Can You Claim Medical Expenses And Disability Tax Credit If the medical practitioner charged a fee for completing the DTC application or for providing information you may be able to claim the fee as medical expense on lines 33099 or

To make it easier to understand and calculate the approximate disability tax credits you are eligible for you can follow the formula below An eligible adult can receive a total of 1 500 2 500 per The disability tax credit DTC reduces taxes you owe but does not generate a refund You have to apply for the DTC with a medical practitioner s

Can You Claim Medical Expenses And Disability Tax Credit

Can You Claim Medical Expenses And Disability Tax Credit

https://www.cleantechloops.com/wp-content/uploads/2021/08/tax-evasion.jpg

All You Need To Know About Claiming Medical Expenses On Your Personal

https://www.dmtax.ca/wp-content/uploads/2022/12/medical-expenses.jpg

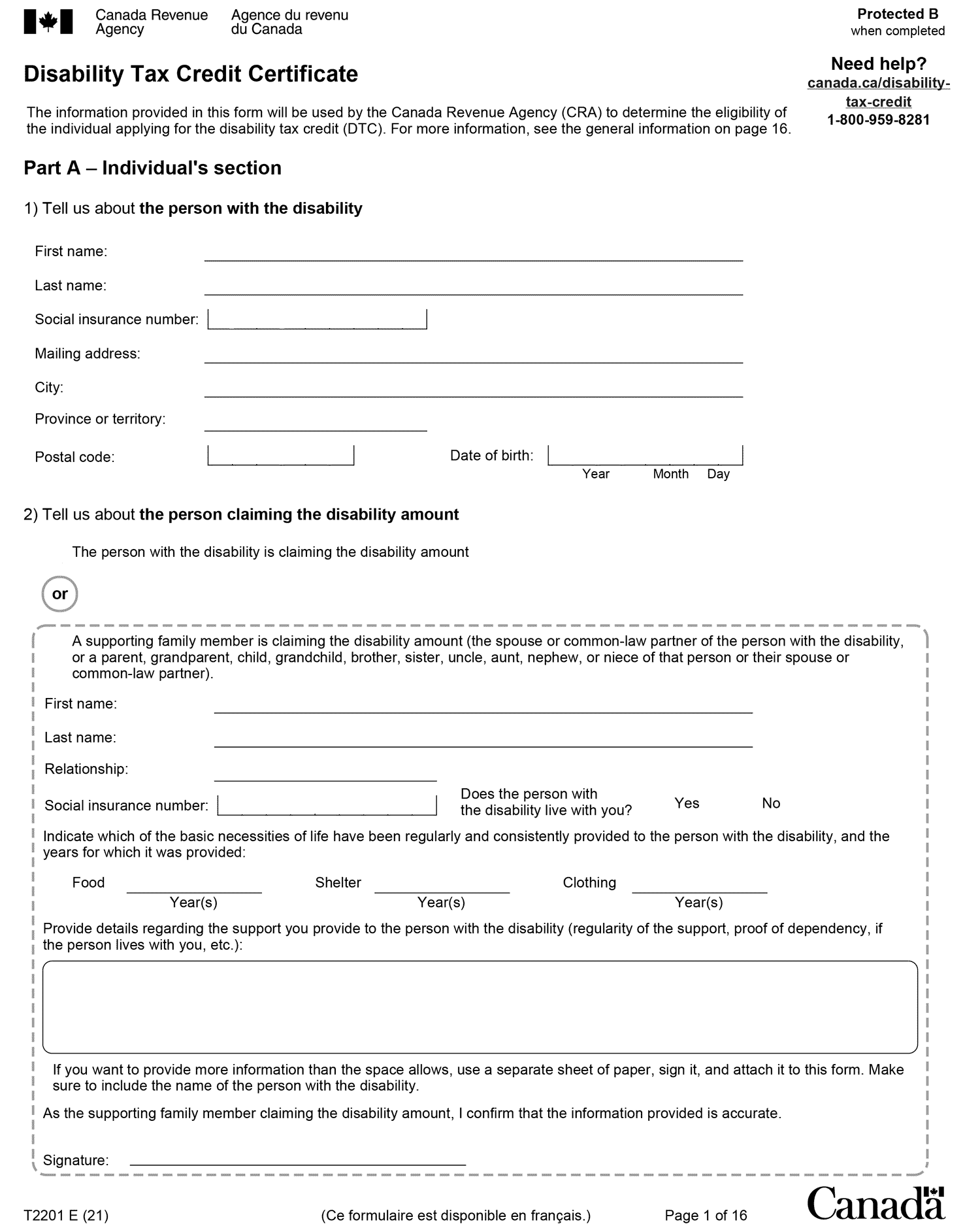

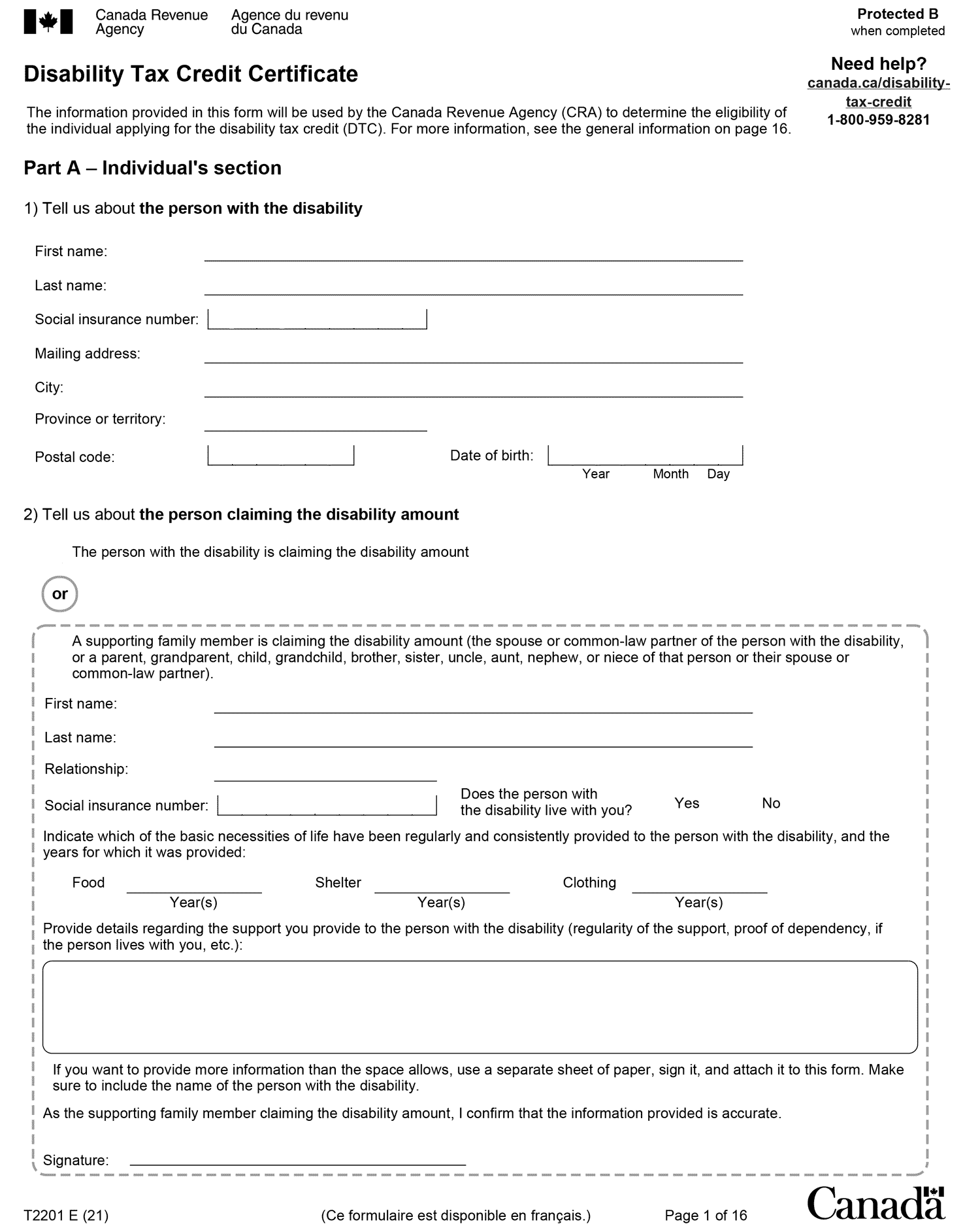

2017 Disability Tax Credit Guide T2201 Form Eligibility Child

https://disabilitycreditcanada.com/wp-content/uploads/2017_Disability_Tax_Credit_Guide.jpg

What are the Disability Tax Credit Eligibility Criteria How to Determine Your Eligibility for the Disability Tax Credit The 3 Main Impairment Categories That Determine the DTC Credit for the Elderly or Disabled You may be able to claim this credit if you are 65 or older or if you are under 65 and you retired on permanent and total disability See IRS

You may be eligible for certain tax credits such as disability tax credits caregiver tax credits or medical expense credits including for medical cannabis While applying for or claiming tax credits may feel a little Disability Medical Expenses In addition to the DTC you re also able to claim medical expenses for certain medicines devices and treatments This includes expenses

Download Can You Claim Medical Expenses And Disability Tax Credit

More picture related to Can You Claim Medical Expenses And Disability Tax Credit

How To Get The Most Out Of Your Medical Expenses Elite Tax

https://elitetax.ca/wp-content/uploads/2016/12/AdobeStock_117273938.jpeg

Claim Medical Expenses On Your Taxes Health For CA

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/04xx.jpeg

Can You Claim Medical Expenses On Taxes Sapling

https://img.saplingcdn.com/640/photos.demandstudios.com/getty/article/217/16/162441921.jpg

You made a claim for medical expenses on line 33200 of your tax return Step 5 Federal tax or for the disability supports deduction on line 21500 of your tax return You were This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and

Medical Expenses Seniors can claim the total eligible medical expenses and disability services paid for them a spouse or common law partner or the senior s spouse s or Option 1 Claim the disability tax credit and claim attendant care expenses as medical expenses to a maximum of 10 000 per year and 20 000 in the year of death Any

TCS Health Insurance Hospitalisation Claim Reimbursement Guidelines

https://image.isu.pub/201206163643-168d62aae50c453c7345f15b084c9154/jpg/page_1.jpg

Registered Disability Savings Plan And Disability Tax Credit YouTube

https://i.ytimg.com/vi/OFiuuYvhuxM/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGBMgOCh_MA8=&rs=AOn4CLDF-PR0M0TSuxd4VCTt4nfjPM639A

https://www.canada.ca/.../disability-tax-credit/claiming-dtc.html

If the medical practitioner charged a fee for completing the DTC application or for providing information you may be able to claim the fee as medical expense on lines 33099 or

https://disabilitycreditcanada.com/disa…

To make it easier to understand and calculate the approximate disability tax credits you are eligible for you can follow the formula below An eligible adult can receive a total of 1 500 2 500 per

20 Medical Expenses You Didn t Know You Could Deduct ZAMONA

TCS Health Insurance Hospitalisation Claim Reimbursement Guidelines

The Disability Tax Credit Infographic

Tax Deductions On Medical Expenses One Click Life

You May Be Able To Claim Medical Expenses On Your Tax Return Greater

Disability Tax Credit Certificate The Oscar Galaxy

Disability Tax Credit Certificate The Oscar Galaxy

New Resource A Practitioner s Guide To The Disability Tax Credit DABC

A Guide On Health Insurance Claim Process HDFC Sales Blog

Disability Tax Credit Application Help Hospice Quinte

Can You Claim Medical Expenses And Disability Tax Credit - This means that if you ve had medical expenses related to your child s disability in previous tax years but perhaps didn t know about the tax benefits you could