Can We Get Tax Benefit On Under Construction Property Here s how you can avail of home loan tax benefits for under construction property Tax deductions on under construction property If you purchase an under construction

Home Loan Tax Benefits on Under Construction Properties Some Home Loan borrowers think that they can claim tax exemptions only if they invest in a ready to The tax benefit under section 24 is reduced from Rs 2 lakhs to Rs 30 000 if the property is not acquired or construction is not completed within 3 years from the

Can We Get Tax Benefit On Under Construction Property

Can We Get Tax Benefit On Under Construction Property

https://i.pinimg.com/originals/eb/38/1d/eb381d0618093f5564fe0a379755f701.jpg

How To Claim Tax Benefit On Home Loan For Under Construction Property

https://i.pinimg.com/originals/3b/e0/41/3be0412655e7c5c3531db9f96c835ab2.jpg

GST On Under Construction Property 2023 Rates India s Leading

https://instafiling.com/wp-content/uploads/2022/12/New-GST-Rate-on-Property-Under-Construction-and-Completed-1024x565.png

As per the law I can get tax benefits on principle up to 1L rs and interest 2 5L for first 2 years then 1 5L if first loan and loan amount Home Loan Tax Benefits for Under Construction Property 2 min read A home loan for under construction property can get tax deductions up to Rs 2 lakhs on interest paid

What is Pre Construction Interest Pre construction interest is the interest that an assessee pays while the residential house is under construction Deduction on home The Section 24 of the Income Tax Act states that if a property is still to be constructed there will not be any tax deduction on the interest payment for all of those years However the interest for the pre

Download Can We Get Tax Benefit On Under Construction Property

More picture related to Can We Get Tax Benefit On Under Construction Property

Buying Ready To Move In Or Under Construction Properties

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgSH9Xq6rzMitO1YJ1Va-09vVbnmeaLQSkuPbUemiauuyJcU1w7MfGyh_lIb1KHvDqHQgChLzVPBC8LFEPF829vwNNhbRpZmDHGfl8eujCfRwPXEH98w_N5CI05SteJB6acZKDeWWkvbLtRq-AFjAh70MqvlGOdn-GlcX30nnZ1gbFlZHlNab_jIcmuSg/s16000/Ready-to-move-in and under-construction properties.png

How To Get Tax Benefit On Under Construction Property Stroymaster

https://www.ammacement.in/wp-content/uploads/2022/12/bekuhynyby.jpg

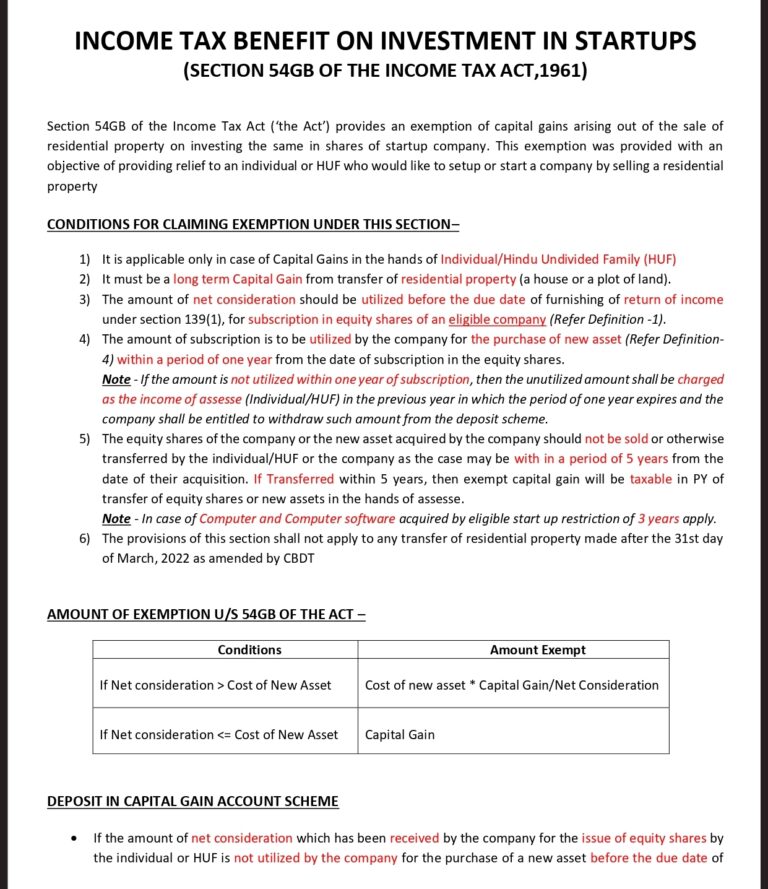

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

https://carajput.com/blog/wp-content/uploads/2022/04/INCOME-TAX-BENEFIT-ON-INVESTMENT-IN-STARTUPS-Section-54GB-1-768x889.jpg

No Let s understand why The Income Tax Act allows to claim a deduction of such interest also called the pre construction interest By opting for an under construction property you not only gain monetary benefits on the cost of purchase but tax benefits on your home loan as well Here are

How can one avail of tax benefits from an under construction property Section 80C allows for a tax deduction for the amount paid for Stamp Duty and the Registration Can I get income tax benefit on under construction property Yes you get income tax benefits for an under construction property under Sections 24 and

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

What Are The Tax Benefit On Home Loan FY 2020 2021

https://www.nitsotech.com/wp-content/uploads/Tax-Benefit-on-Home-Loan.jpg

https://www.tatacapital.com/blog/loan-for-home/...

Here s how you can avail of home loan tax benefits for under construction property Tax deductions on under construction property If you purchase an under construction

https://www.bajajhousingfinance.in/resources/claim...

Home Loan Tax Benefits on Under Construction Properties Some Home Loan borrowers think that they can claim tax exemptions only if they invest in a ready to

How Are Calculate VAT And Service Tax On Under Construction Property In

Income Tax Benefits On Housing Loan In India

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Income Tax Benefits On Home Loan Loanfasttrack

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

Bangalore Property apartments flats lands For Sale In Bangalore

Bangalore Property apartments flats lands For Sale In Bangalore

Can We Get All Events Laid Out Like This R MarvelPuzzleQuest

If You Choose The New Option Of Income Tax Then There Can Be A Big

PDF Worker Status How Can We Get It Working For Australia s Tax System

Can We Get Tax Benefit On Under Construction Property - Home Loan Tax Benefits for Under Construction Property 2 min read A home loan for under construction property can get tax deductions up to Rs 2 lakhs on interest paid