Can Medical Expenses Be Claimed As A Tax Deduction As per section 80D a taxpayer can claim a tax deduction on premiums paid towards medical insurance for self spouse parents and dependent children Individuals and HUF can claim this deduction

Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must itemize your deductions Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are satisfied

Can Medical Expenses Be Claimed As A Tax Deduction

Can Medical Expenses Be Claimed As A Tax Deduction

https://media.cheggcdn.com/study/ca4/ca4cfa1e-c438-40c9-9a38-8437843b3398/image.png

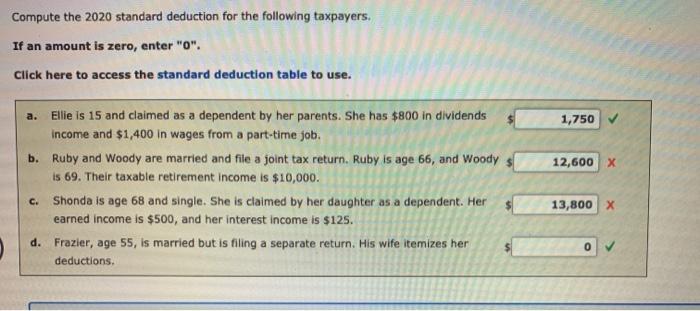

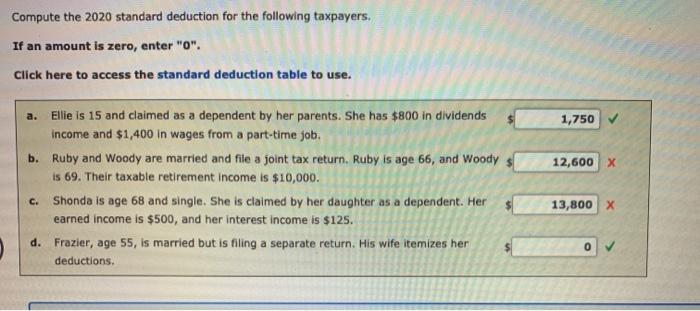

Solved Compute The 2020 Standard Deduction For The Following Chegg

https://media.cheggcdn.com/study/3eb/3eb3ce00-b7ec-410b-9aed-84938bff0189/image

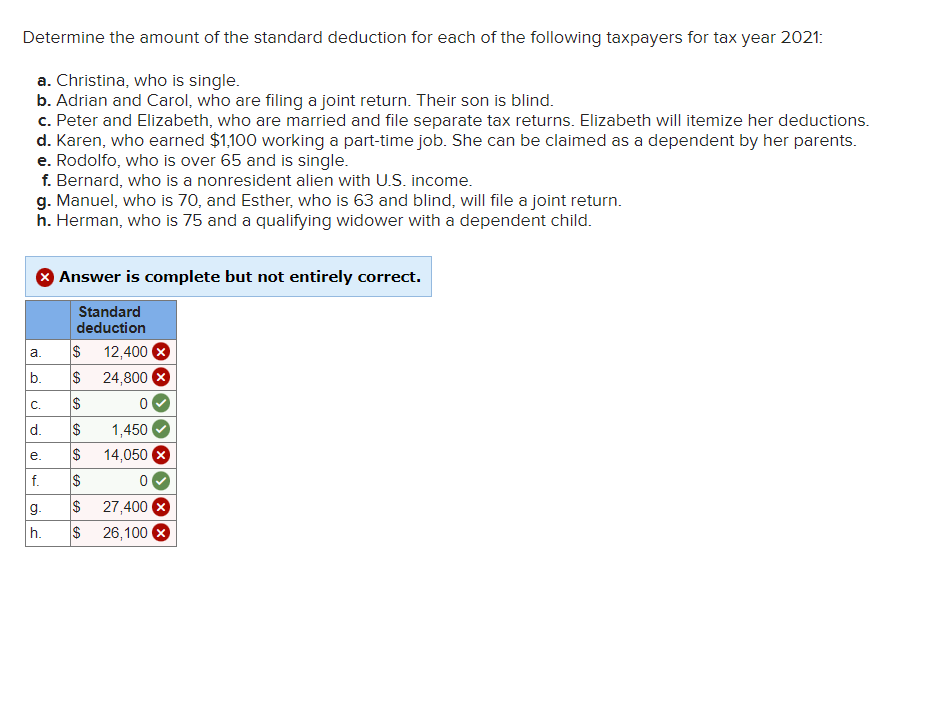

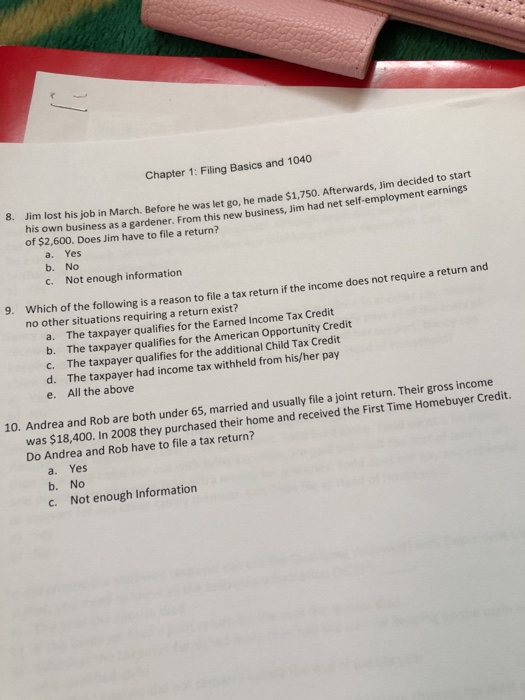

Solved Determine The Amount Of The Standard Deduction For Chegg

https://media.cheggcdn.com/media/faa/faa8478b-0b34-4e5b-a772-65afe424e602/phpBd8dRd

If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7 5 of your adjusted gross income Can I deduct my medical and dental expenses ITA home This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses paid The year in which the expenses were paid Your adjusted gross income

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you paid for yourself your spouse and your dependents during the taxable year to the extent these expenses exceed 7 5 of your adjusted gross income for the year The medical expenses tax offset was available from the 2015 16 to 2018 19 income years The offset is not available from 1 July 2019 You could claim the medical expenses tax offset for net eligible expenses relating to disability aids attendant care

Download Can Medical Expenses Be Claimed As A Tax Deduction

More picture related to Can Medical Expenses Be Claimed As A Tax Deduction

In 2020 David Is Age 78 Is A Widower And Is Being Claimed As A

https://img.homeworklib.com/questions/45b7ca20-13a6-11eb-affe-3be82d211681.png?x-oss-process=image/resize,w_560

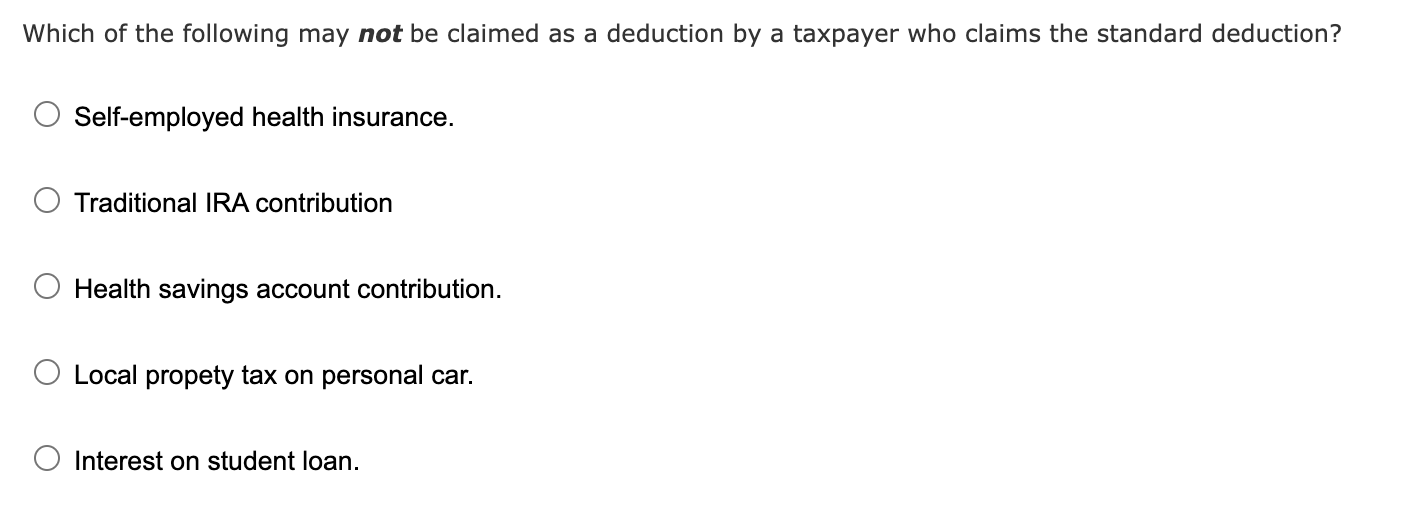

Solved Which Of The Following May Not Be Claimed As A Chegg

https://media.cheggcdn.com/media/701/701edee8-61c3-4034-8a75-41a6d74b1f25/php7reyYh

Tax Guide On The Deduction Of Medical Expenses

https://s3.studylib.net/store/data/008082022_1-bc2b7e2c5cc3e568e8402be213d00b25-768x994.png

Key Takeaways If you incurred substantial medical expenses not covered by insurance you might be able to claim them as deductions on your tax return These costs include If the assessee receives reimbursement for the medical expenses from insurance or their employer they cannot claim the entire amount as a deduction The eligible deduction amount will be the deduction available minus the reimbursement amount

If you re paying a lot of healthcare costs out of your own pocket can you deduct those medical expenses from your taxes The short answer is yes but there are some limitations You can deduct qualified medical expenses if you choose to itemize deductions Learn what medical expenses qualify and how to claim them on your tax return

Operating Expenses OpEx Formula And Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/11/30185632/Operating-Expenses-Model.jpg

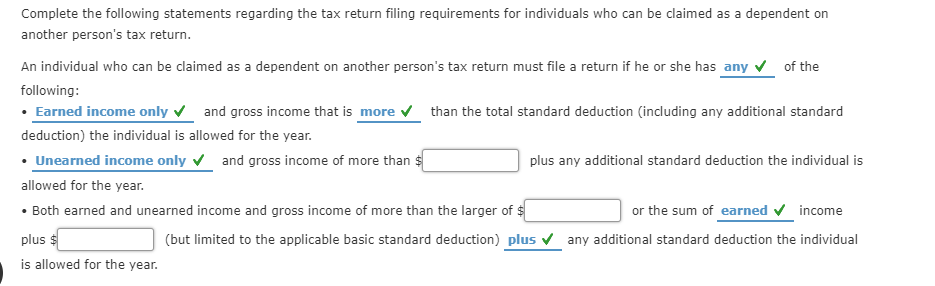

Solved Complete The Following Statements Regarding The Tax Chegg

https://media.cheggcdn.com/media/4c9/4c9042db-a00a-46d7-bee2-2cbf4f5ef4fa/phpF7WHNr.png

https://cleartax.in/s/medical-insurance

As per section 80D a taxpayer can claim a tax deduction on premiums paid towards medical insurance for self spouse parents and dependent children Individuals and HUF can claim this deduction

https://turbotax.intuit.com/tax-tips/health-care/...

Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must itemize your deductions

Solved Problem 3 27 LO 1 Compute The Taxable Income For Chegg

Operating Expenses OpEx Formula And Calculator

Answers To Your Questions About Your Economic Impact Payment Seiler

Can I Claim Wedding Expenses On My Taxes Wedding Poin

What Are Tax Deductions Napkin Finance

Small Business Tax Small Business Tax Deductions Business Tax Deductions

Small Business Tax Small Business Tax Deductions Business Tax Deductions

Weirdest And Most Inappropriate Tax Deductions The Inappropriate Gift Co

Can Medical Expenses Be Claimed Under Section 80D

Travel Expenses How To Claim Travel Deductions Boost Your Tax Refund

Can Medical Expenses Be Claimed As A Tax Deduction - If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7 5 of your adjusted gross income