Can I Use My Hsa Account For Anything After Age 65 How should I manage my HSA after turning 65 After turning 65 understanding HSA rules exploiting its tax free growth strategizing withdrawals based

After age 65 you can use HSA money tax free for several extra expenses such as paying your monthly premiums for Medicare Part B and Part D and Medicare HSA rules after age 65 Once you reach age 65 you can withdraw money from your HSA for any purpose without incurring a penalty

Can I Use My Hsa Account For Anything After Age 65

Can I Use My Hsa Account For Anything After Age 65

https://www.zenefits.com/workest/wp-content/uploads/2022/12/HSA-e1677100040197.jpg

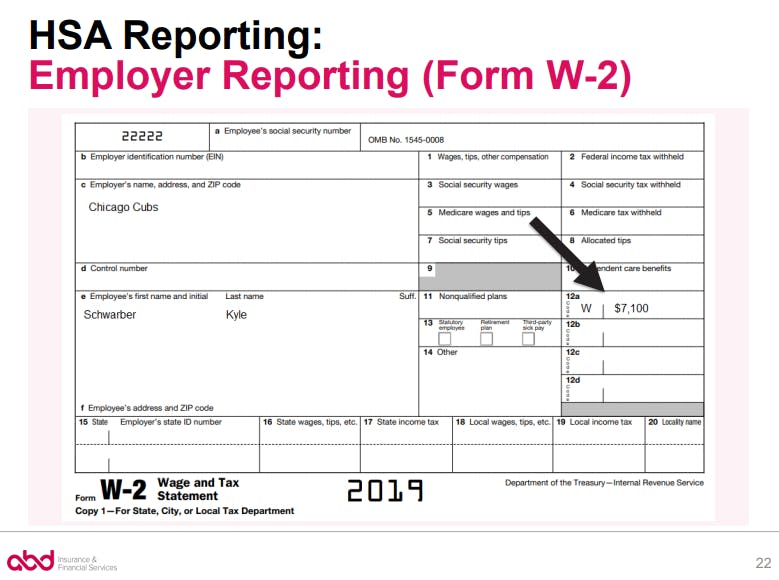

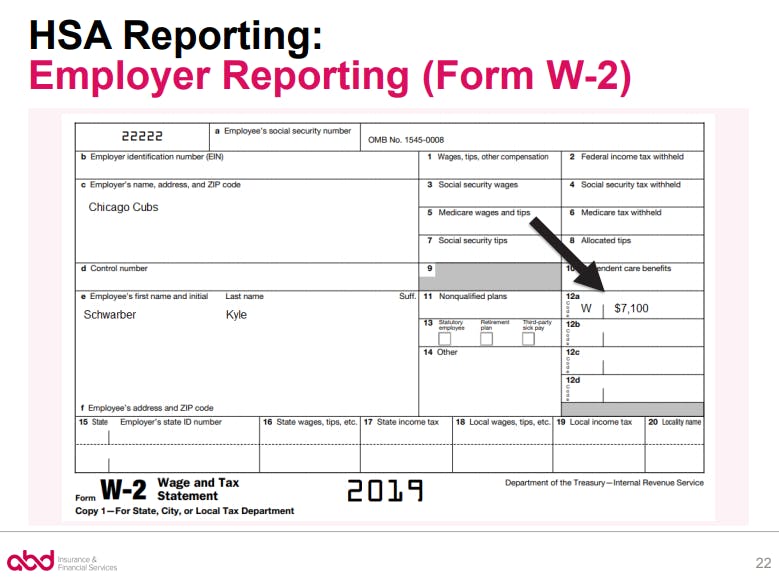

HSA Form W 2 Reporting

https://images.prismic.io/newfront/NmUwZDEzZDgtY2E4Ni00NDVlLTgwY2MtOThiNDgxZDUzZDM3_4_24_20_chart1.png?auto=compress,format&rect=0,0,779,580&w=779&h=580

Can I Invest The Money In My HSA FSA Insurance Neighbor

https://www.insuranceneighbor.com/wp-content/uploads/sites/2939/2020/11/HSA-Money-Medical-Health.jpg

At age 65 you can spend your HSA dollars on anything not just medical expenses and you won t incur the 20 penalty The withdrawal will just count toward your gross annual What Can I Use My HSA for After Retiring Once you re 65 you can use the money for any purpose If the purpose is a qualified medical expense the withdrawal is tax free

After age 65 you can withdraw money from an HSA for any reason without incurring a penalty However if you spend the money on non medical expenses you will have to pay taxes on your withdrawals in And when you turn 65 you can use your HSA for anything without incurring a penalty While you must have a high deductible health plan in order to

Download Can I Use My Hsa Account For Anything After Age 65

More picture related to Can I Use My Hsa Account For Anything After Age 65

What Is Fsa hra Eligible Health Care Expenses Judson Lister

https://medmattress.com/wp-content/uploads/2021/08/Health-Accounts-Comparison.png

CCFBank Health Savings Accounts HSA See Benefits

https://ccf.us/wp-content/uploads/2022/01/hsa-card-render.png

What Can I Buy With My HSA Debit Card Health Savings Accounts For

https://www.texaseducatorshsa.com/wp-content/uploads/HSA-Card.jpg

After 65 HSA funds can be spent on things other than qualified medical expenses but these amounts are added to income which creates a tax liability The Key Takeaways An HSA lets you set aside pre tax income to cover healthcare costs that your insurance doesn t pay You can open an HSA if you have a

You can use the money in your HSA for any purpose once you reach age 65 You ll still pay income tax for anything other than qualified medical expenses But Can my HSA be used for anything other than qualified health care expenses One benefit of the HSA is that after you turn age 65 you can withdraw money from your HSA for

What Is A Health Savings Account HSA UnitedHealthcare

https://www.uhc.com/content/dam/uhcdotcom/en/Videos/brightcove-video-thumbnails/6266405299001-thumbnail.png/_jcr_content/renditions/cq5dam.web.1280.1280.png

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

https://images.ctfassets.net/0rtn79ifmgv3/4GufKGbzoFDeI269pIb5f5/1062c52ae582e8e4b8a1ac4d39758ebe/TaxChecklistv3.jpg

https://hsaharvest.com › articles

How should I manage my HSA after turning 65 After turning 65 understanding HSA rules exploiting its tax free growth strategizing withdrawals based

https://www.kiplinger.com › article › retirement

After age 65 you can use HSA money tax free for several extra expenses such as paying your monthly premiums for Medicare Part B and Part D and Medicare

What Is An HSA And Will It Change Under The New Health Bill ThinkHealth

What Is A Health Savings Account HSA UnitedHealthcare

What Is An HSA How Does It Work The Difference Card

Can I Use My Hsa To Pay Insurance Premiums

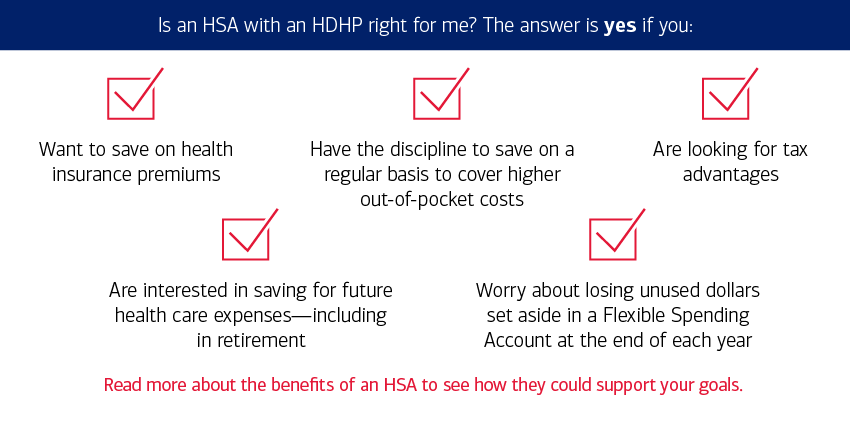

Is An HSA Right For Me

HSA For Chiropractor HSAs Chiropractic Care HSA For America

HSA For Chiropractor HSAs Chiropractic Care HSA For America

What s The Difference Between An HSA FSA And HRA Medical Health

FAQs_featured.jpg)

Health Savings Account HSA FAQs

Eligible Hsa Expenses 2024 Tessa Fredelia

Can I Use My Hsa Account For Anything After Age 65 - Once you reach age 65 and enroll in Medicare you can no longer contribute to an HSA But an HSA comes with a couple of retirement tax advantages