Can I Pay Hmrc Over The Phone For example if you ve agreed a payment with HMRC over the phone You must have a payslip to pay at your bank or building society Payment reference

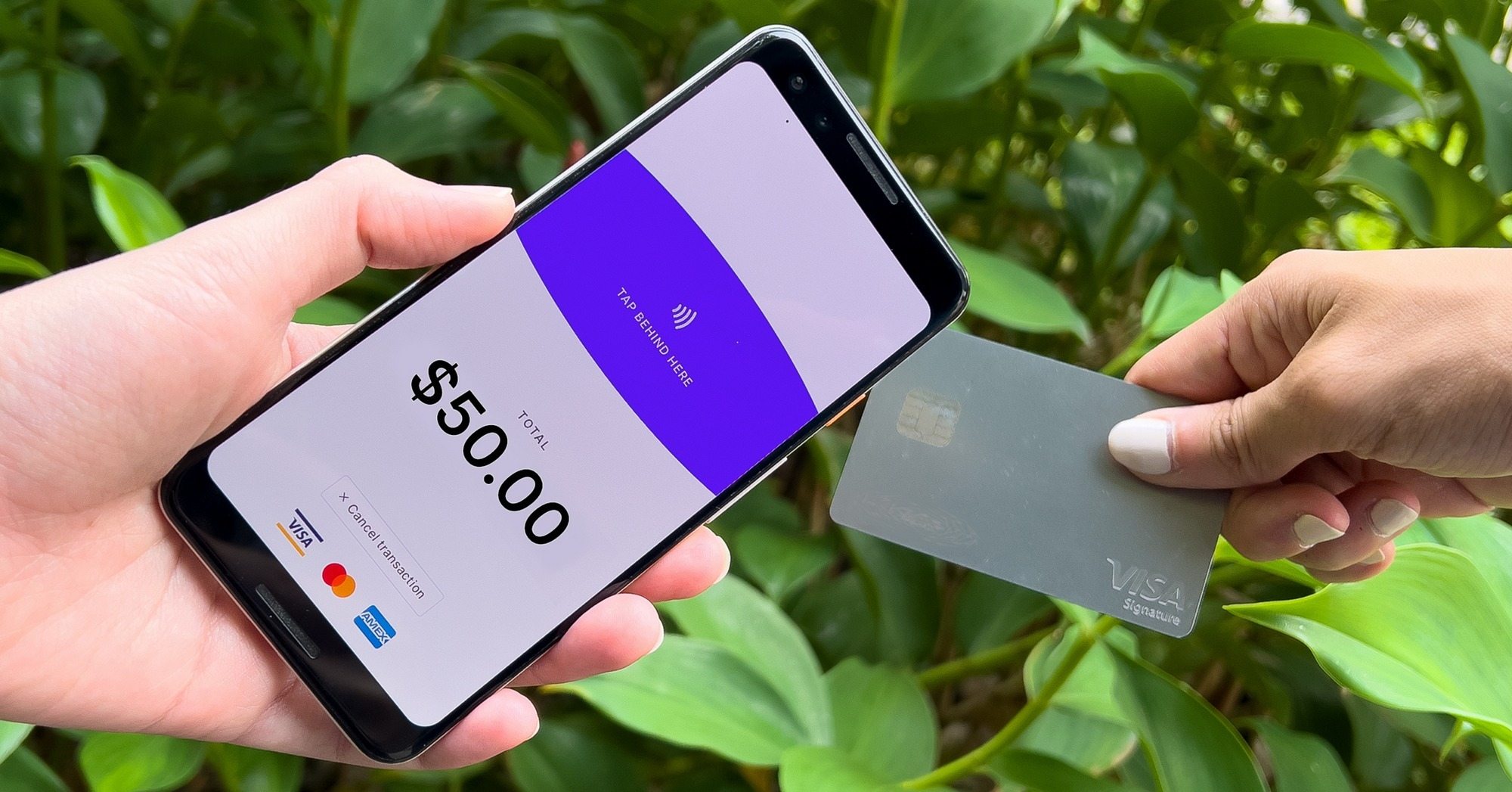

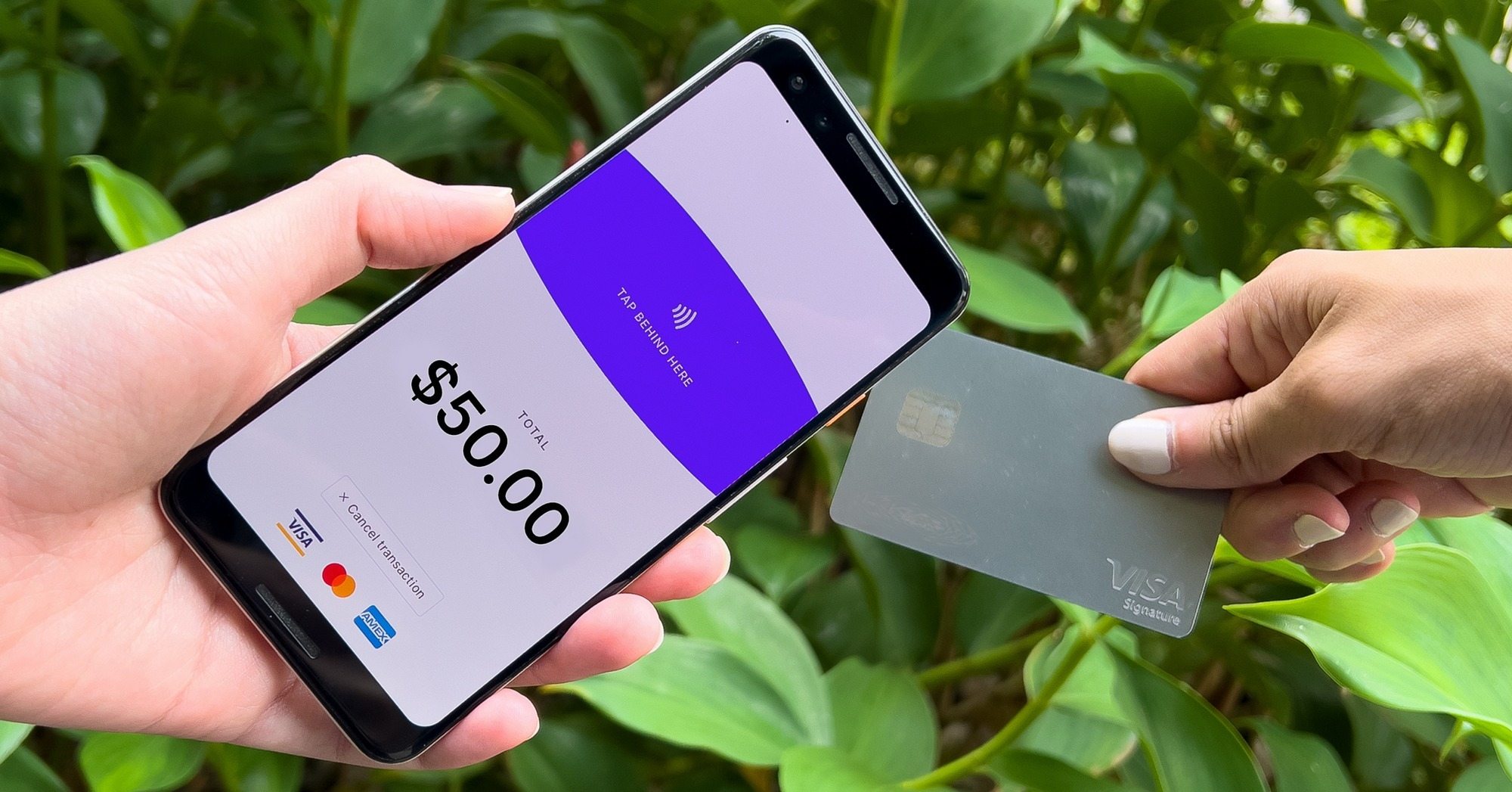

These are sometimes called MOTO payments You get all of the advantages and security of using GOV UK Pay but you fill in your users details on the payment pages for them You can use this You can use GOV UK Pay to take payments over the phone or by post These payments are called Mail Order Telephone Order MOTO payments This kind of payment does not have a section

Can I Pay Hmrc Over The Phone

Can I Pay Hmrc Over The Phone

https://cellularnews.com/wp-content/uploads/2023/09/how-to-process-a-credit-card-payment-over-the-phone-1695524688.jpg

OS Payroll Your P60 Document Explained

https://uploads-ssl.webflow.com/600aa65f147a4d133842bc76/600aa65f147a4dc8e142bd49_p60-explained-1_2x.jpeg

How To Print Your Tax Calculations Better co uk formerly Trussle

https://images.ctfassets.net/bed00l8ra6lf/1c8O9gTiS0yPCj2IORQRha/83df0441e65fdafc9ed02bc52c484409/7._FC_tyoprintyourtaxyo.png

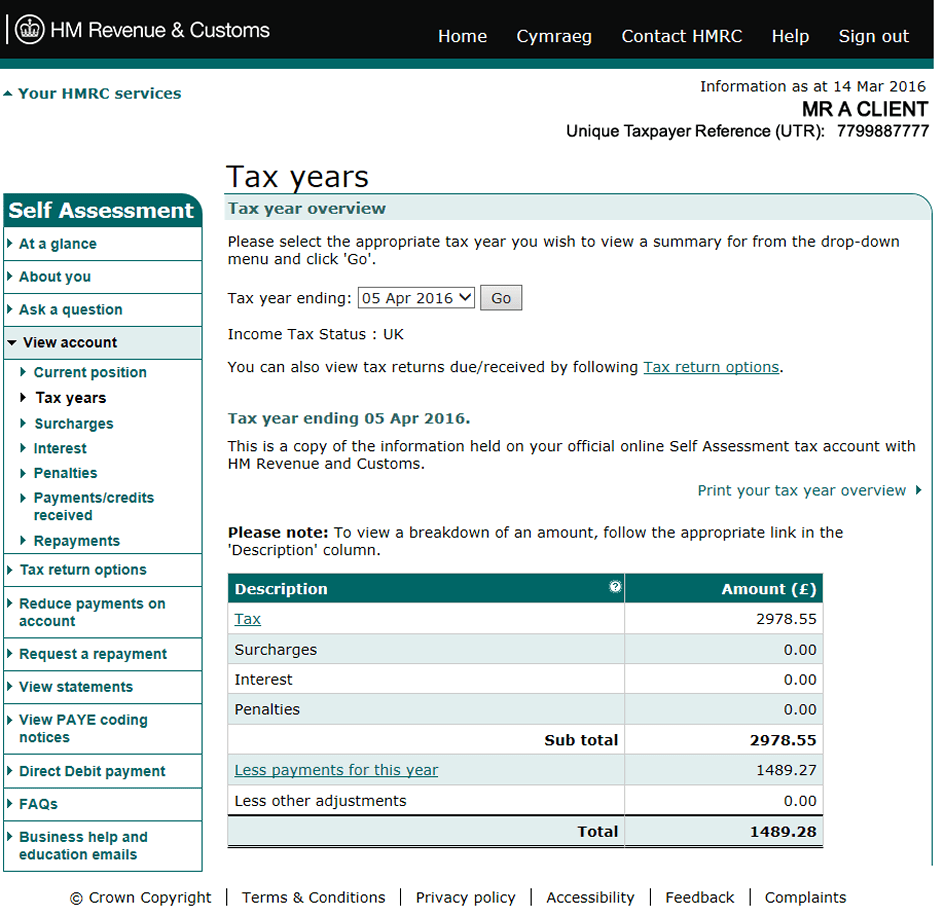

Guidance on how to pay different taxes and duties Including how to check what you owe ways to pay and what to do if you have difficulties paying 1 Use your PAYE tax code If you re an employed worker already paying tax through PAYE but you have to submit a tax return to declare income outside of your main job from a side hustle or rental income for example then this might be an option Other additional sources of income may include

1 Pay in one lump sum by 31 January 2022 Many people opt to pay their self assessment tax bill in one go This is due by midnight on 31 January 2022 but note that different payment methods may take longer to reach HMRC The tax you owe is based on the income you ve declared in your tax return balanced against your expenses and You pay 40 tax so you can personally claim back 20 of 125 25 with calls being answered in just over half an hour HMRC has an automated digital assistant on its website which will

Download Can I Pay Hmrc Over The Phone

More picture related to Can I Pay Hmrc Over The Phone

HMRC Phone Wait Times Over 12 Minutes Davenports Accountancy

https://www.davenportsaccountancy.co.uk/wp-content/uploads/2021/10/iStock-1177482360-1080x675.jpg

How To Pay HMRC NJB Taxback

https://njb-taxback.co.uk/wp-content/uploads/2022/08/AdobeStock_411604313-scaled.jpeg

How To Sell Over The Phone 5 X Critical Tips The 5 Institute

https://www.5percentinstitute.com/wp-content/uploads/2021/10/How-To-Sell-Over-The-Phone-min.png

4 Pay via payment on account If you re self employed HMRC may ask you to make your tax payments in advance by payment on account This involves making two payments one by 31 July and one by 31 January of the following year where you pay half of your estimated tax bill that s due on the 31 January At this point you may have to Pay HMRC via a bank You can no longer pay your bill using a Post Office payment Banks though are still classed as a valid payment station you can walk up and pay your tax bill over the counter To do so ensure you have paper statements from HMRC regarding what s owed Then follow the steps above to pay by cheque

The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain circumstances you will need to write in This table will help you decide how By telephone You can pay by debit card over the phone Please telephone HMRC on 0300 200 3402 and have your 10 digit self assessment reference number ready Please allow 3 working days for your payment to reach HMRC Related Insights Biodiversity Net Gain and tax 14th Feb 2024 Time for a virtual finance director

How Can I Pay Multiple Invoices From A Single Vendor When QBO Only

https://quickbooks.intuit.com/learn-support/image/serverpage/image-id/64124i84280C4019E105A8?v=v2

Can I Take Payments Over The Phone De Jong Phillips

https://www.dejongphillips.co.uk/wp-content/uploads/2022/04/can-i-take-payments-over-the-phone-900x675.jpg

https://www.gov.uk/guidance/pay-taxes-penalties-and-enquiry-settlements

For example if you ve agreed a payment with HMRC over the phone You must have a payslip to pay at your bank or building society Payment reference

https://www.payments.service.gov.uk/take-payments-by-phone-or-post

These are sometimes called MOTO payments You get all of the advantages and security of using GOV UK Pay but you fill in your users details on the payment pages for them You can use this

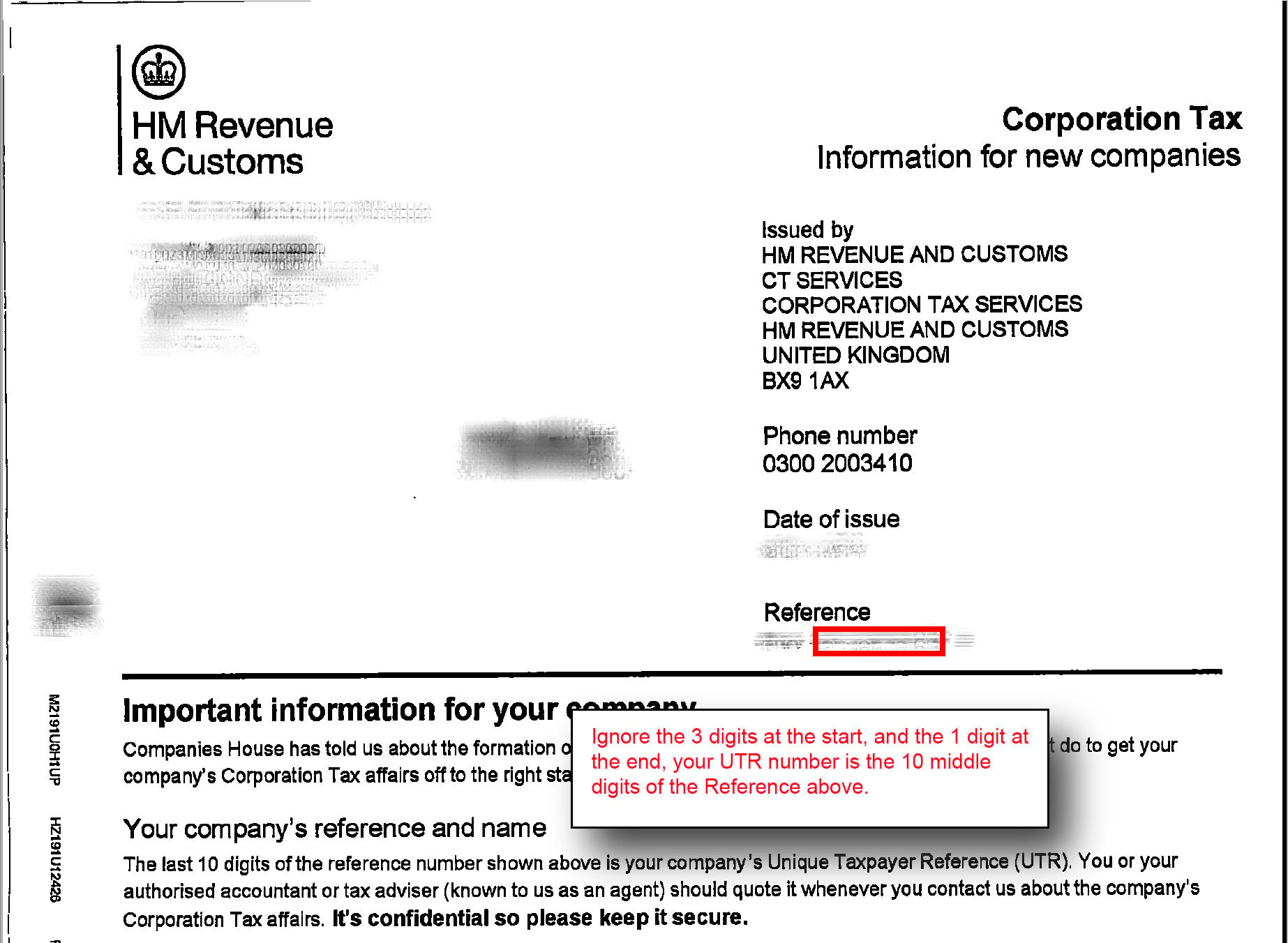

Where Can I Find My UTR Number

How Can I Pay Multiple Invoices From A Single Vendor When QBO Only

How To Fill In A Self assessment Tax Return Which

Exp Code On Invoice Hybridlasopa

Locations Of HMRC Offices In The UK

How Can I Pay My Bill Telair

How Can I Pay My Bill Telair

How Do I Pay Directly From My Phone Leia Aqui How Do I Pay With My

How Can I Pay JDM Digital JDM Digital

HMRC Tax Evasion Scam How It Works Red Flags More Lovemoney

Can I Pay Hmrc Over The Phone - General Enquiries If you have any general enquiries about VAT HMRC operate a dedicated VAT advice service Phone 0300 200 3700 from outside the UK 44 2920 501 261 Lines are open 8am 6pm Monday Friday Webchat https www gov uk government organisations hm revenue customs contact vat enquiries