Can You Claim Child Tax Credit And Child Care Credit Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit

The child tax credit is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The credit The child and dependent care credit can be claimed on tax returns filed in mid April You ll need to attach two forms to the standard Form 1040 Form 2441 and Schedule 3

Can You Claim Child Tax Credit And Child Care Credit

Can You Claim Child Tax Credit And Child Care Credit

http://static1.squarespace.com/static/5fb2ed3e535af708d0c84149/t/6111698df932a77577f7ae13/1628531093504/Child+tax+credit_have+received_1x1%402x.png?format=1500w

Topic Child Tax Credit Change

https://assets.change.org/photos/0/fc/bn/BJFcBnEumbMgwJK-1600x900-noPad.jpg?1648580130

Child Tax Credit 2023 What Are The Changes YouTube

https://i.ytimg.com/vi/jZkTfYSsaw8/maxresdefault.jpg

The Child and Dependent Care Tax Credit CDCTC is a tax credit of up to 35 of what you pay someone to take care of your children or adult dependents who can t provide their own care Any children Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the child

Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in expenses for one child and 8 000 for two You can only make a claim for Child Tax Credit if you already get Working Tax Credit If you get Working Tax Credit To claim Child Tax Credit update your existing tax credit

Download Can You Claim Child Tax Credit And Child Care Credit

More picture related to Can You Claim Child Tax Credit And Child Care Credit

Monthly Child Tax Credit Payments Start Thursday Here s What To Know

https://www.courier-journal.com/gcdn/-mm-/a75b61cdf29c924e642301138dcb5b5b73c5e5d5/c=0-30-1998-1159/local/-/media/2018/01/31/Louisville/Louisville/636530052069237063-IMG-3796.jpg?width=1998&height=1129&fit=crop&format=pjpg&auto=webp

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

https://mfiworks.com/wp-content/uploads/2021/05/the-child-tax-credit-and-the-dependent-care-credit.jpg

Shakopee MN Tax Preparer Shows How To Write Off Johnny s Soccer Camp

https://mendenaccounting.com/wp-content/uploads/2012/06/child-tax-credit-1-scaled.jpg

To be eligible to claim the child tax credit the taxpayer must have at least one qualifying child If taxpayers claim the child tax credit or additional child tax credit but are not Like dependent care FSAs the dependent care tax credit is for care expenses for children younger than 13 plus minors and adults unable to care for themselves For the 2022 2023 tax year you can

The Child Tax Credit is a 2 000 per child tax benefit claimed by filing Form 1040 and attaching Schedule 8812 to the return To qualify for the credit the If you paid someone to care for a child who was under age 13 when the care was provided and whom you claim as a dependent on your tax return you may qualify for the Child

Child Tax Credit Schedule 8812 H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/child-tax-credit-1080x675.jpg

Can You Claim Child Tax Credit If You Didn t Work In 2021 VERIFY

https://i.ytimg.com/vi/idPmdPci8qk/maxresdefault.jpg

https://www.irs.gov/newsroom/understanding-the...

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit

https://www.nerdwallet.com/article/taxes/qu…

The child tax credit is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The credit

2022 Education Tax Credits Are You Eligible

Child Tax Credit Schedule 8812 H R Block

You May Be Able To Get More Money From Federal Child Tax Credits By

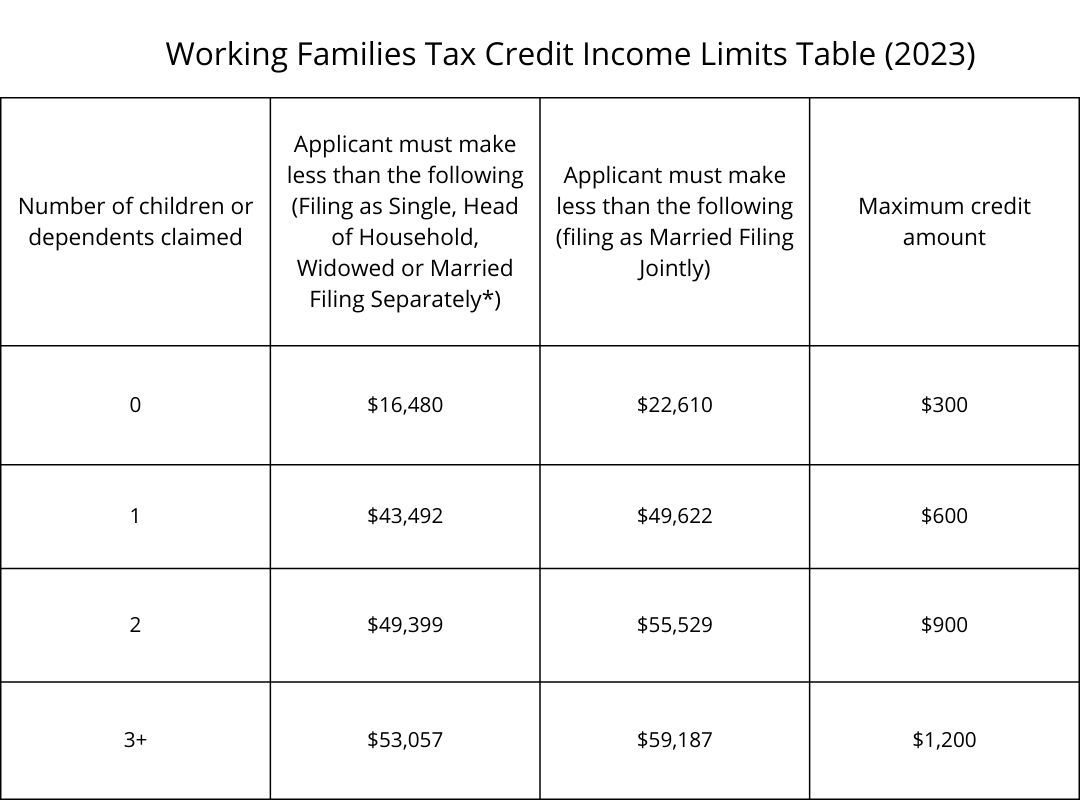

FAQ WA Tax Credit

Fourth Stimulus Check And Child Tax Credit Summary 26 July 2021 AS USA

Month 2 Of Child Tax Credit Hits Bank Accounts AP News

Month 2 Of Child Tax Credit Hits Bank Accounts AP News

Last Chance To Sign Up For 3 600 Advanced Child Tax Credit Payment Is

What Is The Phase Out For Dependent Care Credit Latest News Update

Child Tax Credit Vs Fsa Trending US

Can You Claim Child Tax Credit And Child Care Credit - The Child and Dependent Care Tax Credit CDCTC is a tax credit of up to 35 of what you pay someone to take care of your children or adult dependents who can t provide their own care Any children