Can You Claim Heating Oil On Your Taxes You are eligible to claim the Energy Efficient Home Improvement Credit if you are making qualifying home improvements on your primary residence not installations on a new build This credit is nonrefundable and

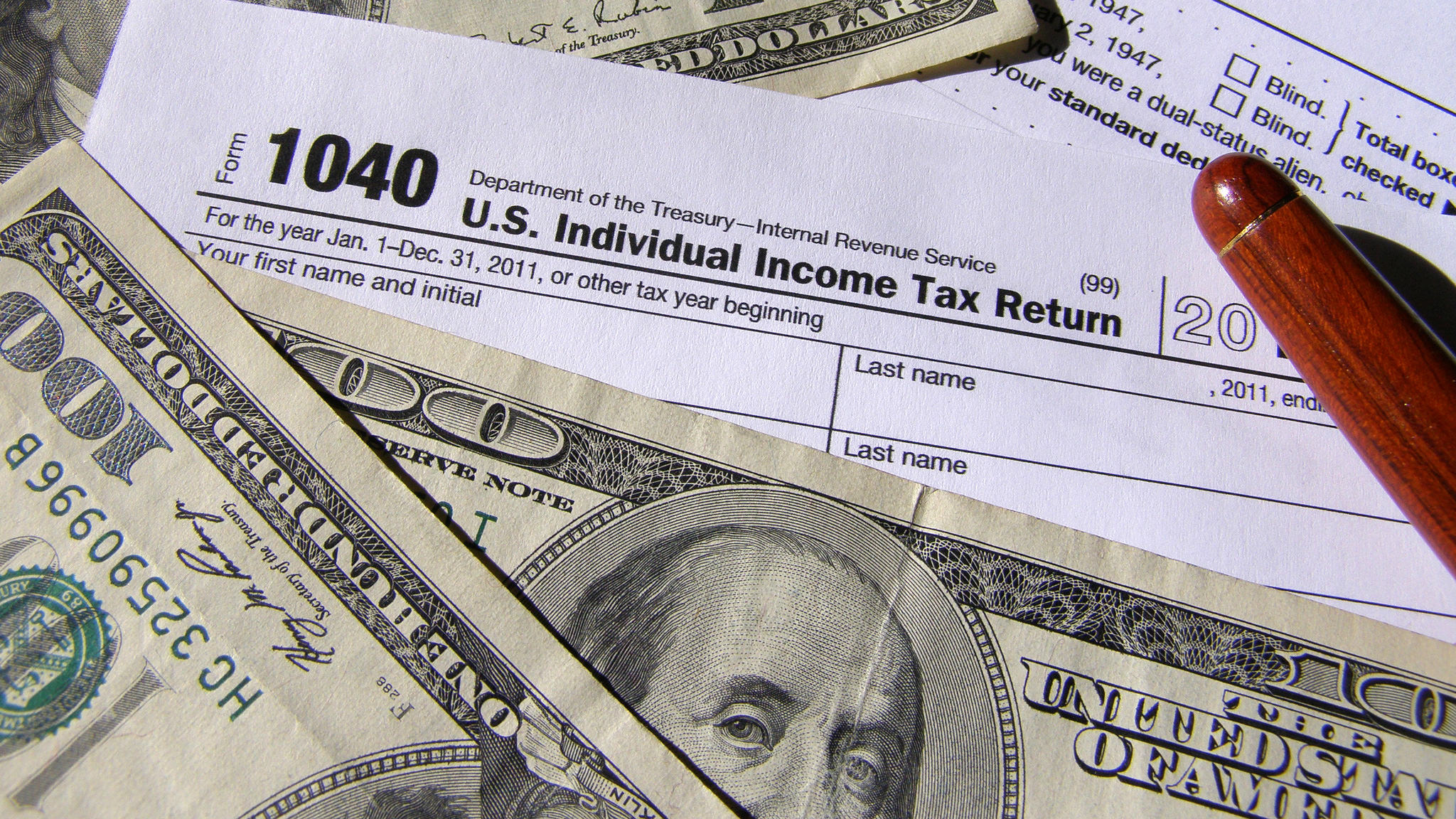

All qualifying capital improvements are tax deductible However you can t claim the deduction until you sell the home You cannot deduct the cost of a new gas furnace for your personal residence You can claim the fair market value of the heating oil as a charity donation as an itemized

Can You Claim Heating Oil On Your Taxes

Can You Claim Heating Oil On Your Taxes

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

What Can You Write Off On Your Taxes INFOGRAPHIC In 2020 Tax Help

https://i.pinimg.com/originals/6e/f1/74/6ef174dc57f9ba0101d63af337acbd3b.jpg

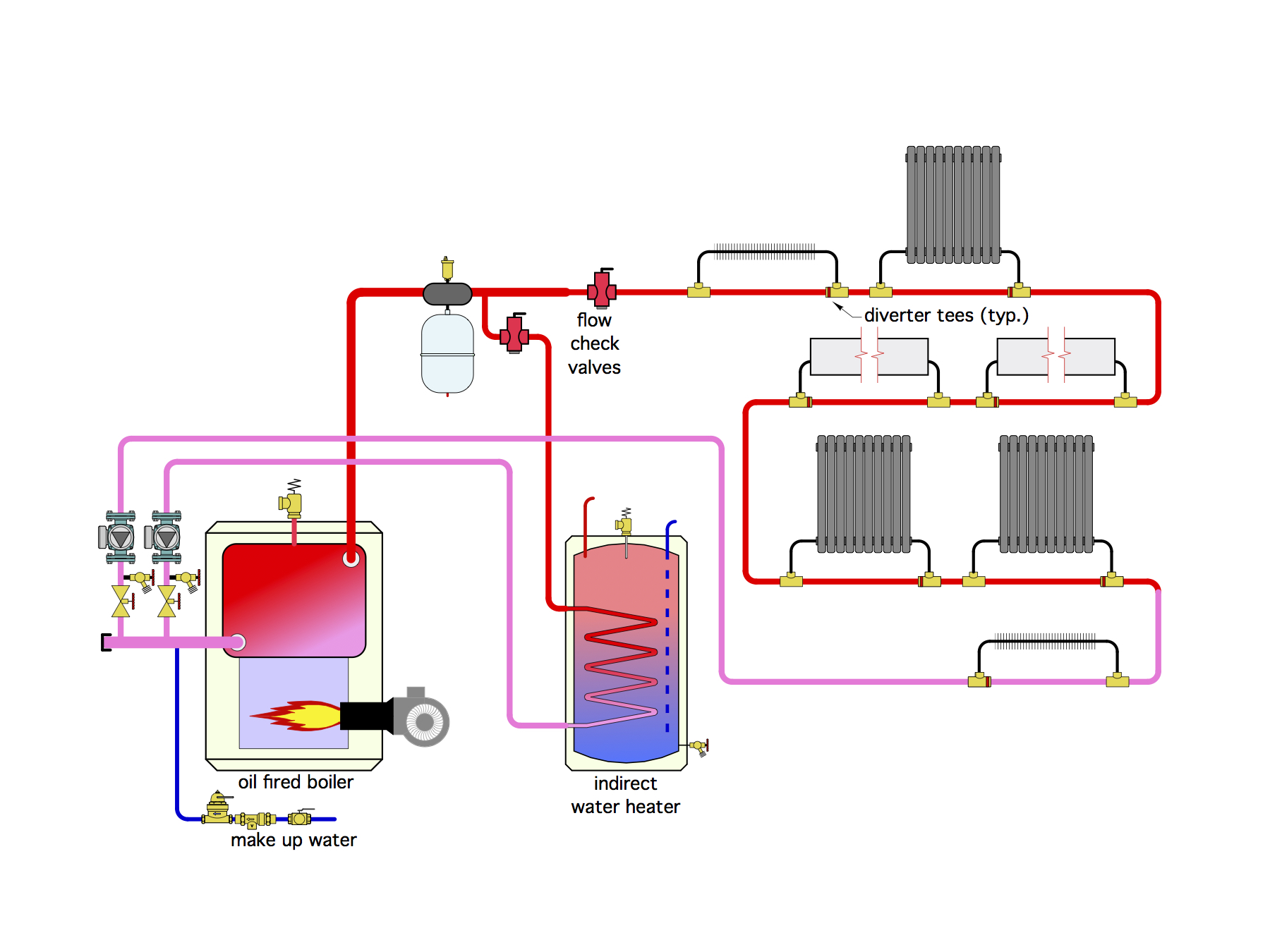

Gas Or Oil Heat Which Is Better To Heat Your Home

https://www.fuelsnap.com/blog/wp-content/uploads/2020/08/275v-oil-tank-2048x1536.jpg

Learn the steps for claiming an energy efficient home improvement tax credit for residential energy property Under the Energy Efficient Home Improvement Credit a taxpayer can claim the credit only for qualifying expenditures incurred for an existing home or for an addition to or

The federal government is offering tax incentives to homeowners and businesses who purchase brand new sustainable energy efficient appliances Homeowners who purchase Unlike some tax benefits you do not need to itemize deductions to claim this credit Whether you itemize or claim the standard deduction you can still qualify for the Energy Tax

Download Can You Claim Heating Oil On Your Taxes

More picture related to Can You Claim Heating Oil On Your Taxes

Can You Claim Your Elderly Parents On Your Taxes The TurboTax Blog

https://blog.turbotax.intuit.com/wp-content/uploads/2011/07/can-you-claim-elderly-parent-on-taxes.jpg?resize=1200,630

How To File Your Taxes Online For Free This 2022 Tax Season Cbs8

https://media.cbs8.com/assets/KFMB/images/3f1d4458-fe1c-489b-b369-0484501143be/3f1d4458-fe1c-489b-b369-0484501143be_1920x1080.jpg

Freelance Taxes 3 50 Deductions You ll Want To Take To Save Money

https://www.theblackandblue.com/wp-content/uploads/2013/04/freelance_filmmaker_taxes_deductions.jpg

Here s some good news The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying New legislation passed in 2022 will cover energy related tax credits and rebates starting in the 2023 tax year so we put together a list of some common home improvement and renewable

To sum up you can t claim for most household appliances on your tax return However there are still significant savings to be had if you make any of a wide range of The Residential Clean Energy Credit provides tax credits for the purchase of qualifying equipment including solar wind geothermal and fuel cell technology

17 Things You Can t Claim In Your Tax Return Platinum Accounting

https://uploads-ssl.webflow.com/63cf642db9b930dbbc59f679/64239dce7da9f063710a18d8_43 - 17 things you can_t claim in your tax return.jpg

Can You Claim Rent On Your Taxes

https://taxsaversonline.com/wp-content/uploads/2022/07/Can-You-Claim-Rent-On-Your-Taxes.jpg

https://www.taxslayer.com/blog/home-imp…

You are eligible to claim the Energy Efficient Home Improvement Credit if you are making qualifying home improvements on your primary residence not installations on a new build This credit is nonrefundable and

https://www.consumeraffairs.com/finance/what-home...

All qualifying capital improvements are tax deductible However you can t claim the deduction until you sell the home

What Is The Lowest Home Loan Interest Rate Of ICICI Bank Loan

17 Things You Can t Claim In Your Tax Return Platinum Accounting

Is Now The Best Time To Buy Heating Oil On Cape Cod Hall Oil

What Can You Claim On Your Taxes Personal Finance Blog And Self

Switching From Oil To Gas Central Heating System

5 Things You Can Claim On Your Taxes AnchorAndHopeSF

5 Things You Can Claim On Your Taxes AnchorAndHopeSF

How To Claim Oil Heating Rebate RECHARGUE YOUR LIFE

Heating Oil Prices Dorset Spendlessonfuel What Is Heating Oil

Can You Claim A Travel Trailer On Taxes Pocketsense

Can You Claim Heating Oil On Your Taxes - This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 Claim the credits using the IRS Form 5695 Who can use this credit