Can I Use Medical Bills As A Tax Deduction You figure the amount you re allowed to deduct on Schedule A Form 1040 For additional information on medical and dental expenses see Can I deduct my medical and dental expenses and Publication 502 Medical and Dental Expenses

Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must itemize your deductions If you itemize deductions and you have unreimbursed expenses for necessary medical or dental care you may be able to claim a tax deduction if they exceed 7 5 of your adjusted gross income Here are five expenses you may be able to deduct

Can I Use Medical Bills As A Tax Deduction

Can I Use Medical Bills As A Tax Deduction

https://images.squarespace-cdn.com/content/v1/5976a036bf629ac6f2a7bfdc/1566955219012-D81E0R00F6Y7YB1PJKUE/Tax+deductions.jpg

Understanding The Basics Of Tax On Superannuation CHN Partners

https://www.chnpartners.com.au/wp-content/uploads/2022/03/6jVDH772nyzhIqDUIHxQRO-pexels-dave-colman-7105019.jpg

How To Claim Stock As A Tax Deduction E Commerce Retail Wholesale

https://i.ytimg.com/vi/CCWF5i2yx7g/maxresdefault.jpg

Individuals can claim some of the cost of medical dental and other health care related expenses on tax returns if they itemize Learn about the rules that apply This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses paid The year in which the expenses were paid Your adjusted gross income If you were reimbursed or if expenses were paid out of a Health Savings Account or an Archer Medical Savings

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses and health insurance premiums if you are self employed If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7 5 of your adjusted gross income You can deduct the cost of care from several types of

Download Can I Use Medical Bills As A Tax Deduction

More picture related to Can I Use Medical Bills As A Tax Deduction

Tax Deductible Beauty Products That Could Get You Money From The IRS

https://www.sheknows.com/wp-content/uploads/2018/12/c9qss3gllgduxi4dmsia.jpeg?resize=600

How Do Tax Deductions Really Work

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/BB1iMU4S.img?w=1920&h=1282&m=4&q=79

How To Claim Super As A Tax Deduction YouTube

https://i.ytimg.com/vi/wBPVfJh8xD4/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGBMgVyh_MA8=&rs=AOn4CLCybQIjVuQ4QGckPvfSv7OjHorYgg

A medical expense deduction could help offset the cost of some of your medical bills provided you qualify to take the deduction Learn about how to qualify for this deduction and how much you might be able to claim on your federal income tax return You can deduct your out of pocket payments for a medical bill even if your insurance plan paid most of the bill The payments your insurer made are what can t be deducted Over the counter drugs and toiletries aren t deductible Nicotine gum and patches are generally not tax deductible as a medical expense

You can deduct unreimbursed qualified medical and dental expenses that exceed 7 5 of your AGI Say you have an AGI of 50 000 and your family has 10 000 in medical Your medical expenses may be tax deductible under certain circumstances If the medical bills you pay out of pocket in a year exceed 7 5 percent of your adjusted gross income AGI you may

How To Get A Higher Tax Refund This Financial Year Nixer

https://nixer.com.au/wp-content/uploads/2018/06/shutterstock_352655828.jpg

EXCEL Of Tax Deduction Form xlsx WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20191025/a893d00e6a764d2f9dbbb7838baa295d.jpg

https://www.irs.gov/taxtopics/tc502

You figure the amount you re allowed to deduct on Schedule A Form 1040 For additional information on medical and dental expenses see Can I deduct my medical and dental expenses and Publication 502 Medical and Dental Expenses

https://turbotax.intuit.com/tax-tips/health-care/...

Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must itemize your deductions

You Can Use Your Vehicle Registration As A Tax Deduction In Oregon

How To Get A Higher Tax Refund This Financial Year Nixer

Claiming Funeral Expenses As Tax Deductions

Tax Deductible Black Friday Deals For The Self Employed

What Is A Tax Write off And How Does It Work Workhy Blog

Medical Allowance Its Exemption Rate Limit And How To Calculate

Medical Allowance Its Exemption Rate Limit And How To Calculate

How The New Tax Laws Might Impact Divorce Settlements

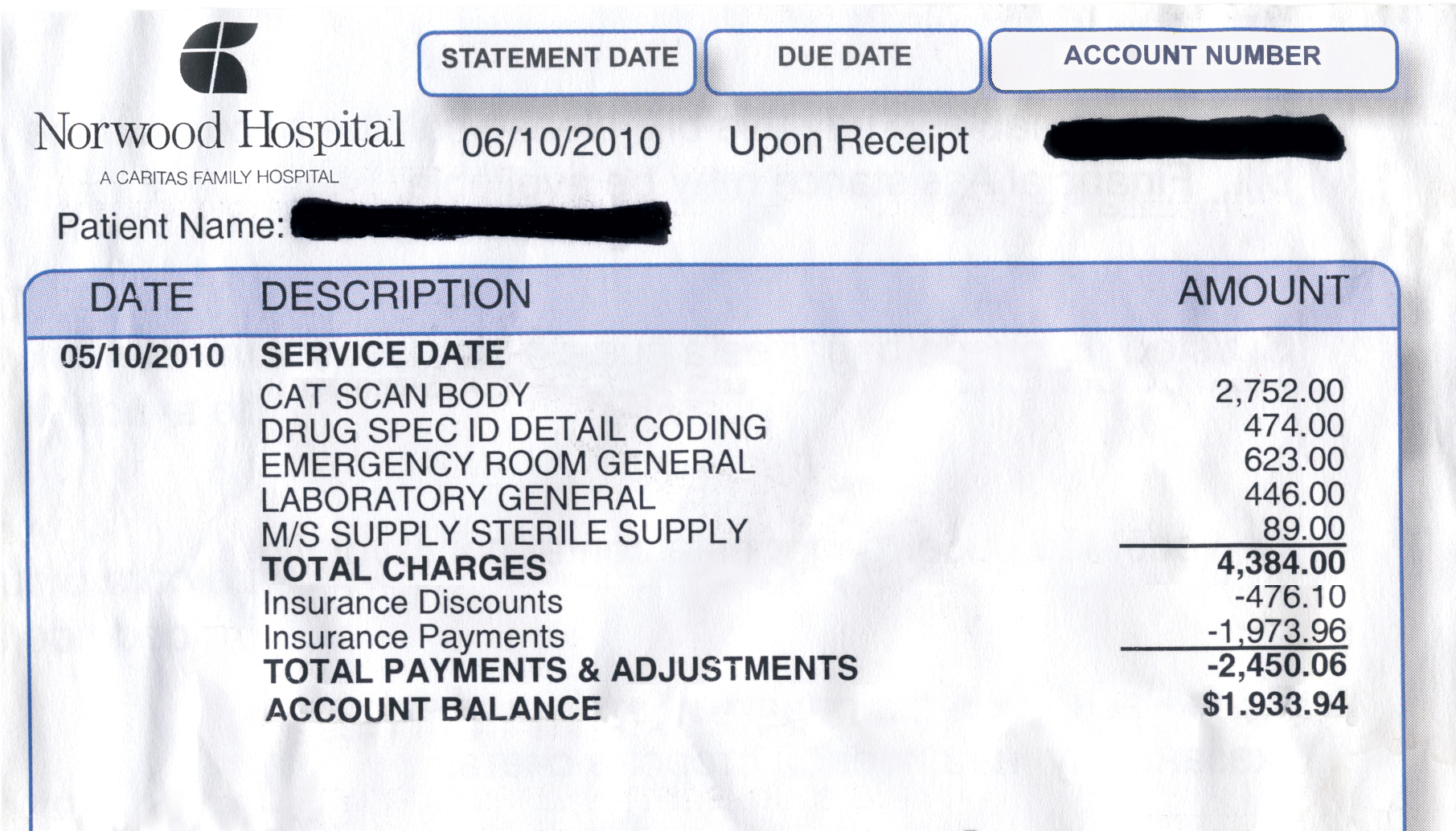

Anatomy Of A Medical Bill

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Can I Use Medical Bills As A Tax Deduction - This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses paid The year in which the expenses were paid Your adjusted gross income If you were reimbursed or if expenses were paid out of a Health Savings Account or an Archer Medical Savings