Can You Claim Expenses From Previous Years Australia Income and allowances to declare and the expenses you can claim a deduction for in your occupation or industry Find out which expenses you can claim as income tax

You can t double dip and claim for phone expenses that have been reimbursed by your employer To work out your deduction you need to choose a typical four week period You can claim a deduction for expenses incurred in managing your own tax affairs such as the cost to lodge through a registered agent

Can You Claim Expenses From Previous Years Australia

Can You Claim Expenses From Previous Years Australia

https://image.isu.pub/190614055856-f37297c9cdf410e73136d35d4d477b86/jpg/page_1.jpg

How To Create A Simple Expenses Claim Form Template Free Sample

https://i2.wp.com/wordtemplate.net/wp-content/uploads/2017/10/Expense-Claim-Form.jpg

Business Expenses What Can You Claim

https://www.uhyhn.co.nz/wp-content/uploads/2016/04/Business-expenses-pic.jpg

You can get that overpaid tax back by lodging your tax return In Australia if you re doing it yourself make sure to lodge it by the 31st of October When completing your tax Here are 8 tax deductions you may be able to claim at tax time 1 Home office expenses If you re working from home and you incurred expenses related to your work you may be entitled to claim a deduction for home

You can claim tax deductions for most costs involved in running your business This helps to reduce the income you pay tax on Find out what expenses you You can also claim the proportion of your pre paid expenses from a previous income year that relate to 2023 24 Deductions for prepaid expenses 2024 will

Download Can You Claim Expenses From Previous Years Australia

More picture related to Can You Claim Expenses From Previous Years Australia

Pre Trade Expenses For New Self employed Business

https://www.heelanassociates.co.uk/wp-content/uploads/2022/05/Heelan-139-Pre-business-Expenses-2022-.jpg

EXCEL Of Expense Claim Form xlsx WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20190822/468eb21a039146b7a06c76a652c95c70.jpg

Claim Expenses From The Co owner For The Maintenance Of The Property

https://www.white-baos.com/wp-content/uploads/2021/11/Claim-expenses-from-the-co-owner.jpg

No not in the wrong year from my experience although on a couple of occasions e g a three figure donation I d forgotten in FY19 I ve amended my return All Generally speaking if you re eligible to claim work related expenses as a deduction you can claim the expense in the financial year in which it was incurred

On this page Complete this section if you have a tax loss from an earlier income year for which you may be able to claim a deduction in 2021 22 If your latest If you did then you can claim the amount you paid last year on this year s return On your tax return simply put the amount you paid last year into the Cost of Managing Tax

Sales And Expenses Spreadsheet In Small Business Spreadsheet For Income

https://db-excel.com/wp-content/uploads/2019/01/sales-and-expenses-spreadsheet-in-small-business-spreadsheet-for-income-and-expenses-australia-sample.jpg

HOW DO YOU CLAIM EXPENSES WHEN WORKING FROM OUR HOME OFFICE HOW TO

https://i.ytimg.com/vi/Pwdlv9OzGhM/maxresdefault.jpg

https://www.ato.gov.au/.../deductions-you-can-claim

Income and allowances to declare and the expenses you can claim a deduction for in your occupation or industry Find out which expenses you can claim as income tax

https://www.hrblock.com.au/tax-academy/guide-tax...

You can t double dip and claim for phone expenses that have been reimbursed by your employer To work out your deduction you need to choose a typical four week period

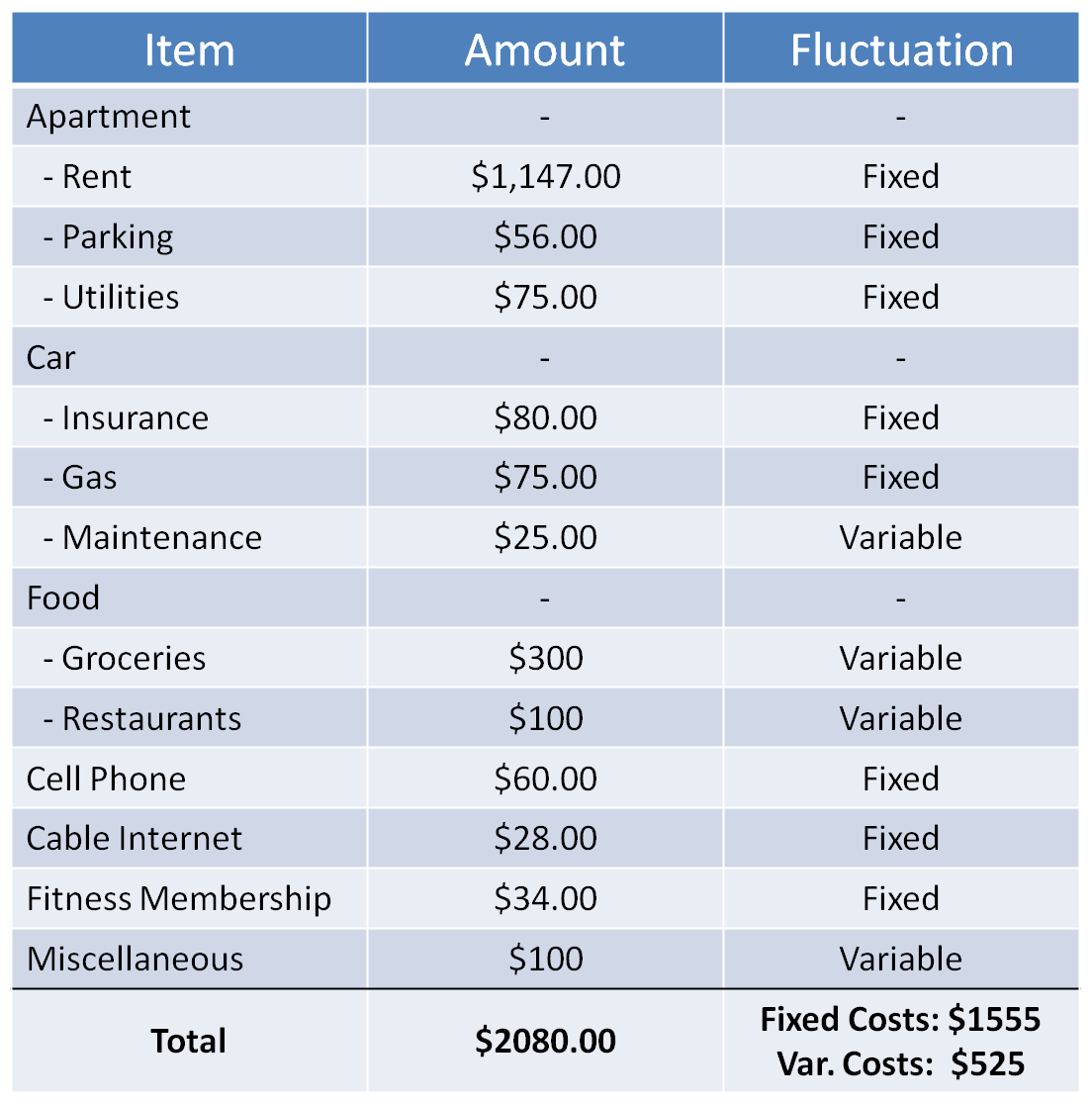

Dividend Diligence Monthly Expenses

Sales And Expenses Spreadsheet In Small Business Spreadsheet For Income

Can You Claim Moving Expenses The Storage Box

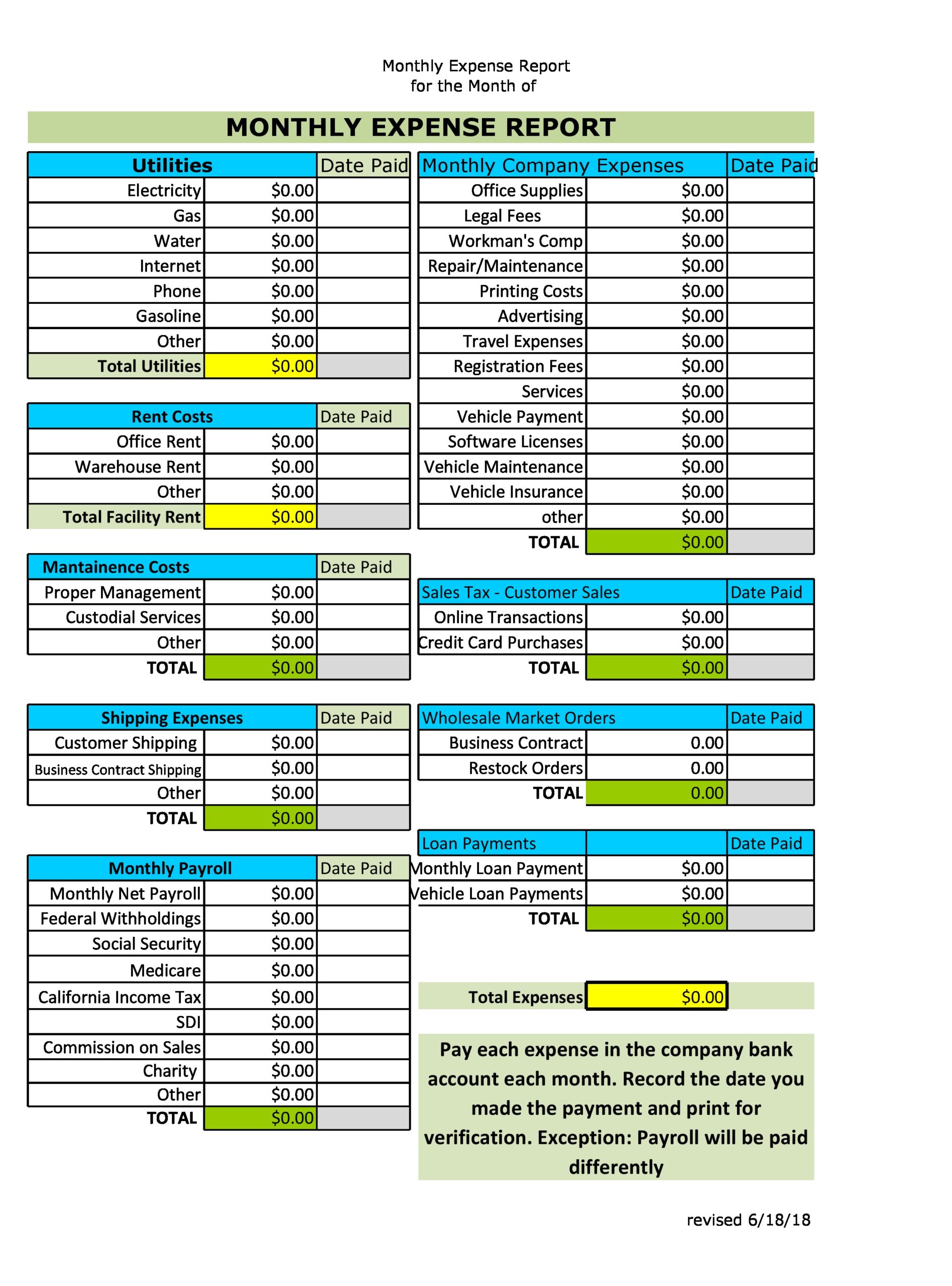

Image Result For Hair Salon Expenses Printable Business Tax

30 Effective Monthly Expenses Templates Bill Trackers

Can You Claim Expenses Using An Umbrella Company When Shopping

Can You Claim Expenses Using An Umbrella Company When Shopping

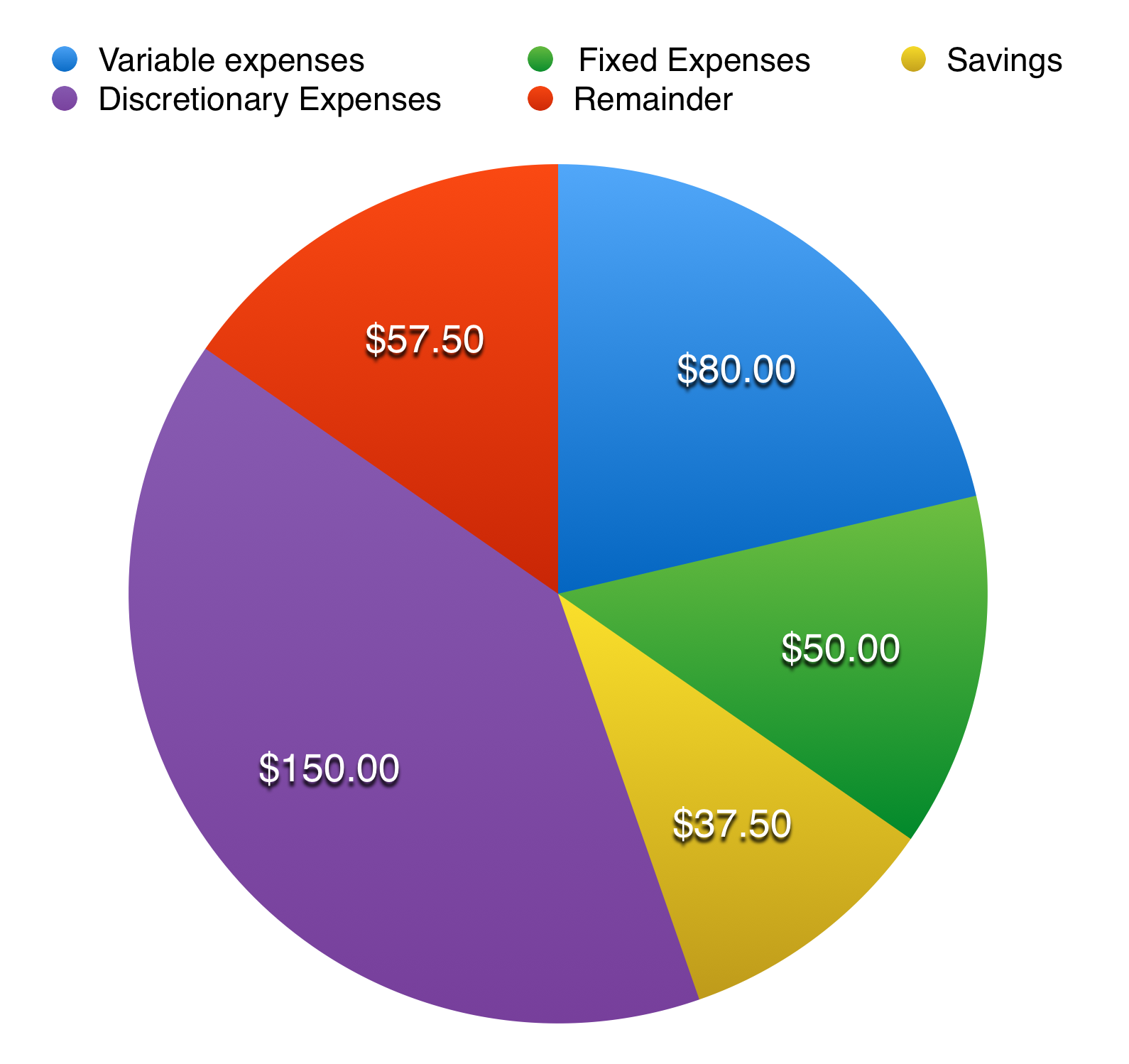

Budgeting Financial Literacy

Claim Work Travel Expenses This Can Boost Your Tax Refund Work

Can You Claim Expenses Without A Receipt

Can You Claim Expenses From Previous Years Australia - When an investor has missed or not maximised their claim in previous years the depreciation schedule can be tailored within the eligible years For example low value