Can You Claim Laundry On Tax Use this list to check if you can claim a fixed amount of tax relief also known as flat rate expenses for your work expenses if you re an employee

If your laundry expenses pass the wholly exclusively and necessarily test you can claim self employed expenses You do this when you do your Self Assessment tax return In the 2024 25 tax year the flat rate expense for uniform is 60 so If you earn up to 50 270 you can claim 20 of that 60 back If you earn over 50 270 you can OVERVIEW If you have to buy a smart new suit for your paralegal job or uniforms for your National Guard duties it might seem these are obvious work expenses and valid tax deductions Not necessarily according to

Can You Claim Laundry On Tax

Can You Claim Laundry On Tax

https://i.ytimg.com/vi/yHJtKlvuvaY/maxresdefault.jpg

Tax Return How To Claim Laundry Education And Super Contributions

https://content.api.news/v3/images/bin/c0d7e4b67b4c361252548d2b83a7cdd2

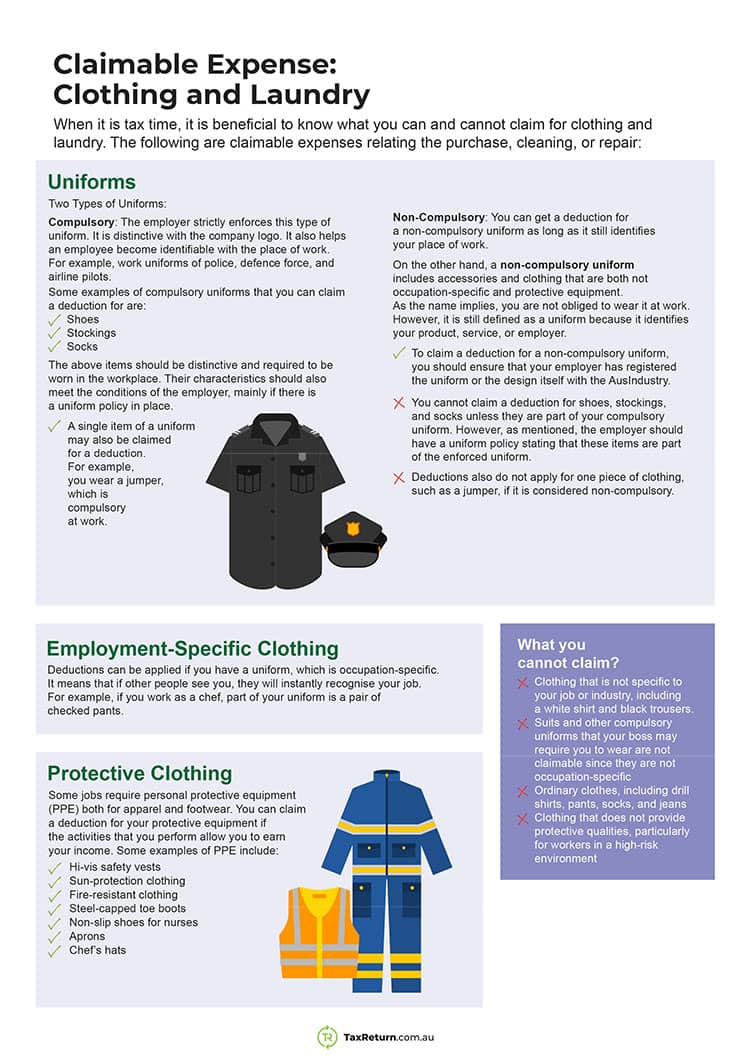

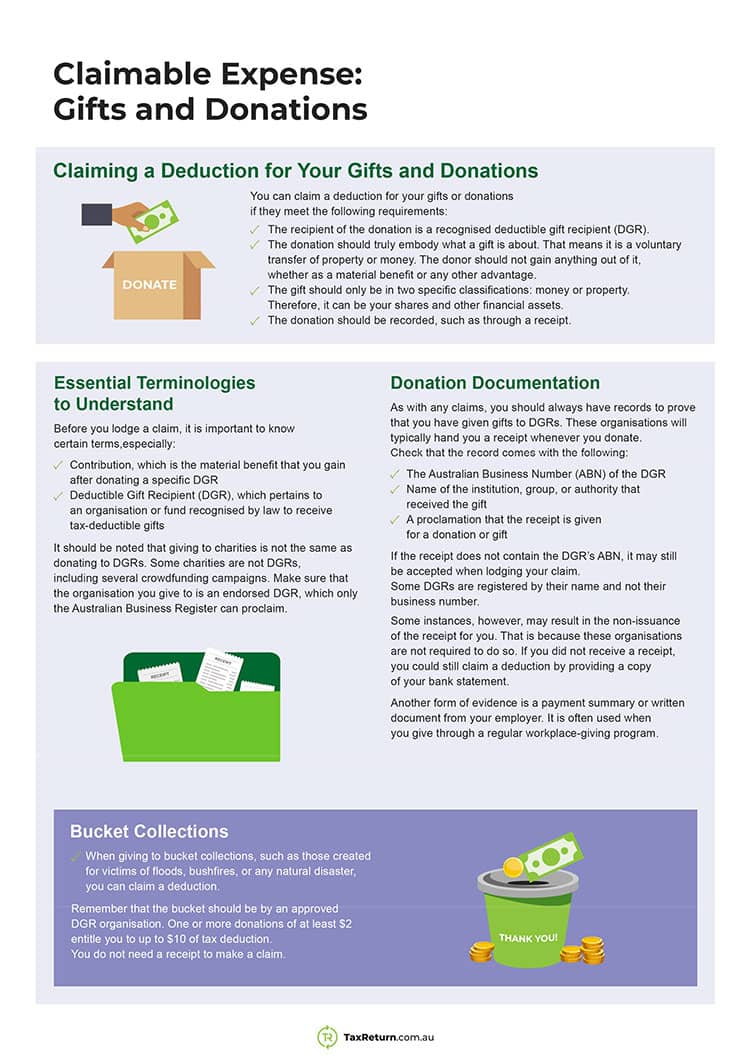

Claimable Expenses What You Can Claim On Your Tax Return

https://www.taxreturn.com.au/wp-content/uploads/2021/02/claimable-expenses-clothing-laundry-tax.jpg

You cannot claim tax relief for the initial cost of buying clothing for work cleaning repairing or replacing everyday clothing you wear for work even if you must wear a certain design You can t claim a deduction for the cost of buying hiring repairing or cleaning conventional clothing you bought to wear for work such as black trousers and a white shirt or suit even if your employer says this is compulsory or

You can t claim You can t claim a deduction for the cost of purchasing or cleaning clothes you bought to wear for work that are not specific to your occupation such as black trousers and a white shirt or a suit even if your employer says this is compulsory If you re planning to claim back tax with regard to laundry costs it must be the case that wearing your uniform in the first place is a necessity If you re employed you can make your claim yourself using form P87

Download Can You Claim Laundry On Tax

More picture related to Can You Claim Laundry On Tax

.png)

Clothing And Laundry Deductions TaxSmart Cafe

https://rest.siteplus.com/filestorage-api-service/68810f1cc4043d7c3d968e21518060d1/20210308-clothing-and-laundry-page1(2).png

Clothing And Laundry Deductions TaxSmart Cafe

https://rest.siteplus.com/filestorage-api-service/81fd8b55180b7d7bf39b71eeedd8910d/20210308-clothing-and-laundry-page2.png

Tax Deductions Claimed Without Receipts ATO Proven 2023

https://www.wattleaccountants.com.au/wp-content/uploads/2021/10/Laundry-Expenses.png

Clothing is one of the more contested tax deductions and it tends to get rejected a lot But this doesn t mean you should avoid deducting work related clothing expenses on your tax return altogether Here s an overview of the clothing purchases that can and can t be deducted as a business expense If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 100s of tax for up to five years of expenses You can reclaim whether it s just a branded T shirt or if you re a fully uniformed pilot police officer or nurse

Eligible pieces of clothing can be claimed alongside your other deductible expenses on Schedule C of your tax return You have to be self employed to write off your work clothes If you re a regular W 2 employee you ll either have to swallow the cost of any uniforms or have your employer reimburse you for it The amount you can claim as part of the laundry expense tax rebate depends on the type of clothing you re seeking to claim for and your industry s norms It s crucial to keep accurate records of your expenses including receipts and invoices to ensure your claim s legitimacy

What Can You Claim Tax Return Advice From Just Done Accountants

https://justdone.com.au/wp-content/uploads/2017/05/What-to-claim_JD.png

Think Twice Before Claiming Your Laundry As A Tax Deduction Finder

https://www.finder.com.au/finder-au/wp-uploads/2017/07/laundry-738.jpg?fit=600

https://www.gov.uk/guidance/job-expenses-for...

Use this list to check if you can claim a fixed amount of tax relief also known as flat rate expenses for your work expenses if you re an employee

https://taxscouts.com/expenses/how-much-can-i...

If your laundry expenses pass the wholly exclusively and necessarily test you can claim self employed expenses You do this when you do your Self Assessment tax return In the 2024 25 tax year the flat rate expense for uniform is 60 so If you earn up to 50 270 you can claim 20 of that 60 back If you earn over 50 270 you can

How Much Can You Claim For Laundry And Clothing Visory

What Can You Claim Tax Return Advice From Just Done Accountants

How Much Can I Claim For Laundry Expenses self employed TaxScouts

ATO Targeting False Laundry Claims Muntz Partners Business Taxation

Ministers Can Claim 3 500 Tax Refund For Laundry Expenses

False Laundry Claims ATO Targets This Tax Time Taxwise Australia

False Laundry Claims ATO Targets This Tax Time Taxwise Australia

Deductions To Claim On Your Tax Return Affordable Bookkeeping Payroll

Claimable Expenses What You Can Claim On Your Tax Return

ATO Crackdown On Work Related Clothing Laundry Claims

Can You Claim Laundry On Tax - If you re planning to claim back tax with regard to laundry costs it must be the case that wearing your uniform in the first place is a necessity If you re employed you can make your claim yourself using form P87