Can You Claim Dental Cleaning On Taxes Verkko 15 jouluk 2023 nbsp 0183 32 In the United States the Internal Revenue Service IRS allows taxpayers to deduct unreimbursed medical expenses including dental expenses that

Verkko 29 huhtik 2023 nbsp 0183 32 You can deduct unreimbursed qualified medical and dental expenses that exceed 7 5 of your AGI Say you have an AGI of 50 000 and your family has 10 000 in medical bills for the tax year Verkko SOLVED by TurboTax 3541 Updated 3 weeks ago You probably already know that you can deduct things like medical and dental fees co pays eyeglasses prescriptions

Can You Claim Dental Cleaning On Taxes

Can You Claim Dental Cleaning On Taxes

https://i0.wp.com/www.cleantechloops.com/wp-content/uploads/2021/08/tax-evasion.jpg?resize=768%2C768&ssl=1

Can You Claim Workers Compensation Benefits From A Work Related Car

https://dpaynetwork.com/wp-content/uploads/2021/02/claim-workers-comp-insurance-from-car-accident.jpg

Can You Claim Mortgage Interest On Taxes CountyOffice YouTube

https://i.ytimg.com/vi/IUnJn3SsPLw/maxresdefault.jpg

Verkko 11 tammik 2023 nbsp 0183 32 You are only allowed to deduct dental expenses if they total more than 7 5 of your adjusted gross income AGI But you must itemize deductions to claim this tax benefit You can also Verkko You can claim dental expenses on your taxes if you incurred fees for the prevention and alleviation of dental disease This includes Services of a dental hygienist or

Verkko 2 lokak 2023 nbsp 0183 32 Can I Deduct My Medical and Dental Expenses ITA Home This interview will help you determine if your medical and dental expenses are deductible Verkko 16 marrask 2023 nbsp 0183 32 If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental

Download Can You Claim Dental Cleaning On Taxes

More picture related to Can You Claim Dental Cleaning On Taxes

Can You Claim Assisted Living Expenses On Taxes CountyOffice

https://i.ytimg.com/vi/unnH6kH01lw/maxresdefault.jpg

Working From Home What Can You Claim And How Do You Claim It Public

https://www.publicaccountant.com.au/images/tax_consultant_.jpeg

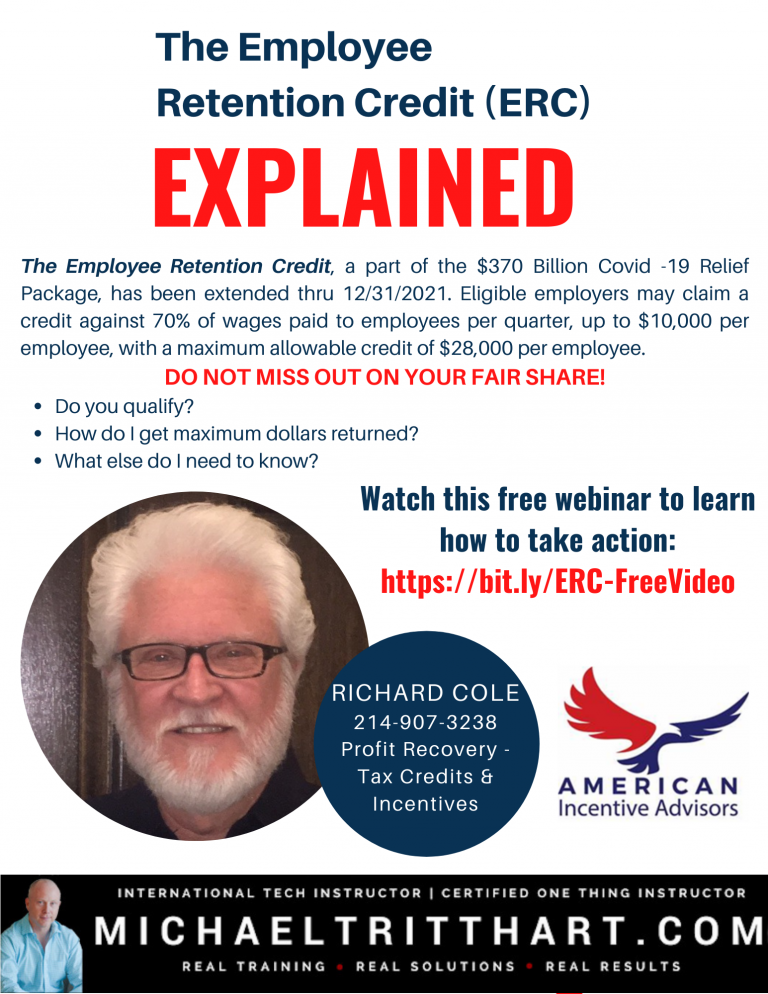

Can You Claim The Employee Retention Credit MichaelTritthart

https://michaeltritthart.com/wp-content/uploads/2021/08/RichardCole-v2-768x994.png

Verkko 12 tammik 2023 nbsp 0183 32 Individuals can claim some of the cost of medical dental and other health care related expenses on tax returns if they itemize Learn about the rules that apply Verkko 24 syysk 2013 nbsp 0183 32 Dental expenses include any amounts paid for preventive treatment such as teeth cleanings fillings extractions X rays and braces Also included are premiums paid for any insurance related

Verkko This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring Verkko 18 jouluk 2021 nbsp 0183 32 Are dental expenses tax deductible Yes you can take a dental tax deduction for most of the costs associated with non cosmetic dental expenses for you

Can You Claim Clothing As A Business Expense Crunch Accounting Services

https://crunchaccounting.co.nz/app/uploads/3ldTidrbSxJkesCX2b8o8x-gez-xavier-mansfield-b34E1vh1tYU-unsplash-scaled.jpg

Can You Claim Clothing As A Business Expense NH Associates

https://www.nh-a.co.nz/wp-content/uploads/2022/07/BLOG-Covers-2.png

https://www.stilt.com/taxes/are-dental-expenses-tax-deductible

Verkko 15 jouluk 2023 nbsp 0183 32 In the United States the Internal Revenue Service IRS allows taxpayers to deduct unreimbursed medical expenses including dental expenses that

https://www.investopedia.com/articles/person…

Verkko 29 huhtik 2023 nbsp 0183 32 You can deduct unreimbursed qualified medical and dental expenses that exceed 7 5 of your AGI Say you have an AGI of 50 000 and your family has 10 000 in medical bills for the tax year

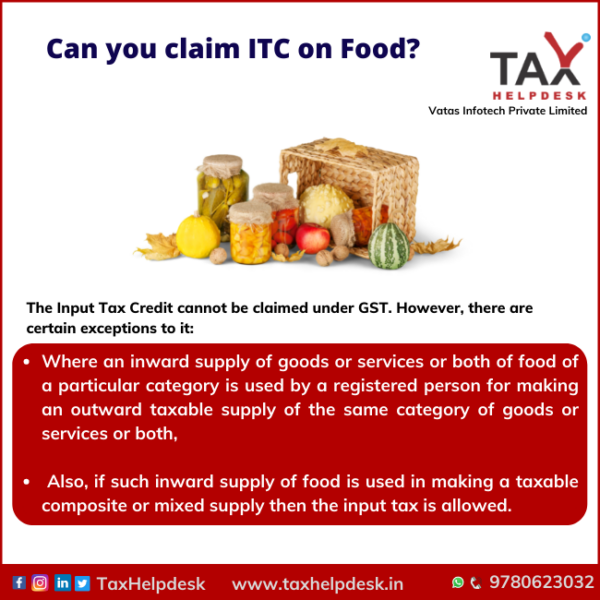

Know Whether You Can Claim Input Tax Credit On Food

Can You Claim Clothing As A Business Expense Crunch Accounting Services

Mistakes To Avoid When Claiming Work From Home Tax Deductions Work

.png)

General 1 EC ACCOUNTING SOLUTIONS CPA

Can You Claim Prescription Drugs On Income Tax Canada 27F Chilean Way

7 Ways Dental Cleaning Does Wonders To Your Teeth

7 Ways Dental Cleaning Does Wonders To Your Teeth

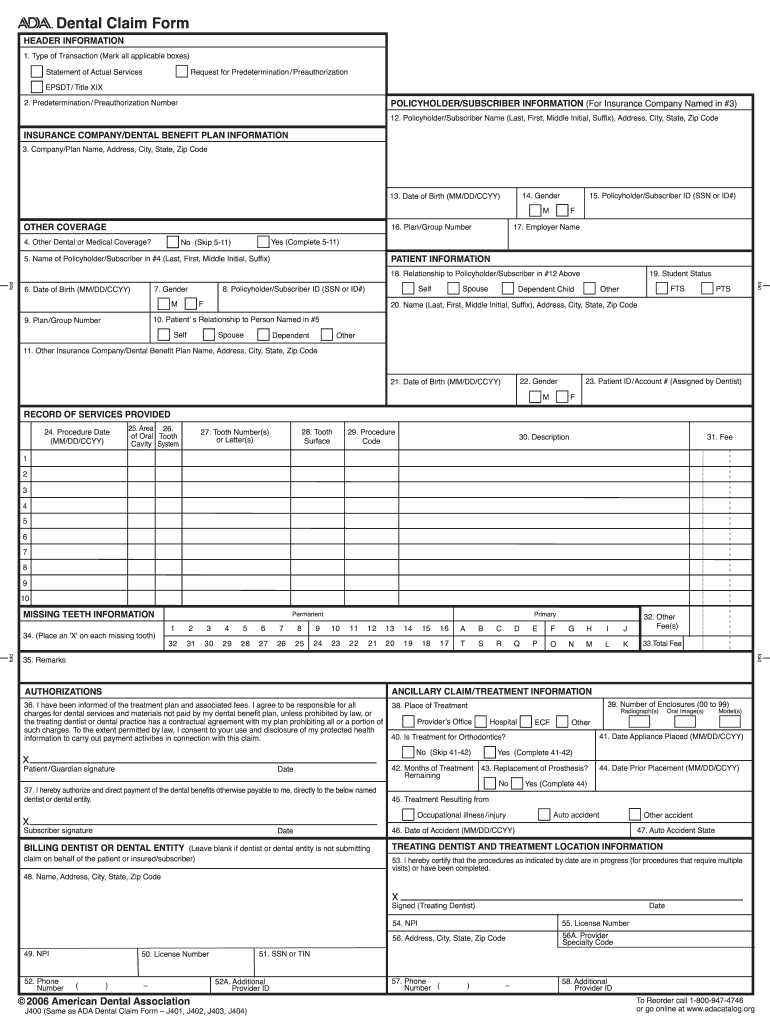

Free Printable Ada Dental Claim Form

Working From Home Tax Relief What Can You Claim Enterprise Made Simple

Can You Claim Daycare On Taxes DaycarePulse

Can You Claim Dental Cleaning On Taxes - Verkko 11 tammik 2023 nbsp 0183 32 You are only allowed to deduct dental expenses if they total more than 7 5 of your adjusted gross income AGI But you must itemize deductions to claim this tax benefit You can also