Can You Claim Mileage On Taxes For Doordash Working with DoorDash Tax deductions to know about As an independent contractor you re eligible for special deductions If you use a personal car for dashing you can choose one of two methods to claim a deduction

If you have not used Everlance to track your mileage DoorDash will send mileage information during tax season only Please click here to learn more on how mileage was sent to Dashers for the 2021 tax year Sign up The good news is you can write off your DoorDash mileage from your taxes The IRS provides a few ways to deduct mileage expenses Keep reading to learn which one is best for you In this article we explain what

Can You Claim Mileage On Taxes For Doordash

Can You Claim Mileage On Taxes For Doordash

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110c7808a1a34e392da06a0_610f13719242da6fd79cc8b1_MileIQ-vs-paper-mileage-log-1.jpeg

![]()

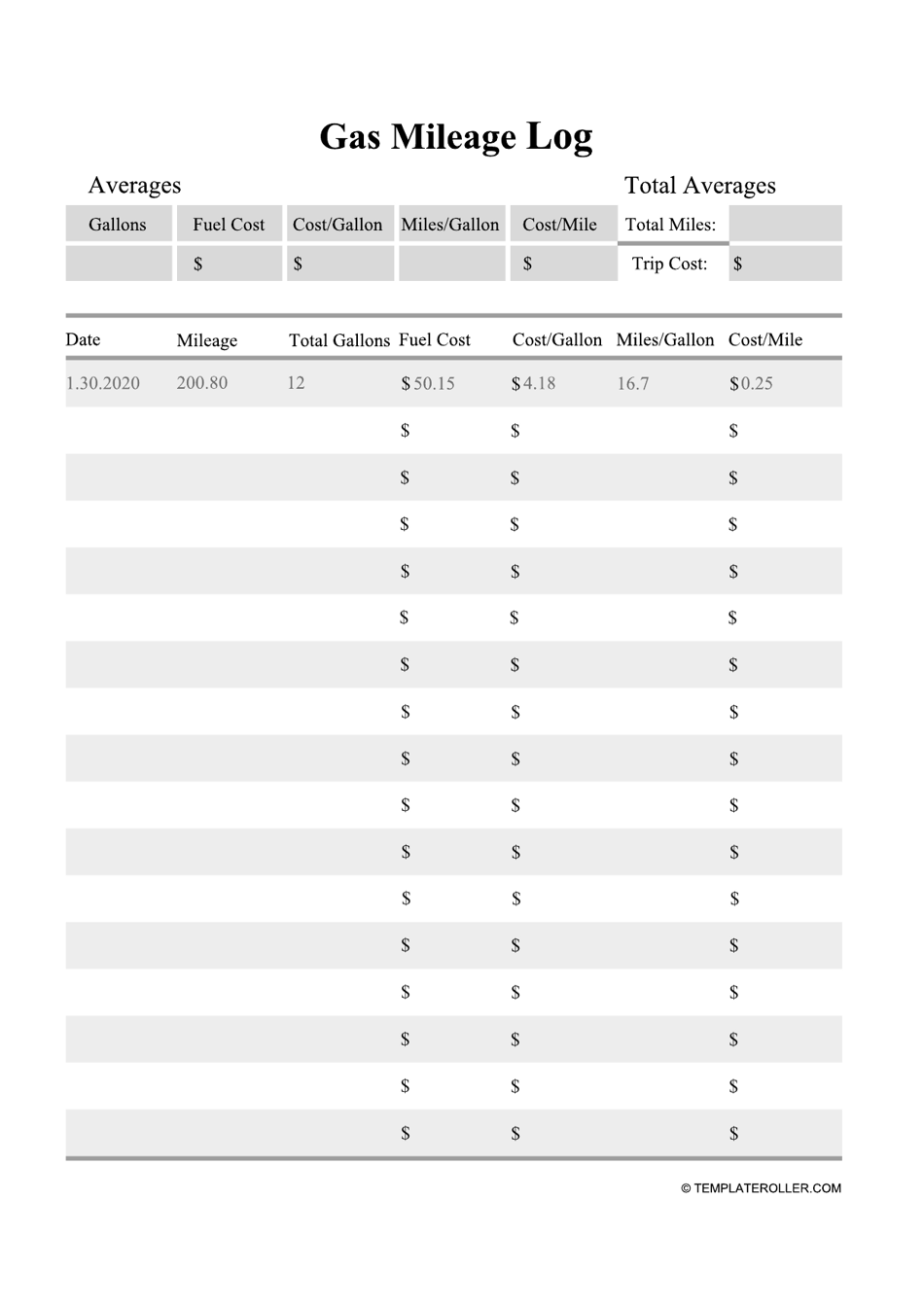

25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes

https://wssufoundation.org/wp-content/uploads/2020/11/25-printable-irs-mileage-tracking-templates-gofar-mileage-log-for-taxes-template-excel-768x543.jpg

Doordash Is Considered Self Employment Here s How To Do Taxes Stride

https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/bea1cd88-6aec-4981-a2c0-962d82b5638a/screencapture-irs-gov-pub-irs-pdf-f1099nec-pdf-2022-01-10-13_48_46.jpg

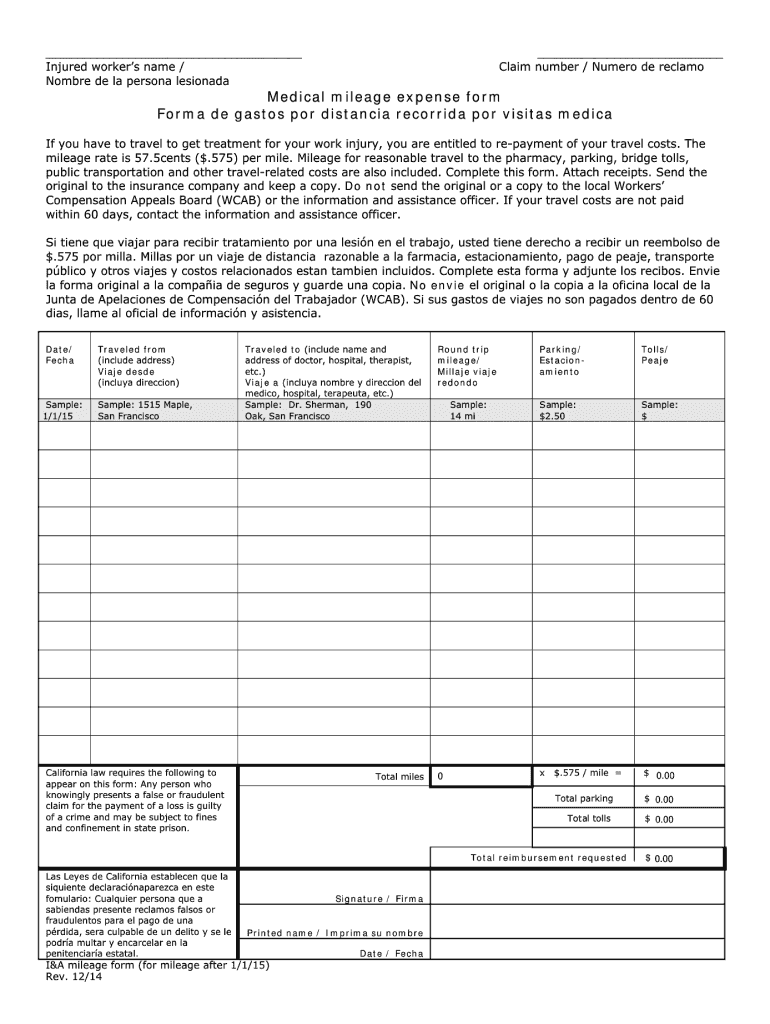

It s true Taxes are tricky to put it mildly It s impossible for any one article to help you know exactly what to expect This is why we have an entire series of articles on You can claim the business use percentage of the actual cost of driving for Doordash or a flat rate per mile For the 2023 tax year the standard mileage allowance is 65 5 cents per mile The IRS did not

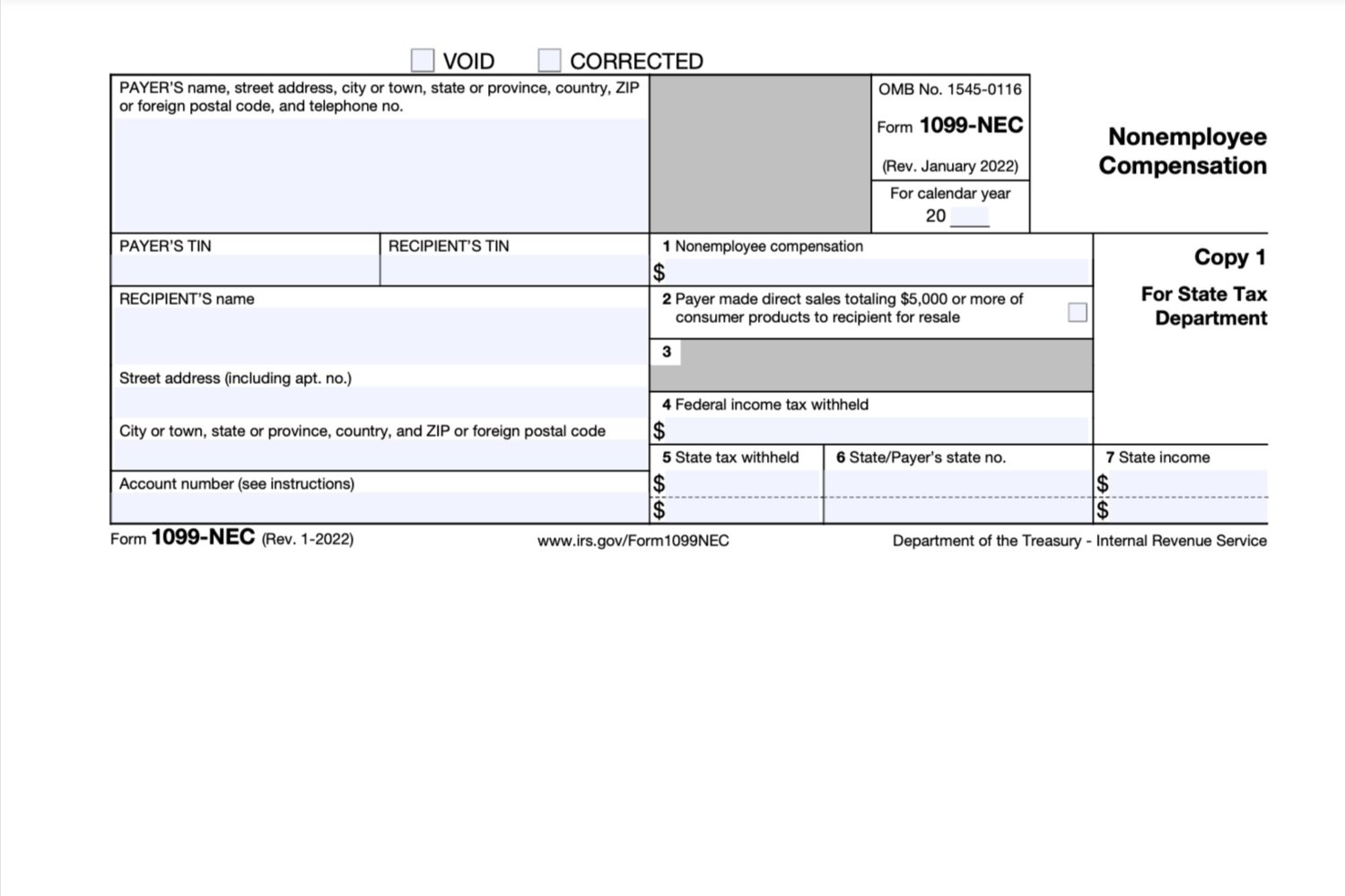

Claim now Everything You Need To Know About Doordash Taxes Working as a delivery driver is a gig that has a lot of perks You can set your hours and schedule based on Gross earnings from DoorDash will be listed on tax form 1099 NEC also just called a 1099 as nonemployee compensation This is the reported income a Dasher will use to file their taxes and what is

Download Can You Claim Mileage On Taxes For Doordash

More picture related to Can You Claim Mileage On Taxes For Doordash

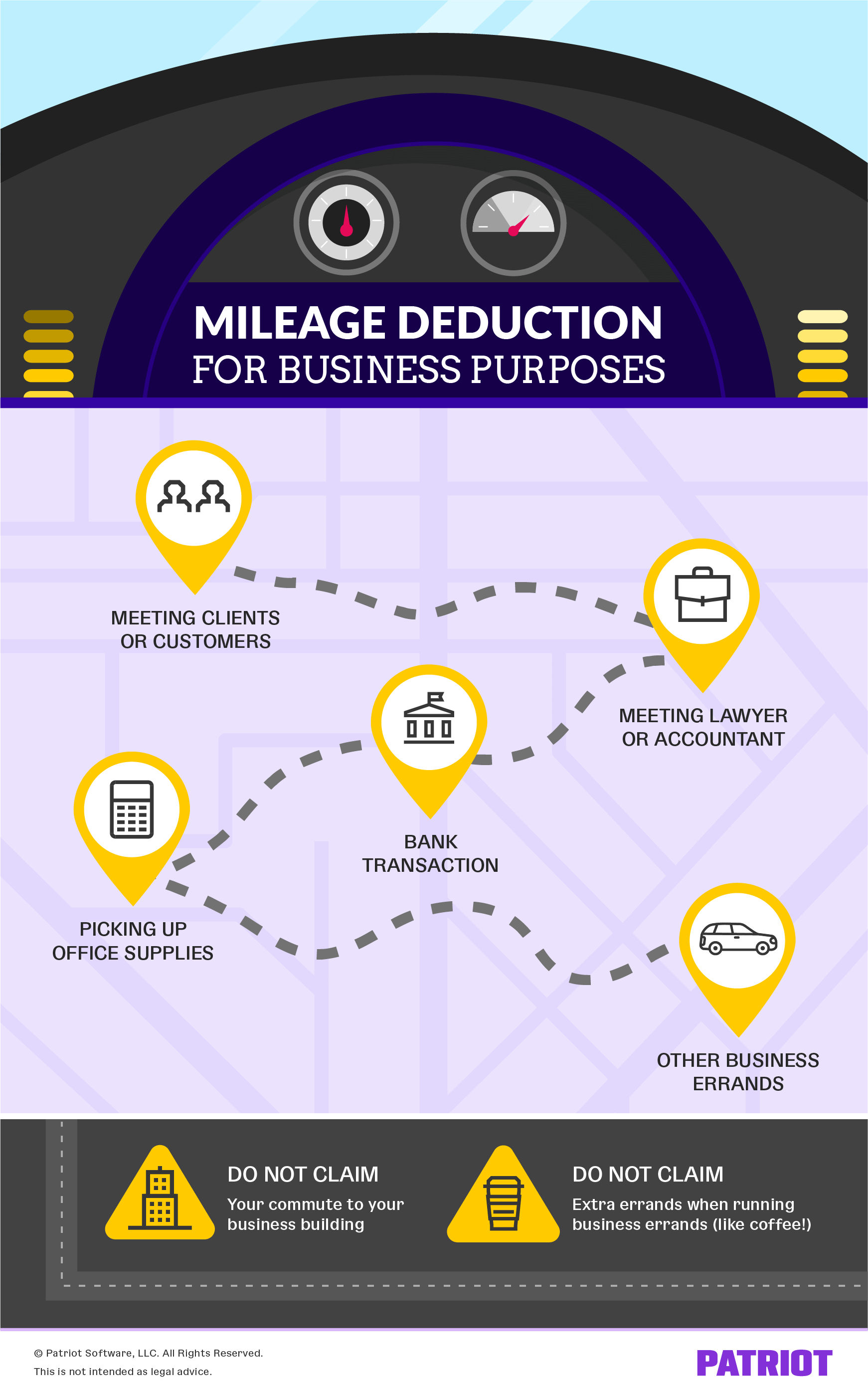

How The Self Employed Claim Mileage On Their Taxes

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6111cabad516a1f1ceea16e1_60d8c67933840b4f5f836616_claim-mileage-deduction-canada.jpeg

Can You Claim Mileage On Your Taxes short YouTube

https://i.ytimg.com/vi/8-sQobq8uEk/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AZQDgALQBYoCDAgAEAEYZSBYKFIwDw==&rs=AOn4CLDb58N6KZEbWA4b8sBstJieLA4rNQ

Simple Expense Reimbursement Form 1 Excelxo

https://excelxo.com/wp-content/uploads/2018/02/simple-expense-reimbursement-form-1-601x466.png

Gas and mileage expenses Deductions can lower the amount of your income that s taxable which reduces your total tax bill and maximizes your refund Understanding Deductions on Your Doordash Tax Forms Deductions can significantly lower your tax bill As a delivery driver you can deduct business expenses

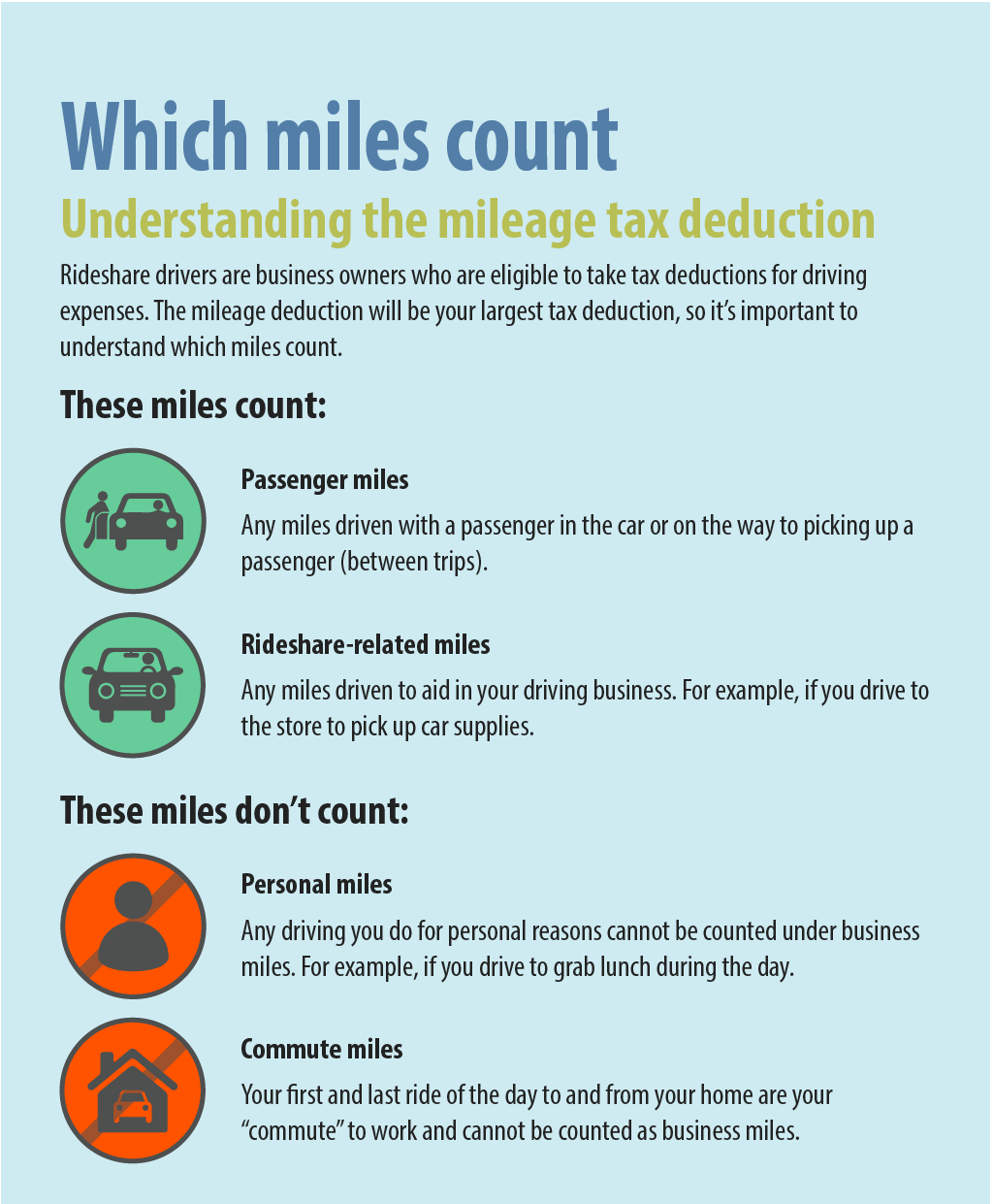

The Mileage Deduction When driving for DoorDash you must of course use your own car The counts as company use of your personal vehicle and you can deduct No DoorDash does not take taxes out when they pay you This is true for anyone working as an independent contractor whether that s delivering for DoorDash

9 Best Apps To Track Mileage For DoorDash 2024

https://blog-cdn.route4me.com/2022/11/[email protected]

Business Mileage Deduction 101 How To Calculate For Taxes

https://www.patriotsoftware.com/wp-content/uploads/2019/04/mileage_reimbursement-03.png

https://www.hrblock.com/.../door-dash-taxes

Working with DoorDash Tax deductions to know about As an independent contractor you re eligible for special deductions If you use a personal car for dashing you can choose one of two methods to claim a deduction

https://help.doordash.com/dashers/s/article/T…

If you have not used Everlance to track your mileage DoorDash will send mileage information during tax season only Please click here to learn more on how mileage was sent to Dashers for the 2021 tax year Sign up

Business Spreadsheet Tools Custom Software Development Working Data

9 Best Apps To Track Mileage For DoorDash 2024

Mileage Form 2021 IRS Mileage Rate 2021

Free Printable Gas Mileage Logs Printable Templates

Can I Claim Mileage On My Taxes

Can You Write Off Mileage For DoorDash

Can You Write Off Mileage For DoorDash

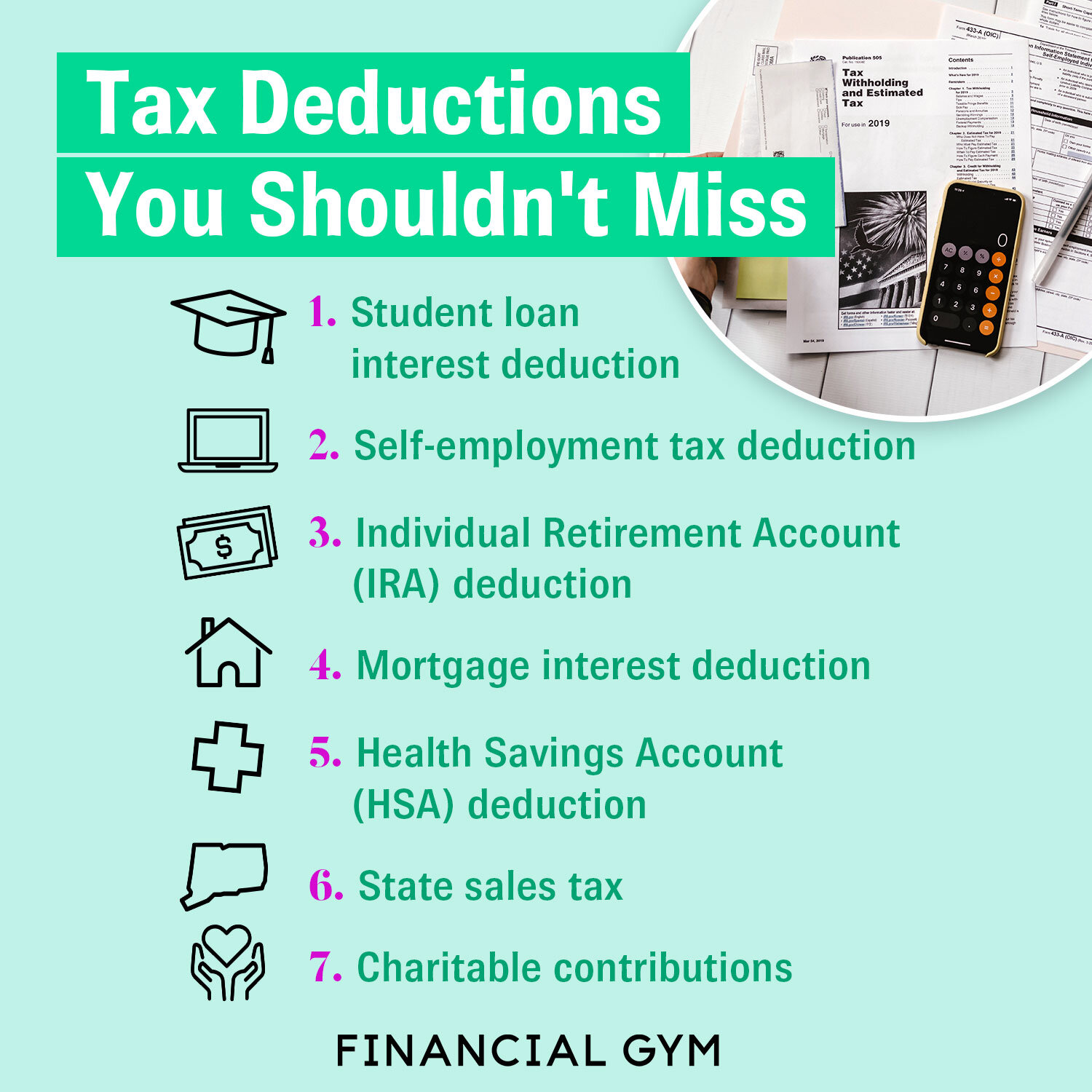

Tax Deductions Write Offs To Save You Money Financial Gym

How To File Taxes For Doordash Drivers 1099 Write offs And Benefits

24 Vehicle Lease Mileage Tracker Sample Excel Templates

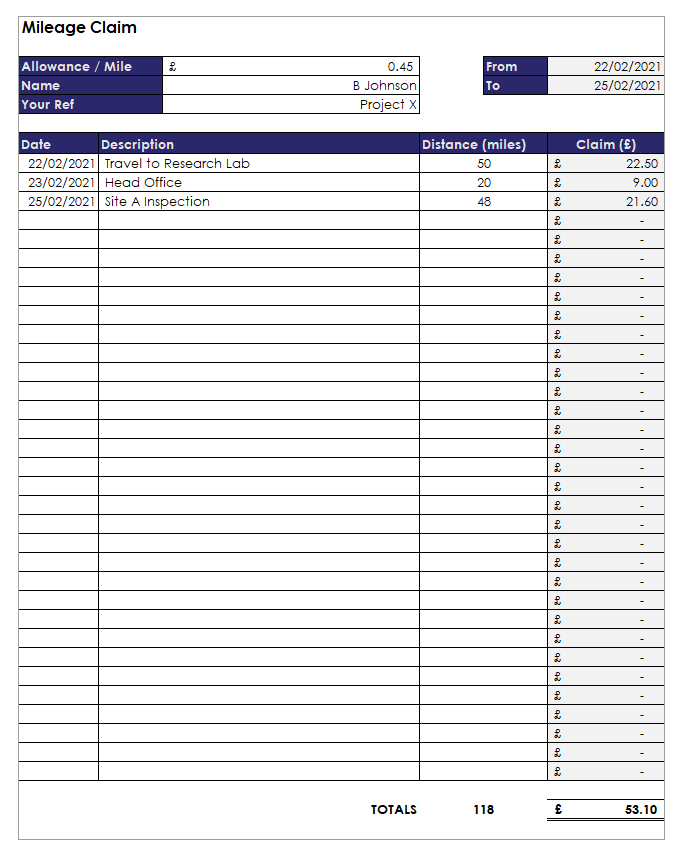

Can You Claim Mileage On Taxes For Doordash - And yes you can claim miles whether you itemize your tax deductions or take the standard deduction Doordash s mileage estimate fails to document your