Can Solar Tax Credits Be Carried Back To put it simply yes you can carry forward the Solar Tax Credit if your tax bill is smaller than your tax credit A carry forward is a provision in the tax law that allows taxpayers to apply some of their unused credits deductions or losses to a future tax year

About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit Q4 May a taxpayer carry forward unused credits to another tax year added December 22 2022 A4 The rules vary by credit Under the Energy Efficient Home Improvement Credit a taxpayer may not carry the credit forward

Can Solar Tax Credits Be Carried Back

Can Solar Tax Credits Be Carried Back

https://propertymanagerinsider.com/wp-content/uploads/2022/12/Commercial-Solar-Tax-Credit-Guide-2023.png

Solar Tax Credits How They Can Help You Save Money On Your Energy

http://www.streamx.com.au/wp-content/uploads/2022/11/image1-5.png

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

If the credit exceeds the amount of income tax you owe the credit can take your liability to zero but you can t use the credit to get money back from the IRS However you can carry the unused portion of the credit over to the following tax year The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers other

With the passage of the IRA certain renewable energy tax credits can now be transferred sold by those generating eligible credits to any qualified buyer seeking to purchase tax credits Through credit transfers taxpayers have the option to sell credits in exchange for cash as part of their overall renewable energy goals The ITC allows you to deduct a percentage of the total cost of installing a solar or energy storage system from federal taxes with no cap The credit includes equipment wiring labor and even battery energy storage systems It is a critical component in many customers financial calculations ITC Restoration

Download Can Solar Tax Credits Be Carried Back

More picture related to Can Solar Tax Credits Be Carried Back

When Does Solar Tax Credit End SolarProGuide 2022

https://www.solarproguide.com/wp-content/uploads/when-does-the-federal-solar-tax-credit-expire.png

26 Federal Solar Tax Credit Extended SolarTech

https://solartechonline.com/wp-content/uploads/011022-Fed-Solar-Tax-Credit.jpg

Understanding How Solar Tax Credits Work Credit

https://www.credit.com/blog/wp-content/uploads/2019/02/solar-tax-credit1.jpg

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work More information about reliance is Disclaimer This webpage provides an overview of the federal investment and production tax credits for businesses nonprofits and other entities that own solar facilities including both photovoltaic PV and concentrating solar thermal

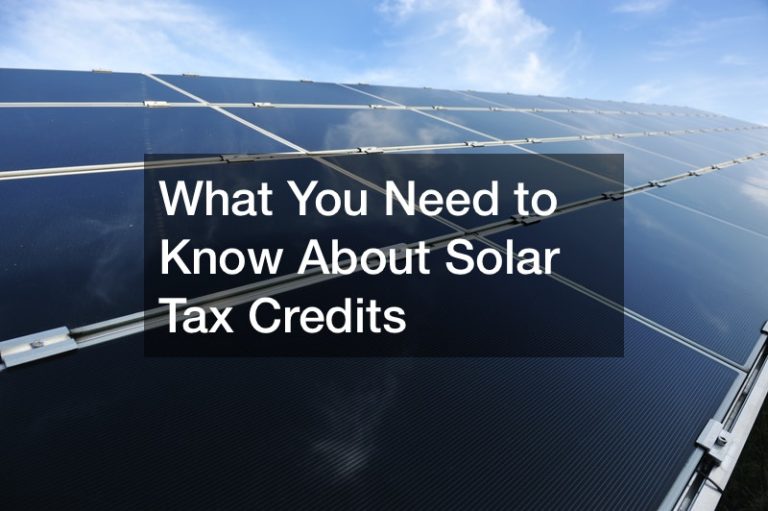

President Biden signed the Inflation Reduction Act into law on Tuesday August 16 2022 One of the many things this act accomplishes is the expansion of the Federal Tax Credit for Solar Photovoltaics also known as the Investment Tax Credit ITC This credit can be claimed on federal income taxes for a percentage of the cost of An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence

Everything You Need To Know About The Solar Tax Credit

https://gospringsolarnow.com/wp-content/uploads/2022/08/Everything-You-Need-To-Know-About-The-Solar-Tax-Credit-scaled-2560x1280.jpeg

Sample Question For Tax 2 Unused Net Capital Losses Generated In A

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/74ba378144ce6f5321b7ff0772ffaa3a/thumb_1200_1553.png

https://palmetto.com/learning-center/blog/solar...

To put it simply yes you can carry forward the Solar Tax Credit if your tax bill is smaller than your tax credit A carry forward is a provision in the tax law that allows taxpayers to apply some of their unused credits deductions or losses to a future tax year

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Everything You Need To Know About The Solar Tax Credit

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

Federal Solar Tax Credits For Businesses Department Of Energy

Tax Credits Save You More Than Deductions Here Are The Best Ones

Can Solar Tax Incentives Make It Affordable YouTube

Can Solar Tax Incentives Make It Affordable YouTube

How Does The Federal Solar Tax Credit Work In 2022 And Beyond

What You Need To Know About Solar Tax Credits

Solar Tax Credits For PV And Solar Hot Water Systems RevoluSun

Can Solar Tax Credits Be Carried Back - The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers other