Can I Transfer Hsa Funds To Another Hsa Account An HSA rollover allows you to move funds from one HSA to another without tax penalties if executed correctly Unlike a direct transfer a rollover involves you personally

You start by opening an HSA account and transferring your other HSA funds to the new custodian you ve chosen In the process of opening that account your new custodian will offer you a Direct Transfer Request Form If your HSA money is invested you may be able to do an in kind transfer into a self directed HSA which allows your HSA provider to transfer both your cash balance and your investments to Fidelity You may need a separate transfer

Can I Transfer Hsa Funds To Another Hsa Account

Can I Transfer Hsa Funds To Another Hsa Account

https://mysolo401k.net/mycommunity/wp-content/uploads/2022/08/HSA-Information-scaled.jpeg

HSA Contribution Limits Higher In 2022 Linden Wealth Management

https://static.twentyoverten.com/61915772e25fc62c82c655d3/l7zX6mfsDT/HSAPlan-min.jpeg

CCFBank Health Savings Accounts HSA See Benefits

https://ccf.us/wp-content/uploads/2022/01/hsa-card-render.png

Individuals transferring or rolling over to HSA Bank with HSA assets invested in stocks bonds or mutual funds with another HSA custodian may be eligible to do so in kind Elements to consider include Send the Investment Account There are actually two processes to move your HSA funds into a new account A trustee to trustee transfer The trustees administering your HSA move your money to a different HSA

Luckily for you the HSA rollover process isn t as difficult as you may think The IRS allows you to fund a new HSA account from another HSA account an individual retirement Already have a health savings account HSA with another HSA provider Consolidate your funds into one account with Optum Financial

Download Can I Transfer Hsa Funds To Another Hsa Account

More picture related to Can I Transfer Hsa Funds To Another Hsa Account

HSA Rollover How To Transfer HSA Funds To A New Provider

https://youngandtheinvested.com/wp-content/uploads/HSA-rollover-transfer-funds-to-new-provider-584x389.webp

Can I Transfer Money From HSA To Bank Account

https://fredbever.com/wp-content/uploads/2023/07/Can-I-Use-My-HSA-Card-In-Store.jpg

Can I Transfer Money From An IRA To An HSA HSA For America

https://hsaforamerica.com/wp-content/uploads/2022/09/Can-I-Transfer-Money-from-an-IRA-to-an-HSA.png

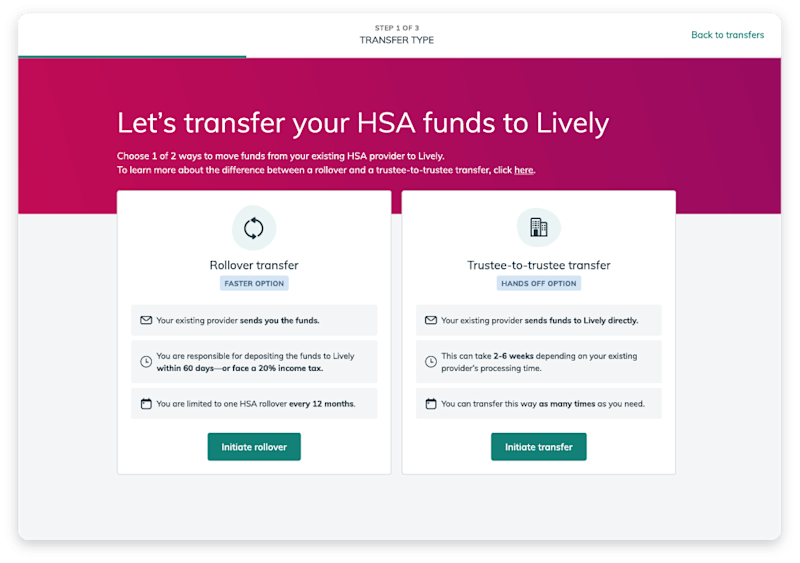

An HSA Rollover allows you to transfer funds between two HSA accounts of the same beneficiary However the IRS has rules you must follow to combine HSA funds Employer HSA provider said You can transfer your HSA Health Savings Account funds to your new HSA administrator You ll need to contact your new administrator and obtain their Trustee to Trustee Transfer form

To move money from one HSA account to another you can do a transfer This is a direct custodian to custodian movement of funds also called trustee to trustee With an HSA Even if you no longer contribute monthly funds to an HSA you can still transfer your funds to a new account That means whether you previously had a HDHP are now on Medicaid or

What Is An HSA And Will It Change Under The New Health Bill ThinkHealth

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA.jpg

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

https://images.ctfassets.net/0rtn79ifmgv3/4GufKGbzoFDeI269pIb5f5/1062c52ae582e8e4b8a1ac4d39758ebe/TaxChecklistv3.jpg

https://www.hsasearch.com › hsa-rollovers-and...

An HSA rollover allows you to move funds from one HSA to another without tax penalties if executed correctly Unlike a direct transfer a rollover involves you personally

https://wellkeptwallet.com › how-to-rollover...

You start by opening an HSA account and transferring your other HSA funds to the new custodian you ve chosen In the process of opening that account your new custodian will offer you a Direct Transfer Request Form

Using A Health Savings Account HSA To Pay For Childbirth Intrepid

What Is An HSA And Will It Change Under The New Health Bill ThinkHealth

HSA Rollover How To Transfer HSA Funds To A New Provider

IRS Announces 2023 HSA Contribution Limits

HSA Rollovers And Transfers Lively

IRS Makes Historical Increase To 2024 HSA Contribution Limits First

IRS Makes Historical Increase To 2024 HSA Contribution Limits First

How To Open A Fidelity HSA And Transfer HSA Bank Assets Marotta On Money

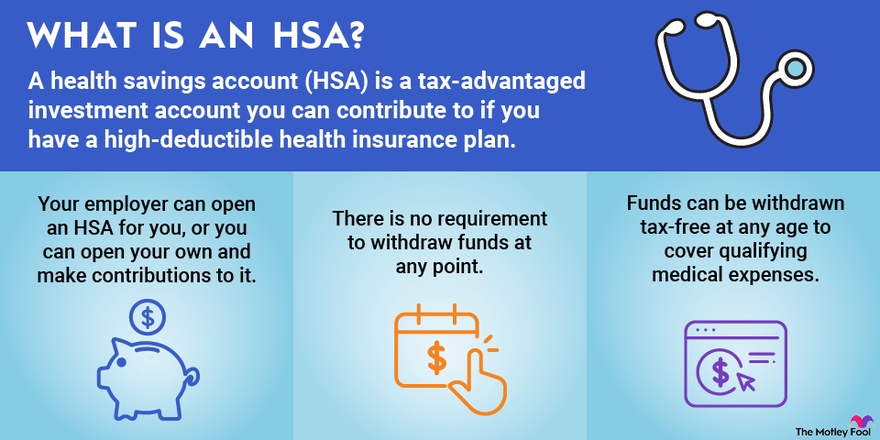

Health Savings Accounts HSAs Explained The Motley Fool

HSA Accounts Optimizing Returns Using Options In Fidelity HSA Accounts

Can I Transfer Hsa Funds To Another Hsa Account - Individuals transferring or rolling over to HSA Bank with HSA assets invested in stocks bonds or mutual funds with another HSA custodian may be eligible to do so in kind Elements to consider include Send the Investment Account