Can You Claim House Interest On Taxes However taxpayers can only deduct mortgage interest if they itemize deductions This means you cannot claim the standard deduction and deduct mortgage interest in the same tax year Is

Eligible homeowners can claim the mortgage interest tax deduction on Schedule A of their annual tax returns Schedule A accompanies Form 1040 or 1040 SR a simplified 1040 for seniors The total deduction allowed for all state and local taxes for example real property taxes personal property taxes and income taxes or sales taxes is limited to 10 000 or 5 000 if married filing separately

Can You Claim House Interest On Taxes

Can You Claim House Interest On Taxes

https://images.ratecity.com.au/large/20210701/can-i-get-a-second-mortgage-for-a-rental-property-wpzVdYYus.jpg?width=3840

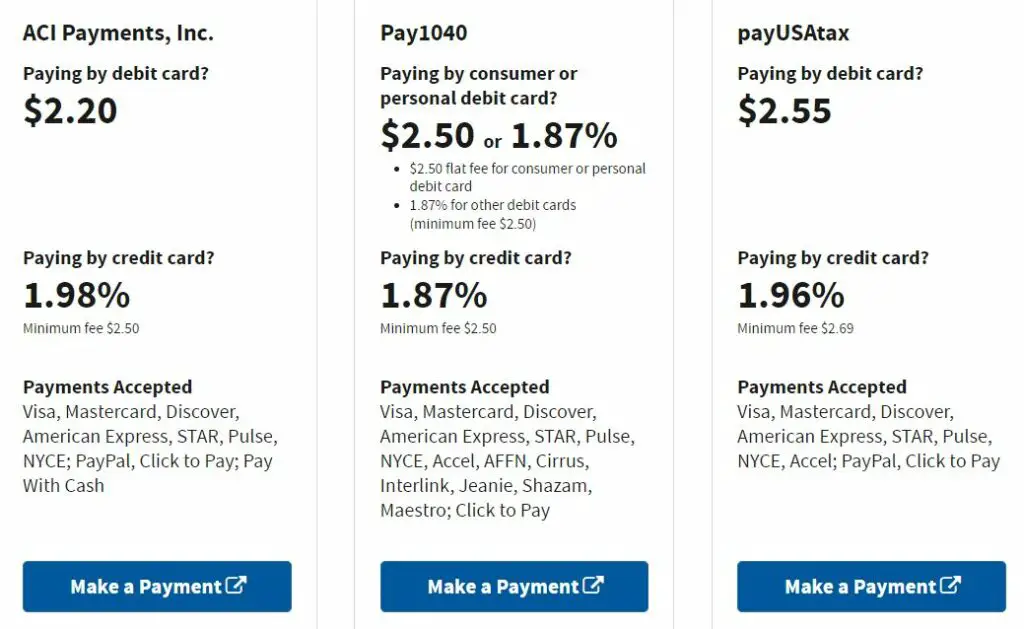

How To Make Tax Payments With Credit Card And Profit Navigating

https://mymoneyplanet.com/wp-content/uploads/2021/08/IRS-Pay-with-credit-card-1024x629.jpg

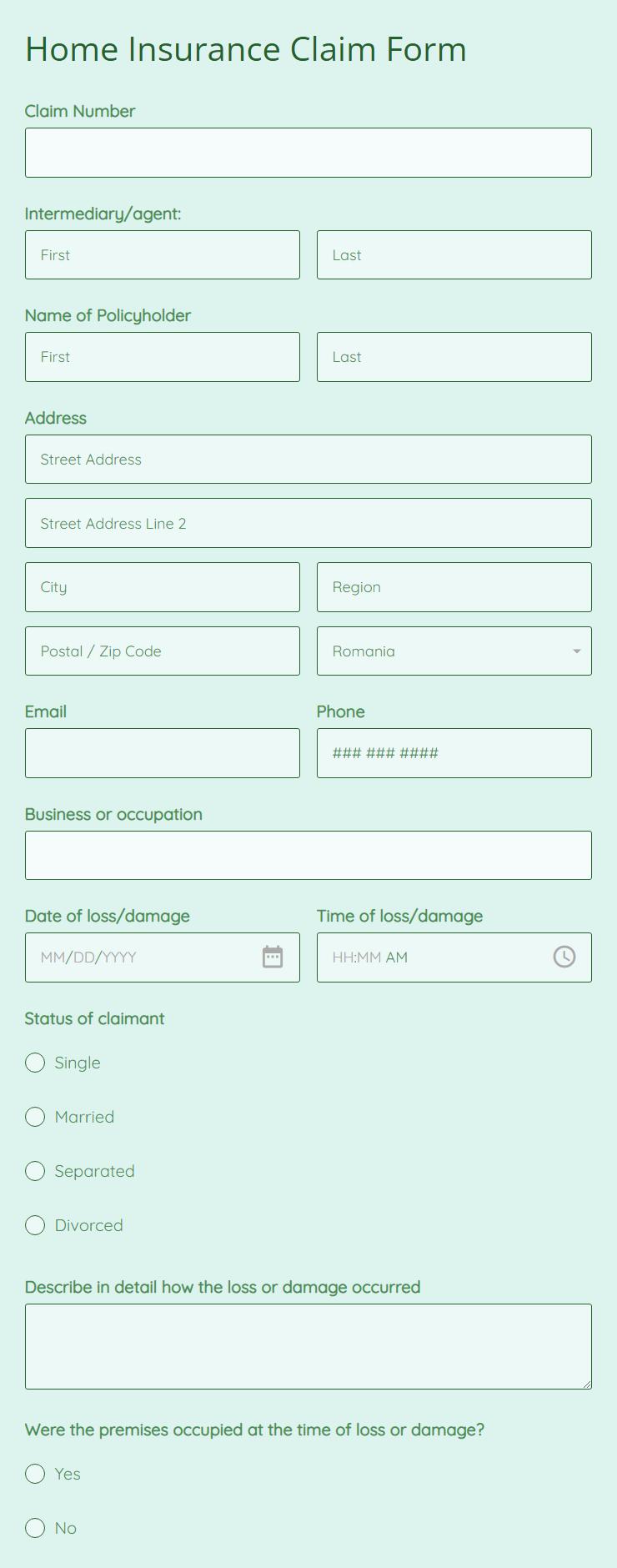

Can You Claim Home Improvements On Your Taxes CountyOffice YouTube

https://i.ytimg.com/vi/Kt1oSzozBIc/maxresdefault.jpg

You can take a mortgage interest tax deduction for tax year 2023 if you paid mortgage interest for a home that is your principal or second residence The interest you pay on a qualified mortgage or home equity loan is deductible on your federal tax return but only if you itemize your deductions and follow IRS guidelines For many taxpayers the standard deduction beats

When you file taxes you can take the standard deduction or the itemized deduction In 2022 the standard deduction is 25 900 for married couples filing jointly and As a taxpayer you can fully deduct most interest paid on home mortgages if all the Internal Revenue Service s IRS requirements are met You must separate qualified mortgage interest from personal interest Mortgage interest is usually

Download Can You Claim House Interest On Taxes

More picture related to Can You Claim House Interest On Taxes

Can You Deduct Attorney Fees On Tax Returns West Law Office

https://s3.amazonaws.com/law-media/uploads/83/24997/large/file5731302982029.jpg?1454989657

How To Paint A House Faster And Easier House Painting House Painting

https://i.pinimg.com/originals/3d/de/00/3dde0054c4740c104e9d839c9da5a77e.jpg

Can You Claim Assisted Living Expenses On Taxes CountyOffice

https://i.ytimg.com/vi/unnH6kH01lw/maxresdefault.jpg

You can deduct mortgage interest property taxes and other expenses up to specific limits if you itemize deductions on your tax return You can usually deduct the interest you pay on a mortgage for your main home or a second home but there are some restrictions The maximum amount of debt eligible for the

You can claim a tax deduction for the interest on the first 750 000 of your mortgage 375 000 if married filing separately HELOCs are no longer eligible for the deduction unless The IRS lets you deduct your mortgage interest but only if you itemize deductions You can t deduct the principal the borrowed money you re paying back In addition to itemizing these

Working From Home What Can You Claim And How Do You Claim It Public

https://www.publicaccountant.com.au/images/tax_consultant_.jpeg

What Is The Lowest Home Loan Interest Rate Of ICICI Bank Loan

https://i.pinimg.com/originals/dc/45/1c/dc451c5ee2402e565220ad229b19376b.png

https://www.kiplinger.com › taxes › mortg…

However taxpayers can only deduct mortgage interest if they itemize deductions This means you cannot claim the standard deduction and deduct mortgage interest in the same tax year Is

https://www.forbes.com › advisor › mortga…

Eligible homeowners can claim the mortgage interest tax deduction on Schedule A of their annual tax returns Schedule A accompanies Form 1040 or 1040 SR a simplified 1040 for seniors

17 Things You Can t Claim In Your Tax Return Platinum Accounting

Working From Home What Can You Claim And How Do You Claim It Public

Can You Claim Tax Benefit On Home Loan And HRA At The Same Time When

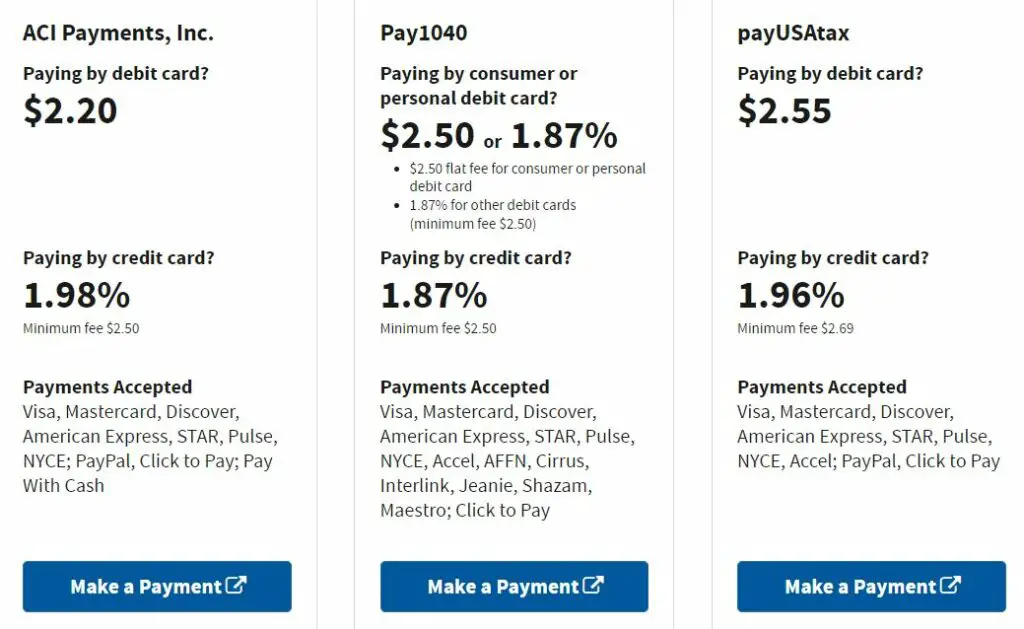

Home Insurance Claim Form Template 123FormBuilder

How Do You Claim House Construction Costs Mint

Can You Claim Tax Relief For Working From Home YouTube

Can You Claim Tax Relief For Working From Home YouTube

The Deductions You Can Claim Hra Tax Vrogue

Can You Claim Asphalt Driveway Costs On Your Tax Return NK

Mistakes To Avoid When Claiming Work From Home Tax Deductions Work

Can You Claim House Interest On Taxes - The interest you pay on a qualified mortgage or home equity loan is deductible on your federal tax return but only if you itemize your deductions and follow IRS guidelines For many taxpayers the standard deduction beats