Can You Claim Mileage On Taxes W2 Are mileage reimbursements tax deductible Yes reimbursements based on the federal mileage rate are tax deductible And since they aren t considered income they re non taxable for your employees But if you

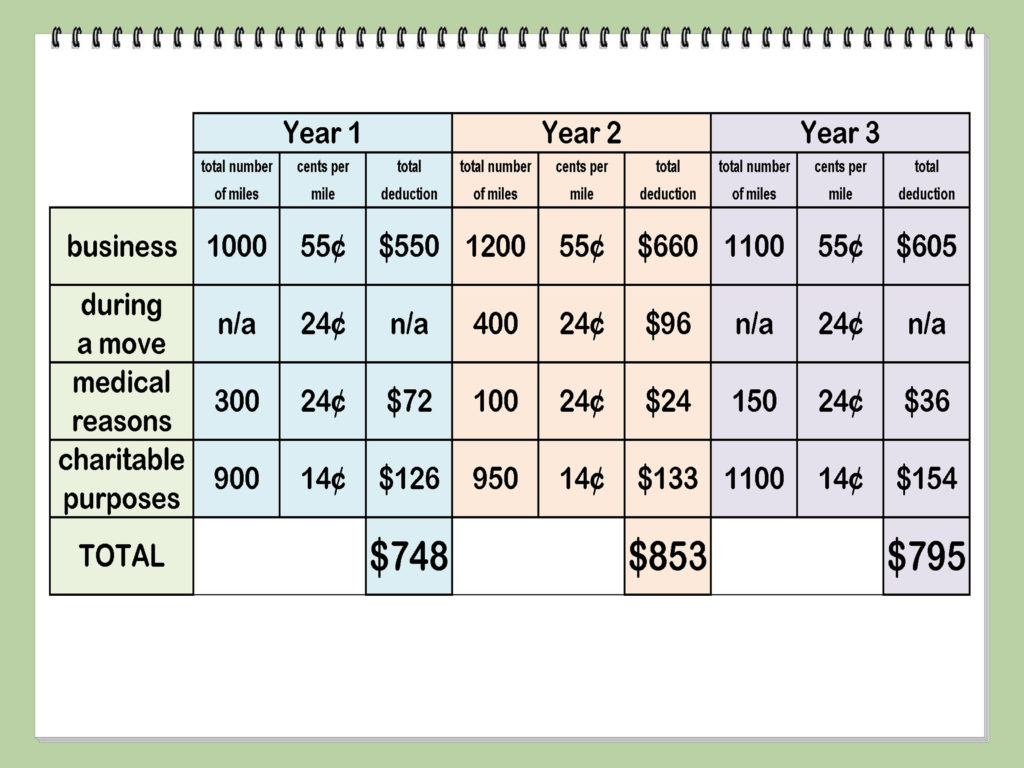

Claiming a tax deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their Whether someone travels for work once a year or once a month figuring out travel expense tax write offs might seem confusing The IRS has information to help all business

Can You Claim Mileage On Taxes W2

Can You Claim Mileage On Taxes W2

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110c7808a1a34e392da06a0_610f13719242da6fd79cc8b1_MileIQ-vs-paper-mileage-log-1.jpeg

![]()

Editable 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log

https://wssufoundation.org/wp-content/uploads/2020/11/editable-25-printable-irs-mileage-tracking-templates-gofar-mileage-log-for-taxes-template-word-scaled-2048x1449.jpg

IRS Increases Standard Mileage Rates Starting July 1 2022 Stinson

https://jdsupra-html-images.s3-us-west-1.amazonaws.com/2cc30a4d-edf6-4797-b367-9df3694291f8-Picture6.png

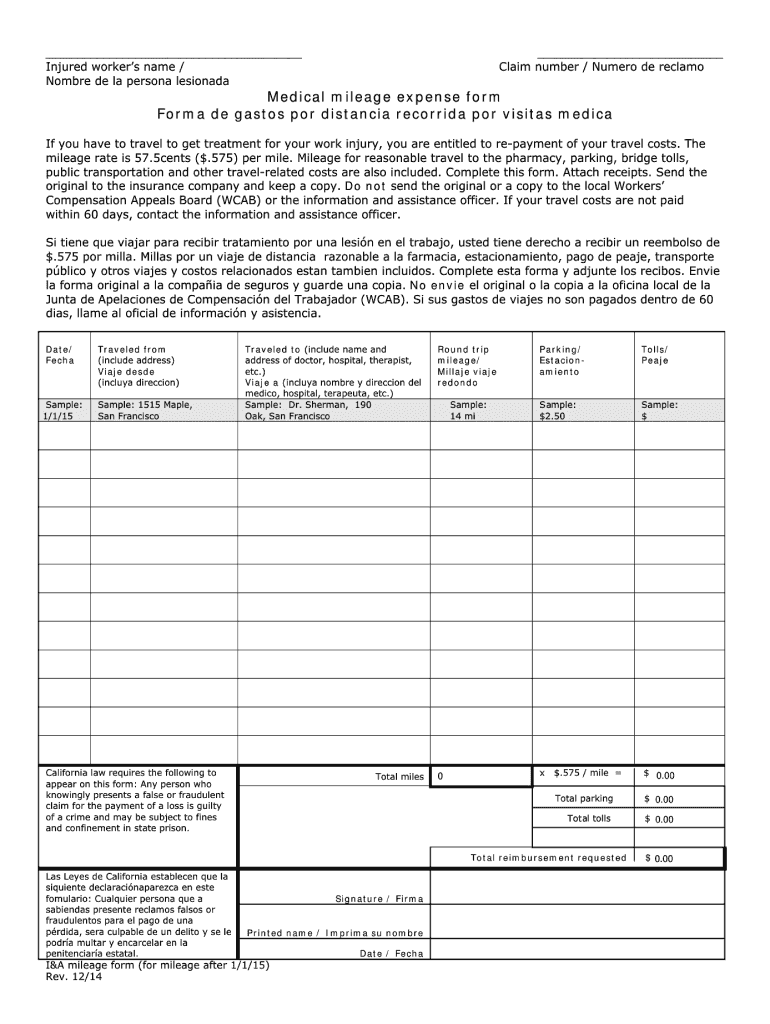

Some cannot Here s a breakdown of which taxpayers can claim this deduction when they file their tax returns Business owners and self employed individuals Individuals who You should use Form 2106 and Schedule 1 Form 1040 to claim mileage on taxes An individual itemizing deductions and are claiming a deduction for medical or charity

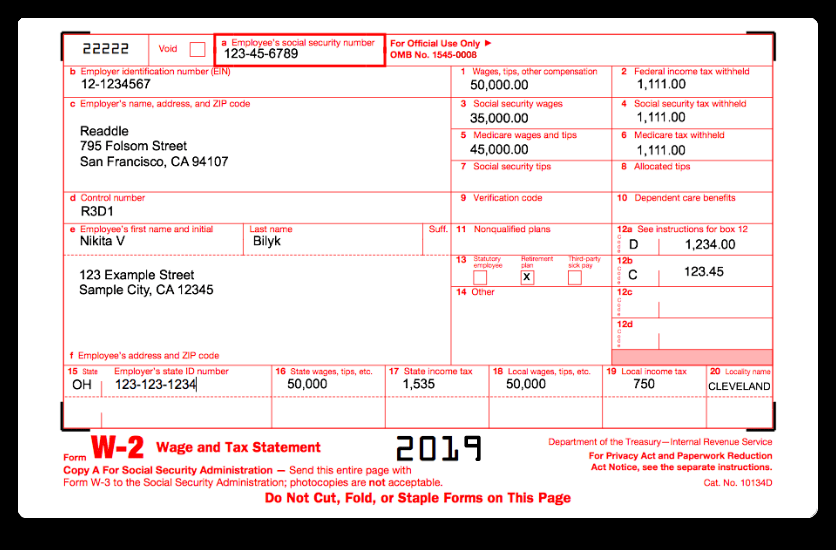

You can deduct actual expenses or the standard mileage rate as well as business related tolls and parking fees If you rent a car you can deduct only the business use portion for Mileage reimbursement might be included in your total wages in your W 2 form but it will not be taxable to you and you cannot claim a mileage deduction on your personal tax

Download Can You Claim Mileage On Taxes W2

More picture related to Can You Claim Mileage On Taxes W2

Can You Claim Mileage On Your Taxes short YouTube

https://i.ytimg.com/vi/8-sQobq8uEk/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AZQDgALQBYoCDAgAEAEYZSBYKFIwDw==&rs=AOn4CLDb58N6KZEbWA4b8sBstJieLA4rNQ

![]()

25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes

https://wssufoundation.org/wp-content/uploads/2020/11/25-printable-irs-mileage-tracking-templates-gofar-mileage-log-for-taxes-template-excel-768x543.jpg

How The Self Employed Claim Mileage On Their Taxes

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6111cabad516a1f1ceea16e1_60d8c67933840b4f5f836616_claim-mileage-deduction-canada.jpeg

The IRS has not set a limit or cap on the amount of deductible miles you can claim You cannot deduct mileage expenses as a W 2 employee because miscellaneous unreimbursed employee expenses are no As a W2 employee you may be able to deduct certain vehicle costs as a job related expense if you are itemizing your deductions However as a W2 employee they are

Step 1 Choose your method of calculation Step 2 Gather your mileage records Step 3 Calculate your mileage claim Step 4 Fill out the correct tax form Step 5 Retain your There are important tax strategies that you can leverage as a W 2 employee and here are my top five that you should know about 1 Standard Deduction When you file your tax

Simple Expense Reimbursement Form 1 Excelxo

https://excelxo.com/wp-content/uploads/2018/02/simple-expense-reimbursement-form-1-601x466.png

Calculate Gas Mileage Reimbursement AntonioTavish

https://www.patriotsoftware.com/wp-content/uploads/2019/04/mileage_reimbursement-03.png

https://www.uschamber.com/co/run/fina…

Are mileage reimbursements tax deductible Yes reimbursements based on the federal mileage rate are tax deductible And since they aren t considered income they re non taxable for your employees But if you

https://money.usnews.com/money/pers…

Claiming a tax deduction for mileage can be a good way to reduce how much you owe Uncle Sam but not everyone is eligible to write off their

Business Spreadsheet Tools Custom Software Development Working Data

Simple Expense Reimbursement Form 1 Excelxo

Mileage Form 2021 IRS Mileage Rate 2021

You ll Never Forget To Use This Simple Mileage Log Money Saving Tips

Can I Estimate Mileage For Taxes Dollar Keg

Social Security Cost Of Living Adjustments 2023

Social Security Cost Of Living Adjustments 2023

What Is A W3 Form And Does Your Business Need It AttendanceBot

Government Mileage Calculator IRS Mileage Rate 2021

Can I Claim Mileage On My Taxes

Can You Claim Mileage On Taxes W2 - You can deduct the cost of your daily round trip transportation between your home and the training location In your case when you have non employee income 1099 MISC you