Can You Charge Sales Tax On A Service Fee By TaxJar October 1 2021 Watch the video When it comes to sales tax the general rule of thumb has always been products are taxable while services are non taxable Under that scenario if your business sells coffee mugs you should charge sales tax

Even though taxes vary by state there are six general types of services that can be subject to sales tax Services to tangible personal property For example improvements or repairs to your property such as a car or appliance Last updated February 19 2024 Introduction What constitutes a service When to charge sales tax on services How to collect sales tax on services Get started with Stripe In the US most physical goods are taxable with a few

Can You Charge Sales Tax On A Service Fee

Can You Charge Sales Tax On A Service Fee

https://cdn.shopify.com/s/files/1/0070/7032/files/How_to_charge_sales_tax.jpg?v=1656354490

Solved A 13 5 Blended Sales Tax On A Pair Of Shoes Amounted To 23

https://www.coursehero.com/qa/attachment/19770935/

What Is A Tax Engine For VAT GST Determination Why VAT Calculator Is

https://www.vatcalc.com/wp-content/uploads/Tax-Engine-1-1600x960.jpg

In some states businesses must charge sales tax on services provided in conjunction with sales of physical goods Do I Charge Sales Tax on Services Each state has its rules and regulations on what type of service to charge sales tax Just like products not all services are subject to sales tax New sales tax regulations are being implemented frequently on services as service based businesses grow in the United States

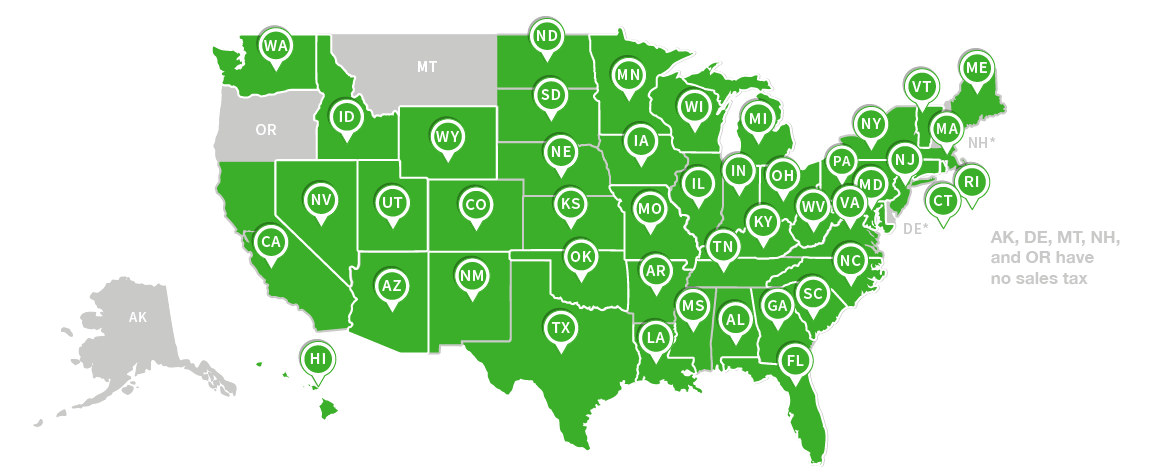

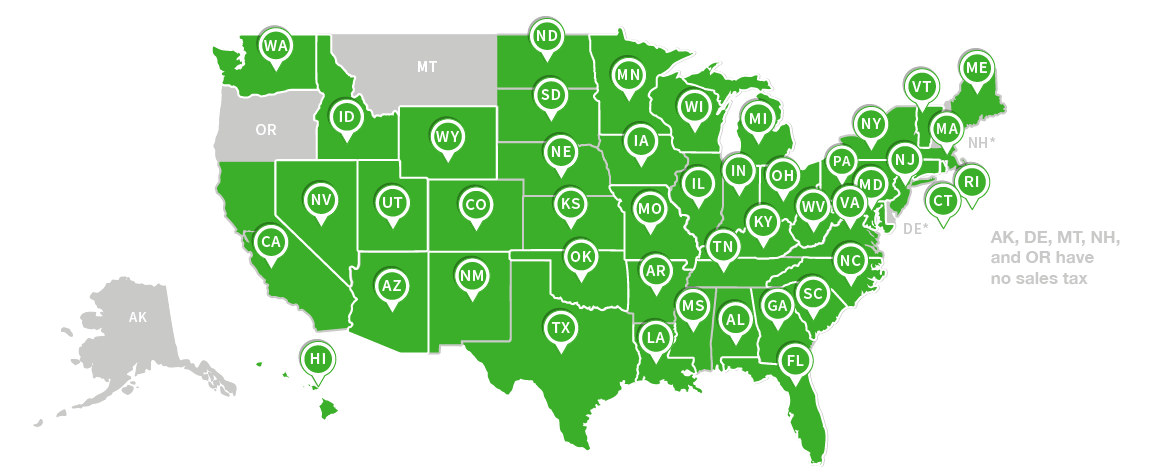

As we mentioned deciding if you need to charge sales tax will depend on the type of service or product you sell and your business location Although some states don t impose sales taxes others have state and local tax rates Here are the 2023 sales tax rules by state and the method the state uses Page 1 of 3 For example if you re a repairman the tax treatment of the services you provide may vary based on whether you are doing repair services or maintenance services You should check the specific tax laws for a state to see what are considered taxable services

Download Can You Charge Sales Tax On A Service Fee

More picture related to Can You Charge Sales Tax On A Service Fee

Should You Charge Sales Tax On Rental Equipment Quipli

https://quipli.com/wp-content/uploads/2022/01/sales-tax-on-rentals.jpg

Sales Tax Basics For Interior Designers Capella Kincheloe

https://images.squarespace-cdn.com/content/v1/58406b84b3db2b7f14465fb8/1494268422868-5B16T0ZTDMV7TRE9N0ZN/sales-tax-basics-for-interior-designers-capella-kincheloe.png

Which 2 Statements Are Correct Regarding Adjusting Sales Tax On A

https://i.ytimg.com/vi/n-qDXr6aQRY/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLD6DxU1Goa368SEJU_-fKAilG_w0w

Sales Tax on Service Charges Tips and Delivery Fees Service charges are always subject to sales tax while the treatment of delivery fees varies from state to state For example in Washington DC delivery fees are taxable when the food or drink being delivered is sold for immediate consumption Is it a Product or a Service Sales Taxes on Digital Products Sales Tax on Products and Services Photo Talaj Getty Images What states have sales taxes why sales taxes on services are growing and how to get information on what s subject to sales tax in your state

Use these rules to determine if you need to charge sales tax Determine If Your Consulting Fees are Taxable Some states charge sales tax on all services by default while others differentiate between personal services professional services and business services Determine the Sales Tax Rate Rates vary from state to state Since I provide a service do I have to charge sales tax Because of your particular situation there is no easy answer to this question You may sometimes have to charge sales tax while at other times you should not

Tax Question For New Ecommerce Store

https://data3.answerbase.com/answerbase/11352/UserFiles/attachments/807-1549950457746.png

Can You File Your Taxes With Your Last Pay Stub This Is What To Know

https://estilo-tendances.com/wp-content/uploads/2020/02/df7477343e18ae41cf296e4b62f1d931.jpeg

https://www.taxjar.com/sales-tax/when-should-a...

By TaxJar October 1 2021 Watch the video When it comes to sales tax the general rule of thumb has always been products are taxable while services are non taxable Under that scenario if your business sells coffee mugs you should charge sales tax

https://www.avalara.com/blog/en/north-america/2018/...

Even though taxes vary by state there are six general types of services that can be subject to sales tax Services to tangible personal property For example improvements or repairs to your property such as a car or appliance

9 99 Plus Tax TusharaMarya

Tax Question For New Ecommerce Store

Tax On A Service Fee R mildlyinfuriating

Can You Charge Tax On A Service Fee Joya Mayo

How To Use And Accept Resale Certificates In Your Online Business

Sales Tax Invoice Template Invoice Maker

Sales Tax Invoice Template Invoice Maker

18 Sales Tax Worksheets For Middle School Worksheeto

Should States Charge Sales Tax To Online Business

Can You Charge Tax On A Service Fee Joya Mayo

Can You Charge Sales Tax On A Service Fee - Since service charges are categorized as regular wages for tax calculation purposes employers are required to deduct payroll taxes before distributing to employees Conversely withholding is not required in advance when distributing tipped wages Tip and service charges can complicate payroll taxes