Can We Claim Conveyance Allowance In Income Tax To claim the conveyance allowance exemption employees must submit Form 10D along with their income tax return Form 10D must be signed by the employer and must contain information such as the

97 rowsLearn about income tax benefits for salaried If you are wondering how to claim an exemption under Section 10 you can do it by filing an income tax return As the exemptions are income based you must

Can We Claim Conveyance Allowance In Income Tax

Can We Claim Conveyance Allowance In Income Tax

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/12/Template-11.png

How To Make Salary Allowance Sheet In Excel How To Calculate

https://i.ytimg.com/vi/dbJLovIyehA/maxresdefault.jpg

Types Of Allowances In India Taxable And Non Taxable Allowance 2022 23

https://life.futuregenerali.in/media/ihsk1hd4/types-of-allowances.jpg

But when an employer has given a tax benefit on transport allowance or forgotten to give the tax benefit in Form 16 you can claim tax exemption by following How much exemption can I claim on conveyance allowance Exemption on conveyance allowance can be claimed under Section 10 14 ii of the Income Tax Act The maximum

Exemption on conveyance allowance can be claimed under Section 10 14 ii of the Income Tax Act with a maximum yearly limit of Rs 19 200 Rs 1 600 This means that if the employer pays its employee s conveyance allowance of INR 8 000 monthly 100 taxable then also you can claim an exemption on conveyance

Download Can We Claim Conveyance Allowance In Income Tax

More picture related to Can We Claim Conveyance Allowance In Income Tax

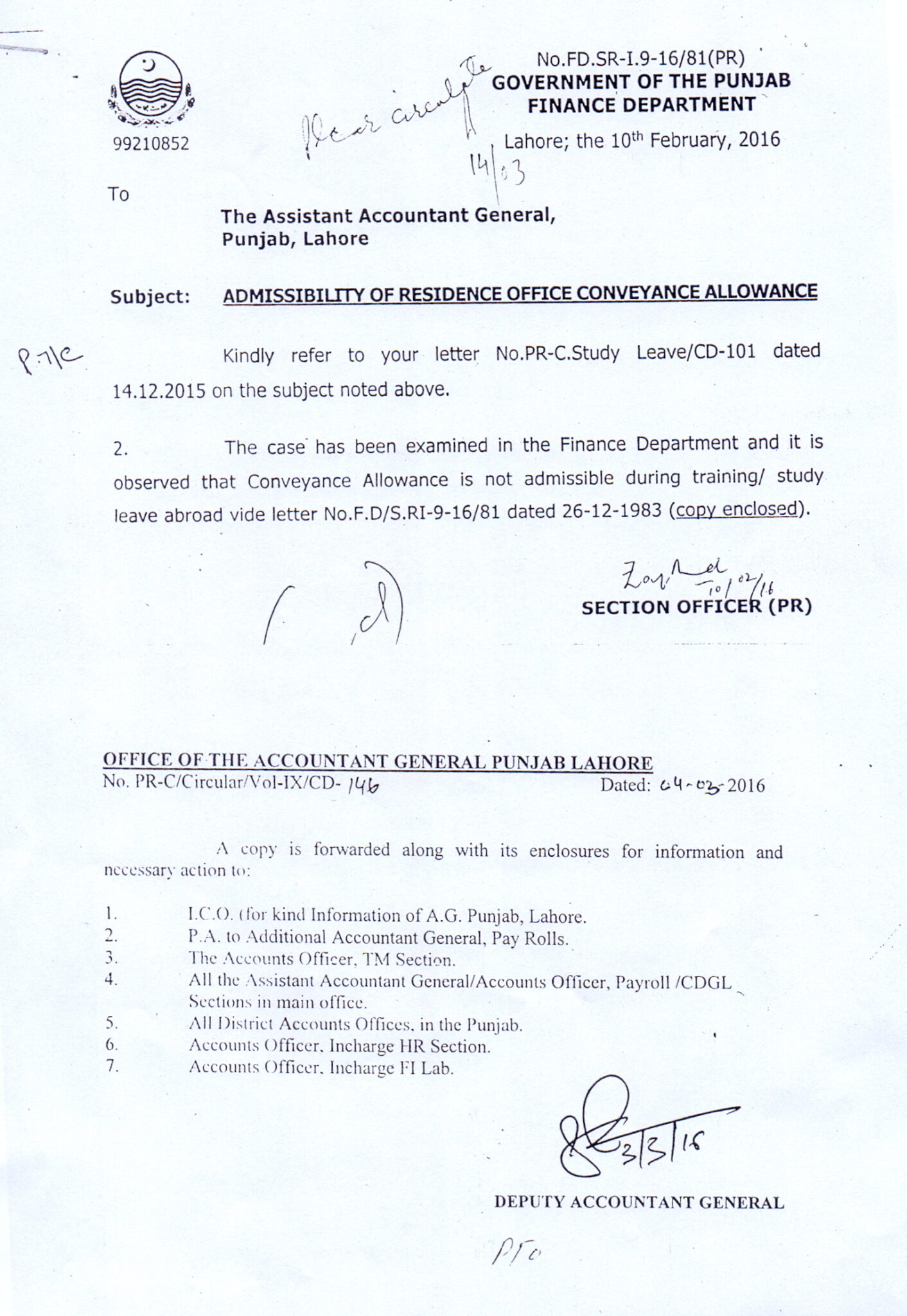

Conveyance Allowance GOVT EMPLOYEE MATTERS

https://govtemployeematters.com/wp-content/uploads/2021/02/Conveyance-Allow.-Admissibility-1412x2048.jpg

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

Conveyance Allowance Definition Meaning Limit Exemption Calculation

https://paytm.com/blog/wp-content/uploads/2023/06/Blog_PR_Special-Allowance-Under-Section-10-for-Salaried-Employees.jpg

Recent Developments in Laws Governing Conveyance Allowance In the Union Budget of 2020 the Central Government laid out two separate Income Tax regimes Under these How much transport and conveyance allowance can I claim This allowance is completely exempt from tax However Transport allowance up to INR 1600 per

Under Section 10 14 of the Income Tax Act and Rule 2BB of Income Tax Rules the conveyance allowance exemption limit is Rs 1 600 per month or Rs 19 200 a year Q Can I get a tax exemption on my conveyance allowance A Yes you can Irrespective of which tax slab your income belongs to you can avail a tax

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

Local Conveyance Allowance Bill PDF

https://imgv2-1-f.scribdassets.com/img/document/600812659/original/dd7926d9e7/1672255033?v=1

https://razorpay.com/.../learn/conveyan…

To claim the conveyance allowance exemption employees must submit Form 10D along with their income tax return Form 10D must be signed by the employer and must contain information such as the

https://taxguru.in/income-tax/list-incom…

97 rowsLearn about income tax benefits for salaried

CALCULATION OF HOUSE RENT ALLOWANCE Allowance Kids Education Excel

Travelling Allowance To The Officials Deployed For Election Duty

Certificate For Conveyance Allowance PDF

Employees Can Claim Tax Exemption On Conveyance Allowance Under New I T

Professional Tax Meaning Slabs Exemptions

Income Tax Response To Defective Notice 139 9 TAXCONCEPT

Income Tax Response To Defective Notice 139 9 TAXCONCEPT

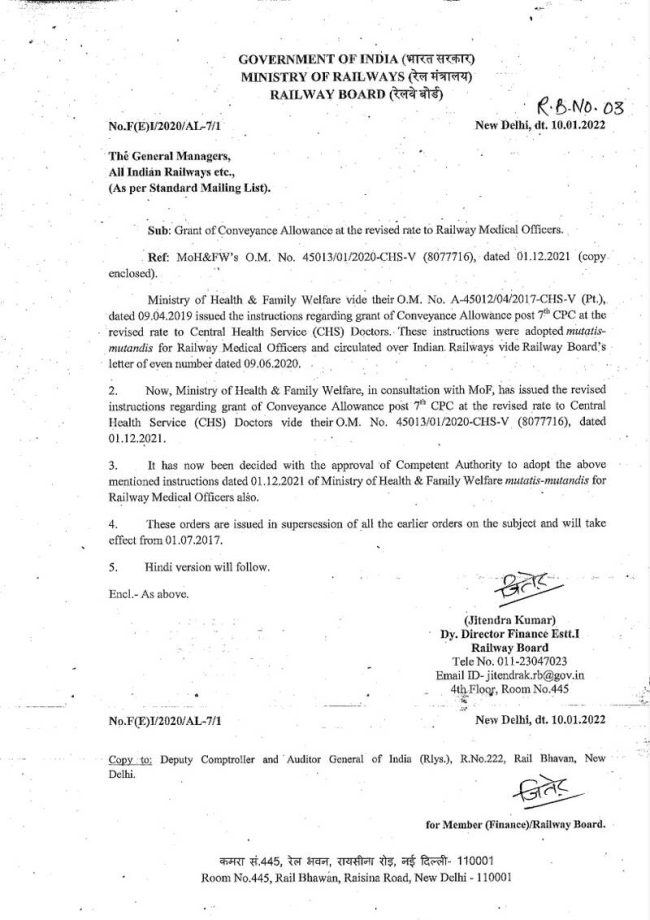

Grant Of Conveyance Allowance At The Revised Rate To Railway Medical

Approval Letter For Conveyance Allowance Request Template Edit Online

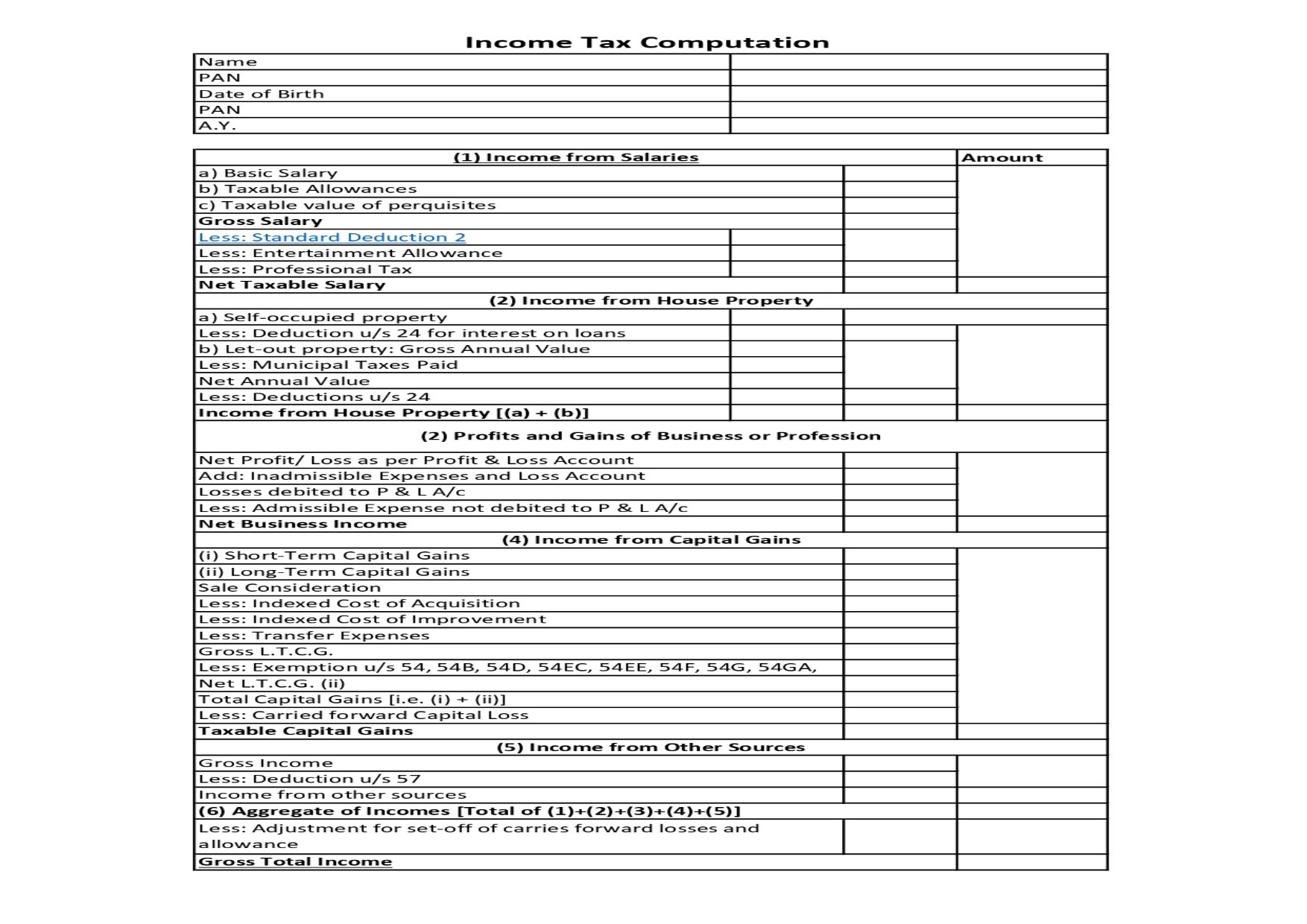

Income Tax Computation Format PDF A Comprehensive Guide

Can We Claim Conveyance Allowance In Income Tax - This amendment is going to hit hard for those Income Tax Assessee s Majorly Salaried Employees who used to make manipulative claims of allowances