Can You Claim 45p Per Mile With Car Allowance 45p per mile reducing to 25p per mile after 10 000 miles is fine if it is my personal car without a car allowance But I can t find the rates for mileage for a personal car

You can claim over 45p tax free as a business mileage allowance if you use your own car for a business journey Here s what you need to know Guidance Travel mileage and fuel rates and allowances Updated 26 March 2024 Approved mileage rates from tax year 2011 to 2012 to present date Passenger

Can You Claim 45p Per Mile With Car Allowance

Can You Claim 45p Per Mile With Car Allowance

https://www.cleantechloops.com/wp-content/uploads/2021/08/tax-evasion.jpg

Your Car As A Business Expense What Can You Claim

https://www.laurenson.co.nz/wp-content/uploads/2022/11/Your-car-as-a-business-expense.jpg

Your Guide To Self Employed HGV Driver Expenses Countingup

https://countingup.com/wp-content/uploads/2022/08/Copyofmaking-tax-digital-and-vat-hero1_8cd9a1ddc294707f88cf4d46c631e8ab_2000.png

You can claim 45p per mile for the first 10 000 miles only if your car allowance is considered a benefit and taxed as a part of your income If your car allowance You can claim 45p per mile for the first 10 000 miles and 25p per mile after that for cars For motorcycles you can claim 24p per mile and 20p per mile for cycles

The level of Mileage Allowance Relief a driver can claim for tax purposes cannot exceed 45p per business mile 25p per mile if the mileage exceeds 10 000 less any amount already paid tax Can you claim 45p per mile with a car allowance Even if you receive a car allowance you can still claim 45p per business mile on your tax return if your employer

Download Can You Claim 45p Per Mile With Car Allowance

More picture related to Can You Claim 45p Per Mile With Car Allowance

Car Allowance Vs FAVR How FAVR Reduces Tax Liability ARC

https://autoreimbursement.com/wp-content/uploads/2022/07/tax-liability-2048x1367.jpg

Does My Employer Have To Pay Me Mileage 45p Per Mile

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/06/Does-My-Employer-Have-to-Pay-Me-Mileage.jpg

When Did Mileage Rate Change To 45p Will It Increase

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/06/When-Did-Mileage-Rate-Change-to-45p-768x515.jpg

The company then pays a certain amount to compensate costs for the tear and wear of the vehicle as well as oil fuel and maintenance For employees using a car or van The mileage allowance payment MAPs lets you claim at 45p per mile for the first 10 000 miles for cars and vans and covers any vehicle associate expenses such as fuel tax

Can you claim 45p per mile with company car No Mileage Allowance Payments MAPs are what you pay your employee for using their own vehicle for business journeys What mileage rate can I claim against tax For mileage allowance payments MAP you can claim 45p per mile for the first 10 000 miles and 25p per mile after that when

Can I Claim VAT On Mileage incl 45p Allowance VAT Reclaims

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/10/Can-I-Claim-VAT-on-Mileage-768x515.jpg

Will The 45p Per Mile Allowance Still Cover My Work Petrol Costs

https://i.dailymail.co.uk/1s/2022/03/09/16/55143529-0-image-a-16_1646843117818.jpg

https://www.accountingweb.co.uk/any-answers/...

45p per mile reducing to 25p per mile after 10 000 miles is fine if it is my personal car without a car allowance But I can t find the rates for mileage for a personal car

https://www.gosimpletax.com/blog/car-allowance-and-claiming-mileage

You can claim over 45p tax free as a business mileage allowance if you use your own car for a business journey Here s what you need to know

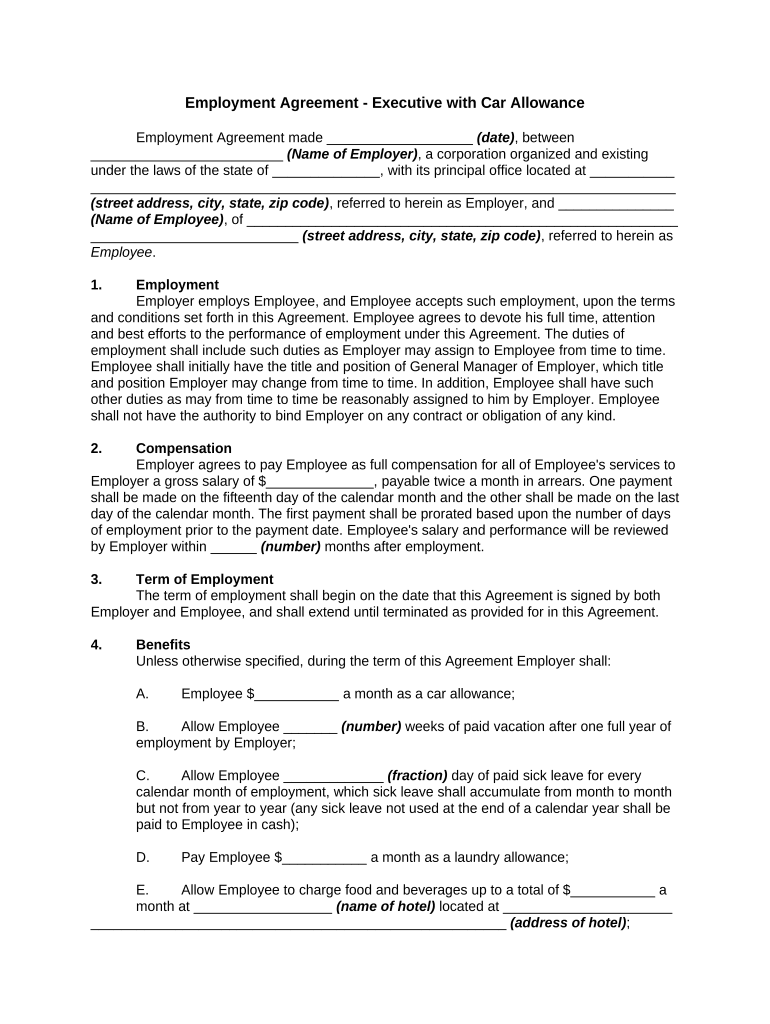

Car Allowance Agreement Template Form Fill Out And Sign Printable PDF

Can I Claim VAT On Mileage incl 45p Allowance VAT Reclaims

Home Care Worker Mileage Allowance Relief Claim Up To 45p Per Mile

Can I Claim VAT On Mileage incl 45p Allowance VAT Reclaims

How To Claim Carer s Allowance Green Tea Benefits Carers Allowance

The Deductions You Can Claim Hra Tax Vrogue

The Deductions You Can Claim Hra Tax Vrogue

Tax Savings When Purchasing Company Cars Abingdon Technologies

Can You Still Claim 45p Per Mile For An Electric Car Allstar EV

Step By Step How To Claim Motor Vehicle Expenses From The CRA

Can You Claim 45p Per Mile With Car Allowance - You can claim 45p per mile for the first 10 000 miles and 25p per mile after that for cars For motorcycles you can claim 24p per mile and 20p per mile for cycles