Can You Claim Moving Expenses From Previous Years However you cannot carry back moving expenses to a prior year For example if you paid moving expenses in the current year for a move that occurred in a prior year you cannot claim

Generally you can claim moving expenses you paid in the year if both of the following apply You moved to a new home to work or to run a business out of a new location or you moved to be a This interview will help you determine if you can deduct your moving expenses Information you ll need Types and amounts of moving expenses Amount of moving expense

Can You Claim Moving Expenses From Previous Years

Can You Claim Moving Expenses From Previous Years

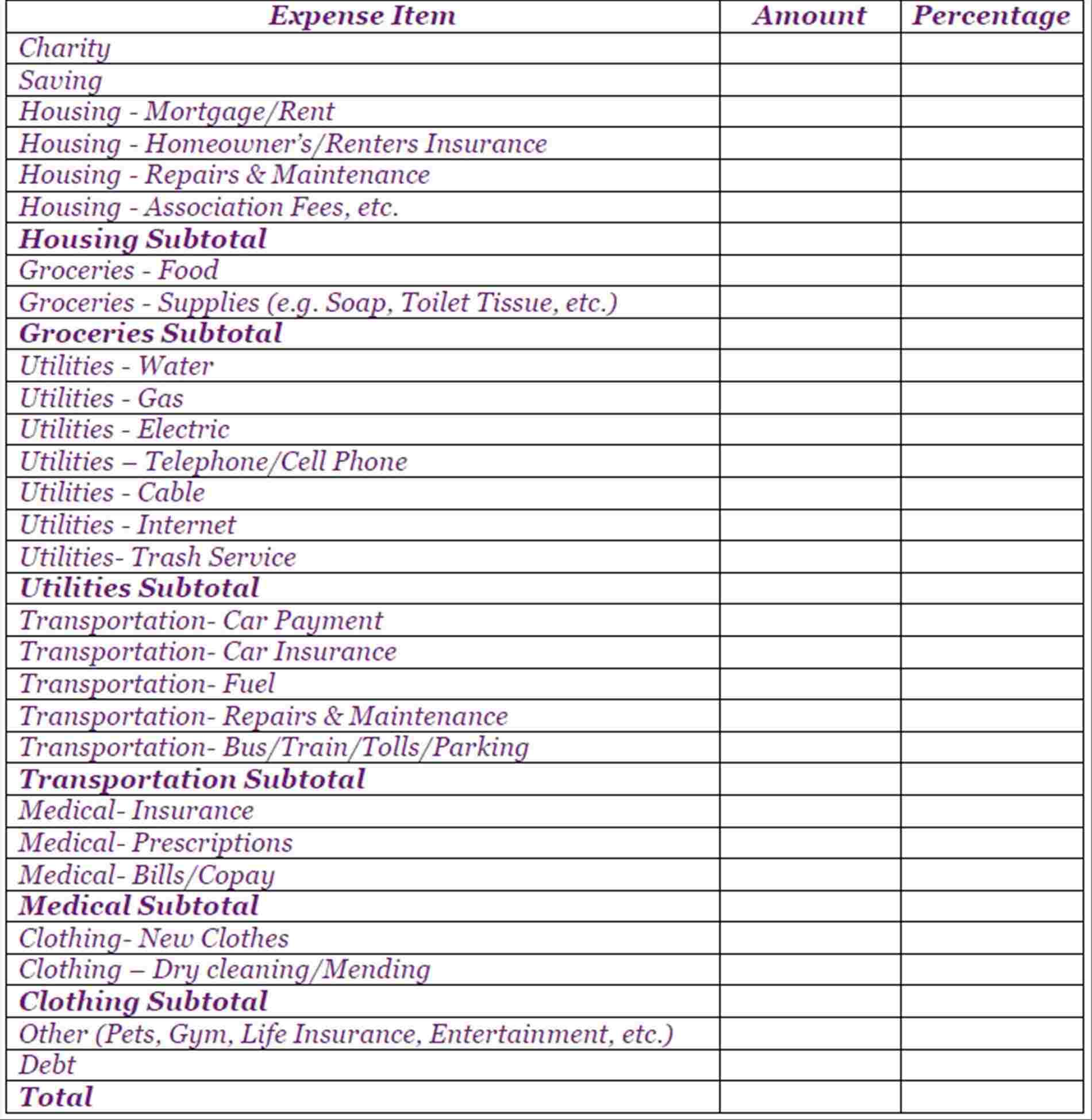

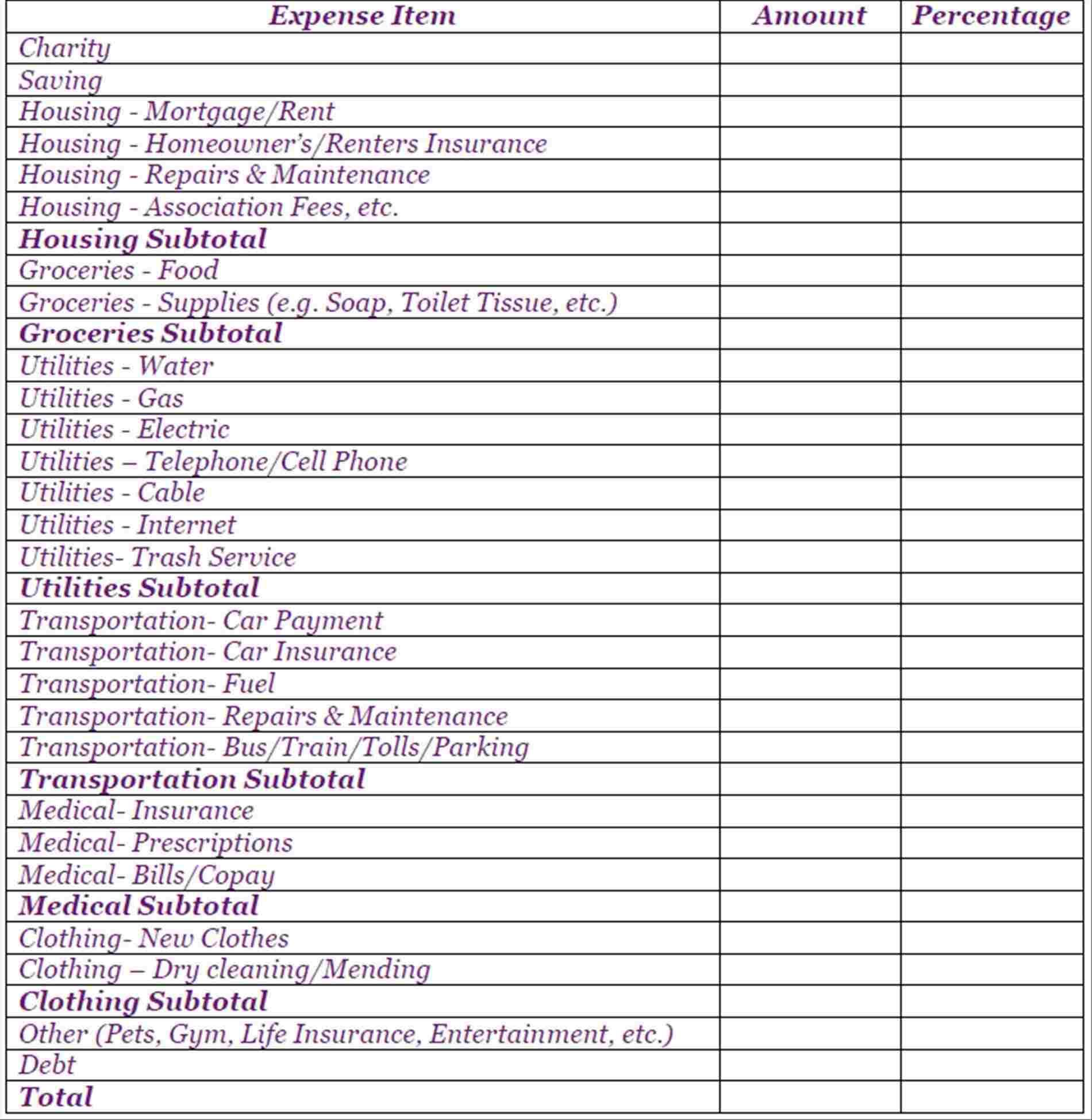

https://db-excel.com/wp-content/uploads/2018/11/monthly-budget-list-for-bills-template-business-expenses-to-business-expense-list-template.jpg

How To Claim Moving Expenses Vector Movers NJ

https://www.vectormoversnj.com/wp-content/uploads/2018/08/tax-1351881_1280-1200x951.png

When Can You Claim Moving Expenses As Tax Deduction

https://moversfolder.com/media/bigimages/when-can-you-claim-moving-expenses-as-tax-deduction.jpg

If you moved before the start of the tax year but started earning income from your new job or educational program in the current tax year you can still claim your moving expenses Here s Under the Income Tax Act you can write off your moving expenses if you moved for work to run a business or to be a full time student To qualify your new home must be at least 40 kilometres closer to your new work

If you have unused moving expenses from prior years you can find the amount on line 24 of your 2023 T1 M form or on line 18 of your 2023 TP 348 form if you re a Qu bec resident Introduction Subsection 62 1 of the Income Tax Act Moving Expenses May be Deducted in Computing a Canadian Taxpayer s Income Each year many Canadians move

Download Can You Claim Moving Expenses From Previous Years

More picture related to Can You Claim Moving Expenses From Previous Years

Did You Know Moving Expenses Can Be Tax Deductible Find Out If Your

https://i.pinimg.com/736x/b0/f7/a8/b0f7a8d1266429db15ed66c2cd568360.jpg

When Can You Claim Moving Expenses As A Tax Deduction UNITS Moving

https://unitsstorage.com/northeast-kansas/wp-content/uploads/sites/103/2023/05/tax-deductions.png

Self Employed Expenses What Can You Claim YouTube

https://i.ytimg.com/vi/bn1yWtJ8Znw/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYZSBWKFgwDw==&rs=AOn4CLBf2I-ETexLjoKCoAz_yHWs5bjRBA

If the moving expenses paid by your employer were not taxed then you can t take a deduction If you did pay tax on these payments then this situation is referred to as a Claim of Right under IRC Section 1341 For instance if you have moving expenses e g cost of maintaining your old home when vacant that you paid for in the current year for a move that you made last year you

Timing You can deduct your moving expenses in the same year you moved Even if you paid some expenses after the move year but before filing your taxes you can still claim You can take a misc itemized deduction on line 28 of schedule A not subject to the 2 of AGI threshold Or you can take a credit The credit is computed by refiguring the tax

When Can You Claim Moving Expenses As A Tax Deduction

https://herculesmoversinc.com/wp-content/uploads/2022/08/moving-expenses-1170x650.jpeg

Can You Claim Assisted Living Expenses On Taxes CountyOffice

https://i.ytimg.com/vi/unnH6kH01lw/maxresdefault.jpg

https://www.canada.ca › ...

However you cannot carry back moving expenses to a prior year For example if you paid moving expenses in the current year for a move that occurred in a prior year you cannot claim

https://www.canada.ca › en › revenue-agency › services...

Generally you can claim moving expenses you paid in the year if both of the following apply You moved to a new home to work or to run a business out of a new location or you moved to be a

How To Claim Moving Expenses U Santini Moving Storage

When Can You Claim Moving Expenses As A Tax Deduction

Can You Claim Clothing As A Business Expense CRUX Award Winning

Updated March 2022 How To Claim A Tax Deduction On Your Moving

Can You Claim Clothing As A Business Expense NH Associates

Deductible Business Expenses For Independent Contractors Financial

Deductible Business Expenses For Independent Contractors Financial

Did You Move This Year Can You Claim Moving Expenses

Business Expenses What Can You Claim

Wisconsin Policy Forum Budget Brief

Can You Claim Moving Expenses From Previous Years - Under the Income Tax Act you can write off your moving expenses if you moved for work to run a business or to be a full time student To qualify your new home must be at least 40 kilometres closer to your new work