Can We Claim Vat On Donations Donations and grants VAT treatment Donation and grant income is not consideration for a supply and is a non business activity that falls outside the scope of VAT This is

Brussels 17 May 2024 Our organisations represent a variety of businesses and tax professionals who see an opportunity for the European Commission to VAT treatment upon receiving donations grants or sponsorships will depend upon whether the donor grantor or sponsor is receiving any benefit in exchange for

Can We Claim Vat On Donations

Can We Claim Vat On Donations

https://gg.myggsa.co.za/can-you-claim-vat-on-fuel-south-africa-.jpg

How To Claim Back VAT VAT Guide Xero UK

https://www.xero.com/content/dam/xero/pilot-images/guides/guide-to-gst-bas-vat/354050_Hero_Guide to VAT_claimingx2.1646877578209.png

Bunching Up Charitable Donations Could Help Tax Savings

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

21 June 2022 Share this article What conditions need to be met to ensure that a donation will not be subject to VAT Key Points What is the issue Income earned by a charity or other organisation is outside the scope of In many EU countries there is a VAT cost on charitable in kind donations either because VAT is due on the donation or the donor can no longer recover the input

Joint Statement on VAT relief for donations European Food Banks Federation FEBA Back to resource library On 11 March 2024 FEBA published a Joint Statement on VAT VAT treatment of donations and sponsorship income Donations to charities including by a business are usually outside the scope of VAT as long as the

Download Can We Claim Vat On Donations

More picture related to Can We Claim Vat On Donations

Reclaiming VAT On Donations And Sponsorship Mad About Bookkeeping Ltd

https://www.madaboutbookkeeping.co.uk/wp-content/uploads/2022/05/shutterstock_1862633668-1-1200x720-1-768x461.jpg

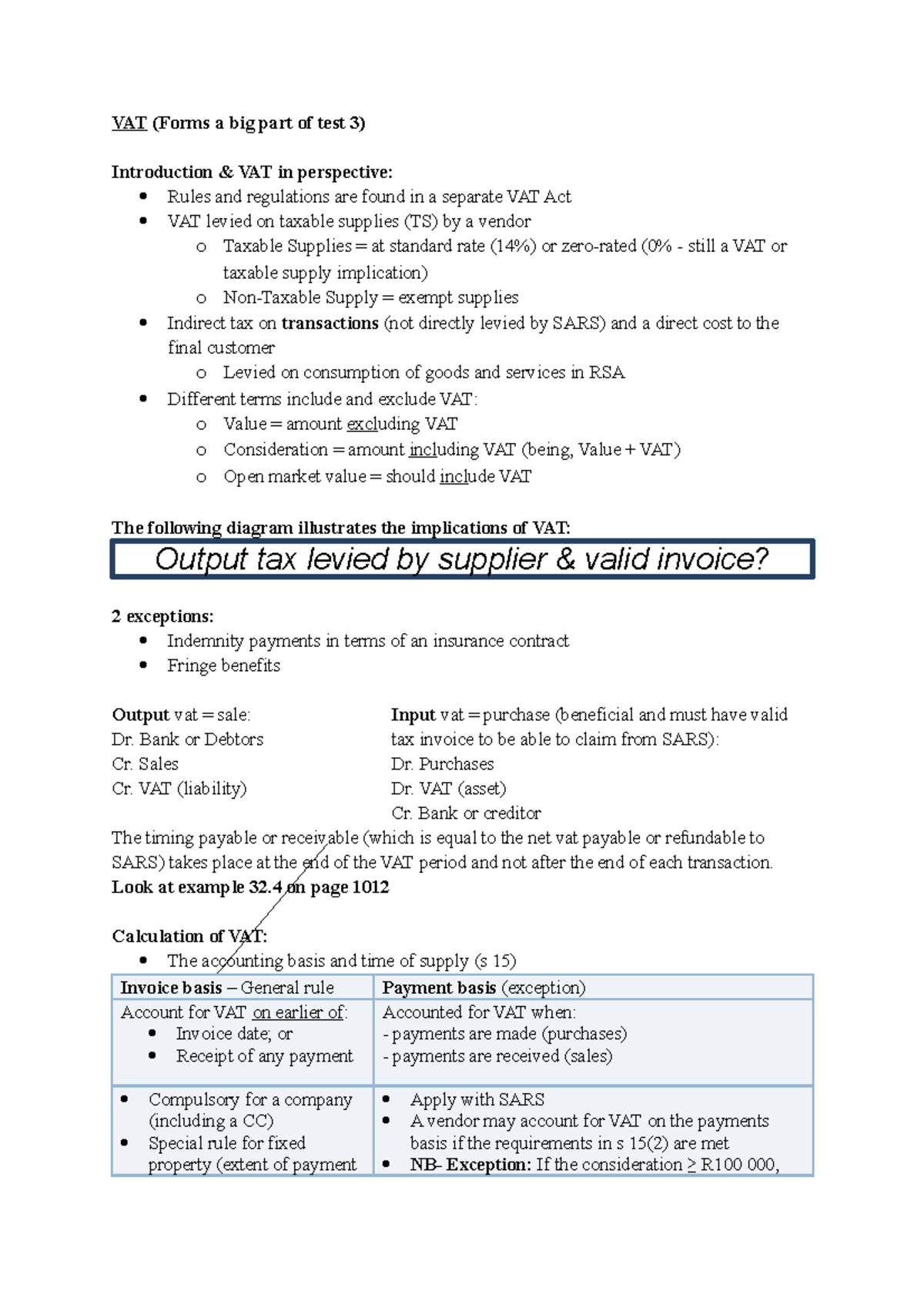

Chapter 32 VAT VAT Forms A Big Part Of Test 3 Introduction VAT

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/56d1c7e8adaa2c40ba44b2f7c004c705/thumb_1200_1698.png

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

https://img.hechtgroup.com/can_i_claim_vat_back_on_a_commercial_property.png

What does it cover Using worked through examples and clearly set out advice covering all aspects of VAT for charities this one stop reference book includes How VAT operates for both registered and unregistered 1 Overview 2 Charities 3 Implications of VAT for charities 4 Deciding whether your activities are business or non business 5 VAT treatment of income

1 Overview 2 VAT you can reclaim under sections 33C and 33D 3 Recover the VAT you ve incurred on your non business activities if you re VAT VAT on items If you re donating items to a charity then VAT registered business can apply zero VAT to these if the charity intends to sell hire or export them

Can You Claim Vat On Client Entertainment 2024 Updated RECHARGUE

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/can-you-claim-vat-on-client-entertainment_446990-1.jpg

21 Best Create Proforma Invoice Online

https://lh3.googleusercontent.com/proxy/jaYx1_SJZkwlk9dB77X42AcHlOiyvEH2PLn68D0A31_jNC2Ia0ExdJgUkuVVrUAa_t0FGB2V00x_93sacTaVXU0nC-_ujvvHeQGVrvTNSl9qtOS-k1L-qegJ8vJnWDoGxZOUpUR6T7gOCy_LFy7q2jFqNYuMKrbpShP0NVg=s0-d

https://www.charitytaxgroup.org.uk/tax/vat/business...

Donations and grants VAT treatment Donation and grant income is not consideration for a supply and is a non business activity that falls outside the scope of VAT This is

https://accountancyeurope.eu/news/industry-calls...

Brussels 17 May 2024 Our organisations represent a variety of businesses and tax professionals who see an opportunity for the European Commission to

VAT Treatment For The Donations Grants And Sponsorships In UAE

Can You Claim Vat On Client Entertainment 2024 Updated RECHARGUE

VAT Calculation On Sales Invoices Manager Forum

No VAT On Donations Grants Sponsorships In Some Cases FTA News

Can You Claim VAT On Donations Made To Charity In South Africa

Give A Donation Craigieburn Trails

Give A Donation Craigieburn Trails

Lettre De Donation Exemple

How Does VAT Work In South Africa

Making VAT Work For You In Your Business Bizmag co za

Can We Claim Vat On Donations - Joint Statement on VAT relief for donations European Food Banks Federation FEBA Back to resource library On 11 March 2024 FEBA published a Joint Statement on VAT