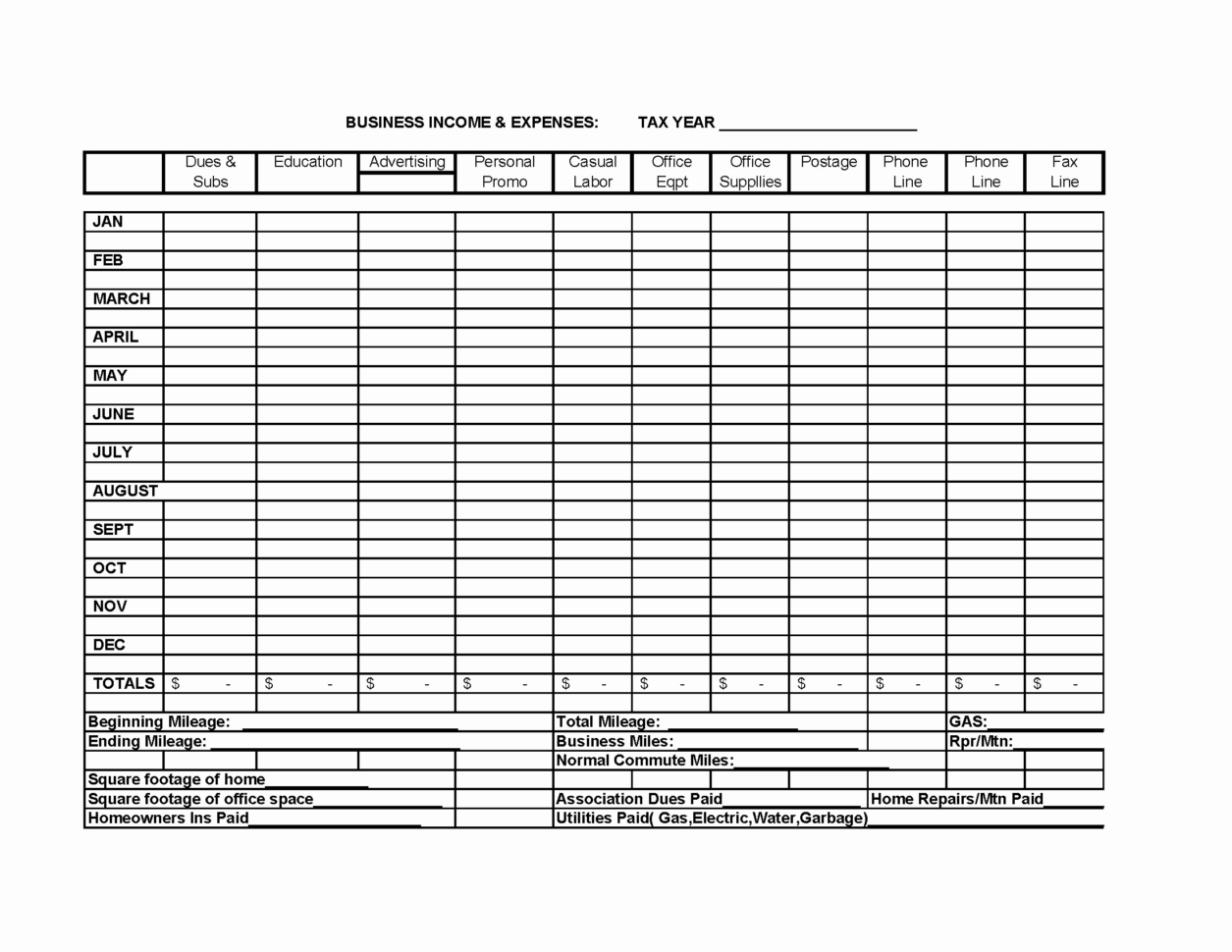

Can You Claim Home Office Expenses On Taxes You can deduct mortgage interest taxes maintenance and repairs insurance utilities and other expenses You can use Form 8829 to figure out the expenses you can deduct

If you do claim depreciation for your home office you may have a taxable gain when you sell your home Any gain or loss on the sale of the home may be both personal and business But the reality is not every taxpayer can claim the home office deduction So here s what you should know about the home office tax deduction before you file your 2024 tax

Can You Claim Home Office Expenses On Taxes

/cloudfront-us-east-1.images.arcpublishing.com/tgam/ORHPAY7LOZFBJL3FMRDCGN4X4A.jpg)

Can You Claim Home Office Expenses On Taxes

https://www.theglobeandmail.com/resizer/zy-YqTzG3xlviQty-n0CODbMhLg=/1200x801/filters:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/tgam/ORHPAY7LOZFBJL3FMRDCGN4X4A.jpg

Claim Medical Expenses On Your Taxes Health For CA

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

Claim Home Office Expenses Karis Tax

https://www.karistax.com.au/wp-content/uploads/2021/03/3.png

The home office deduction allows taxpayers who use a portion of their home for business purposes to deduct a portion of their home expenses on their tax return There are two methods to calculate this deduction the The regular method option allows you to claim a tax deduction based on the percentage of your home office square footage and home related expenses With this option you can claim

The IRS offers a Home Office Deduction for home office workers to claim expenses The amount of the deduction varies depending upon the amount of space the home office The home office deduction allows some filers to claim a tax break for expenses incurred working remotely If you were a W 2 employee in 2024 meaning your company withholds taxes from your

Download Can You Claim Home Office Expenses On Taxes

More picture related to Can You Claim Home Office Expenses On Taxes

HOW TO CLAIM HOME OFFICE EXPENSES HOME OFFICE RULES

https://moneyworldbasics.com/wp-content/uploads/2021/01/How-to-Claim-Home-Office-Expenses-For-Employees-1024x565.jpg

Accountant Shares What You Can Do To Try And Claim Home Office Expenses

https://pittsburgh.cbslocal.com/wp-content/uploads/sites/15909642/2020/08/desk.jpg?w=1024

Business Expenses What Can You Claim

https://www.uhyhn.co.nz/wp-content/uploads/2016/04/Business-expenses-pic.jpg

If you work from home you may be able to claim a tax deduction for home office expenses Learn the qualifications to claim the home office tax deduction The home office deduction is a tax incentive that allows small business owners and self employed individuals to deduct some home expenses from their taxes if a part of the

If you had 10 000 in eligible home related expenses you could claim up to 2 500 in deductions There isn t a limit on how much you can deduct In this comprehensive guide we ll walk you through the intricacies of calculating the home office deduction help you navigate the eligibility criteria and give you tips on how to

The Best Method To Claim Home Office Expenses On Your Tax Return In

https://i.ytimg.com/vi/1UlPrheeWSA/maxresdefault.jpg

How To Claim Home Office Utility Expenses On Taxes Liu Associates

https://www.liuandassociates.com/wp-content/uploads/2021/03/work-from-home-employed.jpg

/cloudfront-us-east-1.images.arcpublishing.com/tgam/ORHPAY7LOZFBJL3FMRDCGN4X4A.jpg?w=186)

https://www.nerdwallet.com › article › taxe…

You can deduct mortgage interest taxes maintenance and repairs insurance utilities and other expenses You can use Form 8829 to figure out the expenses you can deduct

https://www.irs.gov › pub › irs-regs

If you do claim depreciation for your home office you may have a taxable gain when you sell your home Any gain or loss on the sale of the home may be both personal and business

Here s How You Can Claim TAX On A Home Office

The Best Method To Claim Home Office Expenses On Your Tax Return In

Everything You Need To Know About Claiming Home Office Expenses On Your

Home Office Expenses The Essential Guide BOX Advisory Services

Home Office Expenses Are You Missing Out On Valuable Tax Deductions

Tax Return Should I Claim 400 Or 3 000 For Home Office Expenses For

Tax Return Should I Claim 400 Or 3 000 For Home Office Expenses For

Small Business Tax Spreadsheet Template Fresh Sample Expense Report

How To Create A Simple Expenses Claim Form Template Free Sample

Can I Claim Medical Expenses On My Taxes TMD Accounting

Can You Claim Home Office Expenses On Taxes - The home office deduction lets you deduct a portion of your home expenses to reduce your business taxes owed You can use the home office deduction whether you own