Can I Show Fixed Deposit For Tax Exemption A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor can

Fixed Deposits FDs under Section 80C can yield tax benefits but interest income is taxable TDS is deducted when interest exceeds Rs 40k or Rs 50k for senior You can take advantage of the income tax deduction provision under Section 80C of the Income Tax Act by investing up to Rs 1 5 lakh in a tax saver fixed

Can I Show Fixed Deposit For Tax Exemption

Can I Show Fixed Deposit For Tax Exemption

https://i.pinimg.com/originals/ff/c2/2c/ffc22c3cacdd92bd70a97183067c7a7a.jpg

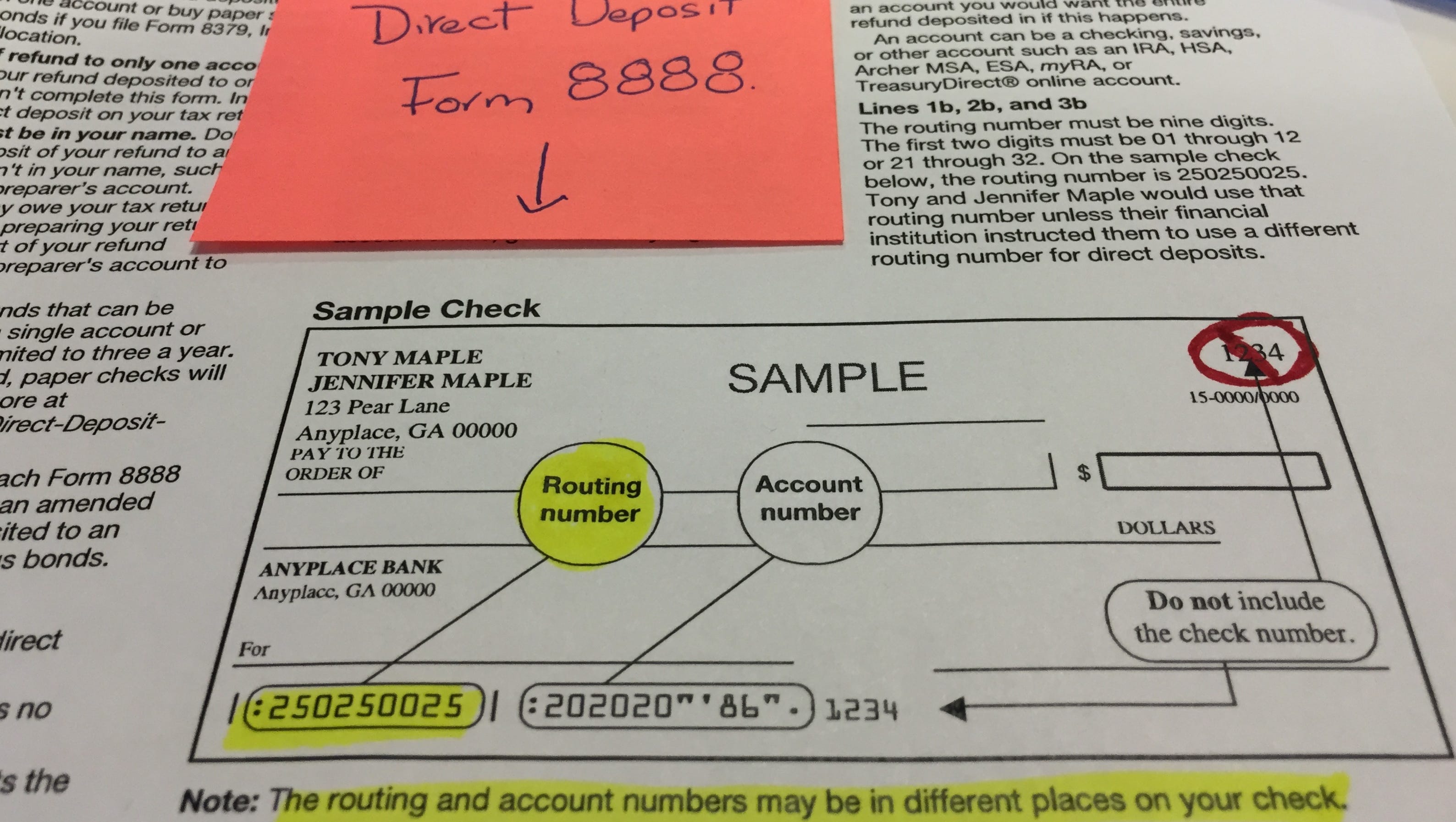

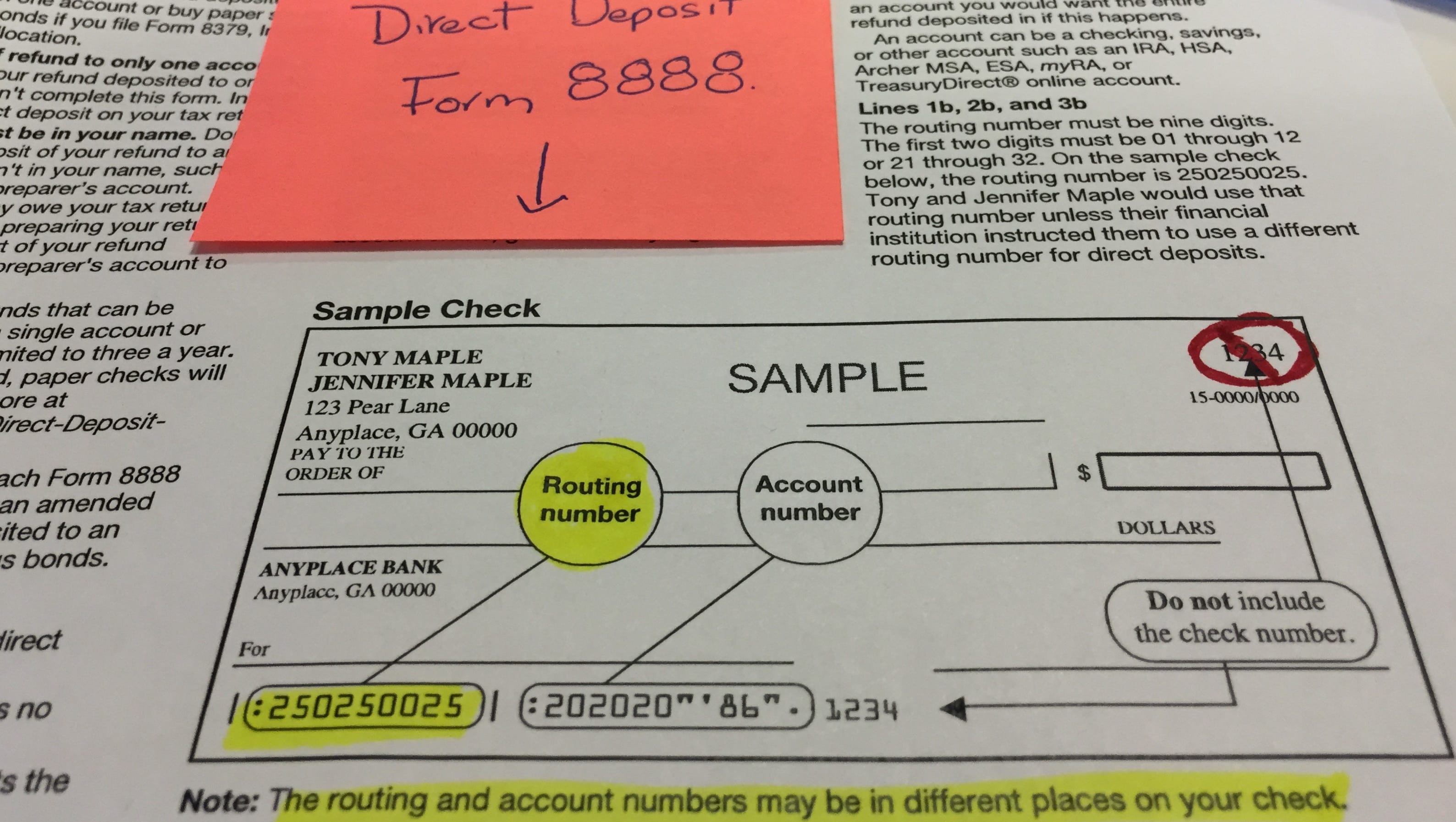

Direct Deposit For Tax Refunds Can Go Very Wrong

https://www.gannett-cdn.com/-mm-/a995824499c81ccaa3f9f23a73e4a0e2c69b891d/c=0-477-3176-2271/local/-/media/2016/03/28/DetroitFreePress/DetroitFreePress/635947703481971388-FullSizeRender.jpg?width=3176&height=1794&fit=crop&format=pjpg&auto=webp

SBI Tax Saving Fixed Deposit Scheme IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2019/03/SBI-Tax-Saving-Fixed-Deposit-Scheme.jpg

Like other fixed deposits senior citizens enjoy 0 25 to 0 5 higher returns on their tax saving fixed deposit investments than regular customers Tax saver FD scheme is Check out the eligibility criteria for Five Year Tax Saving Fixed Deposit Deposits at HDFC Bank Know more about terms conditions charges other requirements

Investing in a fixed deposit can help you earn guaranteed returns Not only can you claim Fixed Deposit tax exemption under Section 80C of the Income Tax Act you can also According to current income tax laws only individuals and Hindu Undivided Families HUFs can invest in tax saving FDs You can open a tax saving FD account either with a bank

Download Can I Show Fixed Deposit For Tax Exemption

More picture related to Can I Show Fixed Deposit For Tax Exemption

Certificate Of Exemption Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/50/825/50825271/large.png

TAX Summary Notes 1

https://s2.studylib.net/store/data/025963115_1-fdd367a29c37c3655891dbac839ea1ba-768x994.png

WooCommerce Tax Exempt Plugin Exempt Tax Based On User Roles

https://addify.store/wp-content/uploads/2022/06/screely-1655279735355.png

Should we pay tax on fixed deposits each year or only on maturity What does the law say What are the options for the investor Can we pay on maturity even if there is a tax A Tax Saving FD is one step better it is aimed at helping you claim a Fixed Deposit income tax exemption under Section 80C of the Income Tax Act for investments up to 1 5 lakh A Tax Saving Fixed Deposit

According to current income tax laws if an individual opts for old existing tax regime then under Section 80C of the Income tax Act you can claim deduction for investments up to Section 80C prevents any investment made under the tax saving fixed deposit of a minimum of 5 years to be tax exempted However the fixed deposit needs to follow the

4 Reasons Why You Should Open A PNB Housing Fixed Deposit Account

https://business2talk.com/wp-content/uploads/2021/01/Bank-Fixed-Deposit-696x458.png

Does EZ Texting Charge Sales Tax

https://callfire.my.site.com/answers/servlet/rtaImage?eid=ka03q000000gpPX&feoid=00N3q00000HIYyd&refid=0EM3q000001iGnj

https://cleartax.in/s/tax-saving-fd-fixed-deposits

A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor can

https://cleartax.in/s/income-tax-on-fixed-deposit-interest

Fixed Deposits FDs under Section 80C can yield tax benefits but interest income is taxable TDS is deducted when interest exceeds Rs 40k or Rs 50k for senior

Budget 2023 No Income Tax For Those Earning Up To Rs 7 Lakh Annually

4 Reasons Why You Should Open A PNB Housing Fixed Deposit Account

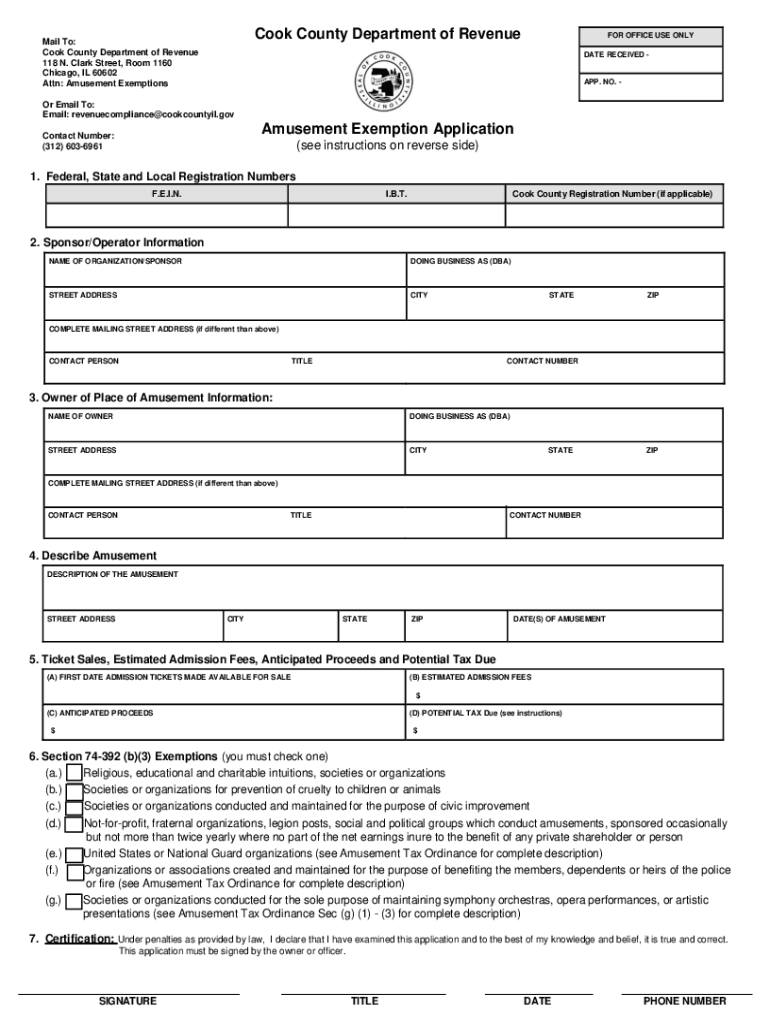

Cook County Amusement Tax Form Fill Out And Sign Printable PDF

Tax Saver FD 5 Year Fixed Deposit For Tax Saving Scheme Explained

Bharat Bank

Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Sample Letter Exemptions Fill Out Sign Online DocHub

PDF Corporate Income Taxation In Canada

Here s Everything About Section 54B Of The Income Tax Act

Can I Show Fixed Deposit For Tax Exemption - Tax saving fixed deposits provide individuals with an opportunity to save on taxes by availing deductions under Section 80C Additionally certain types of fixed deposits such