Can We Declare Nps In New Tax Regime New Tax Regime You can still get tax benefit on NPS contributions Check when it is possible Income Tax News The Financial Express Budget 2024

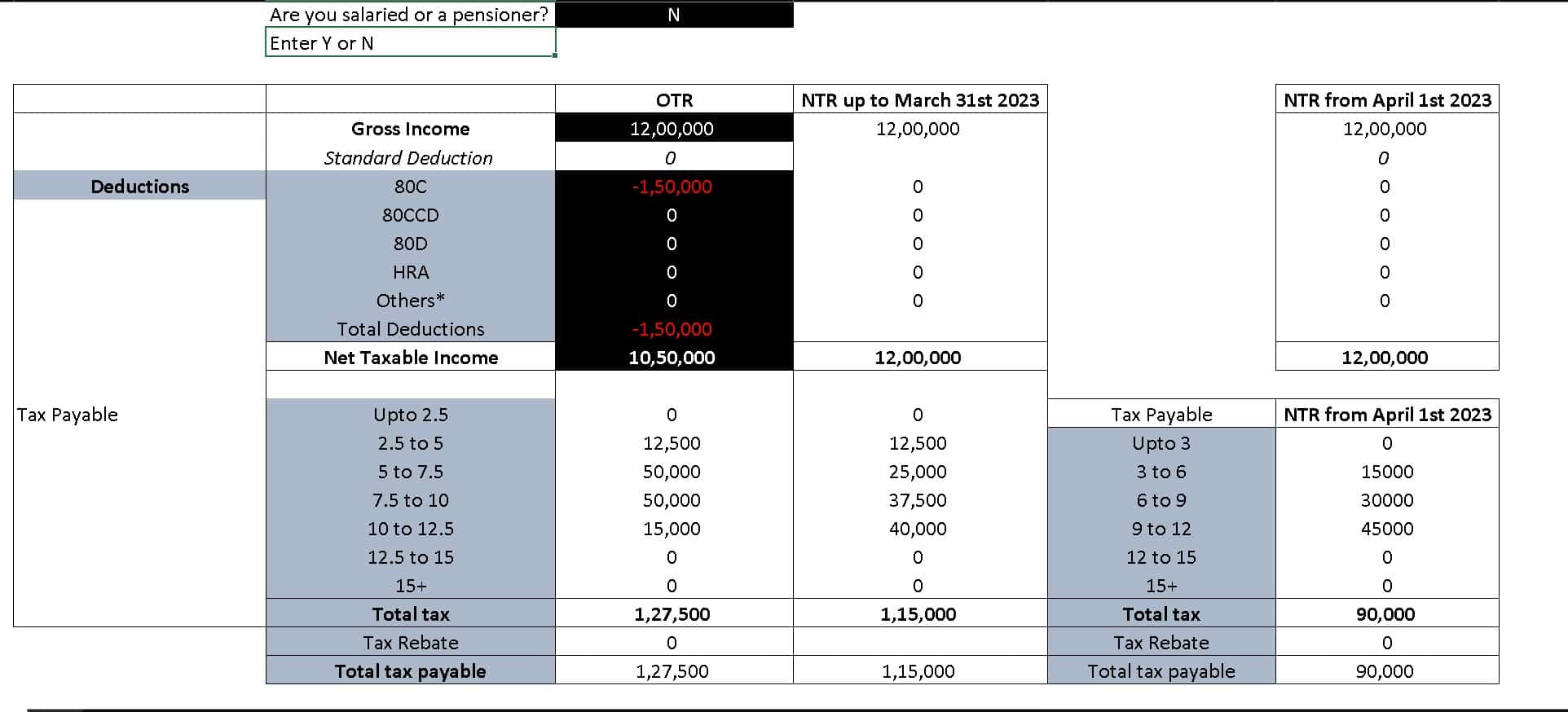

New Tax Regime NPS deduction Provident fund The taxpayers can choose between the new tax regime or the old tax regime from FY 2020 21 If you plan to choose the new tax regime you can Similarly under the new tax regime taxpayers can claim the benefit of employer contributions to their National Pension System NPS account under section

Can We Declare Nps In New Tax Regime

Can We Declare Nps In New Tax Regime

https://images.livemint.com/img/2023/02/01/original/New_Tax_Regime_1675252771001.jpg

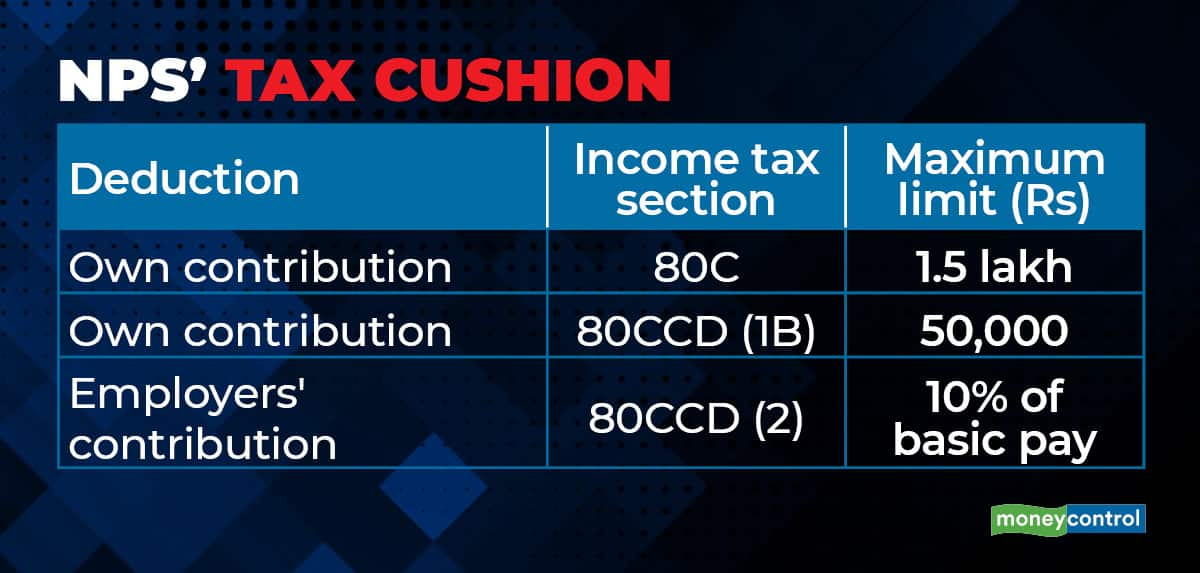

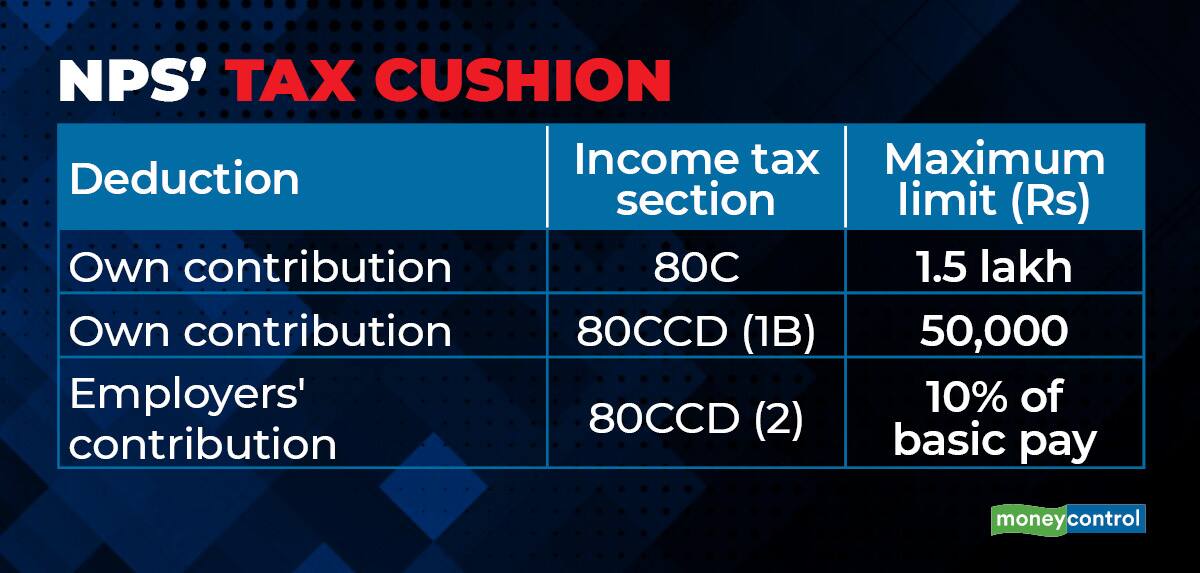

What Are The Tax Benefits That NPS Offers

http://images.moneycontrol.com/static-mcnews/2022/02/NPS-tax_001.jpg

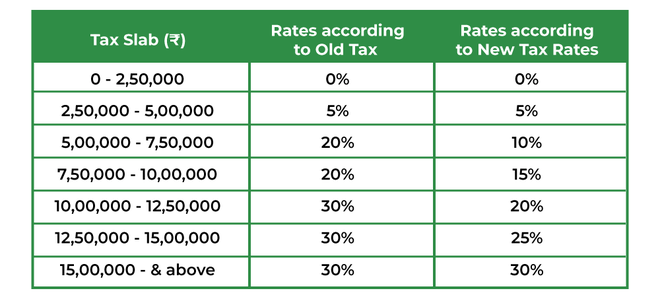

Old Tax Regime Vs New Tax Regime GeeksforGeeks

https://media.geeksforgeeks.org/wp-content/uploads/20220927170008/DifferenceBetweenOldVsNewTaxRegime1-660x299.png

No That s the short answer If you are under the new tax regime and are investing in NPS Tier 1 you are not eligible to get the additional deduction of up to Rs Under Old Tax Regime If you are opting old tax regime then you can continue claiming income tax deduction as listed in the above two points New Tax

Here s how one can claim tax deductions for NPS under old and new income tax regimes New Tax Regime The NPS related deduction under Section 80CCD 2 of An investment in National Pension System NPS allows three separate deductions under the Income tax Act 1961 These are under Section 80CCD 1

Download Can We Declare Nps In New Tax Regime

More picture related to Can We Declare Nps In New Tax Regime

New Tax Regime Vs Old Which Is Better For You Rupiko

https://rupiko.in/wp-content/uploads/2020/08/New-vs-Old-Tax-Regime-1.png

Opinion It s Time For A New Tax Regime The Daily Iowan

https://dailyiowan.com/wp-content/uploads/2022/06/taxop.jpg

Why The New Income Tax Regime Has Few Takers

https://images.moneycontrol.com/static-mcnews/2022/01/New-tax-regime-1.jpeg

Investment in Tier I account of National Pension System NPS via your employer allows you to claim a deduction from your gross total income under the Income This implies that the taxpayer will not be eligible for some of the tax benefits on the National Pension Scheme NPS contribution if they opt for the new tax regime Which deductions are allowed in new tax

New income tax regime allows a deduction under section 80 CCD 2 of the Income tax Act 1961 which is available if an employer contributes to an employee s A resounding yes If your employer is contributing to your NPS account you can claim deduction under section 80CCD 2 There is no monetary limit on how much

Should I Switch To The New Tax Regime From 1st April 2023

https://freefincal.com/wp-content/uploads/2020/02/Screenshot-of-new-tax-regime-vs-old-tax-regime-comparison-table.jpg

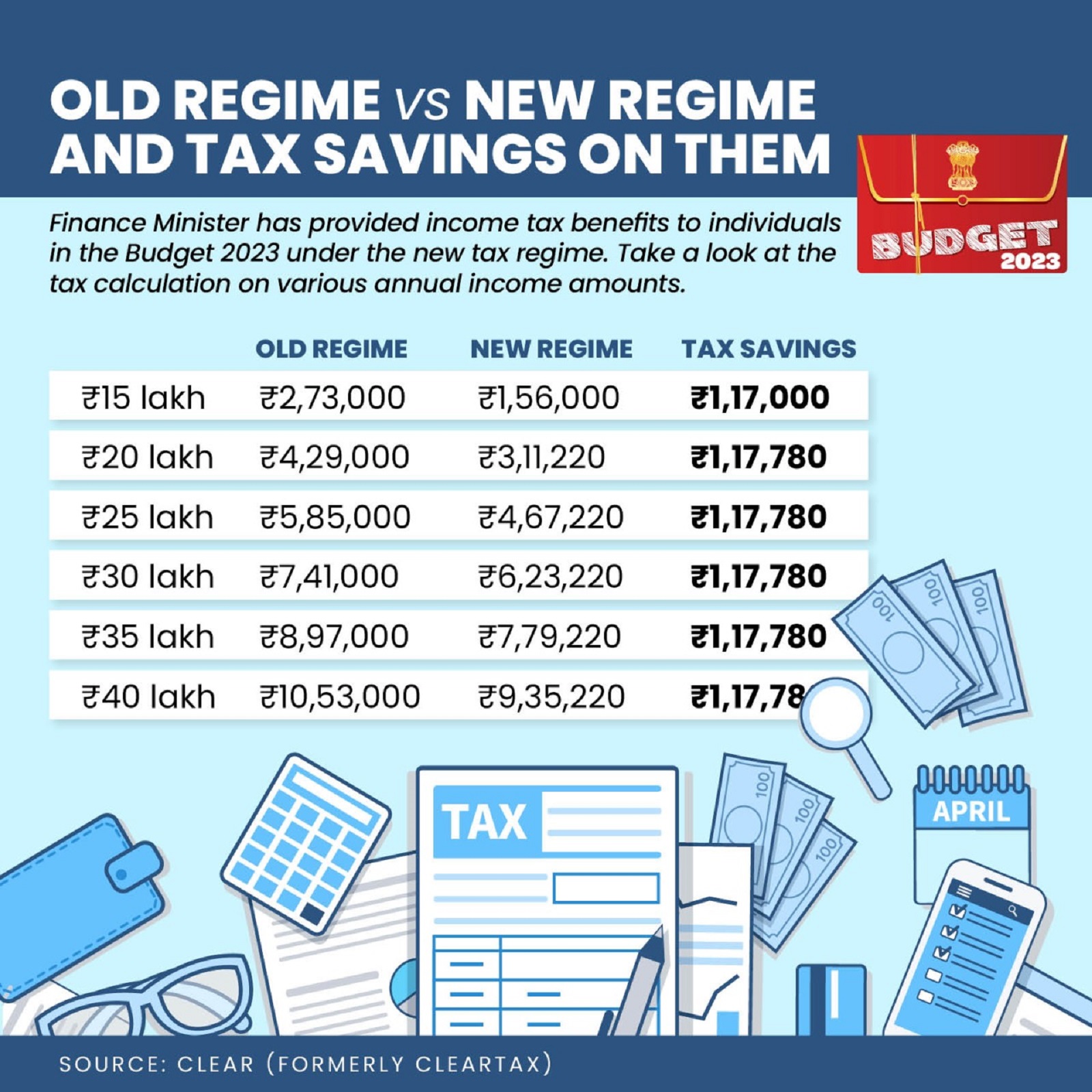

Budget 2023 New Income Tax Slabs How To Calculate Your Tax Hindustan

https://images.hindustantimes.com/img/2023/02/01/original/Tax_Regime_table_Web_1675260619284.png

https://www.financialexpress.com/money/new-tax...

New Tax Regime You can still get tax benefit on NPS contributions Check when it is possible Income Tax News The Financial Express Budget 2024

https://news.cleartax.in/can-salaried-individua…

New Tax Regime NPS deduction Provident fund The taxpayers can choose between the new tax regime or the old tax regime from FY 2020 21 If you plan to choose the new tax regime you can

NPS Tax Benefits Know More About NPS Tax Deduction Alankit

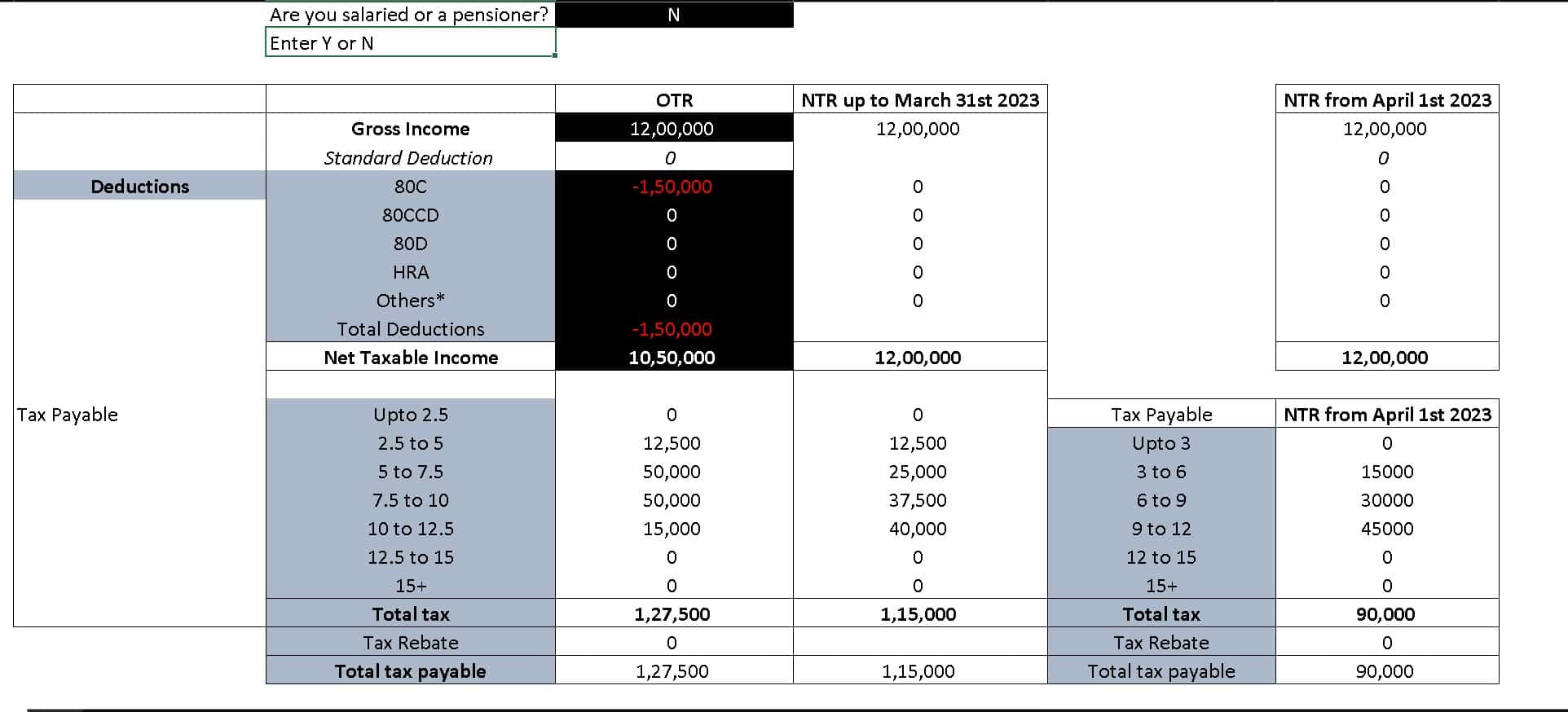

Should I Switch To The New Tax Regime From 1st April 2023

Income Tax Slabs Comparison After Budget 2023 Taxes Under Old Regime

How To Choose Between The New And Old Income Tax Regimes Chandan

New Tax Regime Vs Old Tax Regime Comparison Calculation Tax Slabs

Old Tax Regime And New Tax Regime Explained In 3 Scenarios Forum

Old Tax Regime And New Tax Regime Explained In 3 Scenarios Forum

Rebate Limit New Income Slabs Standard Deduction Understanding What

New Tax Regime Vs Old Tax Regime Which Is Better Yadnya Investment Vrogue

Old Vs New Tax Regime Choose YouTube

Can We Declare Nps In New Tax Regime - The Centre may make an official announcement to include NPS benefits in the new tax structure which is expected to be declared at the Interim Budget 2024 scheduled on