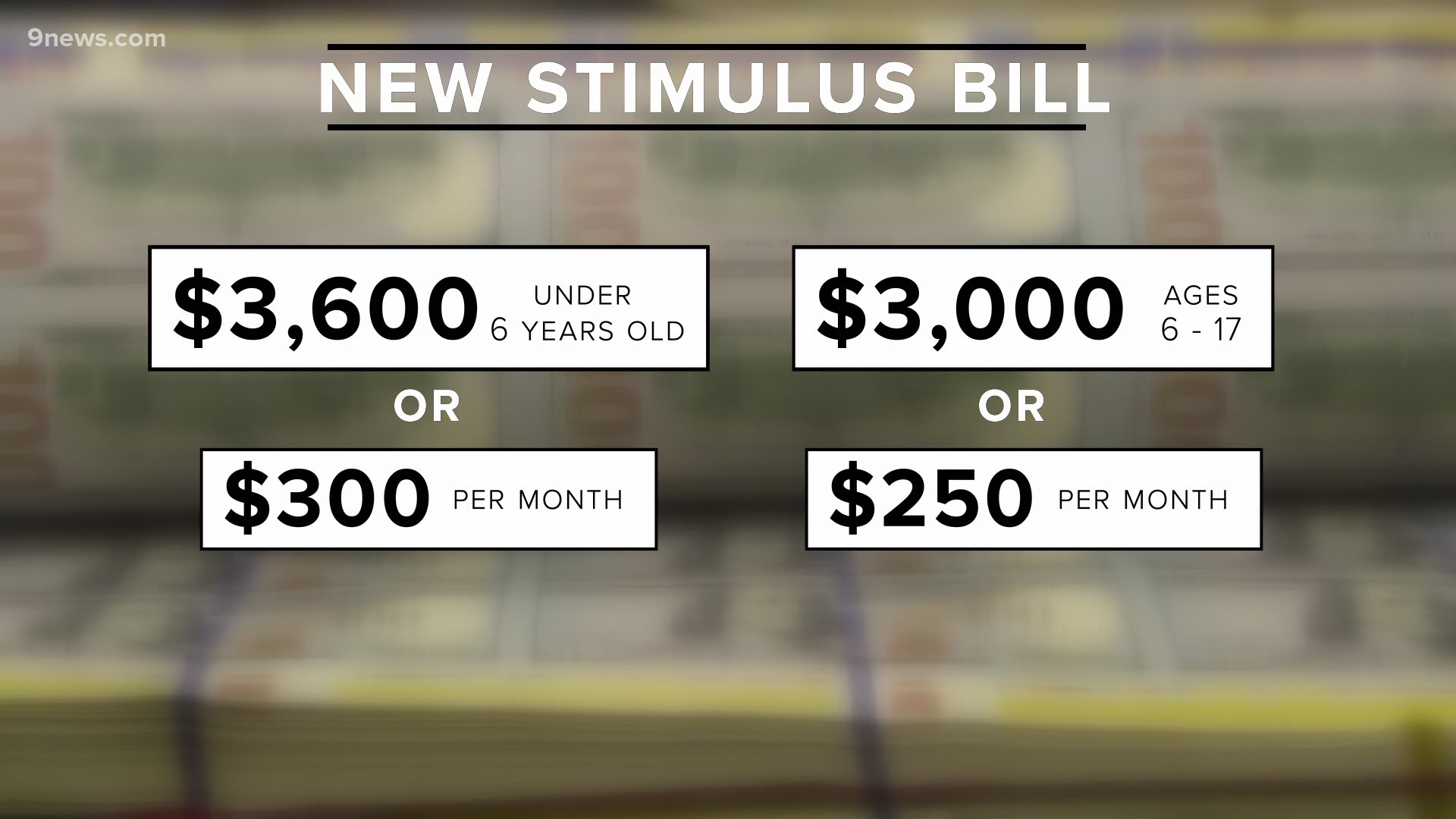

New Child Tax Credit Explained When Will Monthly Payments Start

Tax Return Clipboard Image

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

The Market Future For Tax Preparers Huntersure

Bharat Bank

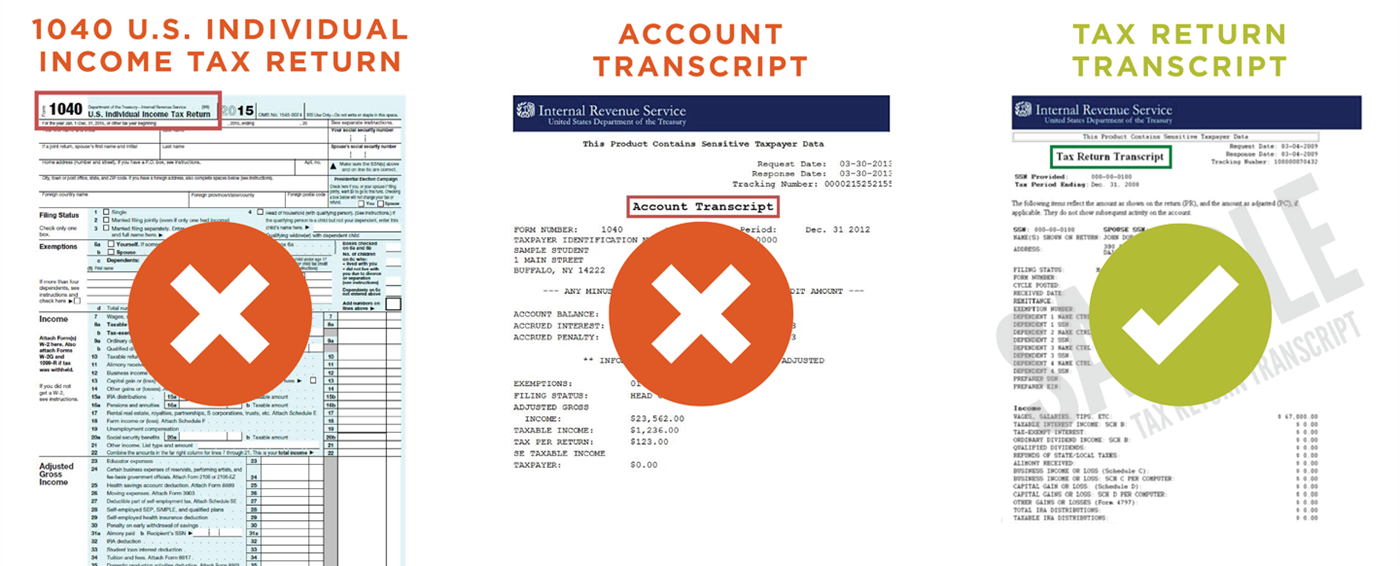

Verification Financial Aid Home TTU

Can I Get A Tax Credit For Working From Home - Since the 2018 tax reform generally only self employed people can claim tax deductions for remote work That means remote employees can no longer claim tax deductions for their work from home Instead employees should ask for reimbursements from their employers Jump straight to a key chapter