Can You Claim Medical Expenses And Disability Tax Credit Canada You made a claim for medical expenses on line 33200 of your tax return Step 5 Federal tax or for the disability supports deduction on line 21500 of your tax return You were

133 rowsYou can claim eligible medical expenses on line 33099 or line 33199 of your For many allowable medical expenses a Disability Certificate as prescribed by the Act is not necessary but for those claiming an expense for attendant care

Can You Claim Medical Expenses And Disability Tax Credit Canada

Can You Claim Medical Expenses And Disability Tax Credit Canada

https://www.connectedinmotion.ca/wp-content/uploads/2022/09/CIM-Blog-DisabilityTaxCredit-05734.jpg

How Do I Qualify For Disability Tax Credit Canada Benefit Flickr

https://live.staticflickr.com/65535/48688950758_b25f95591e_b.jpg

How To Get The Most Out Of Your Medical Expenses Elite Tax

http://elitetax.ca/wp-content/uploads/2016/12/AdobeStock_117273938.jpeg

The disability tax credit DTC reduces taxes you owe but does not generate a refund You have to apply for the DTC with a medical practitioner s approval The DTC can be claimed for yourself or others What are the Disability Tax Credit Eligibility Criteria How to Determine Your Eligibility for the Disability Tax Credit The 3 Main Impairment Categories That Determine the DTC

Unlike the disability tax credit and the medical expense tax credit where certain support people may claim the tax credit the disability supports deduction may be claimed only by the eligible individual You should usually claim the total medical expenses for both you and your spouse or common law partner on one tax return because the reduction of 3 of net income will

Download Can You Claim Medical Expenses And Disability Tax Credit Canada

More picture related to Can You Claim Medical Expenses And Disability Tax Credit Canada

Disability Tax Credit Canada Benefit Group 252 5475 Pare S Flickr

https://live.staticflickr.com/65535/48689288926_5880759386_b.jpg

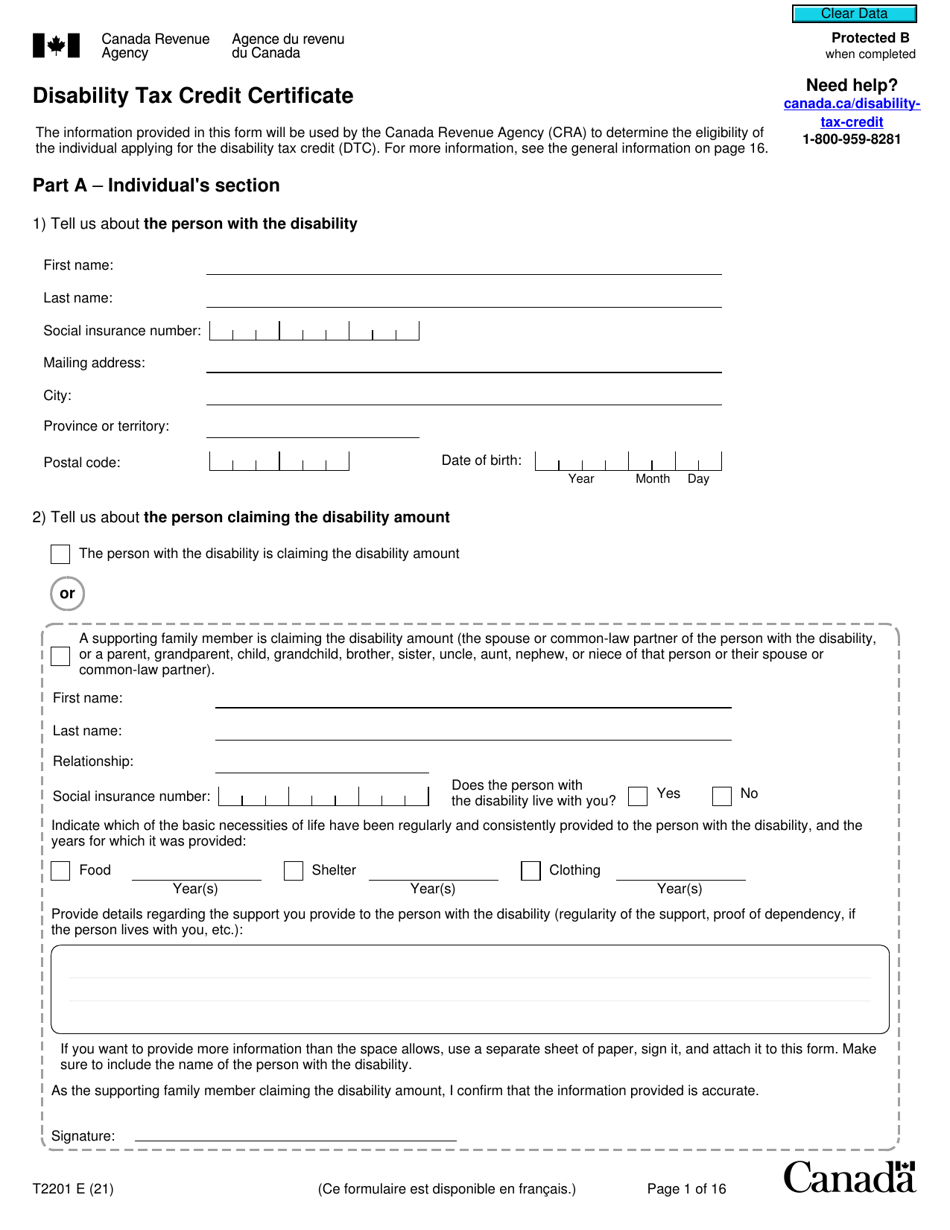

Canada Revenue Agency Disability Tax Credit Certificate Juno EMR

https://s3.amazonaws.com/cdn.freshdesk.com/data/helpdesk/attachments/production/3049889170/original/NnigIk_1bak59pK4tA6K03NB9Vnu-k0CiA.png?1577749338

Claim Medical Expenses On Your Taxes Health For CA

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/04xx.jpeg

Disability Medical Expenses In addition to the DTC you re also able to claim medical expenses for certain medicines devices and treatments This includes expenses If you are a person with a disability or you support someone with a disability you may be able to claim on your income tax and benefit return the deductions and tax

This is the Ultimate 2024 Disability Tax Credit Handbook Guide Your Go To Resource for the Latest Regulations on Applying Eligibility Form T2201 and Claiming the Credit Exciting news If you claimed medical expenses on line 33200 or the disability supports deduction on line 21500 on your return you may be eligible for the medical expense

Canadian Disability Tax Credit Application Information

https://ekbasipym5m.exactdn.com/wp-content/uploads/disability-tax-credit-for-parkinson.jpg

When Can You Claim Medical Expenses On Your Tax Return Objective

https://i0.wp.com/objectivefinancialpartners.com/wp-content/uploads/2022/04/medical-expenses-on-tax-return-canada-900x550-1.jpg?fit=1000%2C611&ssl=1

https://www.canada.ca/en/revenue-agency/services...

You made a claim for medical expenses on line 33200 of your tax return Step 5 Federal tax or for the disability supports deduction on line 21500 of your tax return You were

https://www.canada.ca/en/revenue-agency/services...

133 rowsYou can claim eligible medical expenses on line 33099 or line 33199 of your

With The Participation Of Canada The Canadian Film Of Video Production

Canadian Disability Tax Credit Application Information

Tax Deductions On Medical Expenses One Click Life

Are Medical Expenses Tax Deductible Canada 27F Chilean Way

New Resource A Practitioner s Guide To The Disability Tax Credit DABC

A Guide On Health Insurance Claim Process HDFC Sales Blog

A Guide On Health Insurance Claim Process HDFC Sales Blog

Disability Tax Credit For Canadians YouTube

Form T2201 Download Fillable PDF Or Fill Online Disability Tax Credit

Can You Claim Medical Expenses On Tax

Can You Claim Medical Expenses And Disability Tax Credit Canada - Many obvious and not so obvious medical expenses can be claimed under the Medical Expense Tax Credit METC Getting into the habit of collecting health