Can Irs Calculate My Taxes The solution Lower your taxes and penalties by filing a correct return with all your deductions and credits to replace the return filed by the IRS The IRS can take 2 3 years to file a tax return for you so you have time to act if you haven t filed a

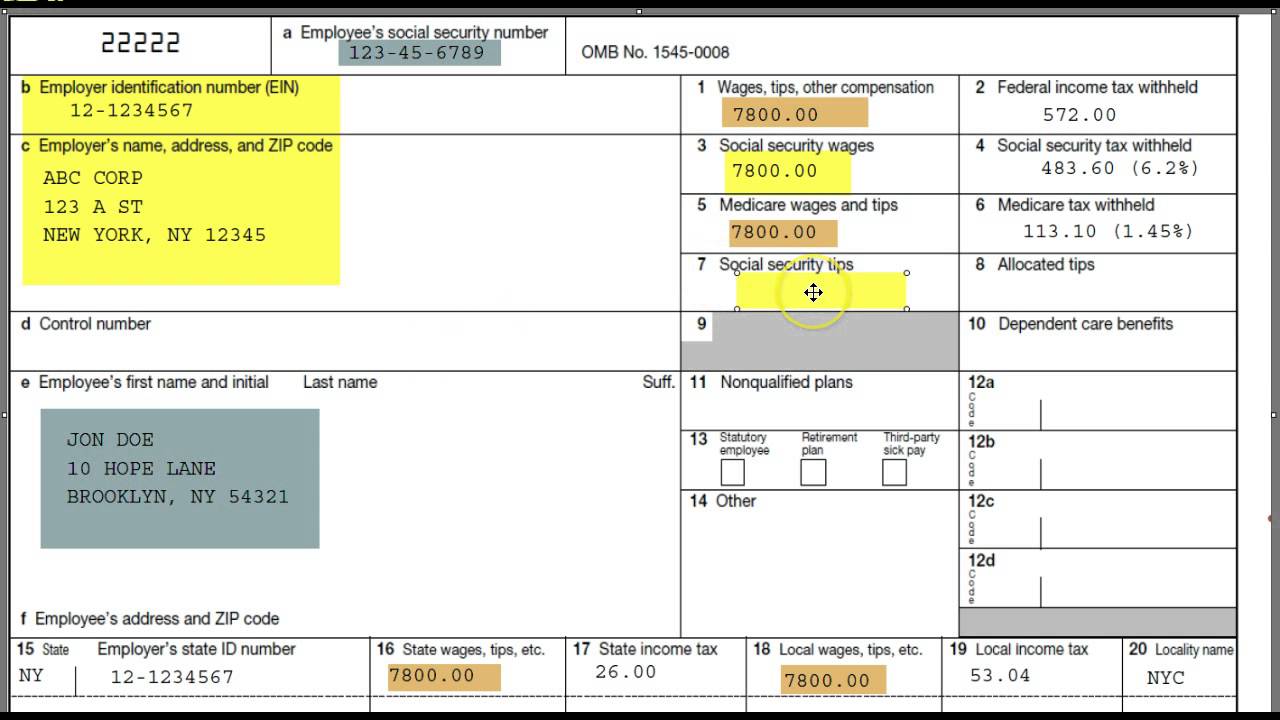

Question Will the IRS figure the amount of tax and credits for taxpayers Answer Yes if you choose the IRS will figure your tax the credit for the elderly or the disabled and the earned income credit on your Form 1040 or Form 1040 SR provided that When calculating the amount of federal income tax you owe the IRS goes through several steps such as excluding certain items from your income applying the current tax brackets and

Can Irs Calculate My Taxes

Can Irs Calculate My Taxes

https://image.cnbcfm.com/api/v1/image/106910918-1626285229297-gettyimages-963468264-_DHP4870.jpeg?v=1626285285&w=1920&h=1080

Taxes s Gallery Pixilart

https://art.pixilart.com/70446beddd7a2e2.gif

Paying Taxes 101 What Is An IRS Audit

https://stophavingaboringlife.com/wp-content/uploads/2020/11/tax-time.jpeg

The Tax Withholding Estimator on IRS gov makes it easy to figure out how much to withhold This online tool helps employees withhold the correct amount of tax from their wages It also helps self employed people who have wage income estimate their quarterly tax payments By Charlene Rhinehart Jan 12 2021 at 10 03AM Hint You ll have to use a formula instead of a single form to find out how much you owe the IRS If calculating your income tax ever felt like

Here s what you ll need to estimate your income tax refund or bill using our calculator Personal info Your filing status and age Income Your gross income for the tax year as well as how much Federal Income Tax Calculator 2023 2024 Return and Refund Estimator The tax calculator will project your 2023 2024 federal refund or tax bill based on earnings age deductions and credits

Download Can Irs Calculate My Taxes

More picture related to Can Irs Calculate My Taxes

Late Filed Tax Returns Excess Collections

https://irstaxtrouble.com/wp-content/uploads/sites/5/2022/12/IRS-excess-collections.jpg

I Don t Care Who The IRS Sends I Am Not Paying Taxes Dan Vs Meme

https://preview.redd.it/0pn9keqxn4b91.jpg?auto=webp&s=92b3c77444bd6aeeb0239d88068160b9b6e5f3ab

No Taxes Clipart Clip Art Library

https://clipart-library.com/img/2002007.jpg

Use SmartAsset s Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount This calculator is updated with rates brackets and other information for your 2023 taxes which you ll file in 2024 Details Federal Withholding Effective Tax Rate Tax Tips for Your Return Calculate your federal state and local taxes for the current filing year with our free income tax calculator Enter your income and location to estimate your tax burden

Tax Bracket Calculator Forbes Advisor advisor Taxes Advertiser Disclosure Tax Bracket Calculator What Is Your Top Tax Rate Kemberley Washington Certified Public Accountant Estimated taxes are payments made to the IRS throughout the year on taxable income that is not subject to federal withholding Typically freelancers those who are self employed businesses

Are You Behind On Your Payroll Tax Filings Or Payments IRS Solutions

https://secureservercdn.net/198.71.233.52/03y.6ac.myftpupload.com/wp-content/uploads/2022/01/IRS-Solutions-Kix-01-01-2-1.png

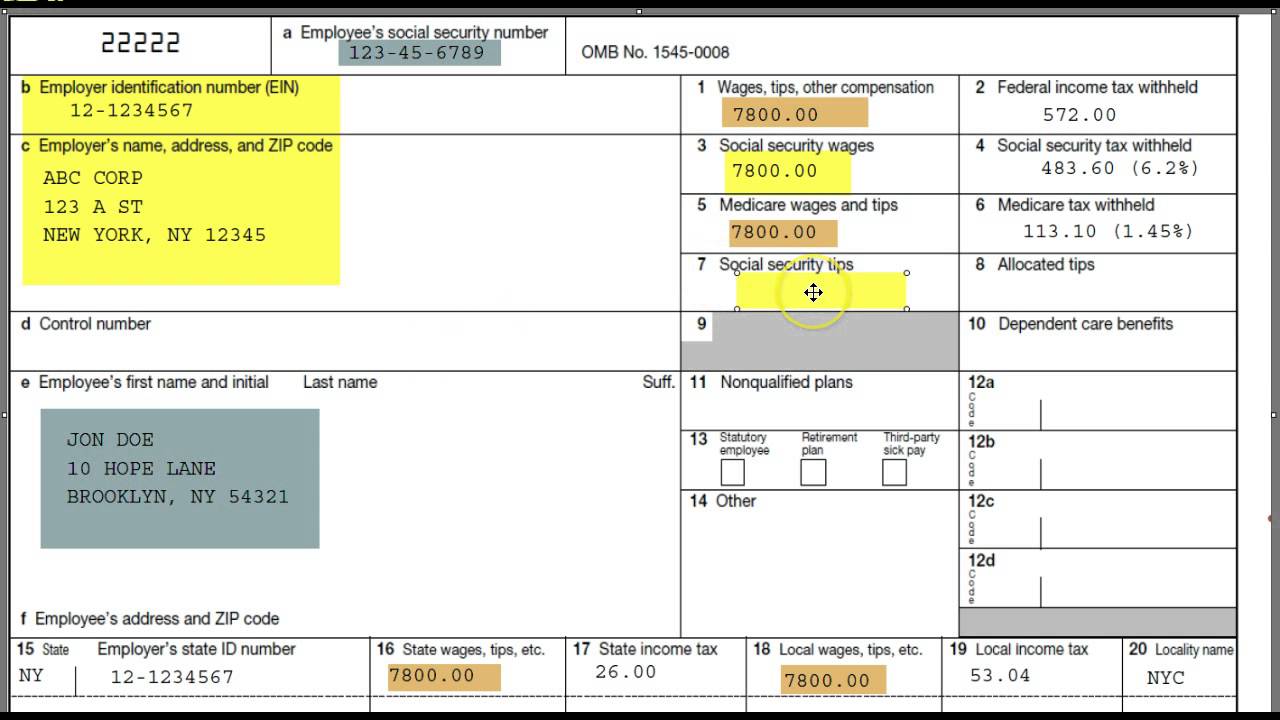

Federal Income Tax FIT Payroll Tax Calculation YouTube

https://i.ytimg.com/vi/Bpta4olQddw/maxresdefault.jpg

https://www. hrblock.com /tax-center/irs/audits-and...

The solution Lower your taxes and penalties by filing a correct return with all your deductions and credits to replace the return filed by the IRS The IRS can take 2 3 years to file a tax return for you so you have time to act if you haven t filed a

https://www. irs.gov /faqs/irs-procedures/general...

Question Will the IRS figure the amount of tax and credits for taxpayers Answer Yes if you choose the IRS will figure your tax the credit for the elderly or the disabled and the earned income credit on your Form 1040 or Form 1040 SR provided that

What Font Does The IRS Use LiveWell

Are You Behind On Your Payroll Tax Filings Or Payments IRS Solutions

IRS Commissioner On Nationwide Tax Season Tour

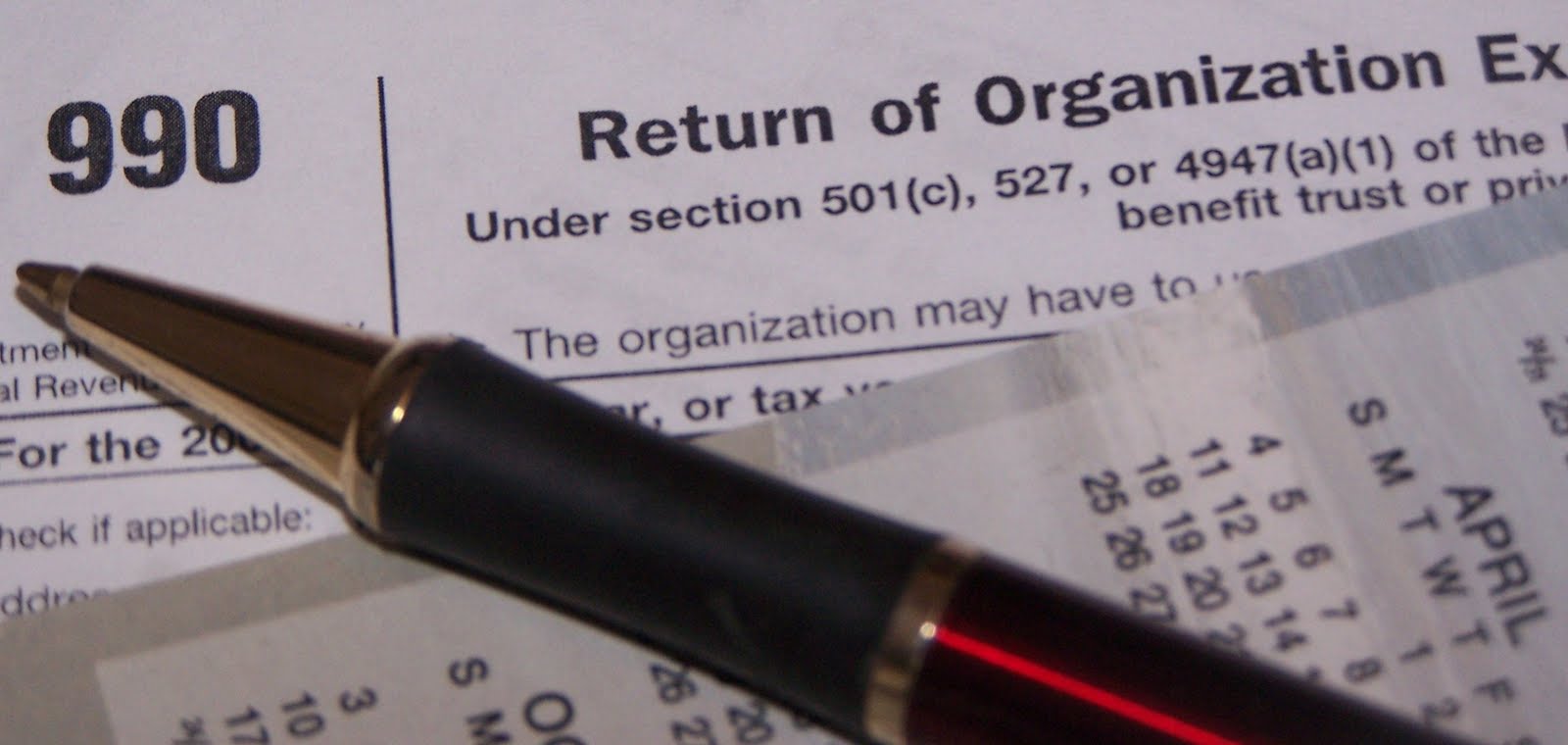

Progressive Charlestown Local Charities Lose Tax exempt Status

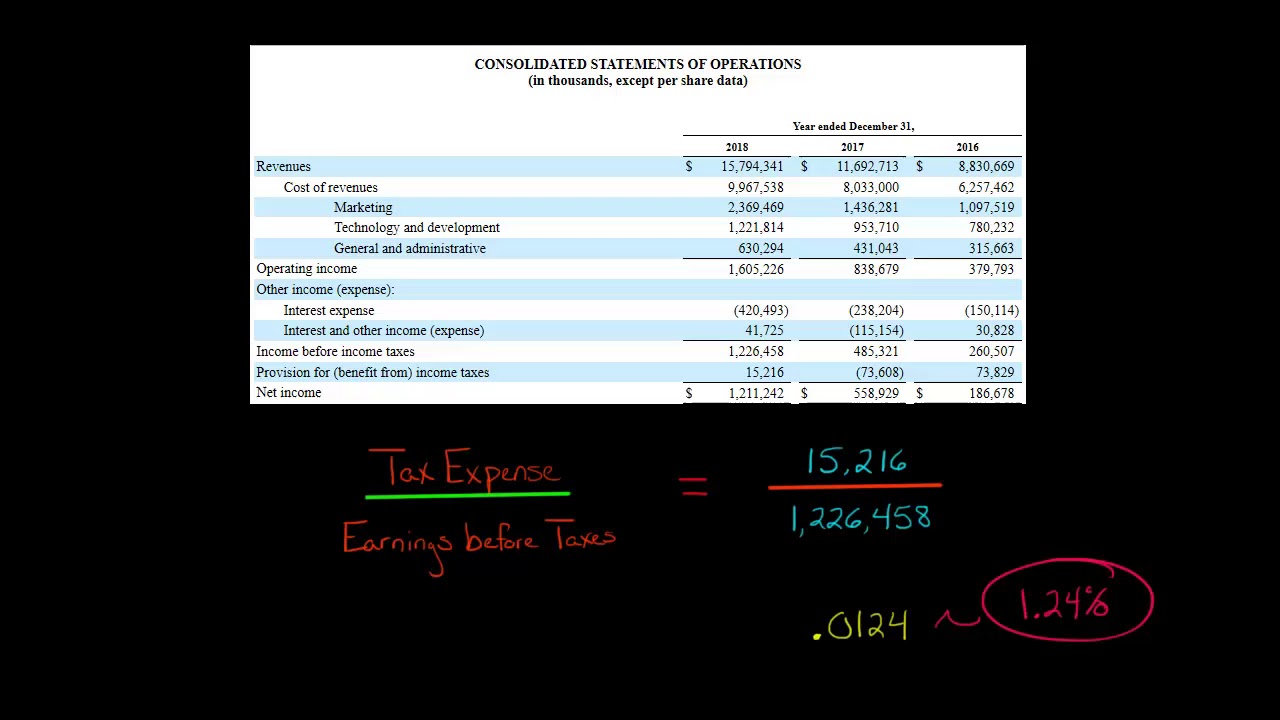

How To Find Ebit With Net Income And Tax Rate Haiper

How To Figure Out How Much You Get Back In Taxes 3 Ways To Calculate

How To Figure Out How Much You Get Back In Taxes 3 Ways To Calculate

Anyone Else Knows What This Means My Taxes Got Adjusted 2 Weeks Ago

Niemann And Company IRS Tax Resolution Services St Louis Missouri

Pensacola State College Free VITA Tax Preparation And E Filing

Can Irs Calculate My Taxes - Here s what you ll need to estimate your income tax refund or bill using our calculator Personal info Your filing status and age Income Your gross income for the tax year as well as how much