Can I Get Tax Benefit On Fixed Deposit Check out the eligibility criteria for Five Year Tax Saving Fixed Deposit Deposits at HDFC Bank Know more about terms conditions charges other requirements

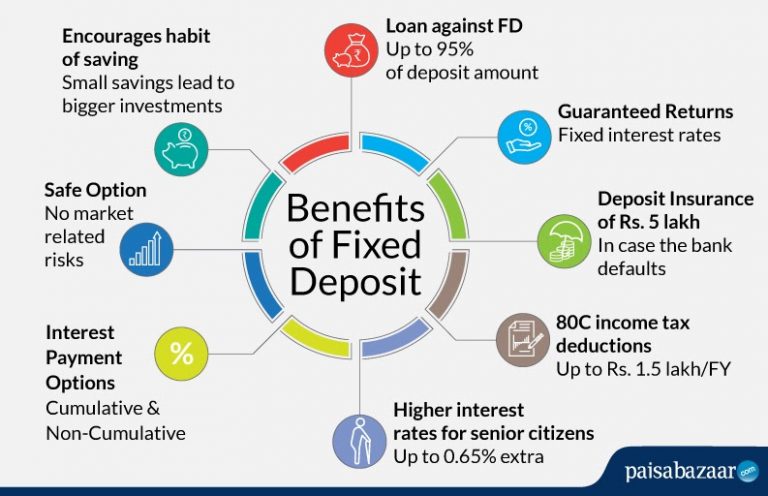

Some common benefits of a tax saving fixed deposit are as follows You get a tax rebate as seen under Section 80C of the Income Tax Act 1961 Senior citizens get an additional interest of 0 5 to the prevailing interest rates You can take advantage of the income tax deduction provision under Section 80C of the Income Tax Act by investing up to Rs 1 5 lakh in a tax saver fixed deposit account The scheme ensures returns along with capital

Can I Get Tax Benefit On Fixed Deposit

Can I Get Tax Benefit On Fixed Deposit

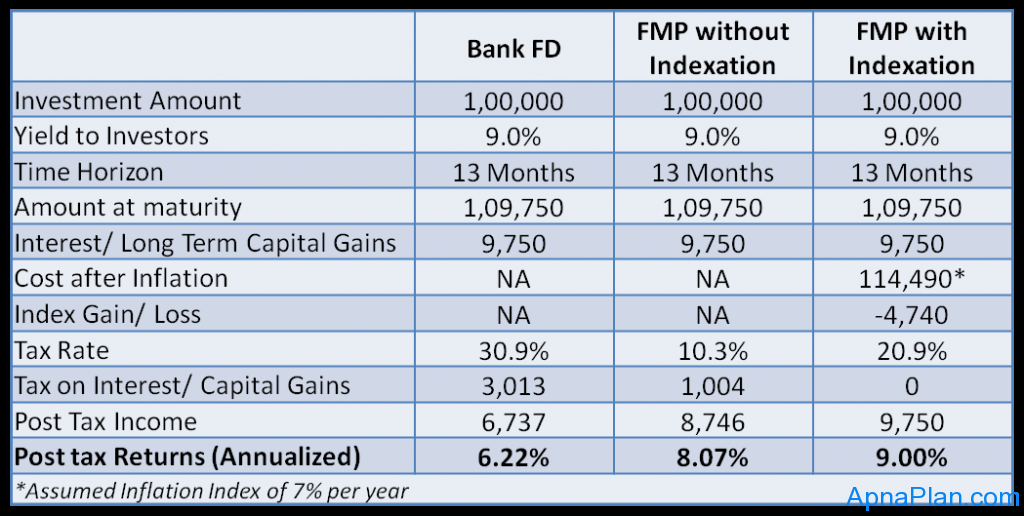

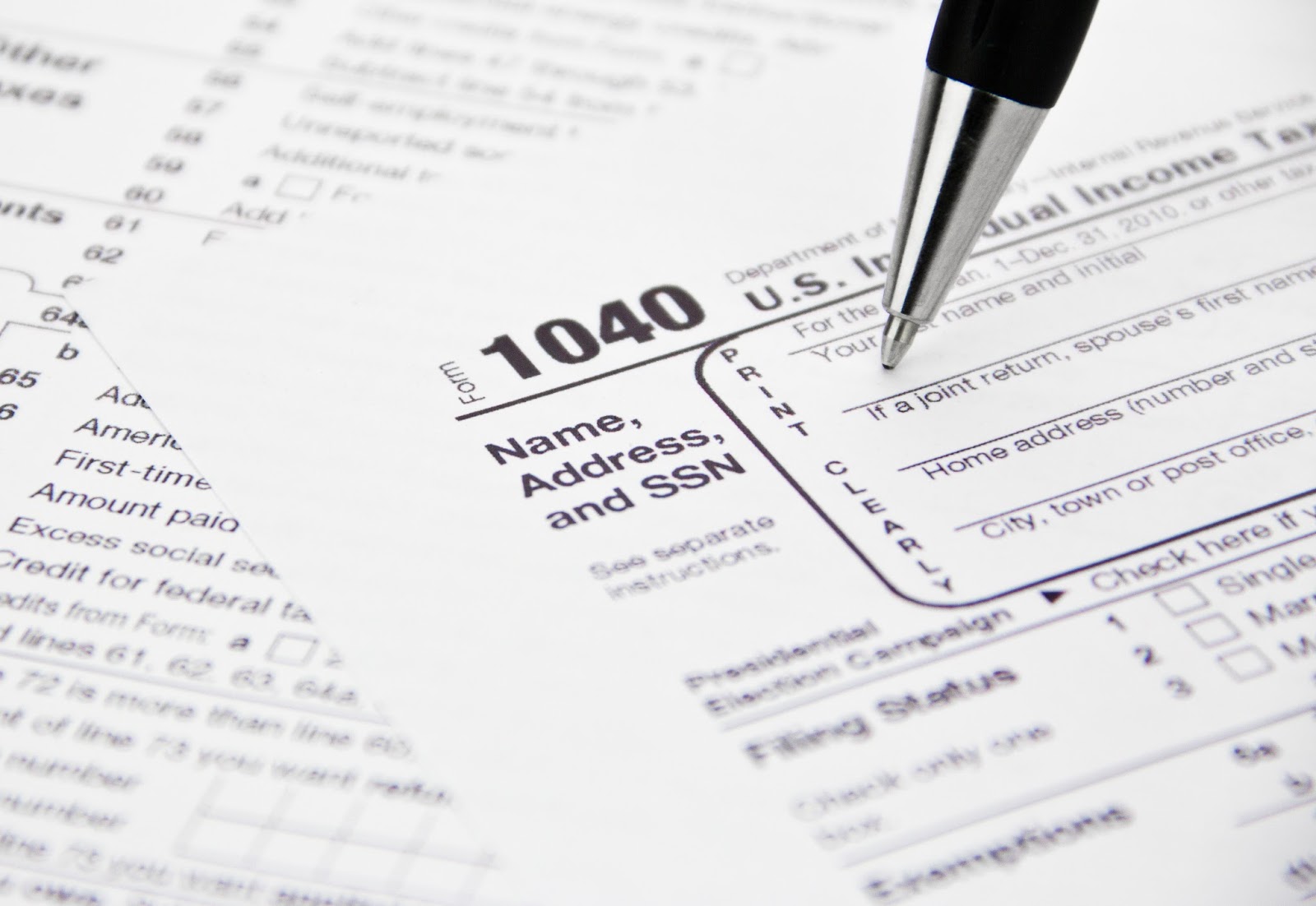

https://www.apnaplan.com/wp-content/uploads/2012/05/FMP-vs-Fixed-Deposit-tax-treatment-1024x516.png

Benefits Of Fixed Deposits FDs In India

https://www.paisabazaar.com/wp-content/uploads/2020/02/fixed-deposit-benefits-768x496.jpg

When How To Pay Income Tax On Fixed Deposit

https://askopinion.com/images/Files/UserFiles/posting/lrg/2017/8/taxes-euw.jpg

Income Tax Exemption on FD Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing Tax saver FD scheme is eligible for deduction under Section 80C of the Income Tax Act up to Rs 1 5 lakh The minimum deposit amount starts as low as Rs 1000 Who Should Invest in Tax Saving FD

Yes you can open a joint FD But only the first holder can claim tax benefit under section 80c Use FD Interest Calculator and Get details of maturity amount and interest earned on However tax saving fixed deposit schemes allow tax benefits interest earned on such FD is taxed at source TDS This means that while the initial deposit amount will be

Download Can I Get Tax Benefit On Fixed Deposit

More picture related to Can I Get Tax Benefit On Fixed Deposit

All You Need To Know About Fixed Deposits And FD Calculators

https://ffxivgilstudio.com/wp-content/uploads/2021/06/Fixed-Deposits-And-FD-Calculators.jpg

How To Make Your Fixed Deposit Yield More Returns Fixed Deposit

https://1.bp.blogspot.com/-57iJansoHXQ/WSa6b5rEvYI/AAAAAAAAARM/444kCTQYceE3bOHY6r8N-SPfzC22YBu8QCLcB/s1600/Fixed-Deposits.jpg

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

https://www.hdfcsales.com/blog/wp-content/uploads/2021/06/tax-deduction-on-fixed-deposit.jpg

Investing in a tax saving FD is one of the effective ways to save on taxes In this type of fixed deposit you can claim a tax deduction of up to 1 5 Lakhs as per Section 80C of the I T Act 1961 on the amount you invest in a 5 According to current income tax laws if an individual opts for old existing tax regime then under Section 80C of the Income tax Act you can claim deduction for

A tax saving FD is a special type of fixed deposit that allows investors to claim tax exemption under Section 80C of the Income Tax Act 1961 This means you can deduct the Can a senior citizen take benefit of this exemption and get a fully tax exempted return from tax saving fixed deposits Yes it is possible ET Wealth Online explains how much

Safe Mode Of Investment

https://lh3.googleusercontent.com/rPDJKUJg_XudsAvXmkQDw1k7MEA9I6mrsJhSgheSZLwMTOwDJ-EM_R9ZrEe2BtmdMi2XqwuKsAHr8Dvy2b41qDvBI2kJrKPFzba564oVsawXJ2bmtPoQRCsvIjIA7g

Bank Fixed Deposit FD Rates 2023 FD Interest Rates In India

https://images.fintra.co.in/cms/fixed-deposit.png

https://www.hdfcbank.com/personal/save/deposits/...

Check out the eligibility criteria for Five Year Tax Saving Fixed Deposit Deposits at HDFC Bank Know more about terms conditions charges other requirements

https://www.idfcfirstbank.com/finfirst-blo…

Some common benefits of a tax saving fixed deposit are as follows You get a tax rebate as seen under Section 80C of the Income Tax Act 1961 Senior citizens get an additional interest of 0 5 to the prevailing interest rates

Income Tax On Fixed Deposit FD Interest Income FD Tax Benefits

Safe Mode Of Investment

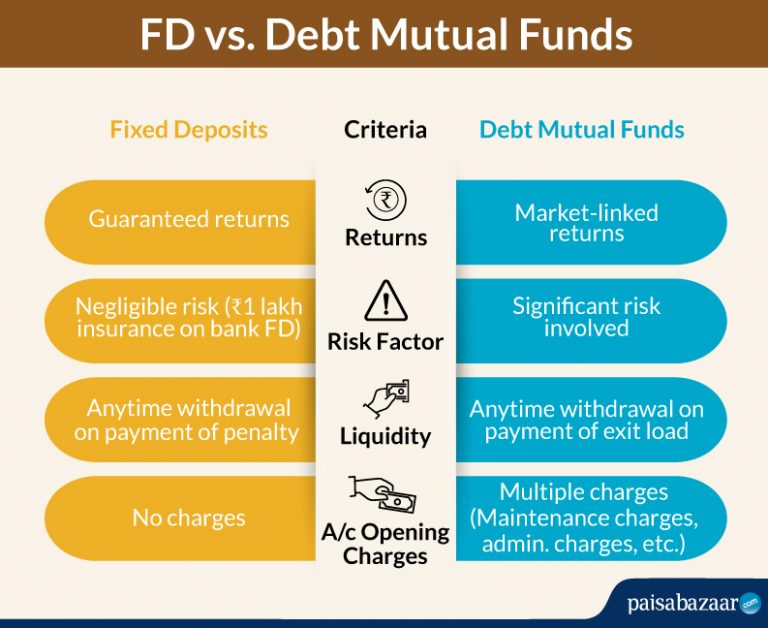

FD Vs Debt Mutual Funds Which Is Better

5 year Tax Saver Fixed Deposit Latest Interest Rates Yadnya

Tax On Cash Deposit And Withdrawal What You Need To Know In 2023

Tax Benefits Of NRE Accounts Saving Current Recurring Or Fixed

Tax Benefits Of NRE Accounts Saving Current Recurring Or Fixed

What Is A Fixed Deposit FD Account Meaning Functioning Features

57 Tax Cut On Debt Mutual Funds Vs Fixed Deposits Sanjay Matai The

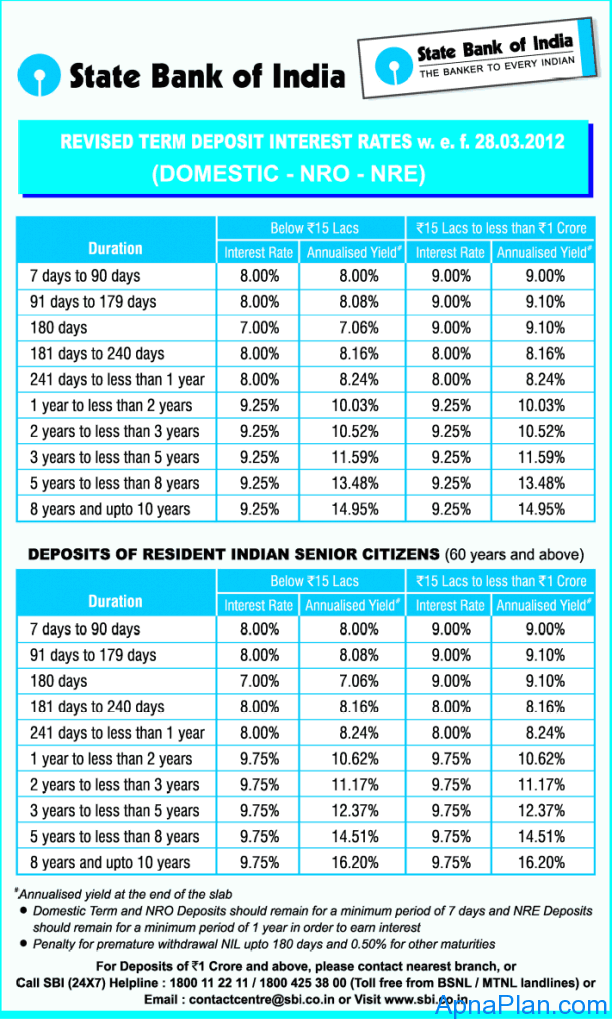

SBI NRE NRO Senior Citizen Domestic Fixed Deposit Rates March 2012

Can I Get Tax Benefit On Fixed Deposit - Explore the benefits of tax savings fixed deposits under Section 80C Learn how to maximize your tax savings with fixed deposits