Can I Still File My Mn Property Tax Refund If you re a Minnesota homeowner or renter you may qualify for a Property Tax Refund The refund provides property tax relief depending on your income and property taxes

PAUL Minn The Minnesota Department of Revenue reminds homeowners and renters to file for their 2020 Property Tax Refund before the deadline of August 15 Both homeowners and renters are eligible to claim a refund If you re still unsure about the status of your return call the MN Dept of Revenue at 651 556 3009 or

Can I Still File My Mn Property Tax Refund

Can I Still File My Mn Property Tax Refund

https://i.ytimg.com/vi/isflgT4S_sw/maxresdefault.jpg

About Your Property Tax Statement Anoka County MN Official Website

https://anokacountymn.gov/ImageRepository/Document?documentID=21308

Tax Return 2021 Can I Still File My Tax Return This 2023 Marca

https://phantom-marca.unidadeditorial.es/28bce67af62c5c9688adc887067c4a54/resize/1320/f/jpg/assets/multimedia/imagenes/2022/09/07/16625617171494.jpg

Get the tax form called the 2023 Form M 1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund You can call 651 296 3781 to get a form or write to Minnesota Tax Forms How to apply You may file for the Property Tax Refund on paper or electronically by August 15 You have up to one year after the due date to file Free electronic filing is

See the Minnesota Where s My Refund webpage to check the status of your property tax refund online If you prefer you can call the automated refund tracking line at 651 296 The Minnesota Department of Revenue offers free electronic filing for the Homestead Credit Refund for Homeowners also known as the property tax refund

Download Can I Still File My Mn Property Tax Refund

More picture related to Can I Still File My Mn Property Tax Refund

Who Can Claim MN Property Tax Refund YouTube

https://i.ytimg.com/vi/KNmghL4AqtM/maxresdefault.jpg

Can I Still File My Taxes Even If It s Late YouTube

https://i.ytimg.com/vi/quOsGZ7QOGQ/maxresdefault.jpg

When Can I Expect My MN Property Tax Refund 2022 YouTube

https://i.ytimg.com/vi/LIVcW2TNnU4/maxresdefault.jpg

Yes you can file your M1PR when you prepare your Minnesota taxes in TurboTax We ll make sure you qualify calculate your Minnesota property tax refund Direct deposit Direct deposit is the most secure way to get your refund Ensure your banking information is accurate when filing your return Track your refund Renters and homeowners are able

If there are delinquent property taxes on your home you cannot file a return unless you pay or make arrangements with the county by August 15 2024 Include a copy of your The renter s property tax refund program sometimes called the renters credit is a state paid refund that provides tax relief to renters whose rent and implicit property taxes are

How To File Tax Extension Self Employed

https://www.forbes.com/advisor/wp-content/uploads/2022/03/getty_do_i_have_to_file_return.jpeg

Fillable Online Form M1PR Homestead Credit Refund Fax Email Print

https://www.pdffiller.com/preview/102/13/102013958/large.png

https://www.revenue.state.mn.us/property-tax-refund

If you re a Minnesota homeowner or renter you may qualify for a Property Tax Refund The refund provides property tax relief depending on your income and property taxes

https://www.revenue.state.mn.us/press-release/2022...

PAUL Minn The Minnesota Department of Revenue reminds homeowners and renters to file for their 2020 Property Tax Refund before the deadline of August 15

Thousands Of Americans To Receive One time Summer Payment Worth Up To

How To File Tax Extension Self Employed

What Happens If You File Taxes Late Chime

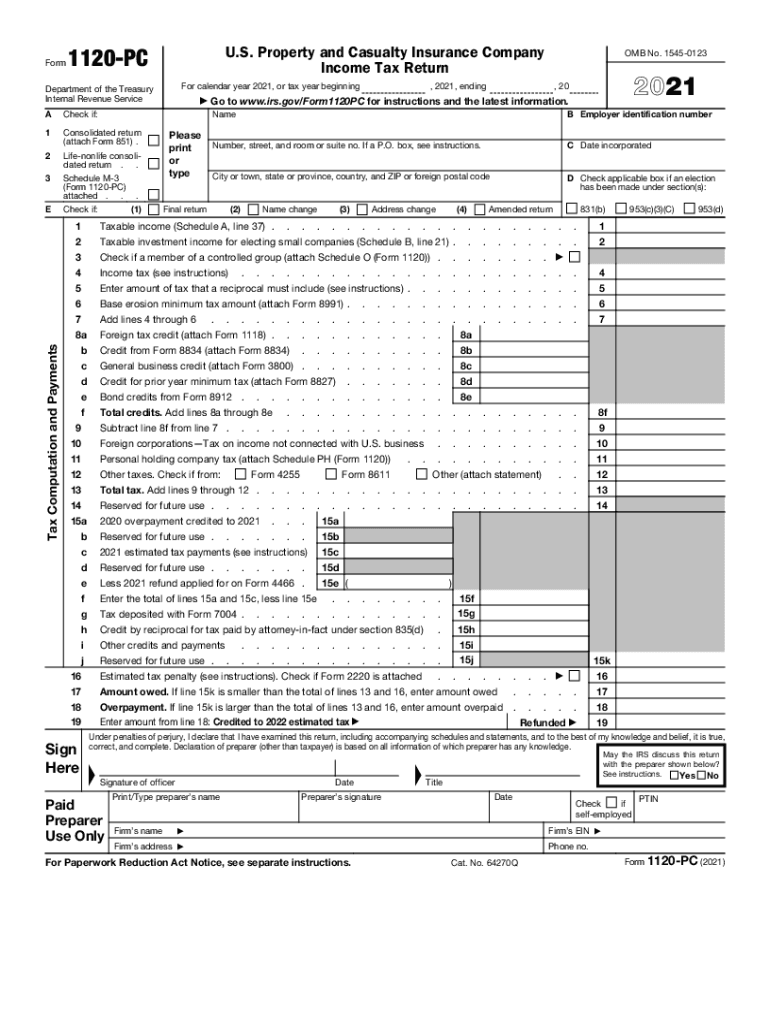

1120 Pc 2021 Fill Out Sign Online DocHub

Can You Claim 2019 Taxes In 2021 Leia Aqui Can I Still File My 2019

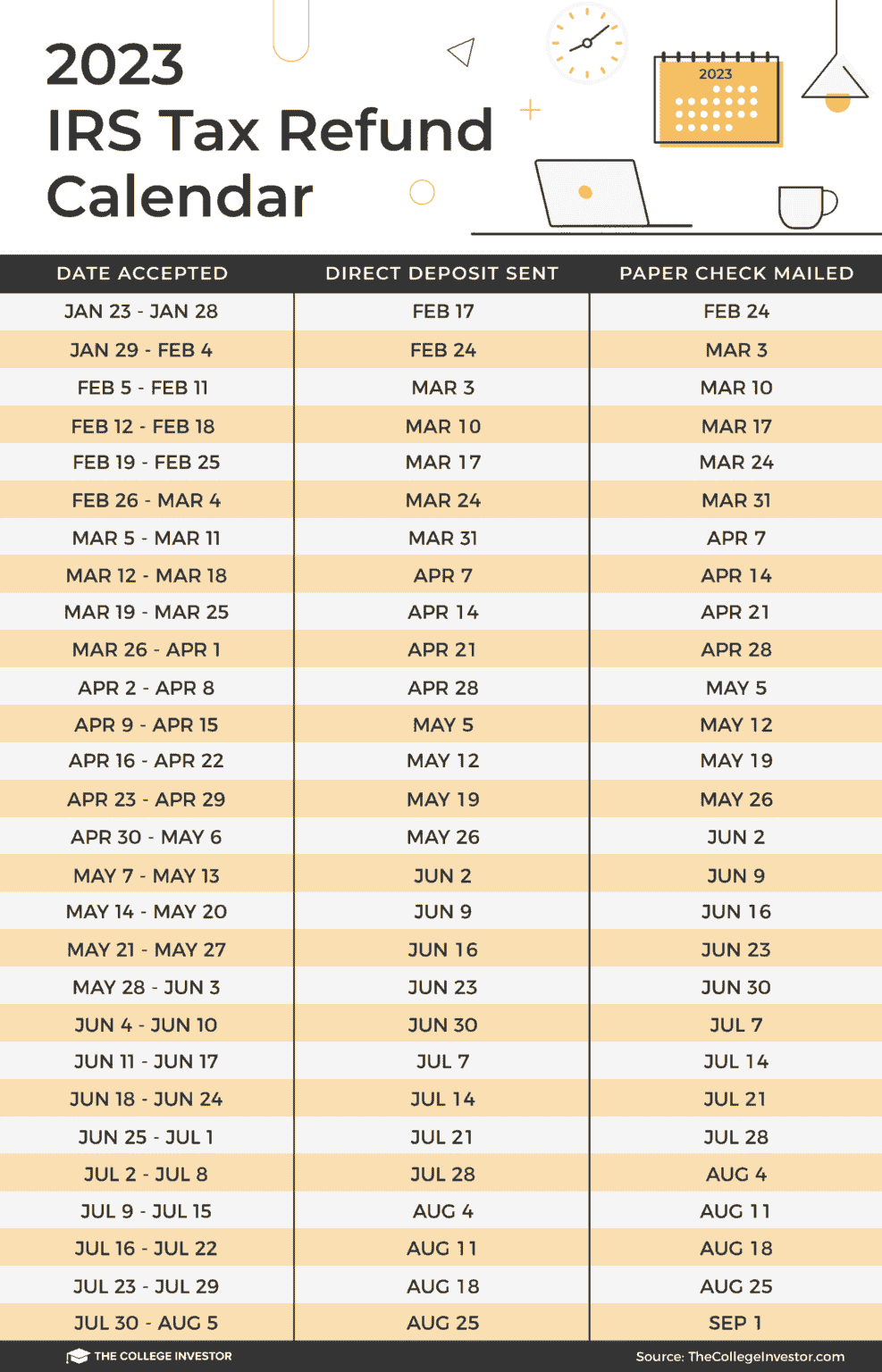

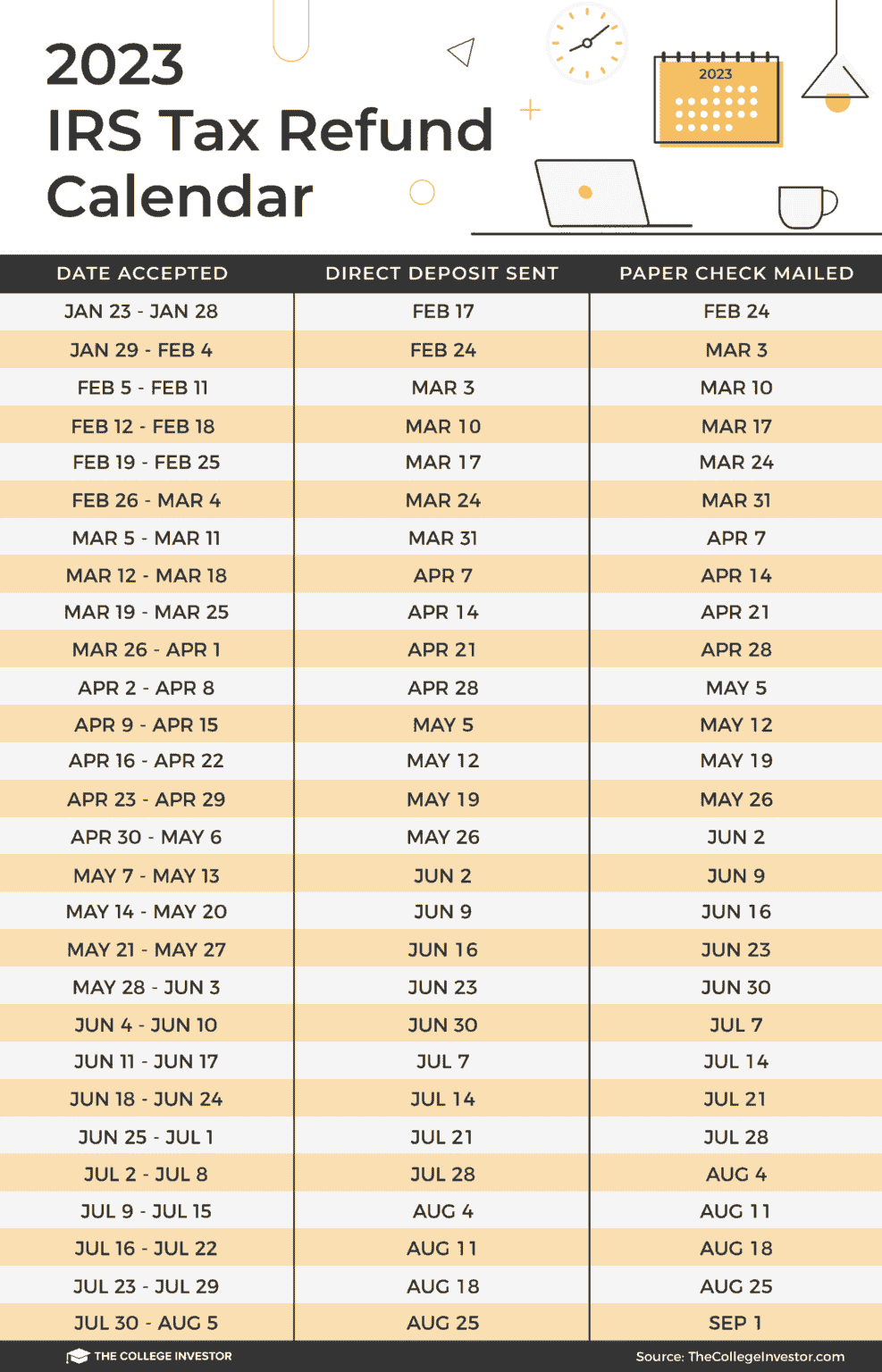

2023 Tax Return Timeline When To Expect Your Refund Texas Breaking News

2023 Tax Return Timeline When To Expect Your Refund Texas Breaking News

Real Property Tax Credit For Homeowners Honolulu PROPERTY HJE

How Do I Check My Mn Property Tax Refund Property Walls

Stimulus Check 2021 How To Check Status Of COVID Relief Tax Refund

Can I Still File My Mn Property Tax Refund - How to apply You may file for the Property Tax Refund on paper or electronically by August 15 You have up to one year after the due date to file Free electronic filing is