Can We Claim Interest On Housing Loan For Under Construction Property If the loan is taken jointly then each of the loan holders can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment u s 80C up to Rs 1 5 lakh

Q Which deduction on home loan interest Cannot be claimed when the house is under construction The deduction for home loan interest is not applicable during the Interest on home loan If you have taken a loan for the acquisition construction or repair of the property you can claim the interest paid on the loan up to certain limits specified

Can We Claim Interest On Housing Loan For Under Construction Property

Can We Claim Interest On Housing Loan For Under Construction Property

https://static.vecteezy.com/system/resources/previews/001/925/926/original/student-loan-concept-free-vector.jpg

HOME LOAN INTEREST CERTIFICATE For FY 2021 22 PDF Loans Interest

https://imgv2-2-f.scribdassets.com/img/document/553973286/original/542bfb7a7c/1661356692?v=1

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

The total home loan interest amount that you have paid during this period can be claimed as an under construction property tax benefit based on Section 24B You need to divide this amount by five and claim each part First time homebuyers who have availed of a housing loan to purchase an under construction property between 1 April 2019 and 31 March 2022 can claim tax benefits on the interest

Interest can be claimed as a deduction under Section 24 You can claim up to Rs 200 000 Rs 1 50 Lakh up to A Y 2014 15 or the actual interest repaid whichever is lower Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions for interest portion till the construction

Download Can We Claim Interest On Housing Loan For Under Construction Property

More picture related to Can We Claim Interest On Housing Loan For Under Construction Property

5 Tips For Home Loan For Under Construction Property

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/articles/5-Tips-for-Home-Loan-for-Under-Construction-Projects.png

Features To Determine The Best Housing Loan For 2021 RemarkMart

https://remarkmart.com/wp-content/uploads/2021/08/753261-home-loan1.jpg

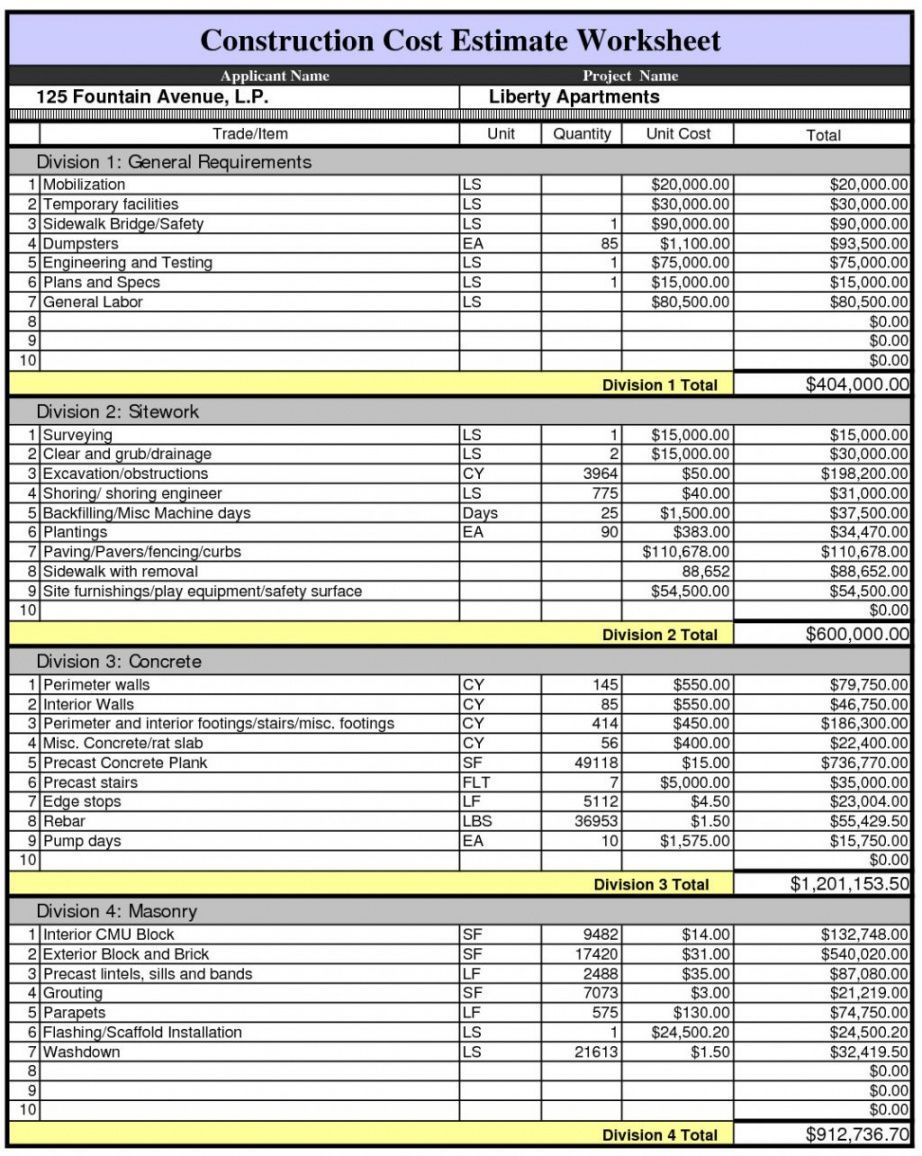

Home Remodeling Cost Estimate Template

https://littlethumbsup.com/wp-content/uploads/2021/06/explore-our-sample-of-construction-loan-budget-template-with-regard-to-home-remodeling-cost-estimate-template.jpg

A home loan for under construction property can get tax deductions up to Rs 2 lakhs on interest paid in a year and up to 1 5 lakhs for principal paid under Section 80C of the Income Tax Act The deduction for the interest repaid can As a homeowner you can claim a deduction of up to INR 2 lakh on your home loan s interest if you are self occupying the house You can also claim this deduction if your house is vacant However if you have let out your

So without further adieu let s see how to claim a tax deduction on Home Loan Interest payments for Under Construction house Or how to claim income tax exemption on Tax exemption on home loan interest for under construction property You can claim a tax exemption of up to Rs 2 00 000 on the interest payments made in a year and

How Does The Interest Rate Of Your Housing Loan Works Fortune My

https://www.fortune.my/wp-content/uploads/2019/04/housing-loan_interest_loan.jpg

Ramanathapuram District District Cooperative Bank HOUSING LOAN

https://rdccbank.co.in/images/housing-loan.png

https://taxguru.in/income-tax/claim-deduction...

If the loan is taken jointly then each of the loan holders can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment u s 80C up to Rs 1 5 lakh

https://tax2win.in/guide/under-construction-property-tax-benefit

Q Which deduction on home loan interest Cannot be claimed when the house is under construction The deduction for home loan interest is not applicable during the

Benefits Of Buying Under construction Property Apartments In Manapakkam

How Does The Interest Rate Of Your Housing Loan Works Fortune My

Afinoz

How To Claim Home Loan Interest For Under Construction Property

Home Loan For Under Construction Property Apply Online 2023

Home Loan Tax Benefits Interest On Home Loan Section 24 And

Home Loan Tax Benefits Interest On Home Loan Section 24 And

Housing Loan Authorization Letter Template

Joint Home Loan Declaration Form For Income Tax Savings And Non

Home Loan Interest Rates November 2019 Archives Yadnya Investment Academy

Can We Claim Interest On Housing Loan For Under Construction Property - However Section 80EEA of the IT Act provides for claiming of interest paid on housing loan up to Rs 1 50 000 irrespective of the restriction imposed by S 24 on the pre