Can Nps Be Claimed Under 80c The maximum deduction under Section 80C 80CCC and 80CCD 1 put together is Rs 1 5 lakhs However you may claim an additional deduction of Rs 50 000 allowed u s 80CCD 1B for

If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above Section 80C deduction of Rs Investments of up to Rs 1 5 lakh can be used to avail tax deductions under Section 80C Additional Rs 50 000 deduction is available for NPS contribution over and above Section 80C limit of Rs 1 5 lakh

Can Nps Be Claimed Under 80c

Can Nps Be Claimed Under 80c

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c.jpg

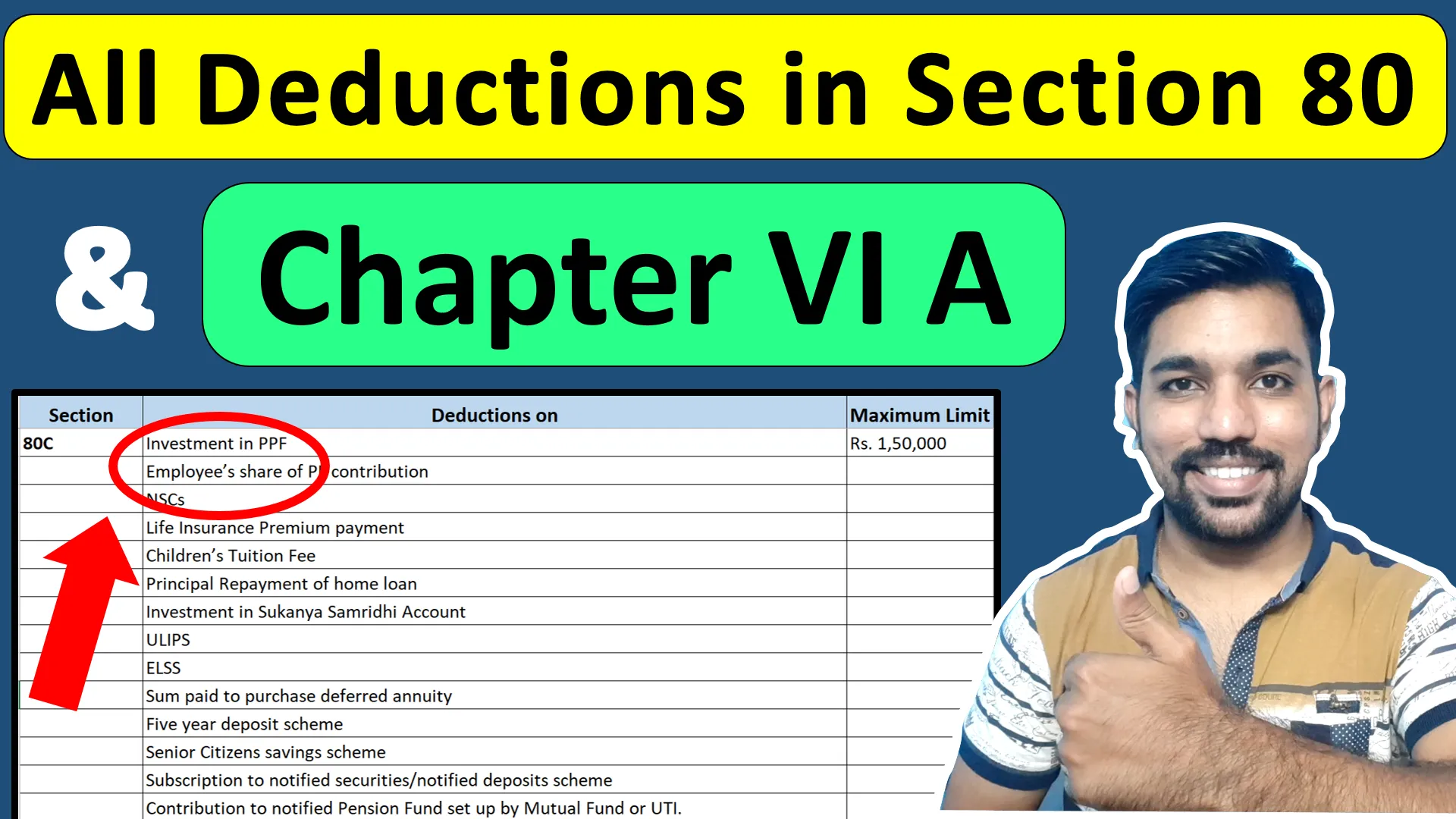

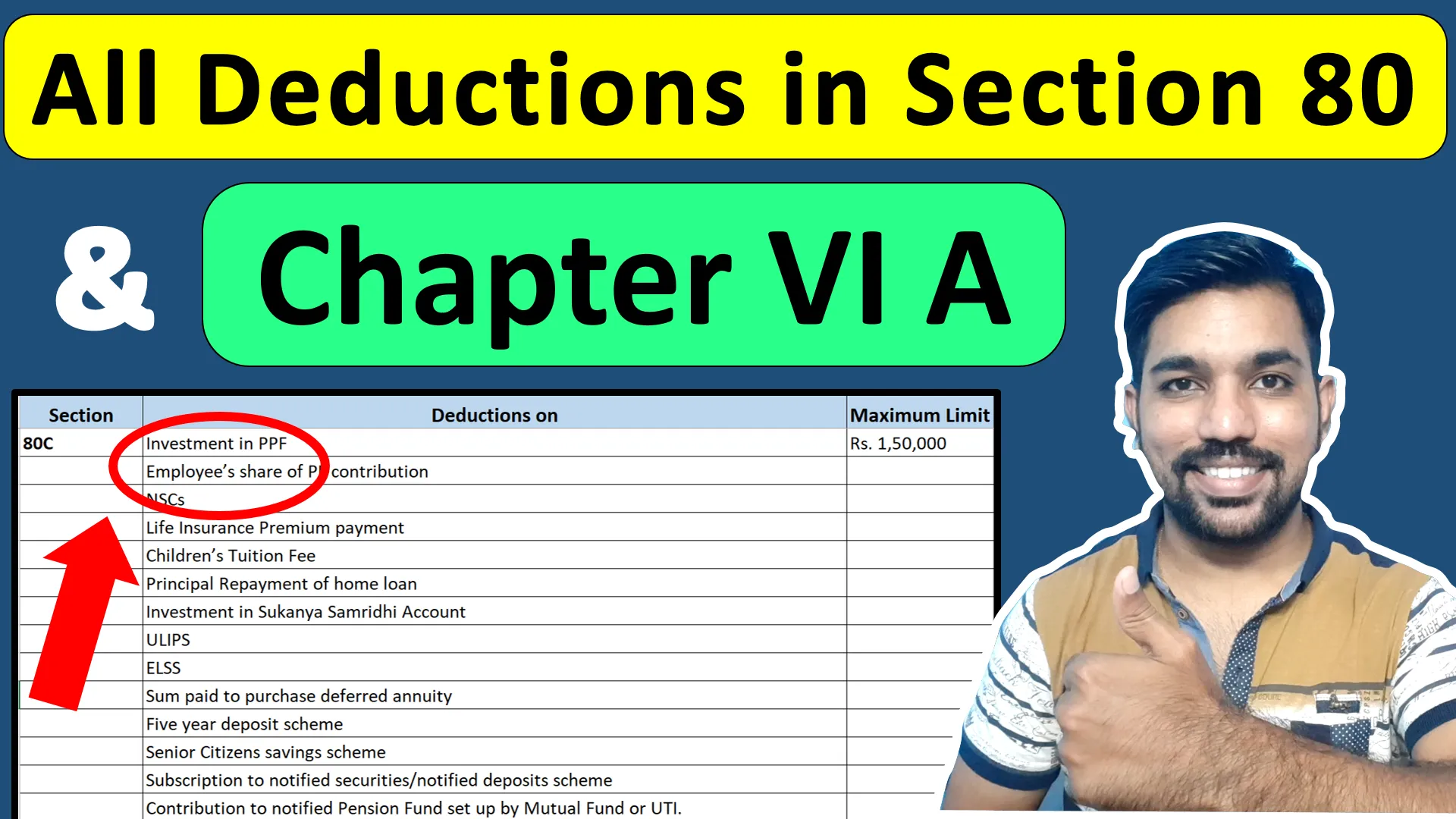

All Deductions In Section 80C Chapter VI A FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/03/All-Deductions-in-Section-80C-80CCC-80CCD-80D-in-Hindi-Chapter-VI-A-1.webp

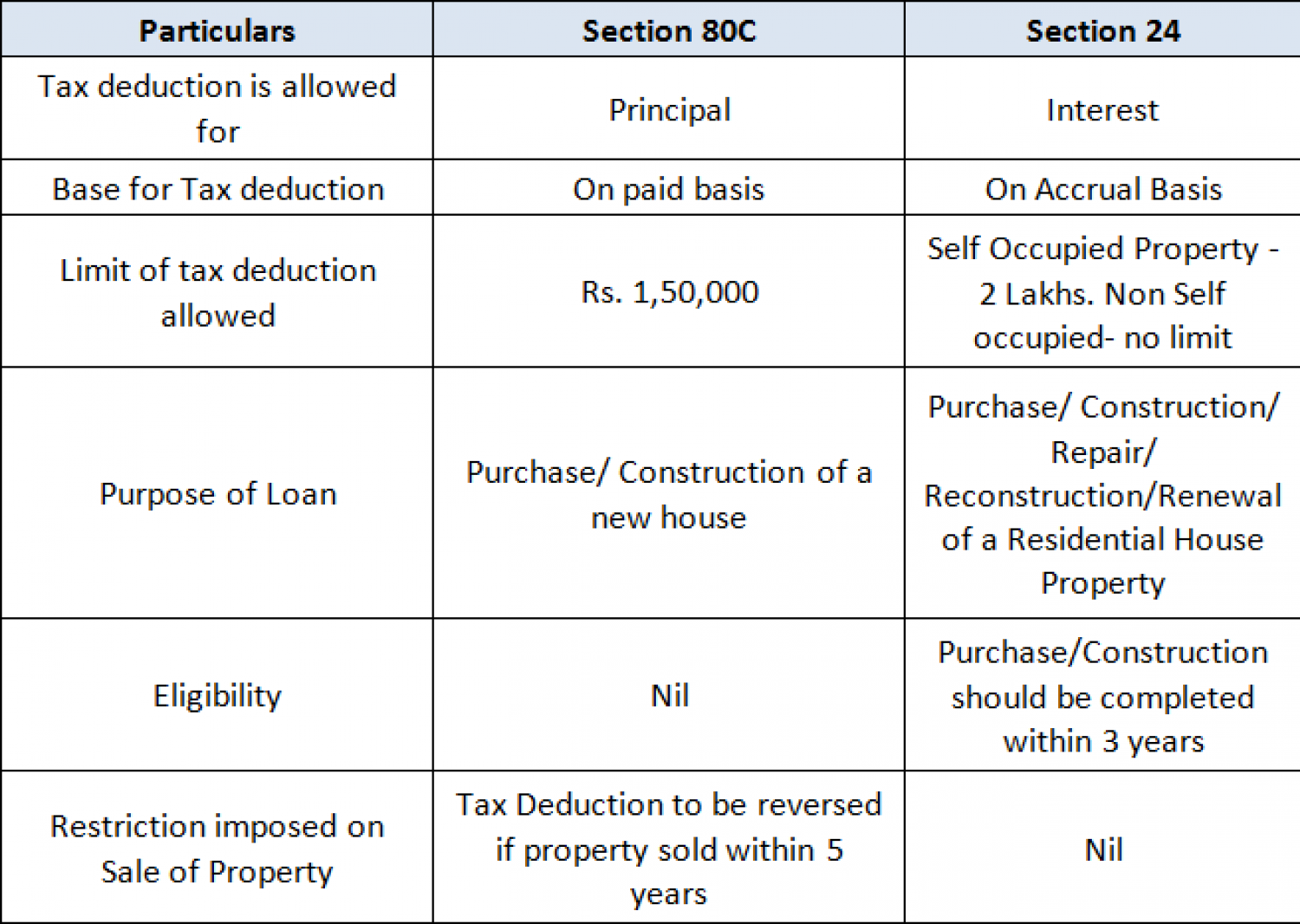

Whether Section 80C 80D Deduction Can Be Claimed By Filing

https://thetaxtalk.com/wp-content/uploads/2023/09/Slide4.jpg

Only the NPS subscriber can claim tax benefits If you invest in NPS which is in your spouse s name then you cannot claim the tax deduction Your contribution to NPS can be claimed under Section Section 80C is a tax saving provision under the Indian Income Tax Act 1961 It allows taxpayers to claim deductions on specified investments and expenses such as Public Provident Fund PPF

The maximum deduction under Section 80C is capped at INR 1 50 000 which also includes contributions under Sections 80CCC and 80CCD 1 However deductions When investing in the National Pension System NPS Tier 1 account individuals should consider their tax liabilities carefully and take advantage of Section 80CCD 2 which allows for a

Download Can Nps Be Claimed Under 80c

More picture related to Can Nps Be Claimed Under 80c

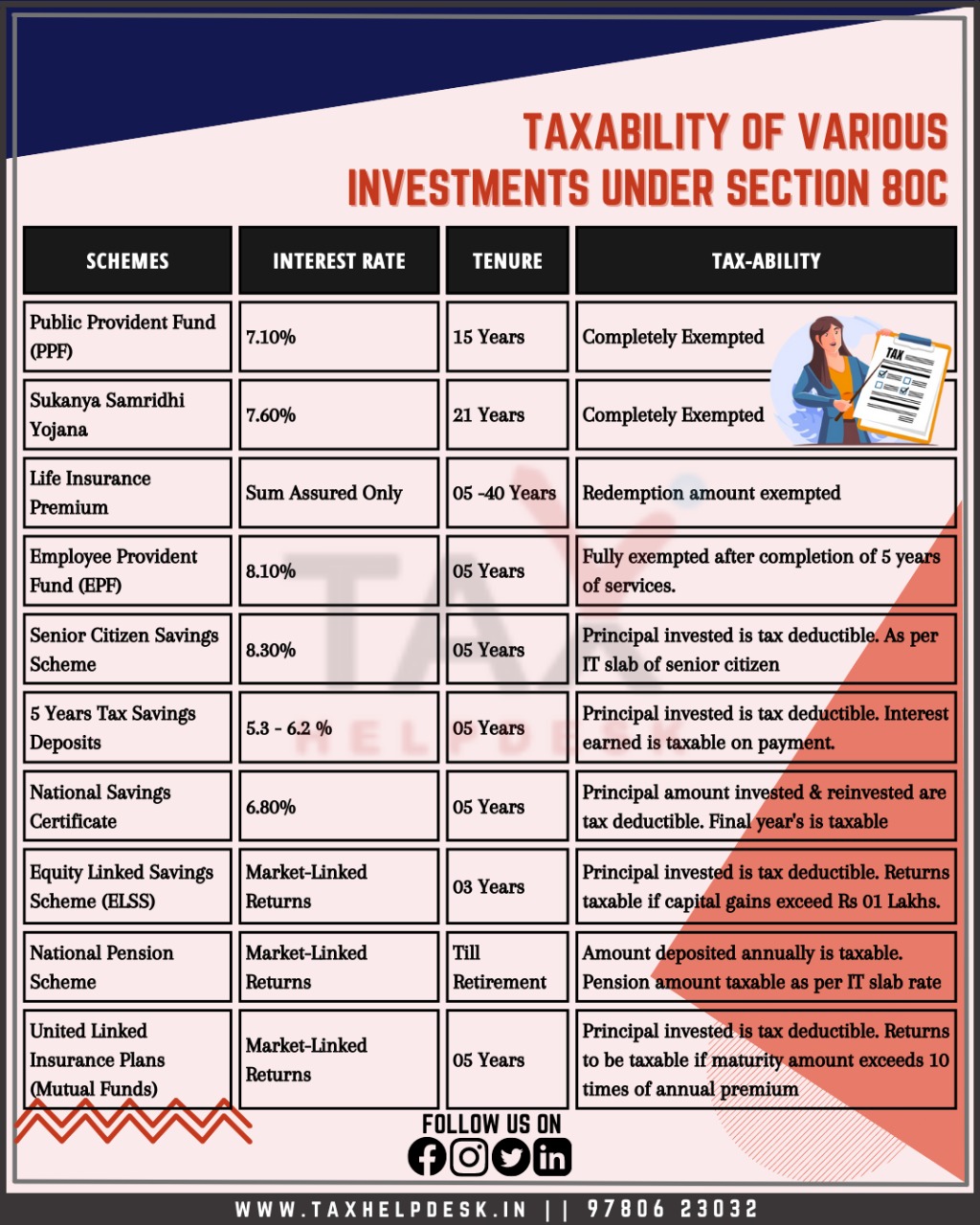

Understand About Taxability Of Various Investments Under Section 80C

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Investments-under-Section-80C.jpeg

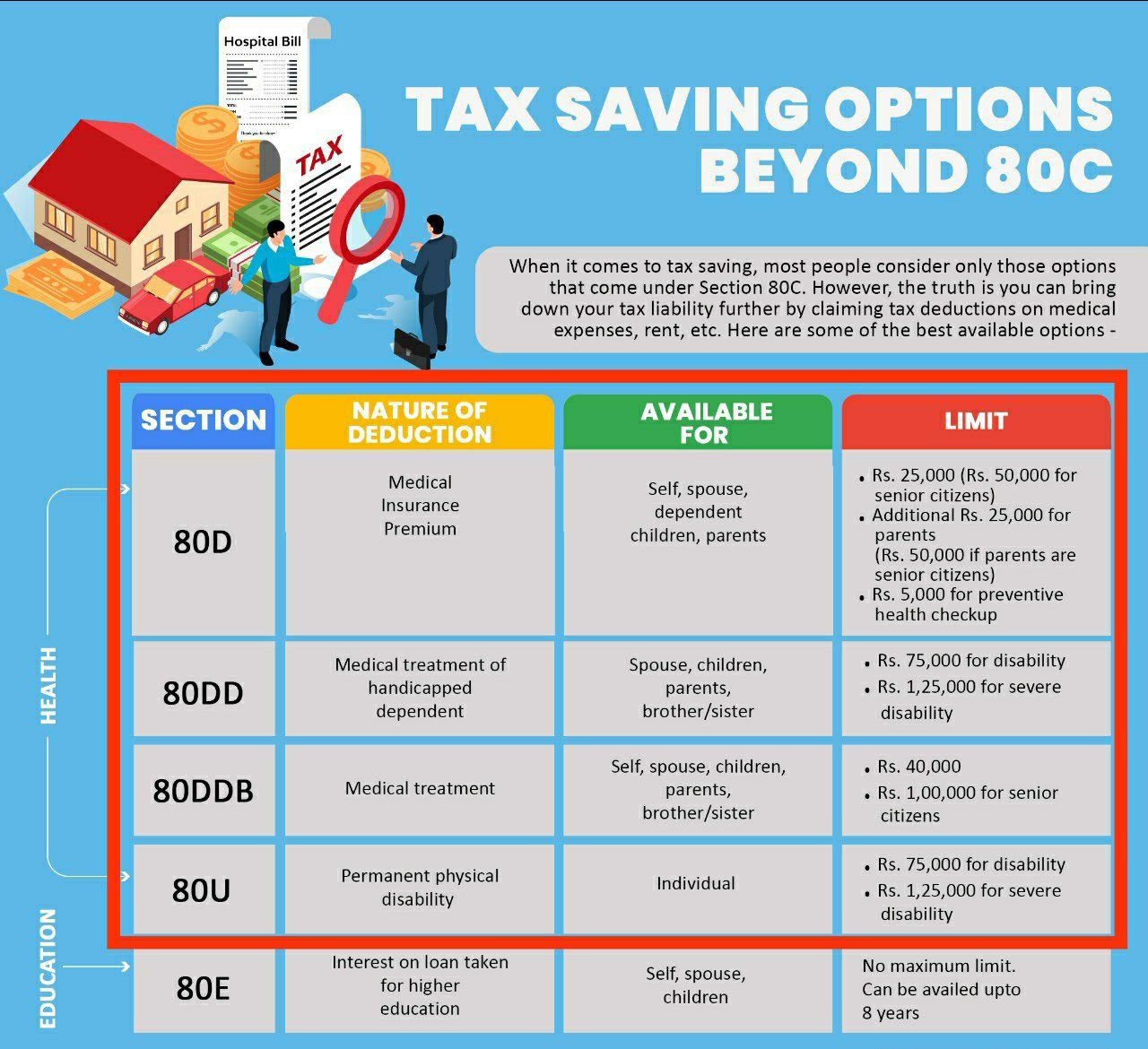

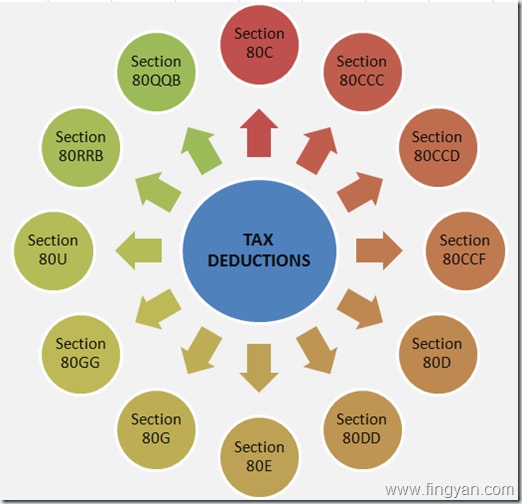

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

https://carajput.com/art_imgs/can-hra-and-home-loan-benefits-be-claimed-when-itr-is-filing.jpg

Any individual who is Subscriber of NPS can claim tax benefit under Sec 80 CCD 1 with in the overall ceiling of Rs 1 5 lac under Sec 80 CCE Exclusive Tax Benefit to all NPS Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section you can claim a deduction of

Yes taxpayers can claim deductions under both Section 80CCD 1 and Section 80CCD 2 for multiple NPS accounts The total amount deducted under Investing in NPS Tier I offers three tax deductions Deduction of up to Rs 1 5 lakh from taxable income under Section 80C Additional deduction of up to Rs 50 000

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

How To Claim Tax Exemptions Here s Your 101 Guide app app

https://okcredit-blog-images-prod.storage.googleapis.com/2021/02/taxexemption3.jpg

https://cleartax.in/s/80c-80-deductions

The maximum deduction under Section 80C 80CCC and 80CCD 1 put together is Rs 1 5 lakhs However you may claim an additional deduction of Rs 50 000 allowed u s 80CCD 1B for

https://economictimes.indiatimes.com…

If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above Section 80C deduction of Rs

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Section 80C Deductions List To Save Income Tax FinCalC Blog

Deductions Under Section 80C Benefits Works Myfinopedia

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Have You Claimed These ITR Deductions On Section 80C 80CCD 80D

As Deadlines Arrive Here Is How You Can Save Your Tax News18

As Deadlines Arrive Here Is How You Can Save Your Tax News18

Tax Savings Under Section 80 Provisions You Need To Know

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Retire With Confidence Expert Advice On Making NPS Your Retirement

Can Nps Be Claimed Under 80c - Tax benefits One of the key advantages of NPS is the tax benefits it offers Contributions are eligible for a deduction of up to Rs 1 5 lakh under Section 80C of the