Can You Claim Energy Tax Credit New Construction Web 18 Dez 2023 nbsp 0183 32 Eligible contractors who build or substantially reconstruct qualified new energy efficient homes may be able to claim tax credits up to 5 000 per home The

Web Vor 2 Tagen nbsp 0183 32 You can claim either the Energy Efficient Home Improvement Credit or the Residential Energy Clean Property Credit for the year when you make qualifying Web 1 Jan 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Can You Claim Energy Tax Credit New Construction

Can You Claim Energy Tax Credit New Construction

https://countingup.com/wp-content/uploads/2022/08/Copyofmaking-tax-digital-and-vat-hero1_8cd9a1ddc294707f88cf4d46c631e8ab_2000.png

Are Your Clients Taking Advantage Of Sellable Tax Credits Certified

https://certifiedtaxcoach.org/wp-content/uploads/2021/03/bigstock-192873124-1.jpg

Do You Qualify For A Home Energy Tax Credit Benefyd

https://www.benefyd.com/wp-content/uploads/2016/02/home-energy-tax-credits0.png

Web 10 Dez 2023 nbsp 0183 32 This means you can claim a maximum total yearly energy efficient home improvement credit amount up to 3 200 Residential Clean Energy Credit The Web 5 Aug 2023 nbsp 0183 32 A range of tax credits for new home construction can alleviate some of the associated costs There are two types of tax breaks available to you tax deductions and tax credits A tax credit deducts a

Web 21 Dez 2022 nbsp 0183 32 A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product receipts Q Are there limits to what Web Updated October 06 2023 Reviewed by Lea D Uradu What Is an Energy Tax Credit An energy tax credit is a government sponsored incentive that reduces the cost for people

Download Can You Claim Energy Tax Credit New Construction

More picture related to Can You Claim Energy Tax Credit New Construction

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg)

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

https://cdn.vox-cdn.com/thumbor/WuOuOQRdPx1e96FGTdEFcOHebJ8=/0x0:1000x669/1200x800/filters:focal(525x411:685x571)/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg

ERC Credits What Is It And How Can You Claim It

https://i0.wp.com/www.cleantechloops.com/wp-content/uploads/2021/08/tax-evasion.jpg?resize=768%2C768&ssl=1

Solar Tax Credit What You Need To Know NRG Clean Power

https://nrgcleanpower.com/wp-content/uploads/2022/05/ITC-Step-Down-2022-01.png

Web 1 Jan 2023 nbsp 0183 32 For eligible homes and apartments referred to as dwelling units in 167 45L acquired on or after January 1 2023 the tax credit is now specifically tied to certification Web 14 Apr 2022 nbsp 0183 32 getty In the U S several tax credits are designed to make boosting energy efficiency more attractive to homeowners developers manufacturers and various types

Web This credit can be claimed for the following qualifying expenditures incurred for either an existing home or a newly constructed home Geothermal Heat Pumps Fuel Cells Small Wind Turbines Battery Storage Technology Web 22 Dez 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Tax Credit ClimaCool

https://climacoolcorp.com/images/18.14995922187eadd2c85269/1683913191583/TaxGuide-MockUp_BLUE.png

Working From Home What Can You Claim And How Do You Claim It Public

https://www.publicaccountant.com.au/images/tax_consultant_.jpeg

https://www.irs.gov/credits-deductions/credit-for-builders-of-energy...

Web 18 Dez 2023 nbsp 0183 32 Eligible contractors who build or substantially reconstruct qualified new energy efficient homes may be able to claim tax credits up to 5 000 per home The

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web Vor 2 Tagen nbsp 0183 32 You can claim either the Energy Efficient Home Improvement Credit or the Residential Energy Clean Property Credit for the year when you make qualifying

Can You Get A Government Grant To Make Your Norwegian Home Energy

Tax Credit ClimaCool

Home Energy Tax Credits Will Ease The Pain Of An Ailing A C

Equipment Tax Credits For Primary Residences About ENERGY STAR

Know Whether You Can Claim Input Tax Credit On Food

.png)

General 1 EC ACCOUNTING SOLUTIONS CPA

.png)

General 1 EC ACCOUNTING SOLUTIONS CPA

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

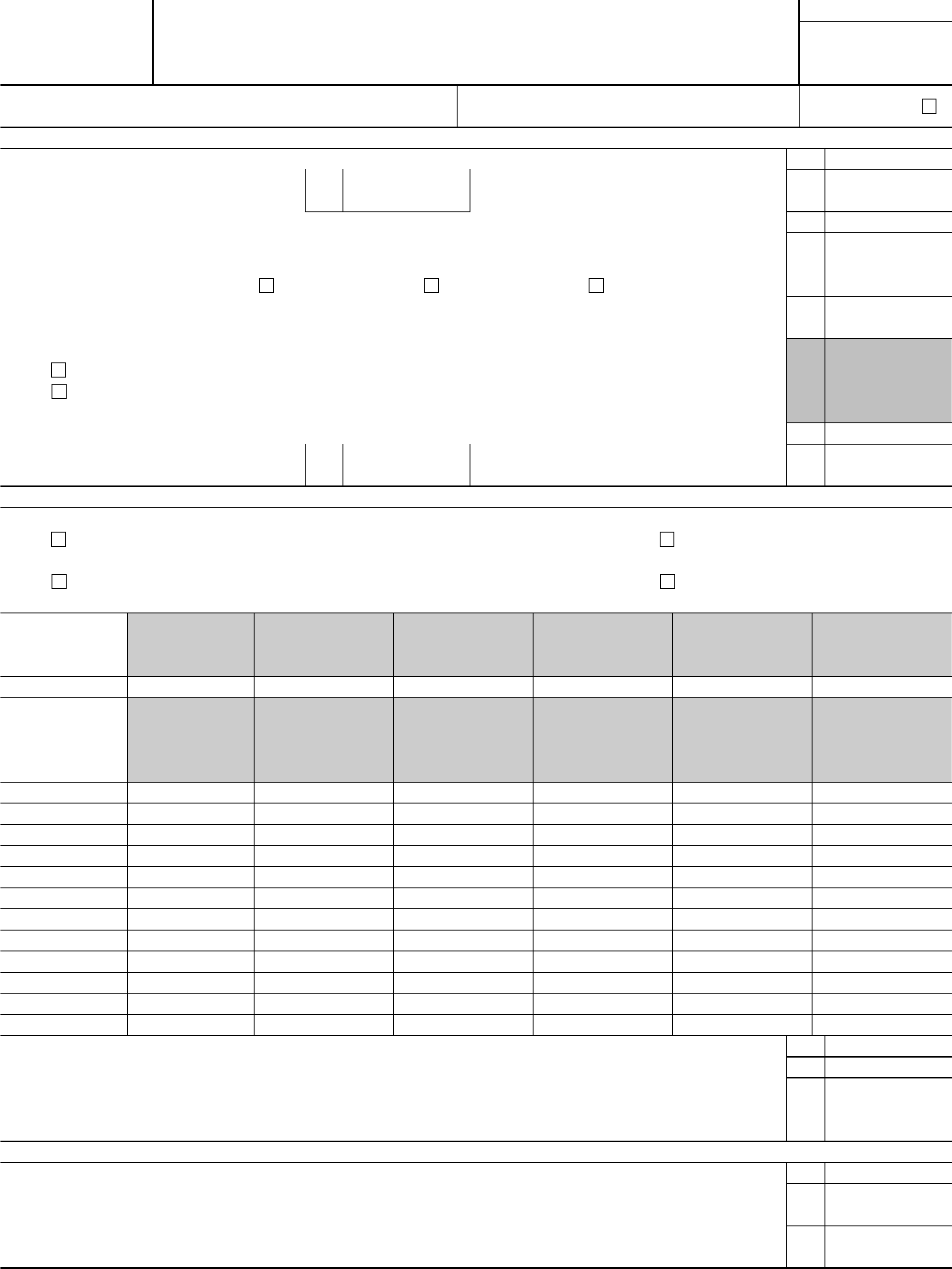

Premium Tax Credit Form Edit Fill Sign Online Handypdf

New Residential Energy Tax Credit Estimates Eye On Housing

Can You Claim Energy Tax Credit New Construction - Web 5 Aug 2023 nbsp 0183 32 A range of tax credits for new home construction can alleviate some of the associated costs There are two types of tax breaks available to you tax deductions and tax credits A tax credit deducts a