Can You Claim Health Care Expenses On Your Taxes Amounts paid for insurance premiums to cover medical care or qualified long term care Certain costs related to nutrition wellness and general health are

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross Individuals can claim some of the cost of medical dental and other health care related expenses on tax returns if they itemize Learn about the rules that

Can You Claim Health Care Expenses On Your Taxes

Can You Claim Health Care Expenses On Your Taxes

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/01xx.jpeg

Health Insurance Claims Without Hospitalization Bajaj Allianz

https://www.bajajallianz.com/blog/wp-content/uploads/2021/12/claiming-health-insurance-without-hospitalization.jpg

Claiming Childcare Expenses In Canada Blueprint Accounting

https://www.experienceyourblueprint.com/wp-content/uploads/Claiming-Childcare-expenses-on-Your-Personal-Tax-Return-Blog-Feature-Img.png

If you itemize deductions and you have unreimbursed expenses for necessary medical or dental care you may be able to claim a tax deduction if they If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 7 5 of your Adjusted Gross

You can claim an itemized deduction for qualified medical expenses that exceed 7 5 of your adjusted gross income You can also take tax free health savings You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This

Download Can You Claim Health Care Expenses On Your Taxes

More picture related to Can You Claim Health Care Expenses On Your Taxes

Expenses In Accounting Definition Types And Examples

https://www.deskera.com/blog/content/images/2021/12/neonbrand-maJDOJSmMoo-unsplash.jpg

Daycare Business Income And Expense Sheet To File Your Daycare Business

https://i.pinimg.com/originals/67/62/b1/6762b1bcb53c6074dab4289dd09b60a5.jpg

What Conditions Qualify For Medical Card In California

https://www.greenworksflowersnyc.com/img/72ab42eac68c43d1aac4a58bb8a26925.jpg?22

If you re paying a lot of healthcare costs out of your own pocket can you deduct those medical expenses from your taxes The short answer is yes but there are There are plenty of qualifying medical expenses that you can claim on your taxes However you can only deduct expenses that exceed 7 5 of your adjusted gross

Can I deduct my medical and dental expenses ITA home This interview will help you determine if your medical and dental expenses are deductible Information you ll need Health and wellness costs Among other health and wellness costs that qualify as deductible medicals are smoking cessation programs nutritional counseling

Can I Claim Medical Expenses On My Taxes TMD Accounting

http://tmdaccounting.com/wp-content/uploads/2017/08/Can-I-Claim-Medical-Expenses-on-My-Taxes-.png

How To Create A Simple Expenses Claim Form Template Free Sample

https://i2.wp.com/wordtemplate.net/wp-content/uploads/2017/10/Expense-Claim-Form.jpg

https://www.irs.gov/taxtopics/tc502

Amounts paid for insurance premiums to cover medical care or qualified long term care Certain costs related to nutrition wellness and general health are

https://www.nerdwallet.com/article/taxes/medical...

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross

Tax Return Should I Claim 400 Or 3 000 For Home Office Expenses For

Can I Claim Medical Expenses On My Taxes TMD Accounting

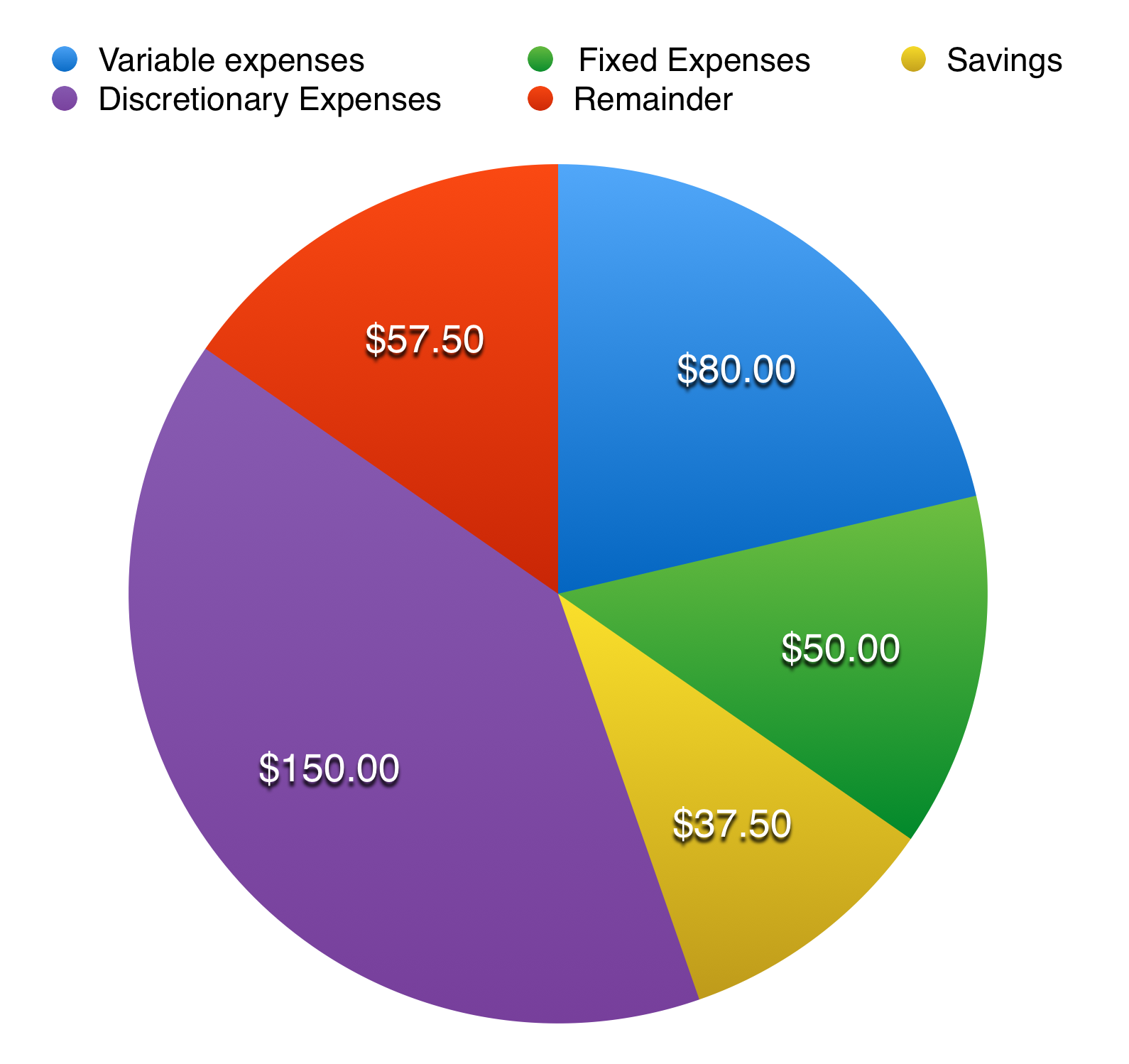

Budgeting Financial Literacy

Mileage Claim Form Template

Tax Deductions You Can Deduct What Napkin Finance

Child Care Chicago How To Deduct Child Care Expenses On Your Taxes

Child Care Chicago How To Deduct Child Care Expenses On Your Taxes

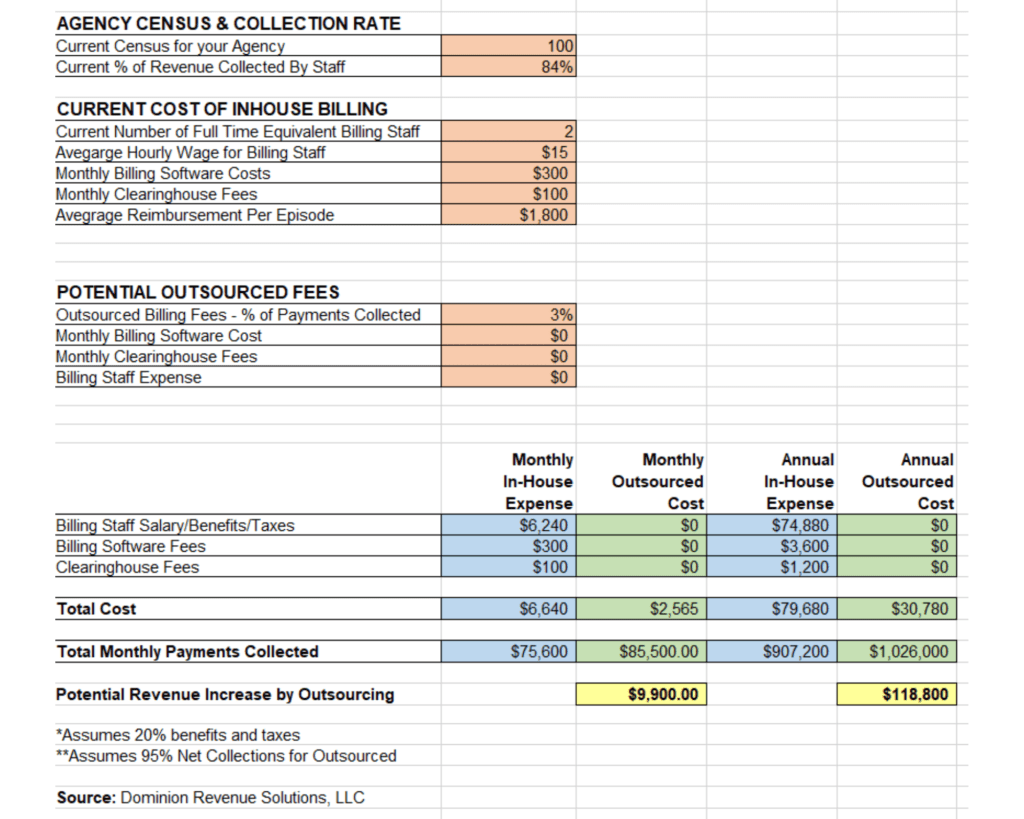

A Practical Example Of Home Health Cost Savings With Outsourced Medical

Printable Tax Deduction Cheat Sheet

Comprehensive Bill To Start Addressing Unsustainable Health Care Costs

Can You Claim Health Care Expenses On Your Taxes - If you itemize deductions and you have unreimbursed expenses for necessary medical or dental care you may be able to claim a tax deduction if they